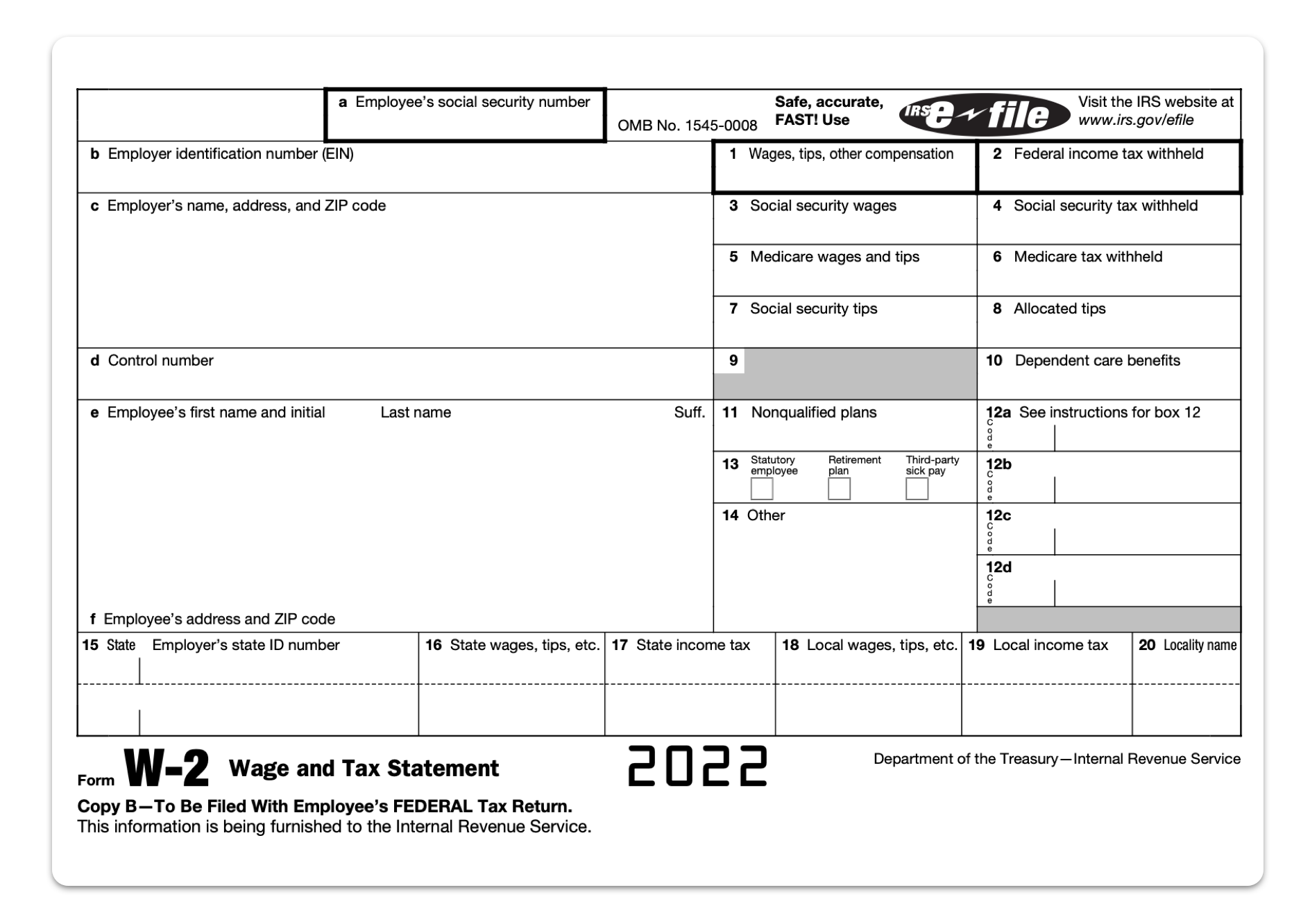

W2 Form Vs W4 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

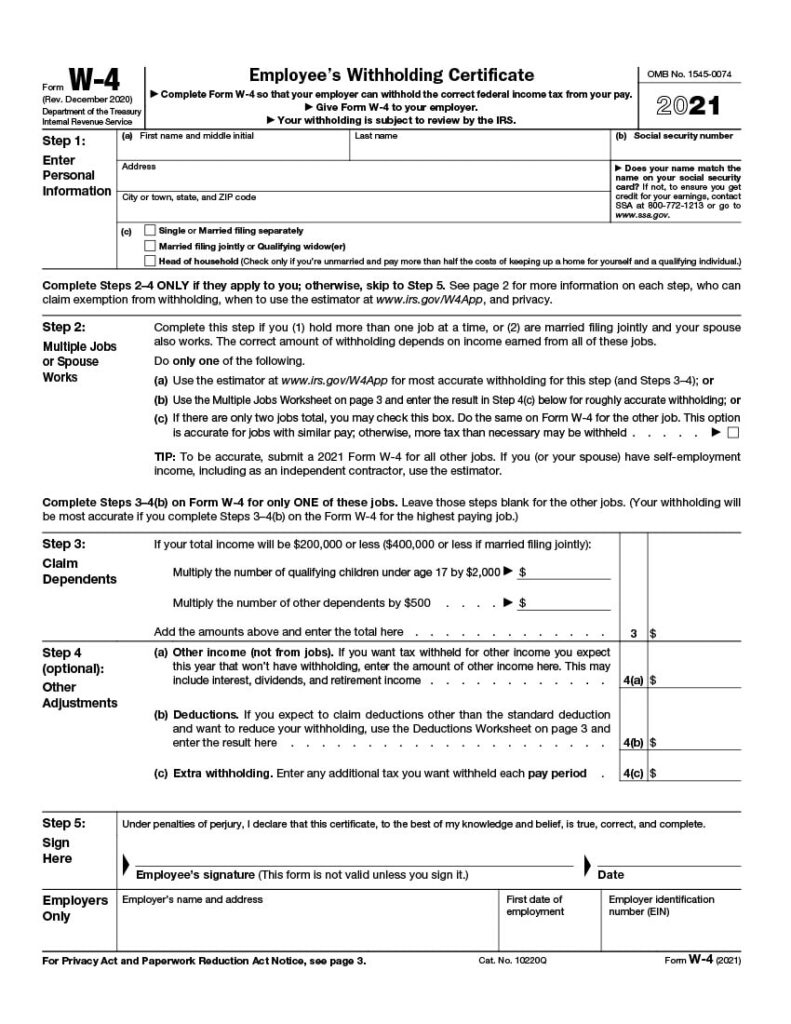

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of W2s and W4s

Are you ready to tackle the intricate dance of W2s and W4s? These tax forms may seem like a daunting puzzle, but fear not! With a little guidance and some fancy footwork, you can unravel the mystery and waltz through tax season with ease. Let’s dive in and discover the secrets behind these important documents.

