What Is A W2 G Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Exploring the Enchantment of the W2 G Form

Ah, the elusive W2 G form, a document that holds the key to unlocking the magic of your gambling winnings. As you gaze upon its intricate rows and columns, you may feel a sense of wonder and curiosity about what secrets it holds. Fear not, for we are here to guide you through the enchanting world of the W2 G form and help you make sense of its mysterious contents.

The W2 G form is more than just a piece of paper – it is a portal to a realm where luck and fortune collide. Filled with numbers and codes, this form is like a treasure map that leads you to the riches you have acquired through your gambling endeavors. But beware, for with great winnings come great responsibilities, and it is crucial to understand the information presented on this form to ensure compliance with the IRS and avoid any potential pitfalls.

As you delve deeper into the mesmerizing world of the W2 G form, you will uncover the secrets of how your winnings are calculated and reported. From casino jackpots to sports betting payouts, each entry on this form tells a story of your gambling adventures. So embrace the magic of the W2 G form, and let it serve as a reminder of the excitement and thrill of testing your luck in the world of gambling.

Decoding the Mystique Behind the W2 G Form

The W2 G form may seem like a cryptic puzzle at first glance, but fear not, for we are here to help you unravel its mysteries. Each section of this form holds vital information about your gambling winnings, from the type of wager to the amount won. By decoding the symbols and numbers on the W2 G form, you can gain a deeper understanding of how your winnings are classified and reported to the IRS.

One of the most intriguing aspects of the W2 G form is its ability to capture the essence of your gambling activities in a concise and organized manner. Whether you are a casual gambler or a high-roller, this form provides a snapshot of your winnings and losses throughout the year. By carefully examining each line item on the W2 G form, you can gain valuable insights into your gambling habits and financial transactions.

As you navigate the labyrinth of the W2 G form, remember that knowledge is power. By taking the time to study and comprehend the information presented on this form, you can ensure compliance with tax regulations and avoid any potential pitfalls. So embrace the challenge of decoding the mystique behind the W2 G form, and let its magic guide you towards a greater understanding of your gambling winnings.

In conclusion, the W2 G form is more than just a piece of paperwork – it is a portal to the enchanting world of gambling winnings. By exploring its contents and decoding its mysteries, you can gain valuable insights into your financial transactions and ensure compliance with tax regulations. So embrace the magic of the W2 G form, and let it illuminate the path towards a deeper understanding of your gambling adventures. Happy unraveling!

