Us W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

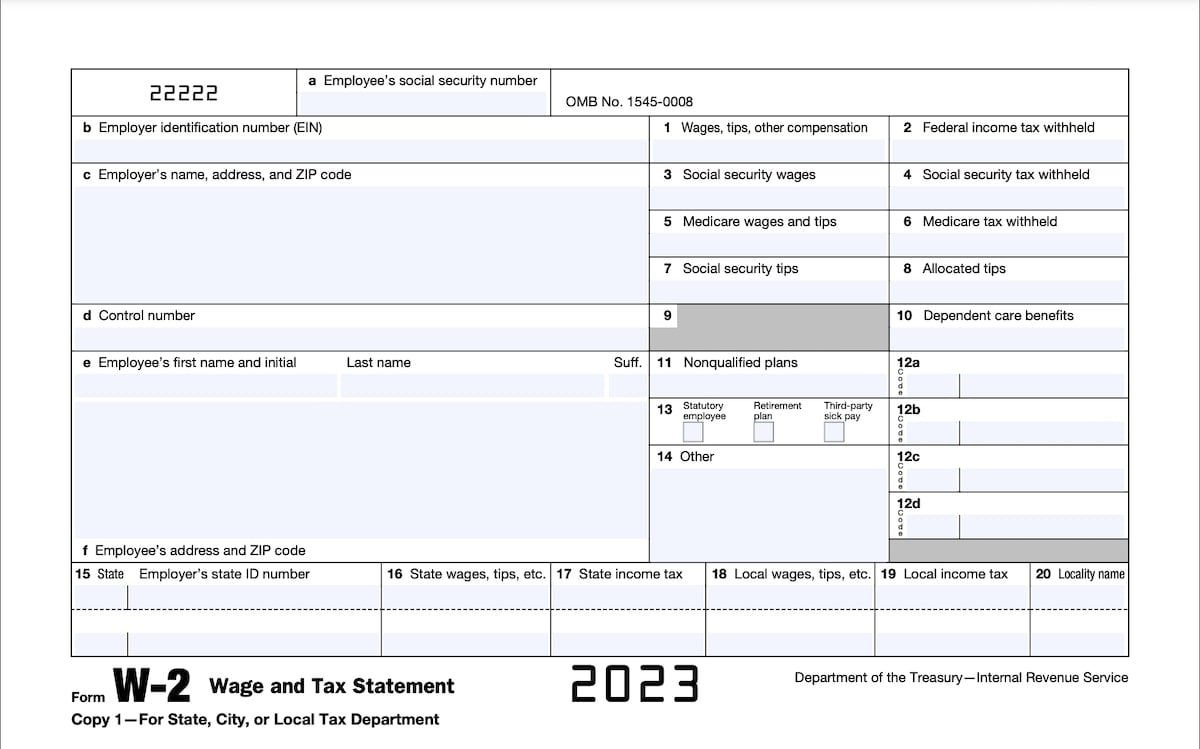

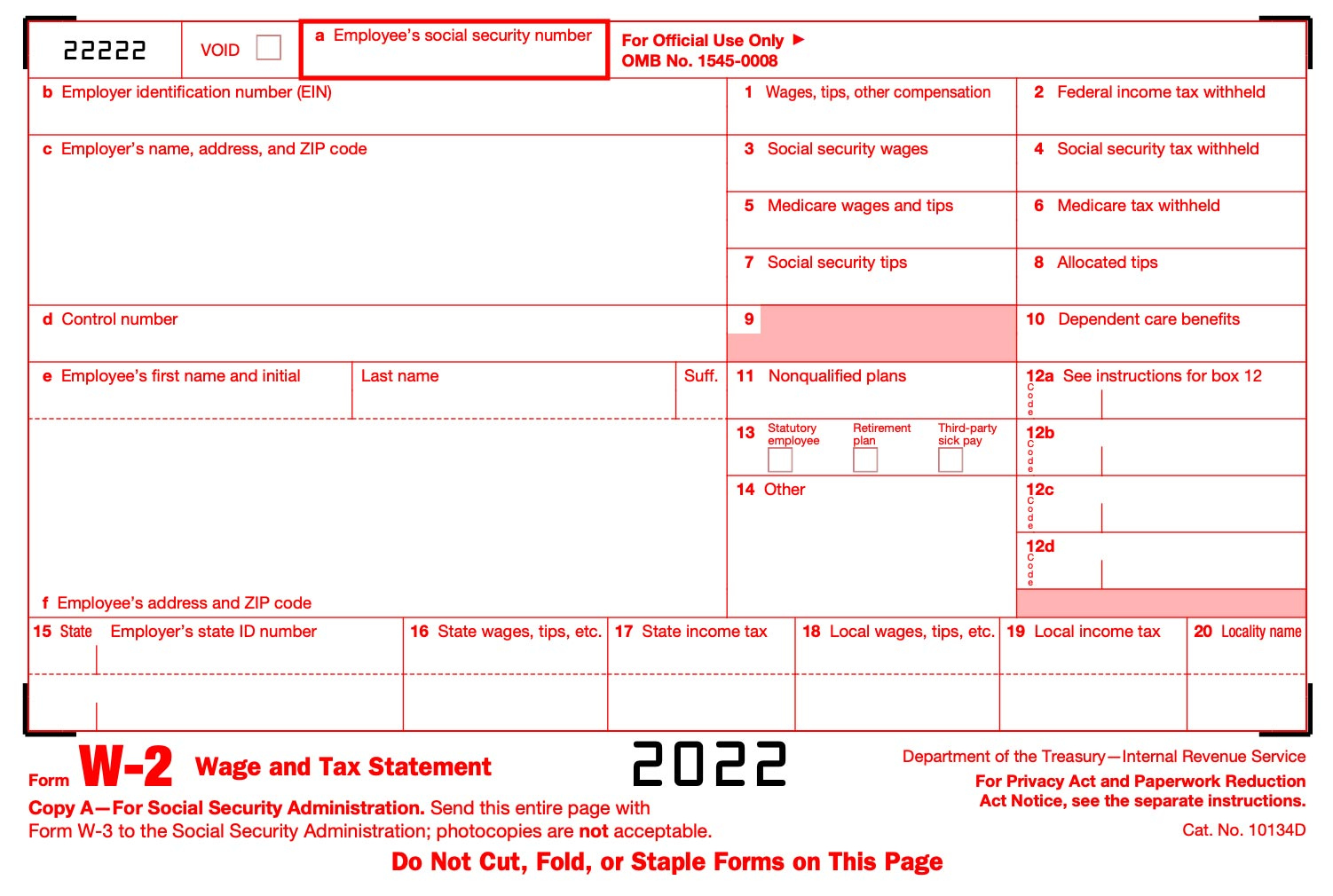

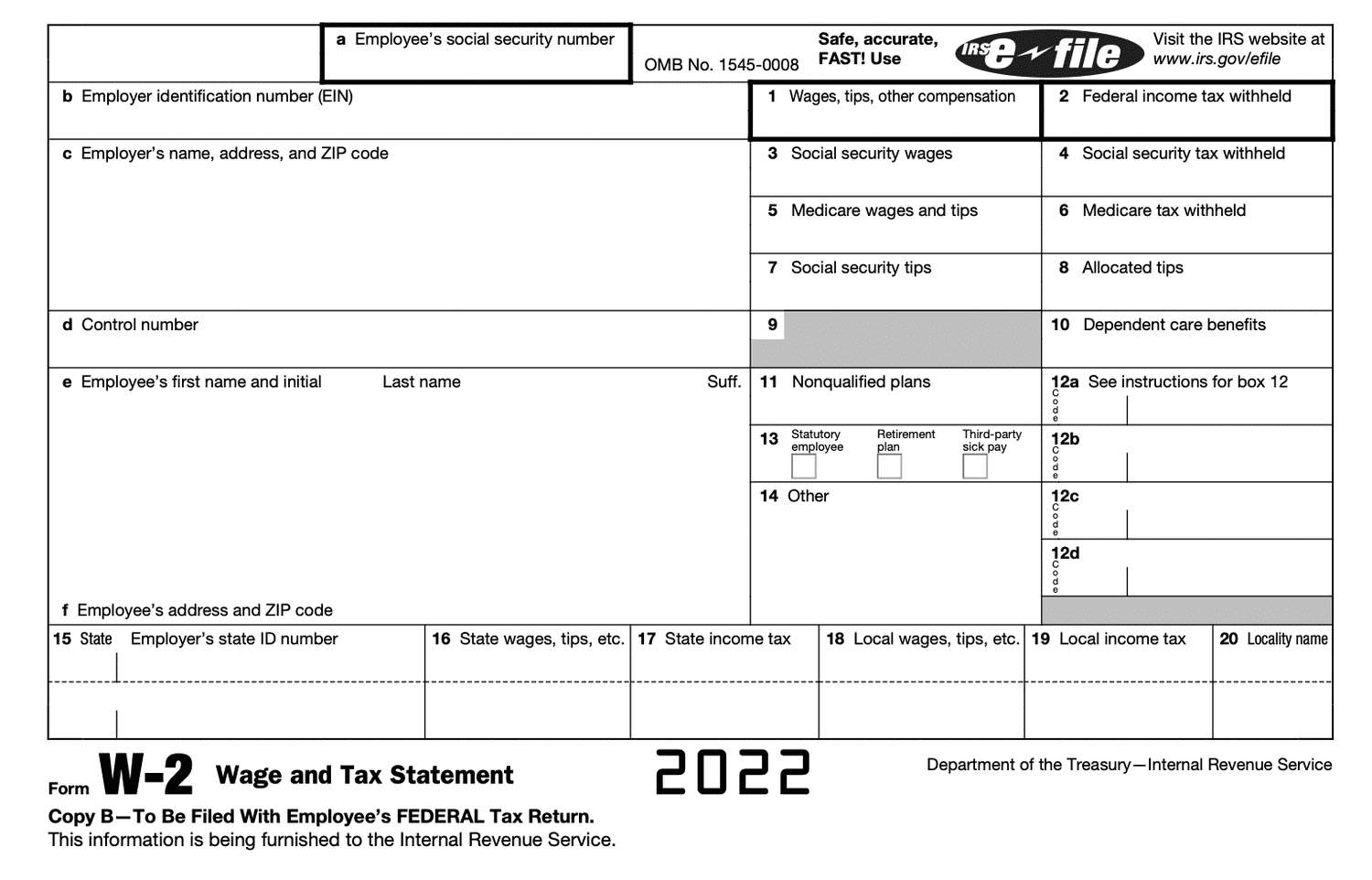

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncover the Enchantment of the US W2 Form!

Oh, the mysterious US W2 form – a document that holds the key to unlocking the magic of your hard-earned income! This seemingly mundane piece of paper actually contains a wealth of valuable information that can help you understand your taxes, deductions, and earnings. Let’s delve into the enchanting world of the US W2 form and discover the secrets it holds!

Discover the Secrets to Harnessing its Power!

