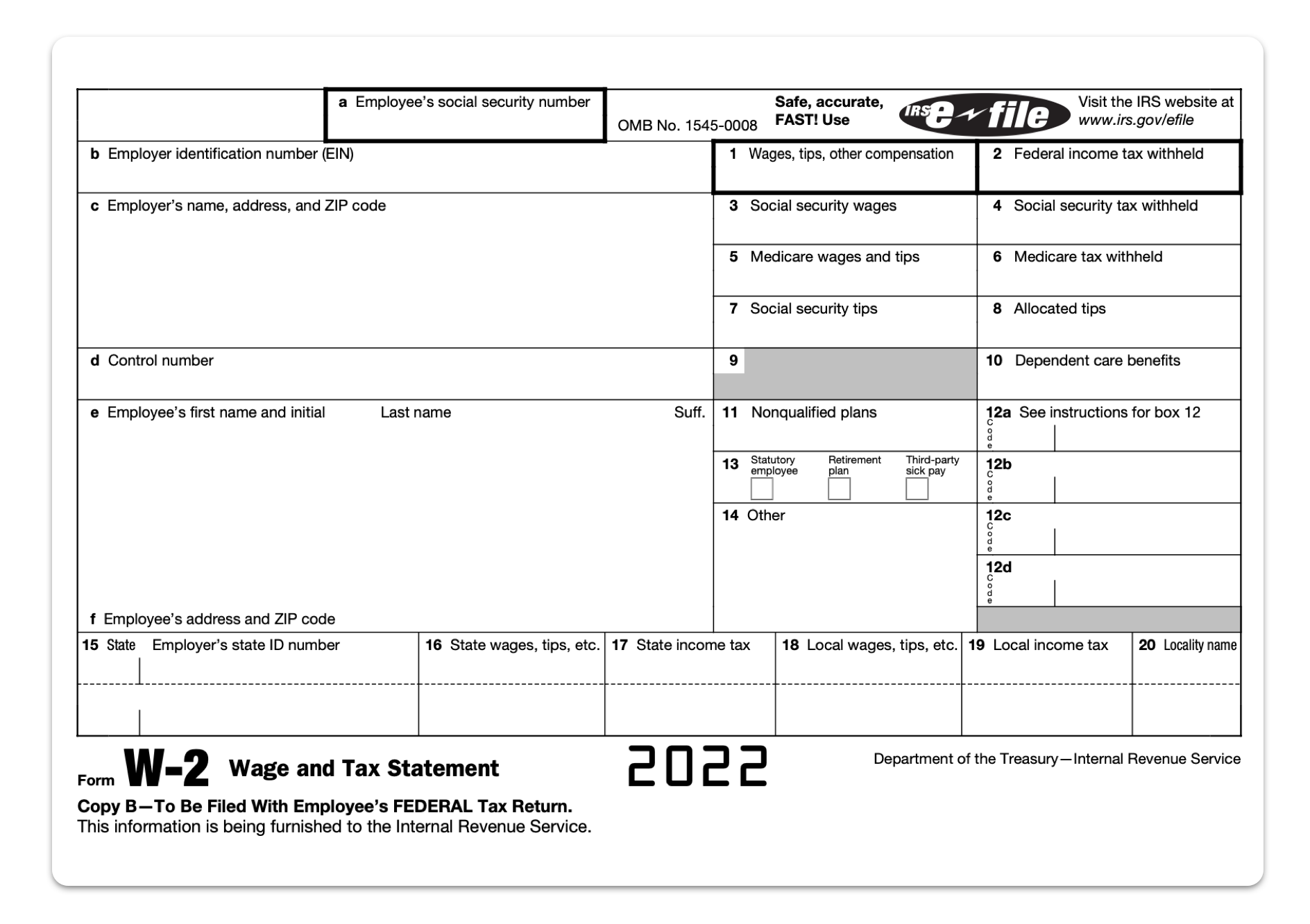

W4 Vs W2 Tax Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

W4 Vs W2: The Ultimate Showdown of Tax Forms!

