W2 Form Vs W9 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Showdown: W2 Form vs W9 Form!

Are you ready for the ultimate tax time showdown? It’s time to pick your tax weapon and decide between the mighty W2 form and the formidable W9 form. These two forms may seem similar at first glance, but each has its own unique strengths and weaknesses. Let’s dive into the battle of the forms and see which one will come out on top this tax season!

Battle of the Forms: W2 vs W9!

In one corner, we have the W2 form, beloved by employees across the nation. This form is a staple of tax season, providing detailed information about your wages, taxes withheld, and other important financial details. It’s the go-to form for salaried employees who receive a regular paycheck from their employer. The W2 form is straightforward and easy to understand, making it a popular choice for many tax filers.

In the other corner, we have the W9 form, a powerful tool used by independent contractors and freelancers. This form is all about self-employment and income earned from various sources. The W9 form requires you to provide your taxpayer identification number and certify that you are not subject to backup withholding. While it may seem more complex than the W2 form, the W9 is essential for those who work outside the traditional employee-employer relationship.

Choose Your Tax Weapon: W2 or W9?

So, which form will you choose for this tax season showdown? If you’re a salaried employee with a regular paycheck, the W2 form may be your best bet. It provides all the information you need to file your taxes accurately and efficiently. However, if you’re a freelancer or independent contractor, the W9 form is your weapon of choice. It allows you to report your self-employment income and take advantage of deductions and credits available to independent workers.

In the end, both the W2 form and the W9 form are essential tools for navigating the tax season. Whether you’re a W2 warrior or a W9 wizard, be sure to use the form that best fits your financial situation. With the right tax weapon in hand, you’ll be ready to conquer tax season and come out victorious on April 15th!

In conclusion, the battle of the forms may be fierce, but with the right knowledge and preparation, you can conquer tax season with ease. Whether you choose the trusty W2 form or the versatile W9 form, make sure to use your tax weapon wisely. Armed with the right form, you’ll be ready to tackle your taxes and emerge victorious in the tax time showdown!

