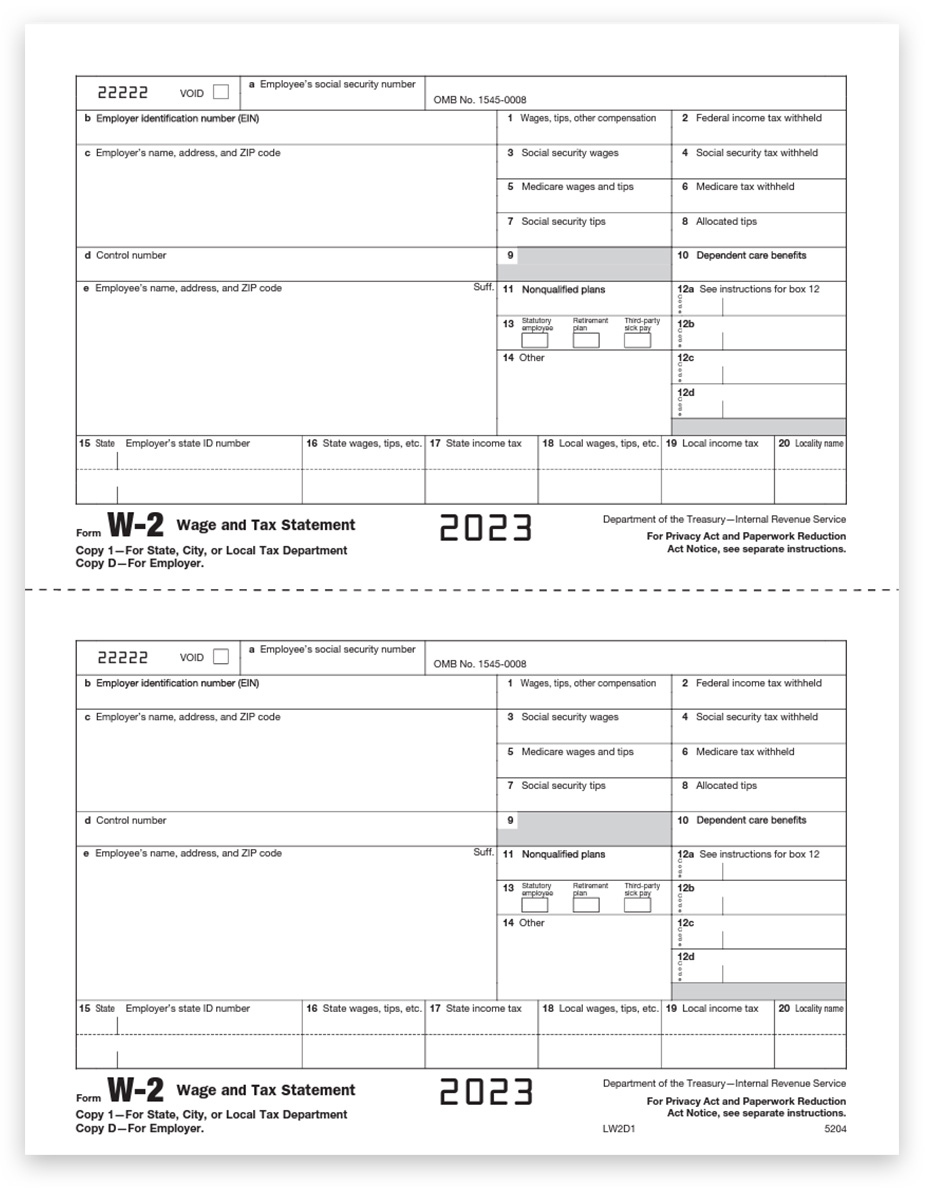

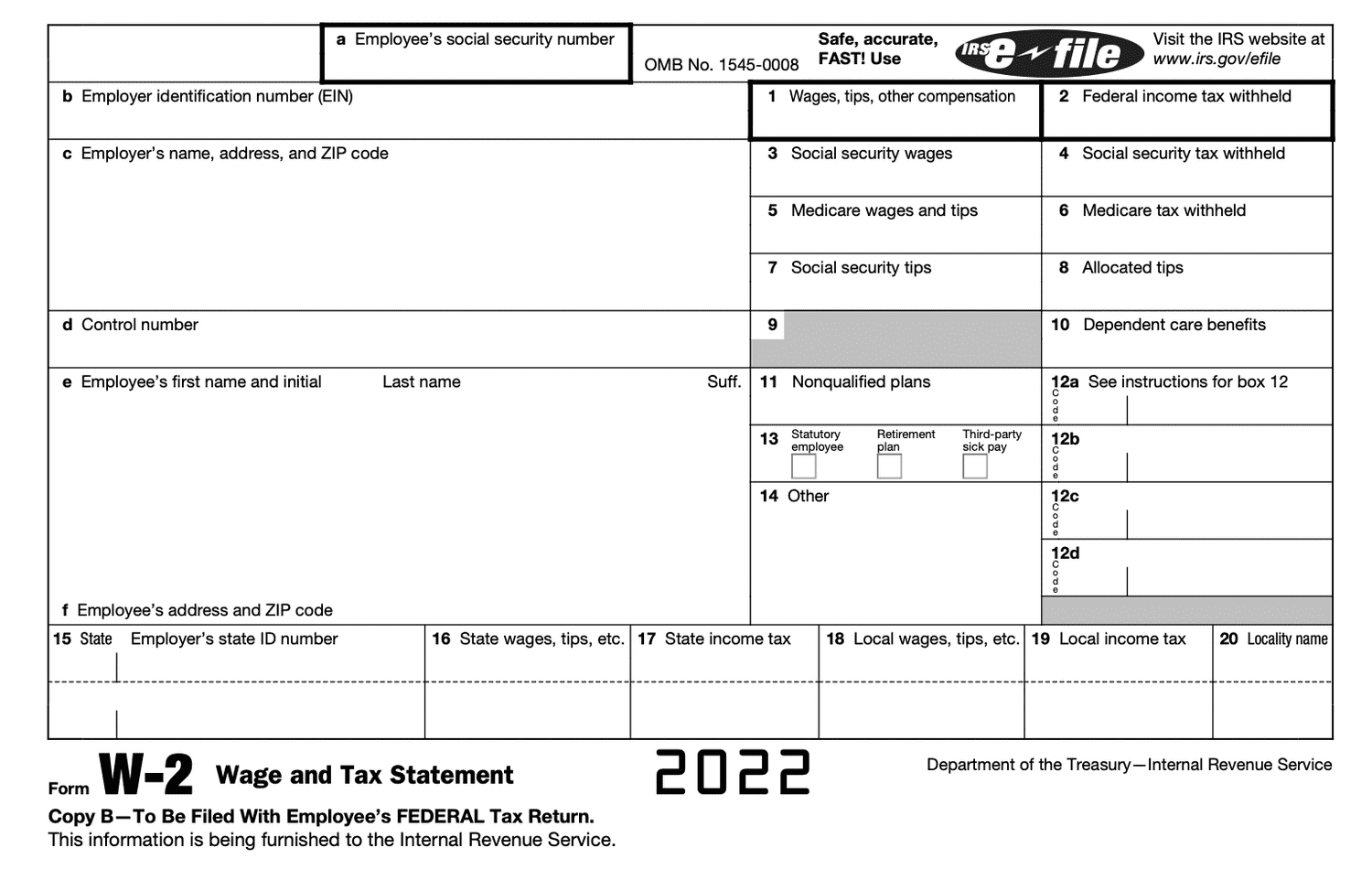

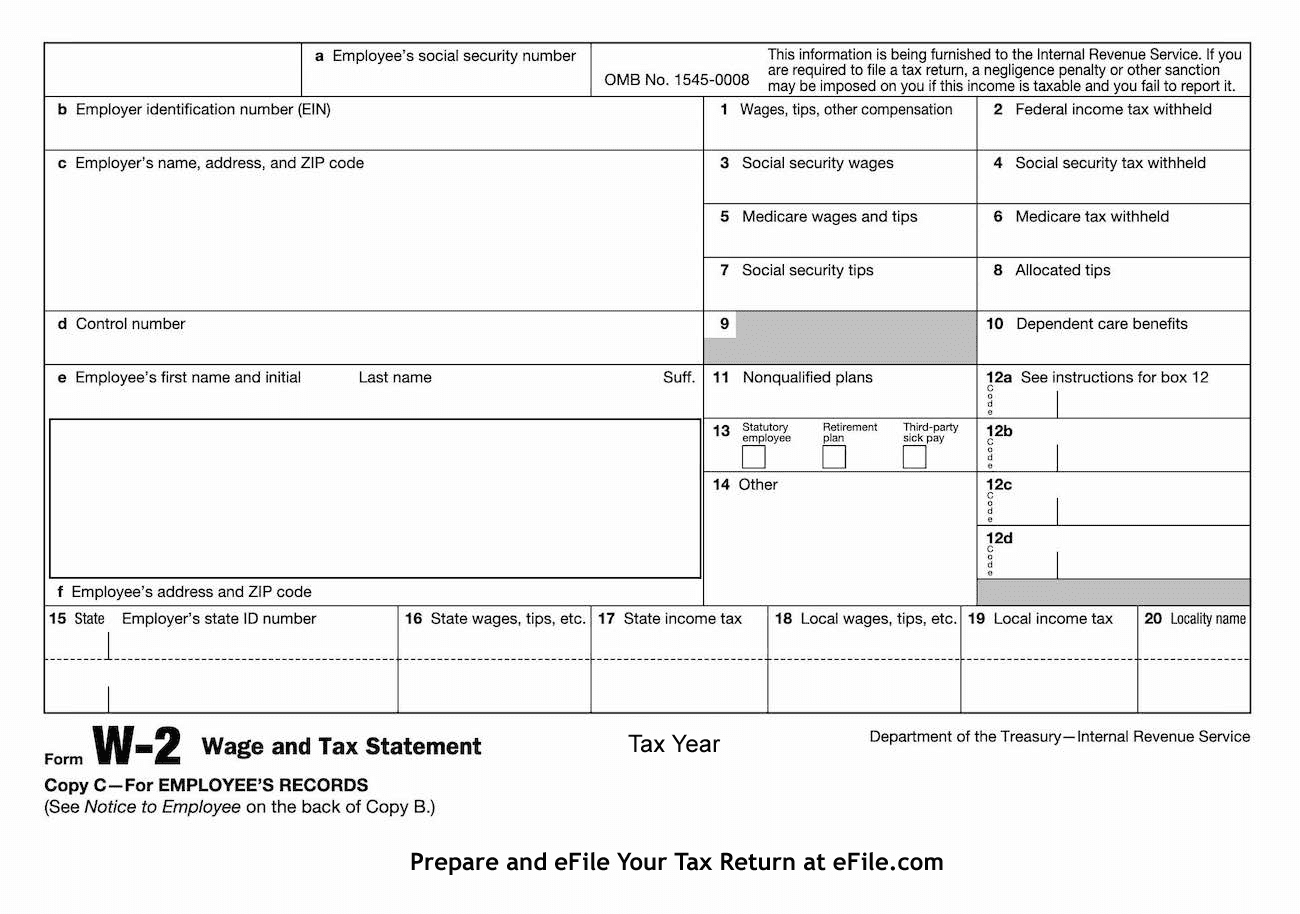

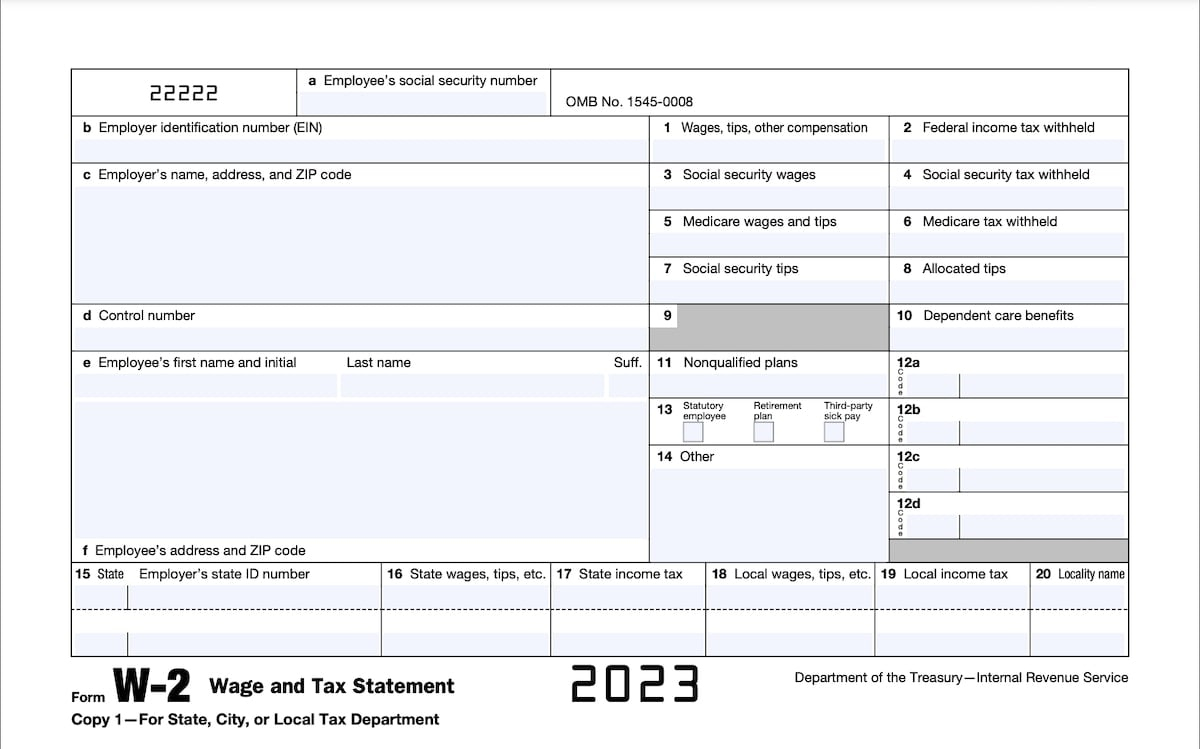

What Is A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Enchantment of the W2 Form

Ah, the mystical W2 form – a document that arrives like a magical scroll in the mail every year, holding the key to unlocking the secrets of your financial world. This seemingly ordinary piece of paper is actually a portal to understanding your earnings, taxes, and contributions throughout the year. While it may seem daunting at first glance, fear not, for we are here to guide you through the enchanting world of the W2 form.

As you unravel the W2 form, you will discover a treasure trove of information that sheds light on your income, taxes withheld, and contributions made to various accounts. This document is not just a mundane piece of paperwork; it is a