The US W2 form may seem intimidating at first glance, with its jumble of numbers and codes. However, with a little bit of guidance, you can uncover its hidden treasures and use them to your advantage. By understanding the different sections of the form, such as wages, taxes withheld, and deductions, you can gain insight into your financial situation and make more informed decisions about your money management.

One of the most magical aspects of the US W2 form is its ability to demystify the tax filing process. By carefully reviewing your W2, you can ensure that all of your income and taxes are accurately reported to the IRS, helping you avoid any potential errors or discrepancies. Additionally, the information provided on the form can assist you in determining if you are eligible for certain tax credits or deductions, ultimately saving you money and maximizing your tax refund.

With a little bit of patience and a keen eye for detail, you can harness the power of the US W2 form to take control of your finances and make informed decisions about your money. So don’t be afraid to embrace the magic of this document and use it to your advantage – your financial future will thank you for it! Unlock the secrets of the US W2 form and watch as its enchanting powers transform your understanding of your income and taxes.

Below are some images related to Us W2 Form

us army w2 form, us bank w2 former employee, us foods w2 former employee, us postal service w2 forms, us taxpayer id in w2 form, , Us W2 Form.

us army w2 form, us bank w2 former employee, us foods w2 former employee, us postal service w2 forms, us taxpayer id in w2 form, , Us W2 Form.