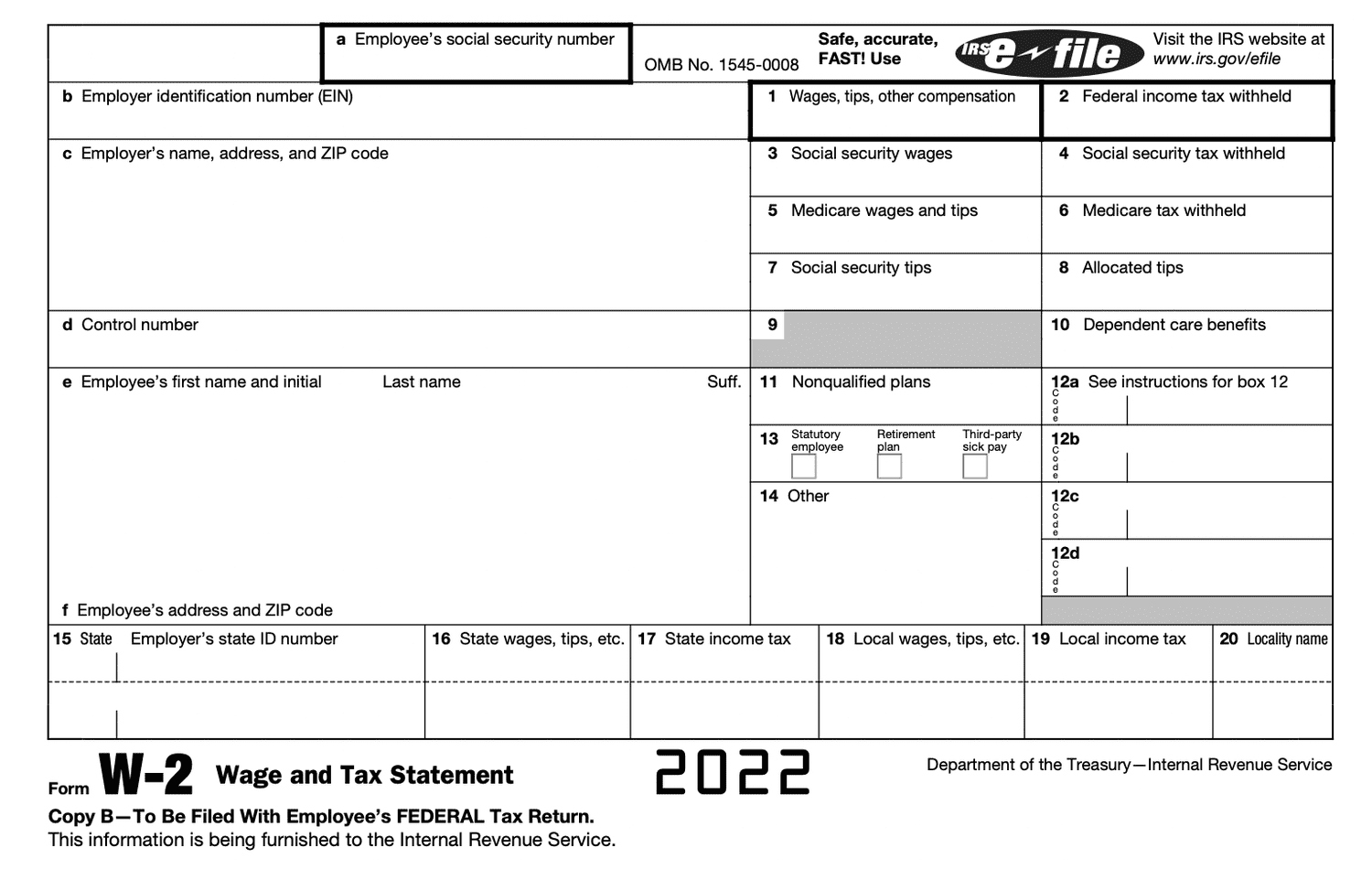

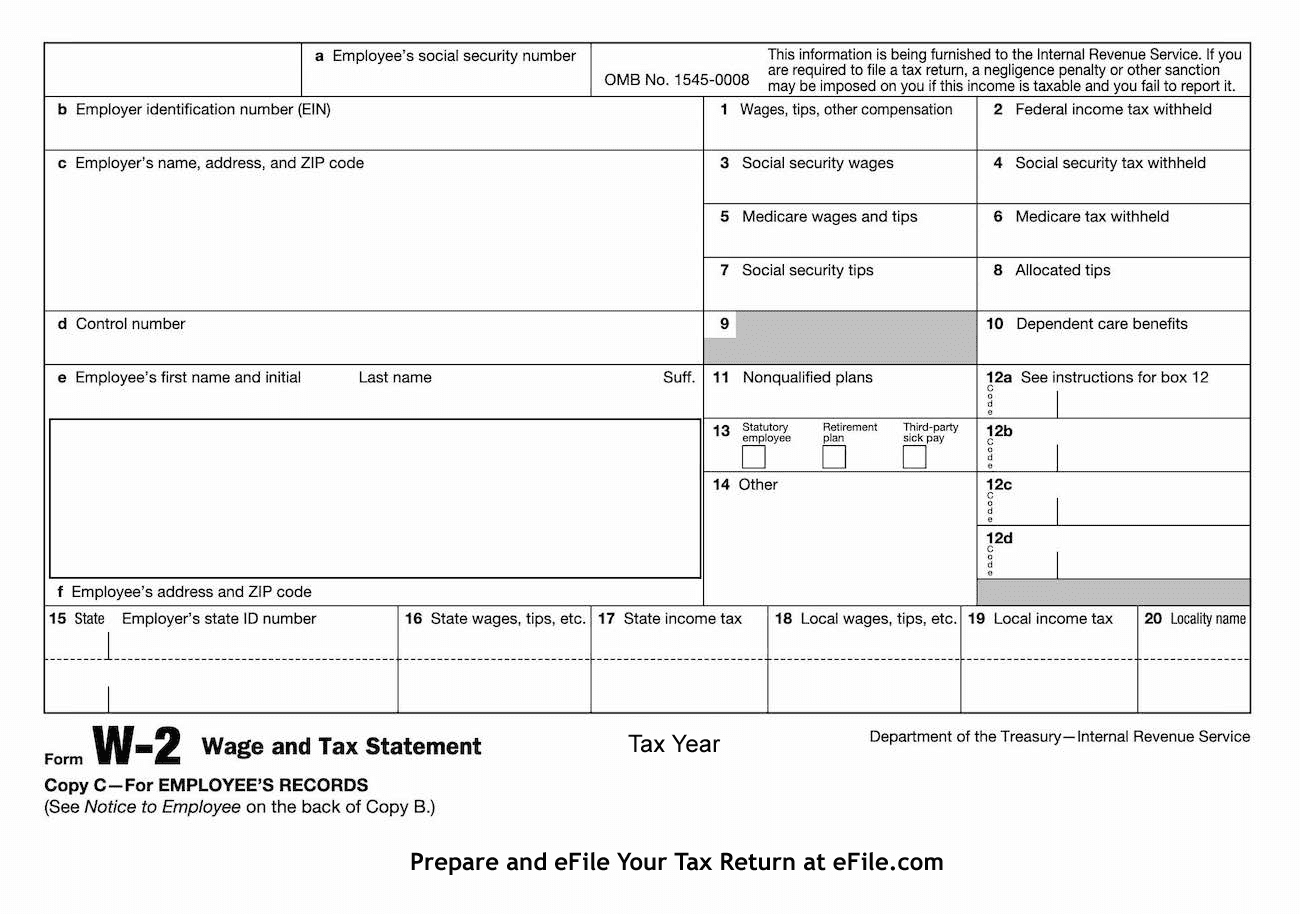

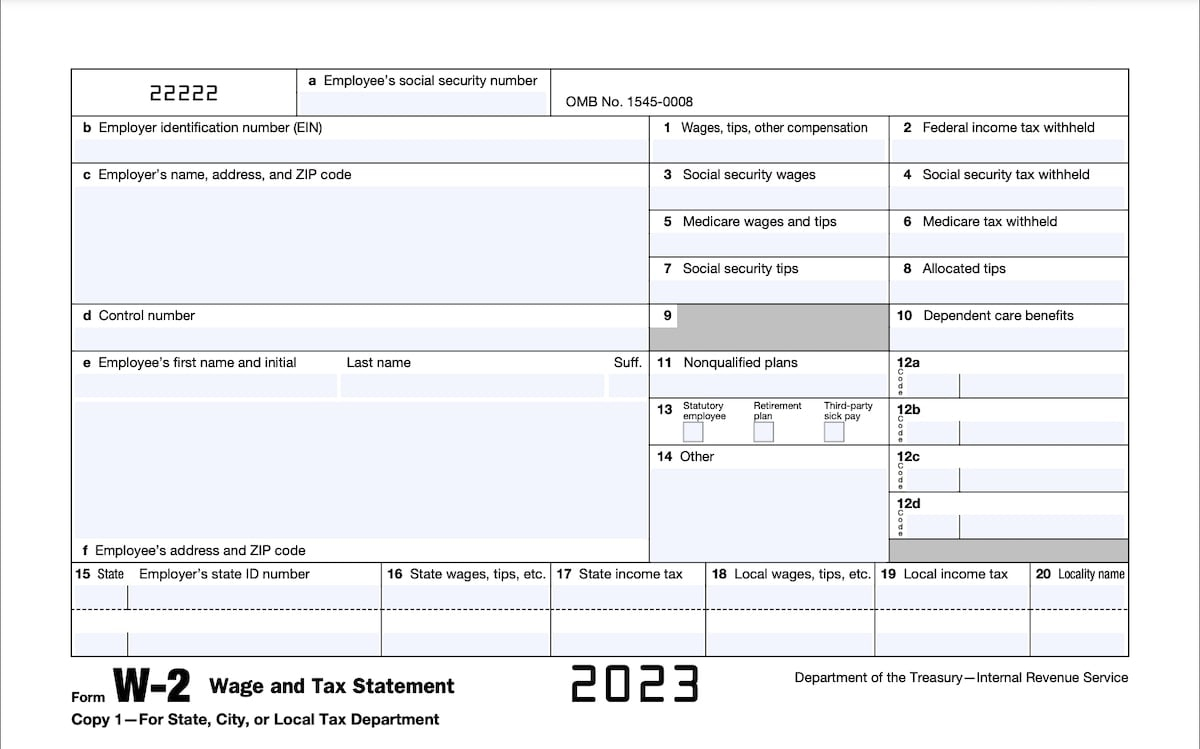

W2 Tax Withholding Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Tax Potential with the Ultimate W2 Guide!

Are you ready to take control of your taxes and maximize your refund? Look no further than your trusty W2 form! This essential document holds the key to unlocking potential savings and ensuring you get the most out of tax season. With the right knowledge and strategies, you can turn your W2 form into a powerful tool for boosting your refund and keeping more money in your pocket.

One of the first steps to unleashing your tax potential is understanding all the information on your W2 form. From your wages and tips to federal and state tax withholdings, each section plays a crucial role in determining your tax liability. By thoroughly reviewing your W2 form and making sure all the details are accurate, you can avoid costly mistakes and ensure you’re not missing out on any potential deductions or credits.

In addition to understanding your W2 form, it’s important to take advantage of all available tax breaks and credits. From education expenses to retirement contributions, there are numerous opportunities to reduce your tax bill and increase your refund. By consulting with a tax professional or using online tax tools, you can identify potential credits and deductions that apply to your situation and make sure you’re getting the maximum refund possible.

Turn Your W2 Form into a Refund-Boosting Machine!

Ready to turbocharge your refund? It’s time to turn your W2 form into a refund-boosting machine! By following a few simple tips and tricks, you can make sure you’re getting the most out of your taxes and maximizing your refund potential. From double-checking your information to exploring tax-saving strategies, there are plenty of ways to make the most of your W2 form.