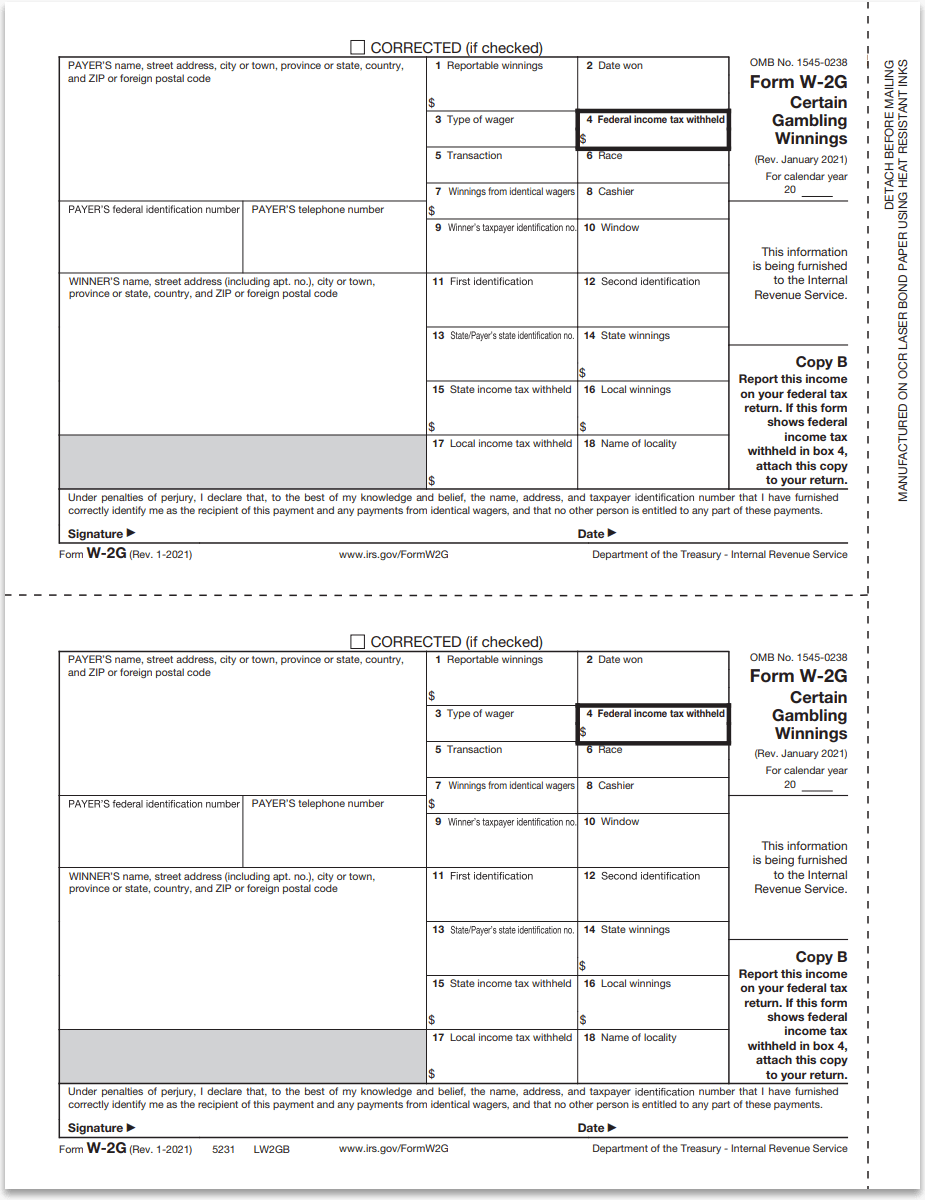

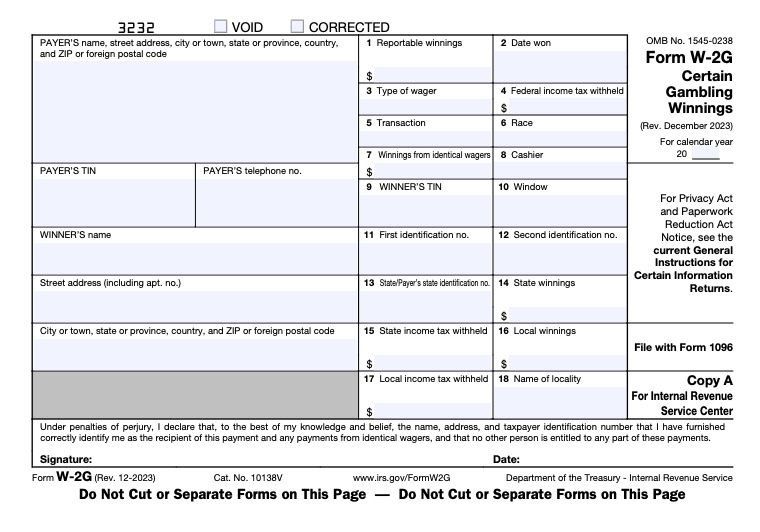

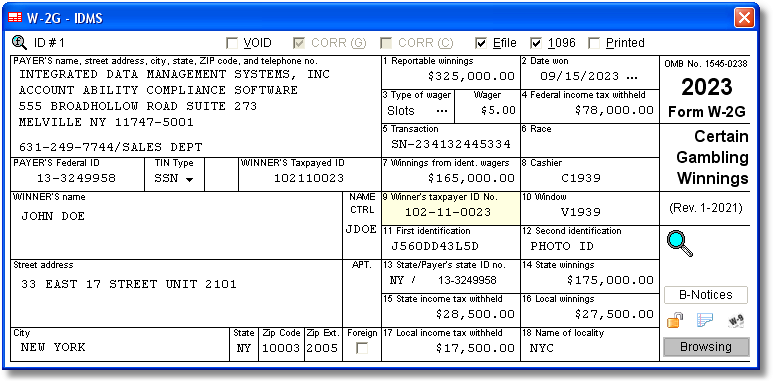

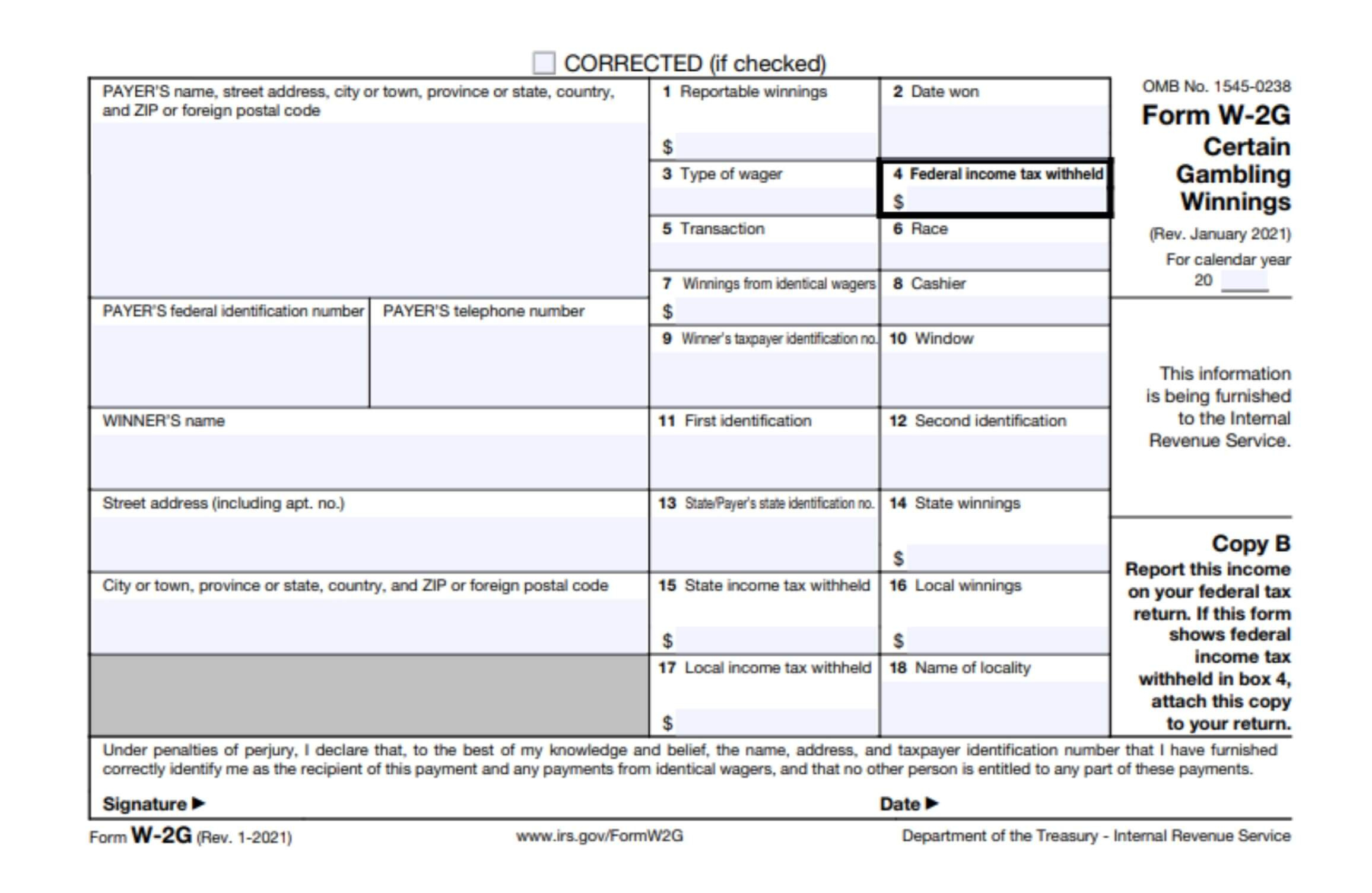

Below are some images related to What Is A W2 G Form

what does a w2-g form look like, what is a w2 g form, what is a w2g form used for, , What Is A W2 G Form.

what does a w2-g form look like, what is a w2 g form, what is a w2g form used for, , What Is A W2 G Form.