What Do I Do With A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

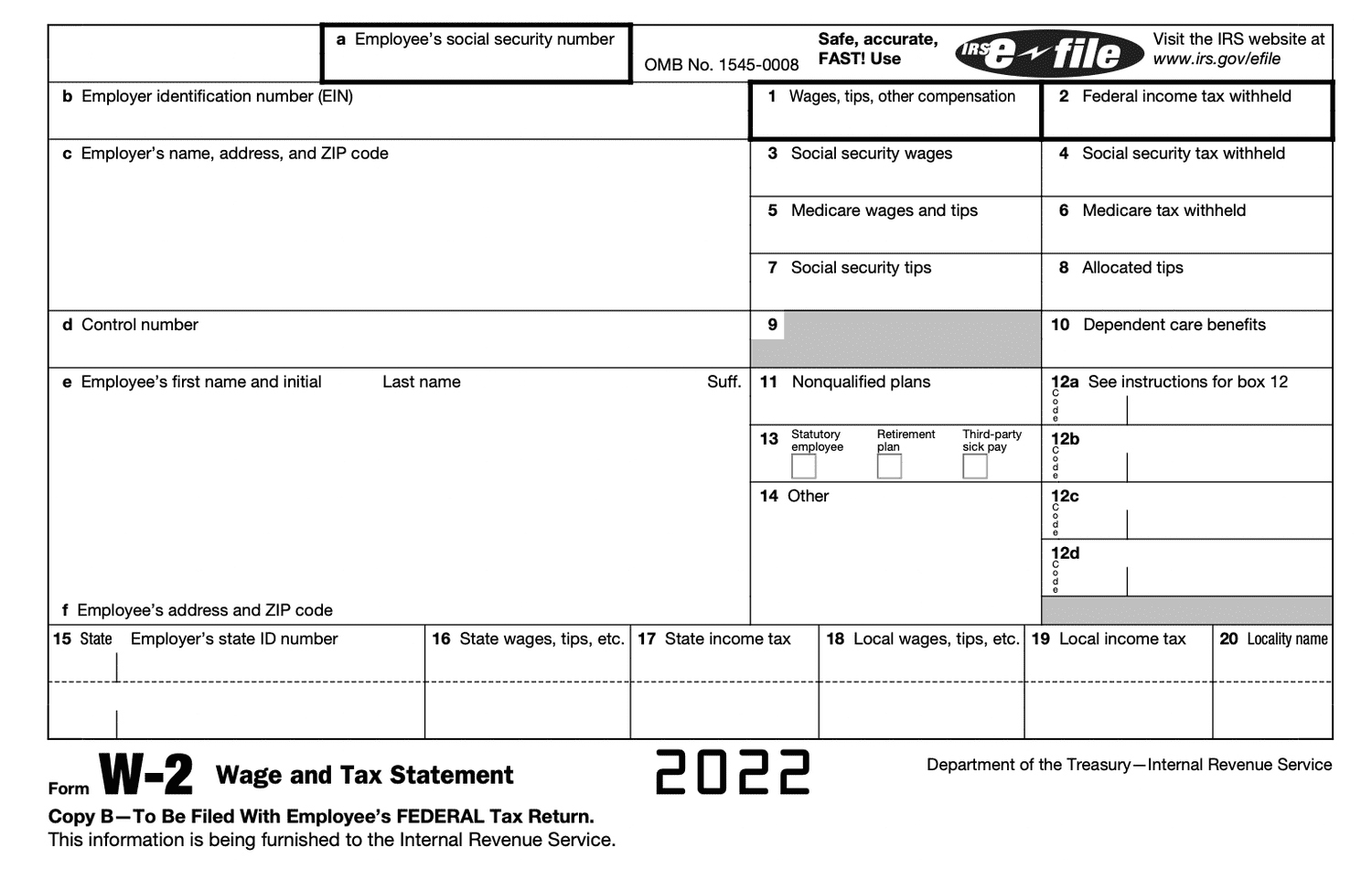

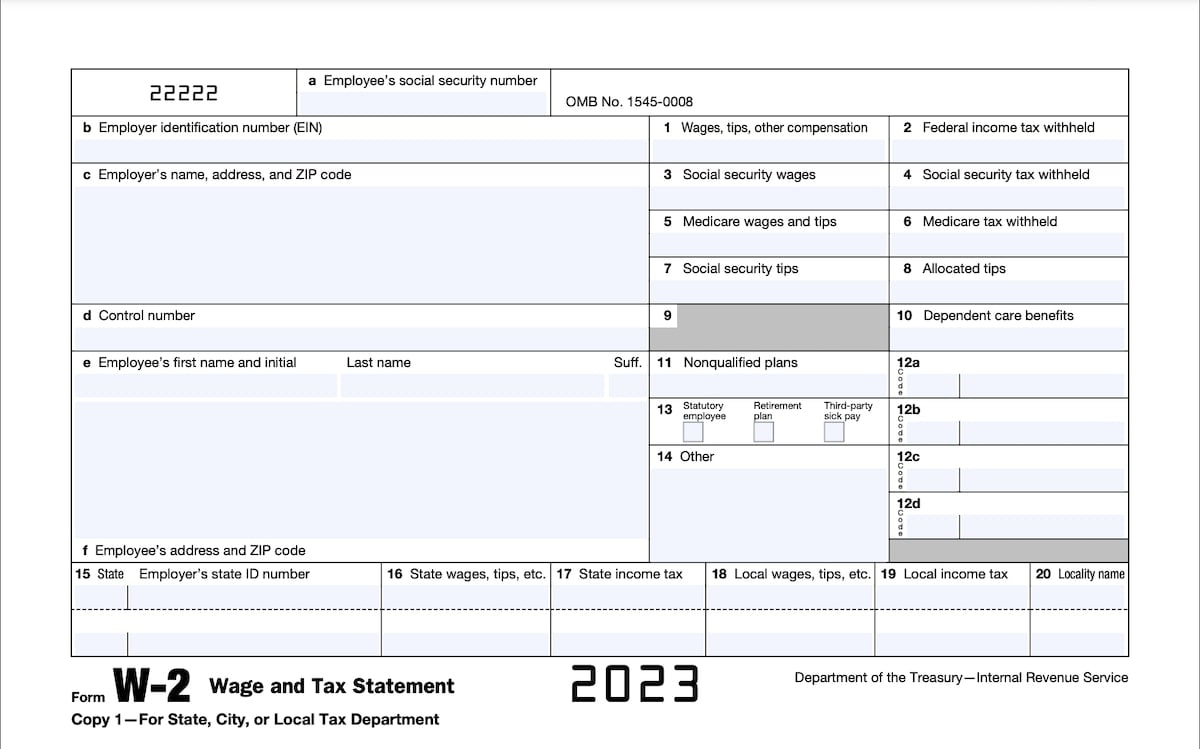

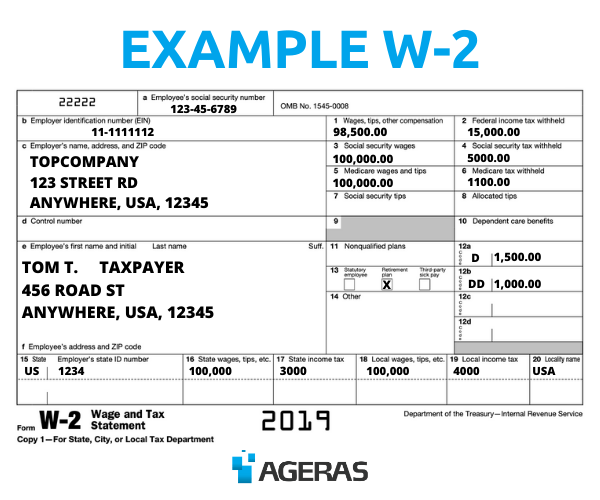

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Easy Peasy Tax Time Tips: What To Do With Your W2!

Tax season can be overwhelming, but with the right tips and tricks, you can make the process a breeze. The first step is to gather all your necessary documents, including your W2 form. Your W2 provides all the information your employer reported to the IRS about your income and taxes withheld. Once you have your W2 in hand, you can start the process of filing your taxes.

Next, it’s important to double-check the information on your W2 to ensure its accuracy. Mistakes on your W2 can lead to delays in processing your tax return, so take the time to review it carefully. Make sure your name, Social Security number, and income amounts are all correct. If you spot any errors, contact your employer immediately to get them corrected.

Once you’ve verified the information on your W2, you can use it to file your taxes. Whether you choose to do them yourself using tax software or seek the help of a professional, having your W2 handy will make the process much smoother. Simply input the information from your W2 into the appropriate sections of your tax return, and you’ll be one step closer to completing your taxes.

Simplify Your Tax Season with These W2 Hacks!

If you’re looking to simplify your tax season even further, consider setting up direct deposit for your tax refund. By providing your bank account information when you file your taxes, you can have your refund deposited directly into your account. This not only saves you the hassle of waiting for a check in the mail but also ensures you get your money faster.

Another helpful hack is to keep a copy of your W2 for your records. While your employer is required to provide you with a copy of your W2, it’s a good idea to make a copy for yourself. This way, you’ll have easy access to the information if you need it in the future. Store it in a safe place with your other important documents to keep everything organized.

Lastly, don’t forget to take advantage of any tax deductions and credits you may be eligible for. Your W2 provides valuable information about your income and taxes paid, which can help you determine what deductions and credits you qualify for. By maximizing your tax breaks, you can potentially lower your tax bill or increase your refund.

In conclusion, tax time doesn’t have to be stressful, especially when you have your W2 in hand. By following these easy peasy tax time tips and simplifying your tax season with these W2 hacks, you can make the process of filing your taxes a breeze. So don’t let tax season get you down – tackle it head-on and make this year’s tax return your easiest one yet!

Below are some images related to What Do I Do With A W2 Form

what can someone do with my w2 form, what do a w2 form look like, what do i do if i have 2 w2 forms, what do i do if i lost my w2 form, what do i do with a w2 form, , What Do I Do With A W2 Form.

what can someone do with my w2 form, what do a w2 form look like, what do i do if i have 2 w2 forms, what do i do if i lost my w2 form, what do i do with a w2 form, , What Do I Do With A W2 Form.