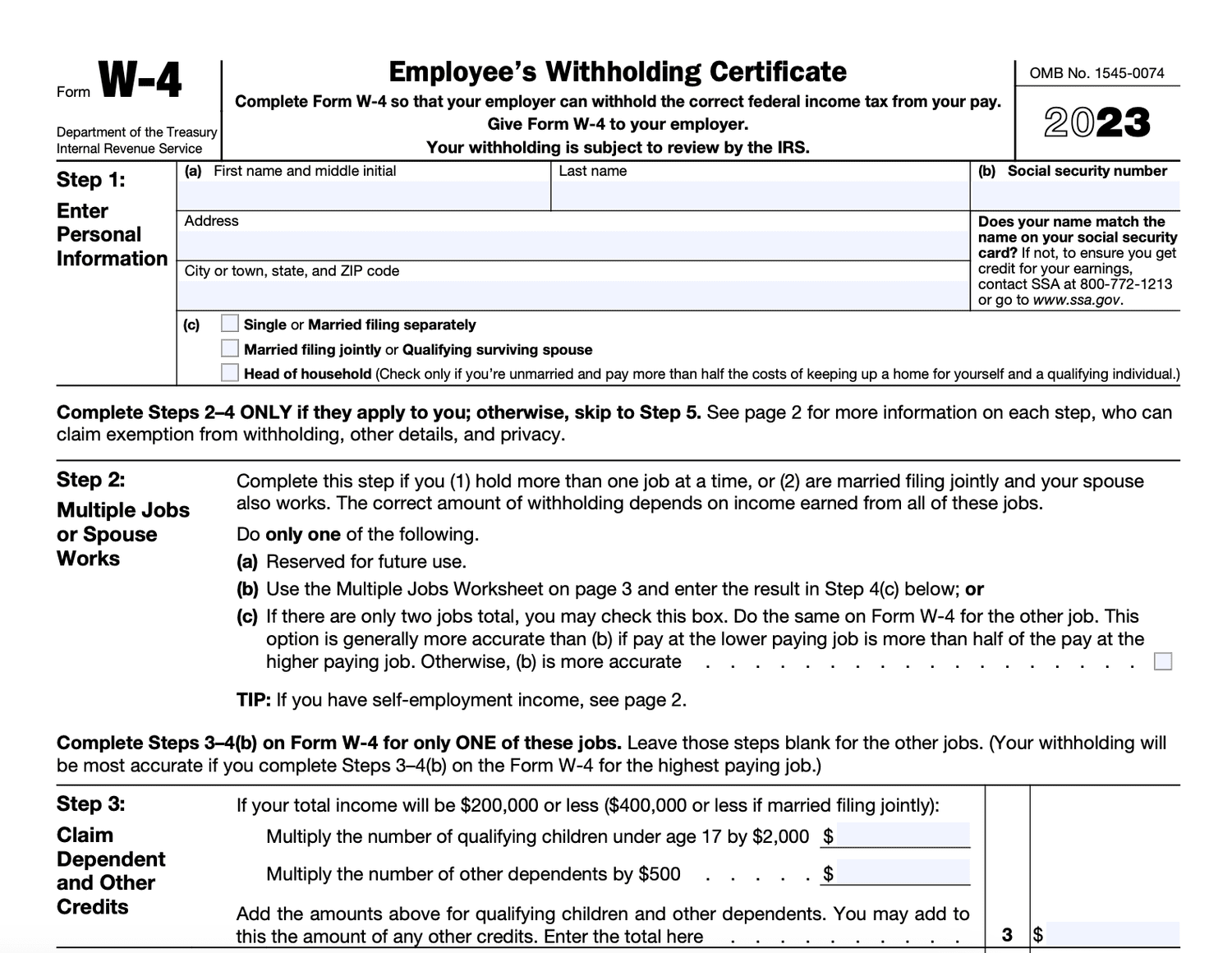

One key strategy for boosting your refund is to review your withholding allowances and make any necessary adjustments. By ensuring your withholdings are accurate, you can avoid underpaying or overpaying your taxes and increase your chances of receiving a larger refund. Whether you’re claiming dependents or have multiple sources of income, it’s important to update your withholding information to reflect your current situation.

Another way to maximize your refund is to explore tax credits and deductions that apply to your specific circumstances. From the Earned Income Tax Credit to the Child and Dependent Care Credit, there are plenty of opportunities to reduce your tax liability and increase your refund amount. By researching potential credits and deductions and keeping detailed records of your expenses, you can ensure you’re not leaving any money on the table.

Conclusion

With the right knowledge and strategies, you can unleash your tax potential and turn your W2 form into a refund-boosting machine. By understanding all the information on your W2 form, taking advantage of available tax breaks, and making smart adjustments to your withholding allowances, you can maximize your refund and keep more money in your pocket. So don’t wait until the last minute – start optimizing your W2 form today and take control of your taxes like never before!

Below are some images related to W2 Tax Withholding Form

w-2 tax state withholding, w2 tax withholding form, what is w2 withholding, what should my w2 withholding be, where is withholding tax on w2, , W2 Tax Withholding Form.

w-2 tax state withholding, w2 tax withholding form, what is w2 withholding, what should my w2 withholding be, where is withholding tax on w2, , W2 Tax Withholding Form.