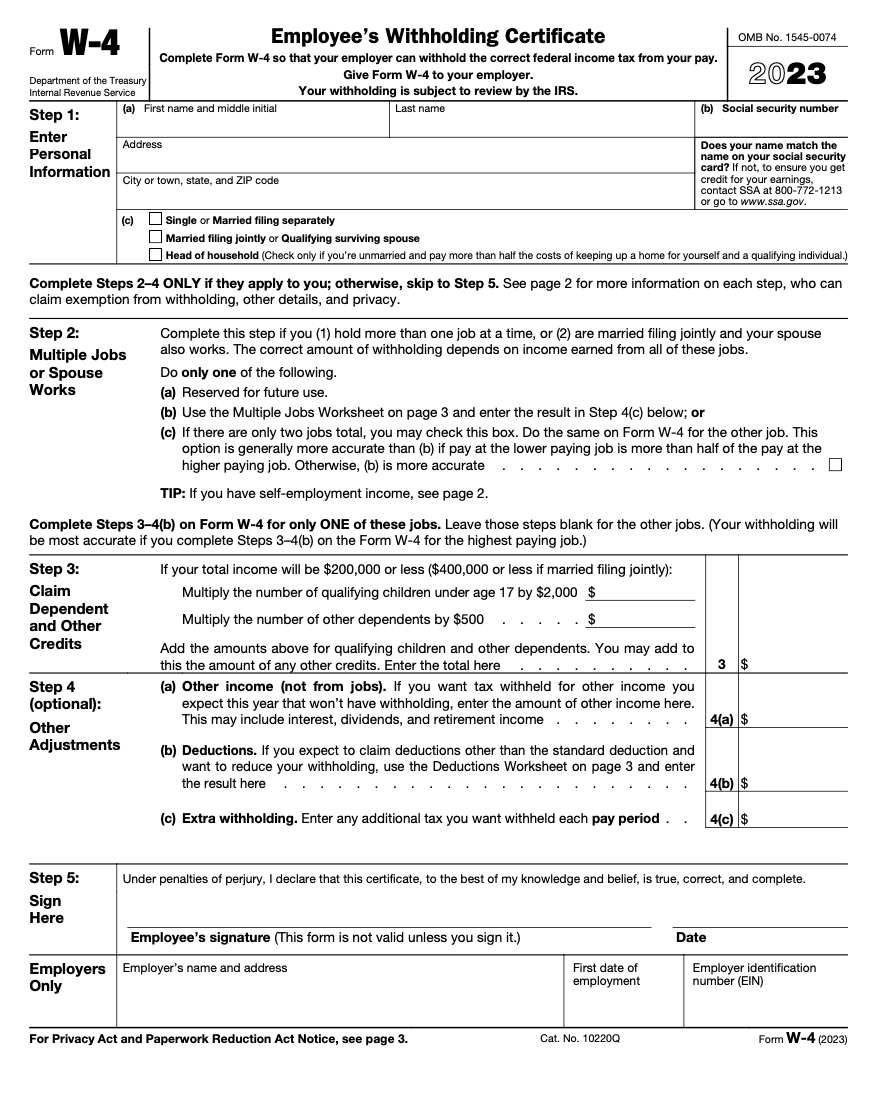

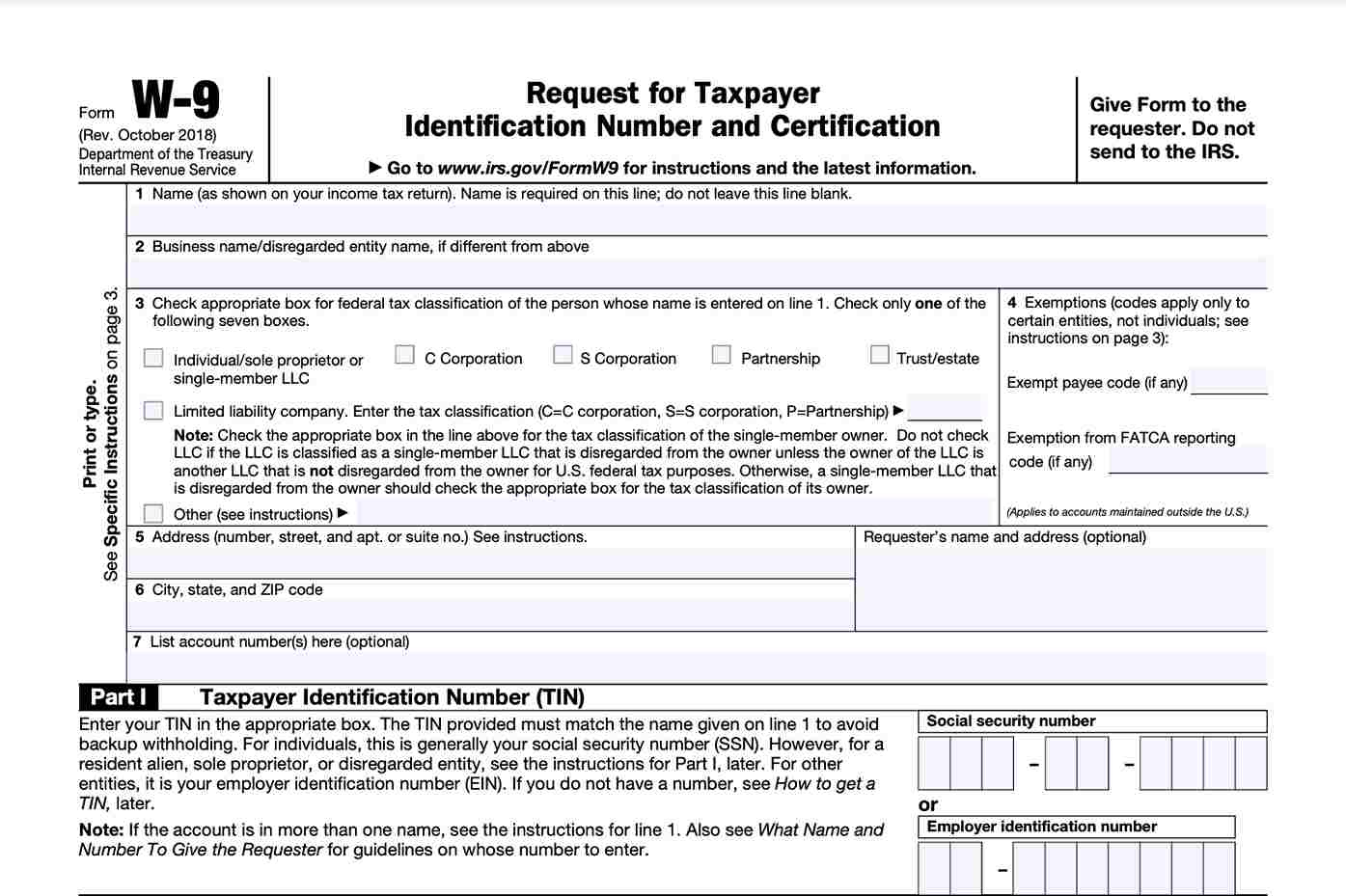

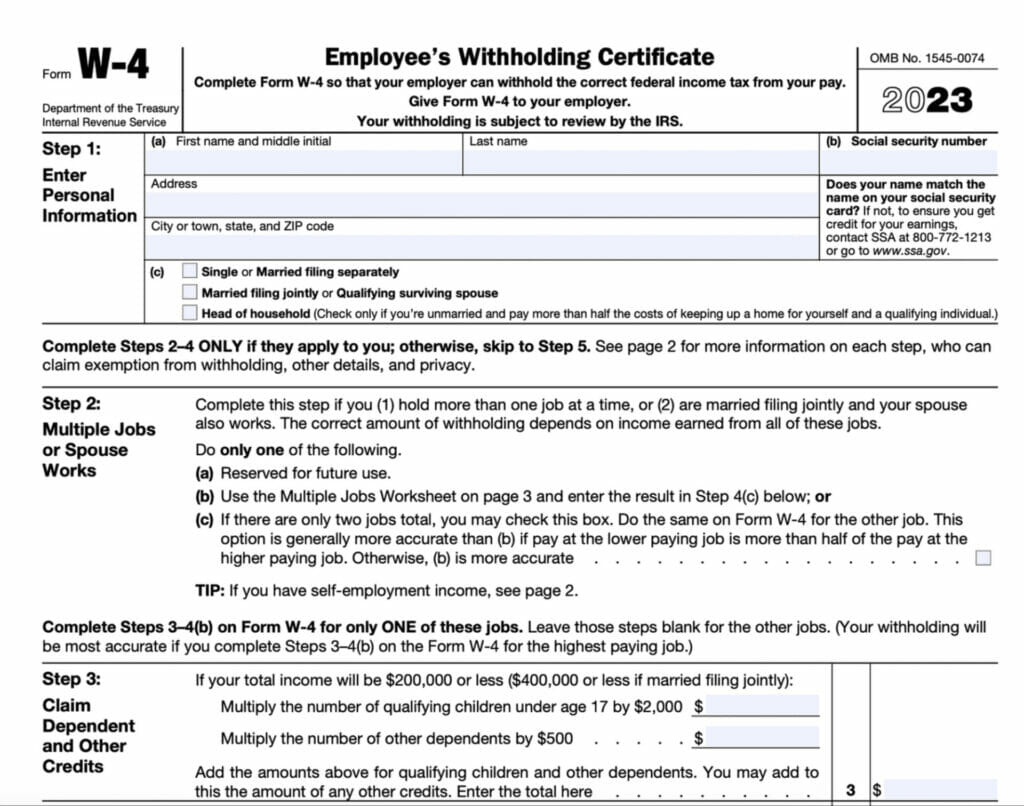

Below are some images related to W2 Form Vs W9

difference w9 and w2, w2 form vs w9, what is w9 vs w2, , W2 Form Vs W9.

difference w9 and w2, w2 form vs w9, what is w9 vs w2, , W2 Form Vs W9.