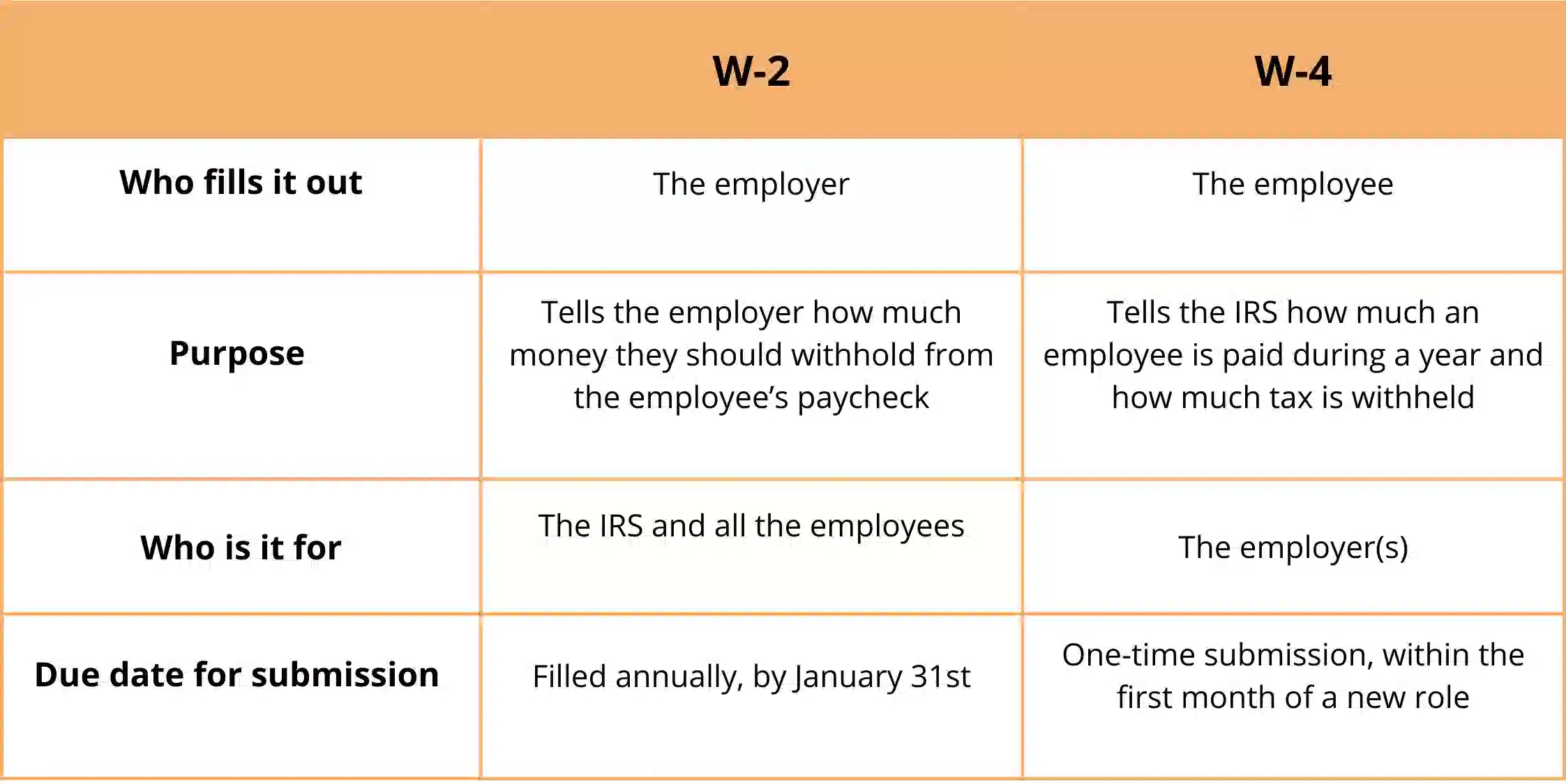

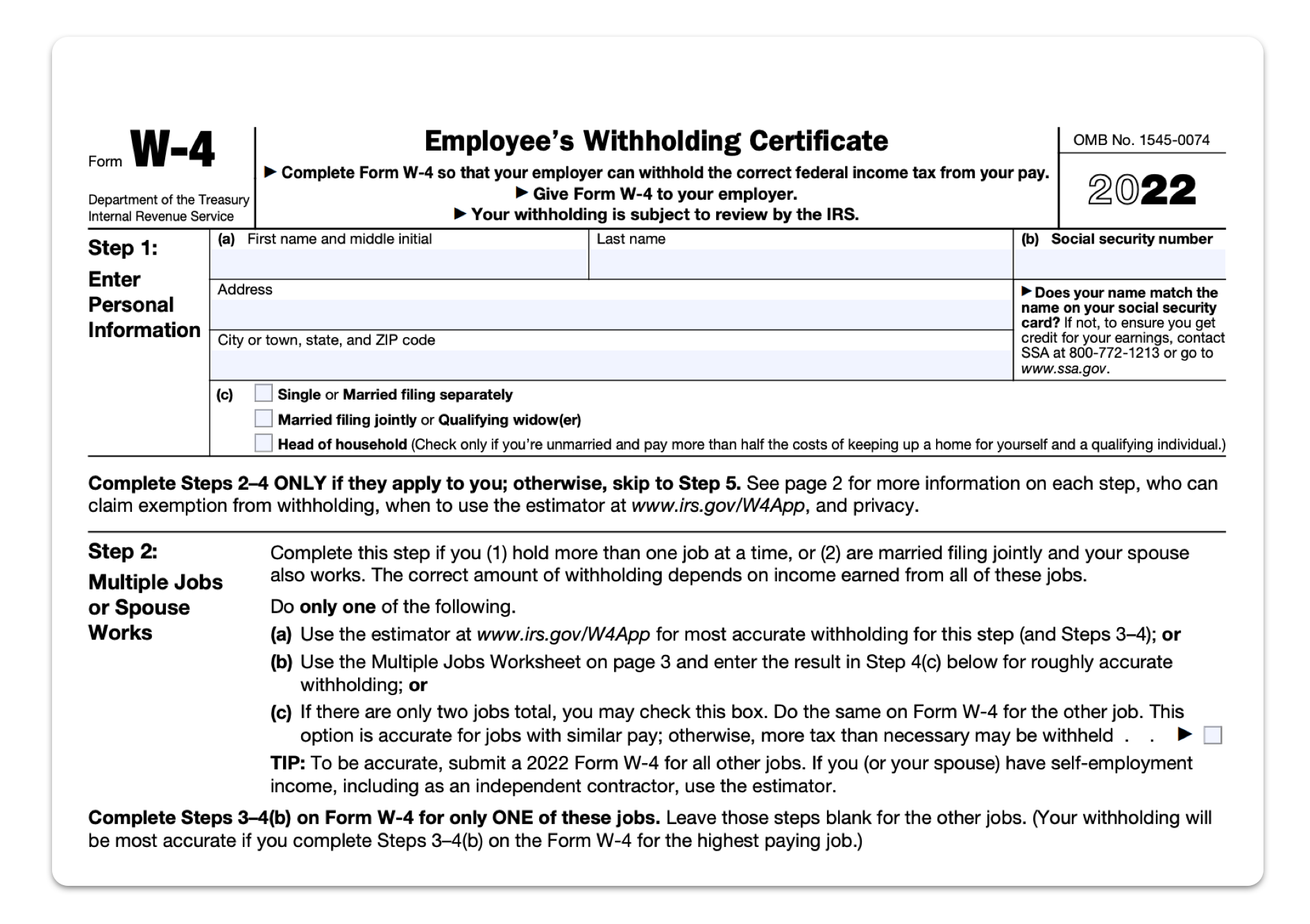

W2s and W4s are key players in the tax game, each serving a specific purpose. Your W2 form, provided by your employer, details your earnings and taxes withheld throughout the year. This information is crucial for filing your taxes accurately and ensuring you receive any refunds you’re entitled to. On the other hand, your W4 form is where you indicate your tax withholding preferences, such as the number of allowances you’re claiming. Understanding how these forms work together is essential for navigating the tax dance floor successfully.

As you navigate the dance of W2s and W4s, pay attention to the details and master the steps. Review your W2 form carefully to ensure all information is accurate, including your name, social security number, and earnings. Take the time to understand your W4 form and make any necessary updates to your withholding preferences. By staying informed and proactive, you can avoid any missteps and ensure a smooth tax-filing experience. Embrace the challenge of decoding these forms and turn tax season into a graceful performance.

Mastering the Steps to Understanding Tax Forms

Now that you’re armed with knowledge about W2s and W4s, it’s time to master the steps to understanding tax forms. Start by familiarizing yourself with common tax terminology and concepts, such as deductions, credits, and exemptions. These elements play a significant role in calculating your tax liability and maximizing your potential refund. Additionally, consider seeking guidance from a tax professional or utilizing online resources to deepen your understanding of tax forms and requirements.

As you navigate the world of tax forms, remember to stay organized and keep all necessary documents in a secure place. Create a system for tracking important information, such as receipts, invoices, and statements, to streamline the tax-filing process. Stay proactive throughout the year by maintaining accurate records and staying informed about any changes to tax laws or regulations. By staying on top of your tax-related paperwork, you can reduce stress and ensure a successful tax season.

In conclusion, mastering the dance of W2s and W4s is within your reach. By unraveling the mystery of these tax forms and mastering the steps to understanding tax requirements, you can confidently navigate the tax season and maximize your financial potential. Embrace the challenge, stay informed, and approach tax season with confidence. With a little practice and determination, you can waltz through tax season like a pro.

Below are some images related to W2 Form Vs W4 Form

w-2 form w-4 form difference, w2 form vs w4 form, w4 form vs w2, , W2 Form Vs W4 Form.

w-2 form w-4 form difference, w2 form vs w4 form, w4 form vs w2, , W2 Form Vs W4 Form.