reflection of your hard work and dedication throughout the year. By delving into its contents, you will gain a deeper understanding of your financial standing and the impact of your efforts.

Do not be intimidated by the complexities of the W2 form – embrace it as a tool for empowerment and knowledge. Let this document be your guide as you navigate the magical realm of taxes and finances. By unlocking the secrets hidden within the W2 form, you will gain a greater appreciation for your financial journey and the opportunities that lie ahead.

Discovering the Mysteries of Your W2 Form

As you embark on the journey of deciphering your W2 form, you will uncover a myriad of symbols, codes, and numbers that may seem perplexing at first. However, fear not, for each of these elements holds a key to understanding your financial picture. From Box 1, which reveals your total wages, to Box 12, which details your contributions to retirement accounts and other benefits, every section of the W2 form has a story to tell.

Take a closer look at Box 2, where your federal income tax withheld is recorded. This number represents the amount of taxes that have already been taken out of your paycheck throughout the year. Understanding this figure can help you gauge whether you have paid enough taxes or if you may owe additional amounts. By unraveling the mysteries of Box 2 and other sections of the W2 form, you will gain valuable insights into your tax obligations and financial well-being.

As you delve deeper into the intricacies of your W2 form, you will unlock a wealth of knowledge that can empower you to make informed decisions about your finances. From calculating your tax refund to planning for future contributions, the information contained in your W2 form is a roadmap to financial success. Embrace the magic of the W2 form and let it guide you on your journey towards financial prosperity.

In conclusion, the W2 form is not just a mundane piece of paperwork – it is a magical document that holds the key to understanding your financial world. By delving into its contents and unraveling its mysteries, you will gain valuable insights into your income, taxes, and contributions. Embrace the enchantment of the W2 form and let it be your guide as you navigate the realm of taxes and finances. Unlock the magic of the W2 form and embark on a journey towards financial empowerment and prosperity.

Below are some images related to What Is A W2 Form

what is a w2 form, what is a w2 form called, what is a w2 form definition, what is a w2 form for dummies, what is a w2 form for taxes, , What Is A W2 Form.

what is a w2 form, what is a w2 form called, what is a w2 form definition, what is a w2 form for dummies, what is a w2 form for taxes, , What Is A W2 Form.