Are you ready for the ultimate battle of tax forms? In one corner, we have the W4 form, known for its intricacies and complexities. And in the other corner, we have the W2 form, the tried and true document that every employee knows all too well. Let’s dive into the showdown between these two tax forms and see which one will emerge victorious!

W4 or W2: Which Tax Form will Emerge Victorious?

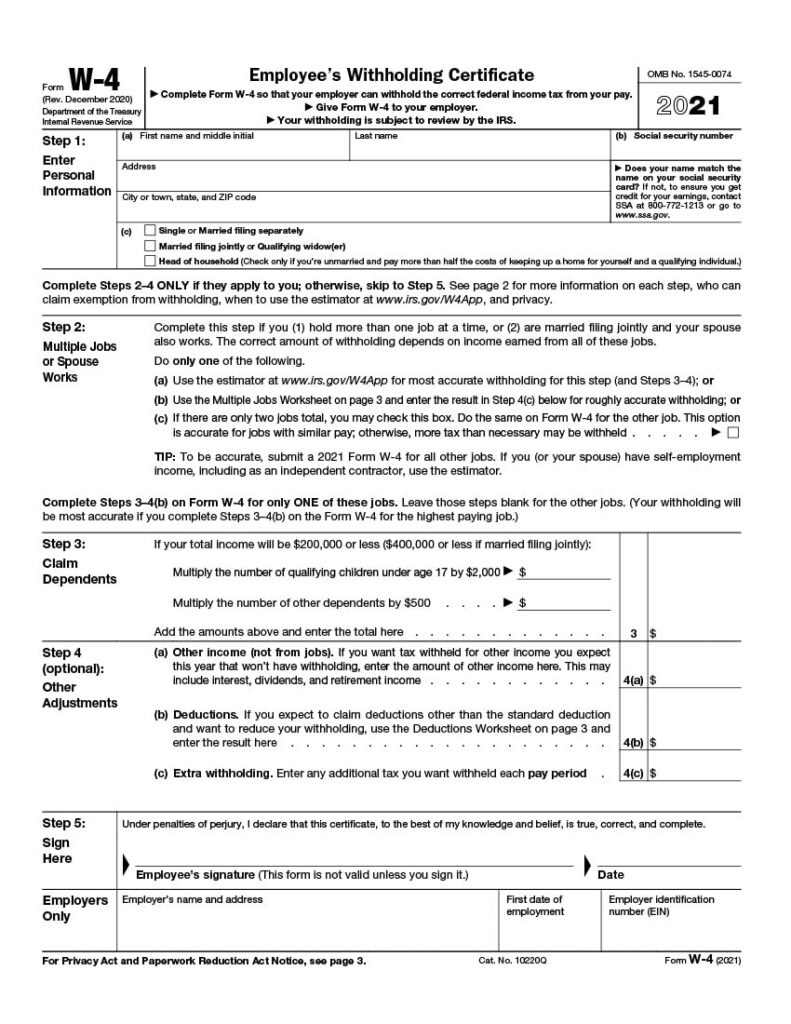

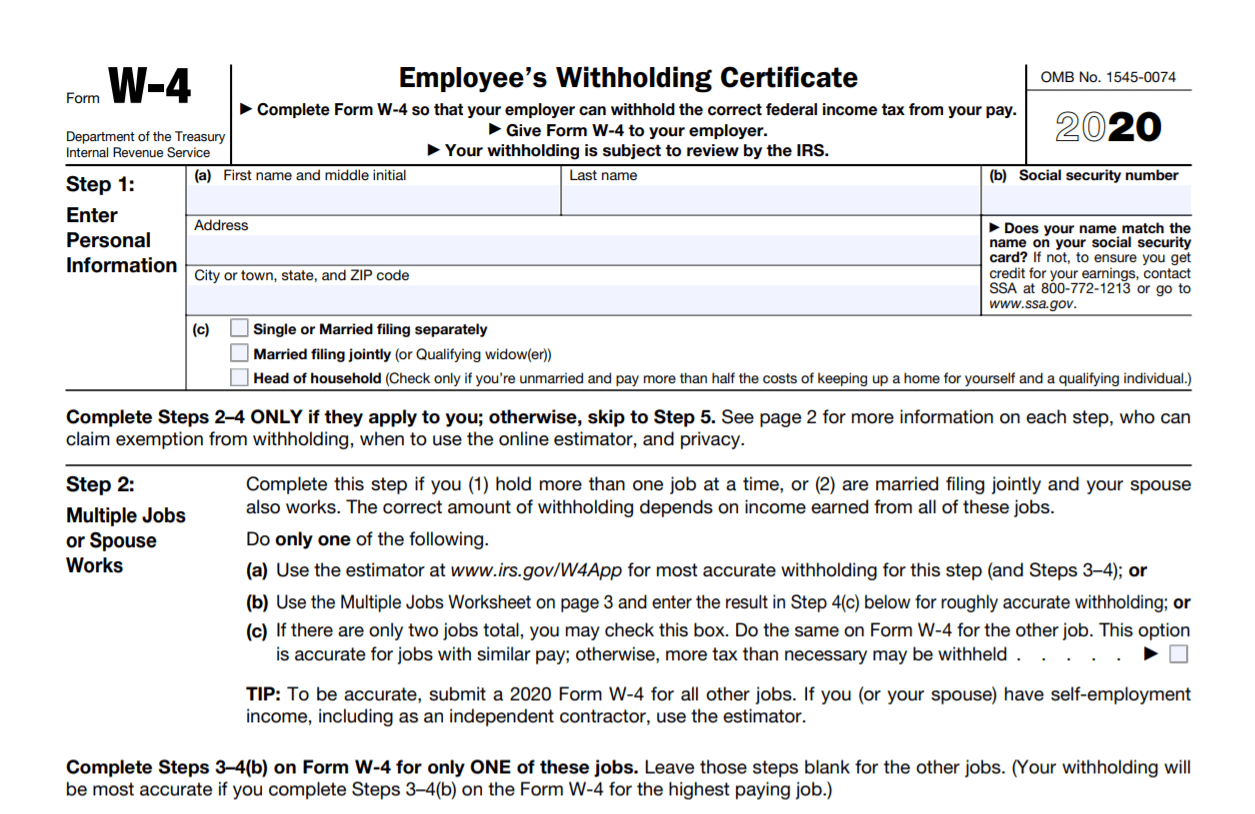

The W4 form is often seen as the underdog in the world of tax forms. It requires individuals to calculate their withholding allowances and can be confusing for those unfamiliar with tax jargon. On the other hand, the W2 form is a familiar sight for employees, detailing their earnings and tax withholdings for the year. While the W4 may seem daunting at first, mastering it can lead to a more accurate withholding amount and potentially a larger tax refund.

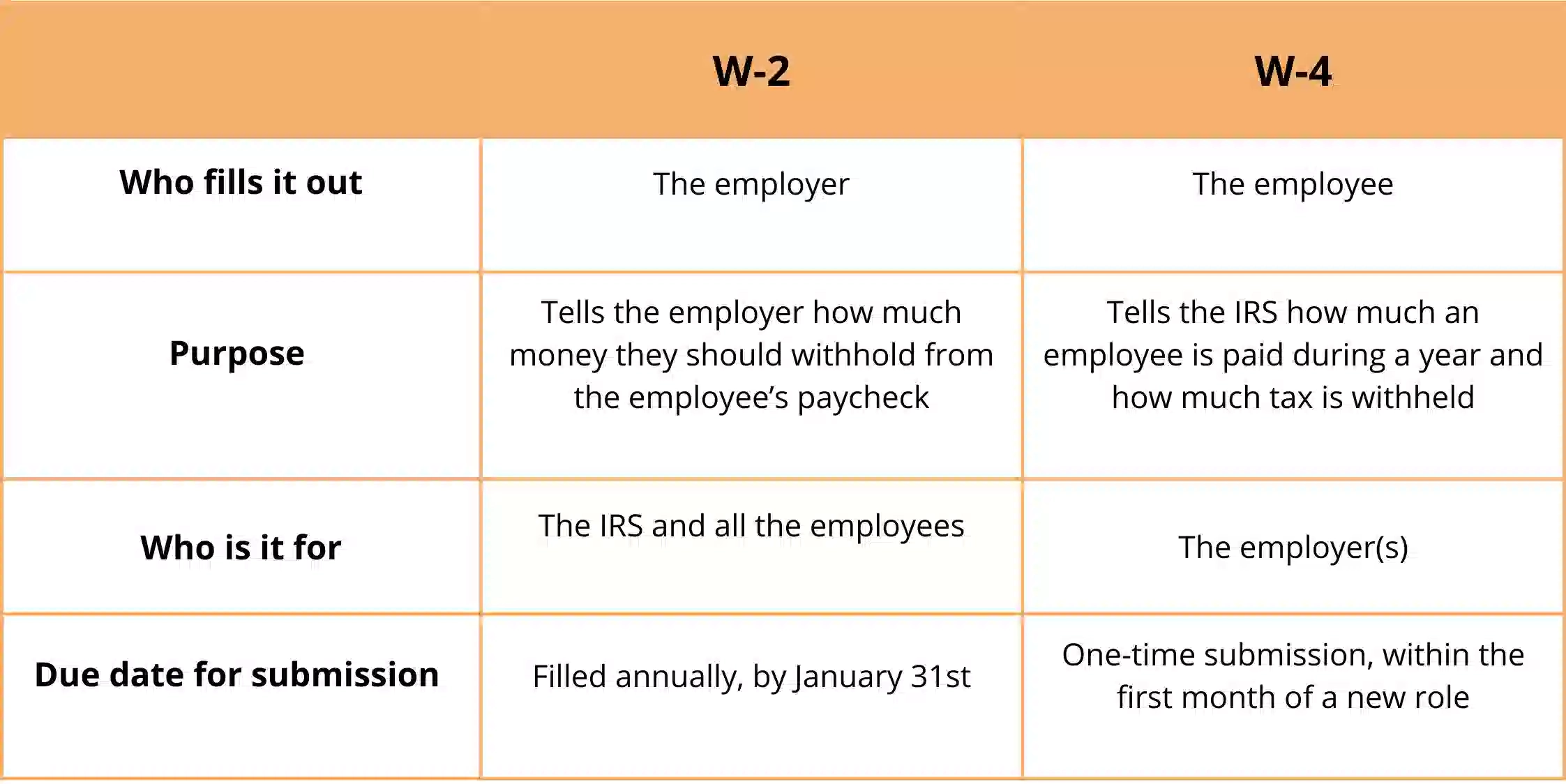

Battle of the Taxes: W4 and W2 Go Head-to-Head!

As the battle between the W4 and W2 forms rages on, it’s important to understand the differences between the two. The W4 form is filled out by employees to determine how much tax should be withheld from their paychecks, based on factors such as marital status and dependents. On the other hand, the W2 form is provided by employers to employees, summarizing their earnings and tax withholdings for the year. Both forms play a crucial role in ensuring that individuals are paying the correct amount of taxes throughout the year.

The Final Verdict: Which Tax Form Reigns Supreme?

In the end, both the W4 and W2 forms have their strengths and weaknesses. The W4 form may require more effort to fill out initially, but it can lead to a more accurate withholding amount and potentially a larger tax refund. On the other hand, the W2 form provides a straightforward summary of earnings and withholdings, making it easier for employees to understand their tax situation. Ultimately, the winner of this showdown depends on your individual tax situation and understanding of tax forms. So, whether you’re Team W4 or Team W2, make sure to fill out your forms accurately and timely to ensure a smooth tax season!

Below are some images related to W4 Vs W2 Tax Form

is there a difference between w2 and w4, w4 form vs w2, w4 vs w2 tax form, what is a w4 vs w2, , W4 Vs W2 Tax Form.

is there a difference between w2 and w4, w4 form vs w2, w4 vs w2 tax form, what is a w4 vs w2, , W4 Vs W2 Tax Form.