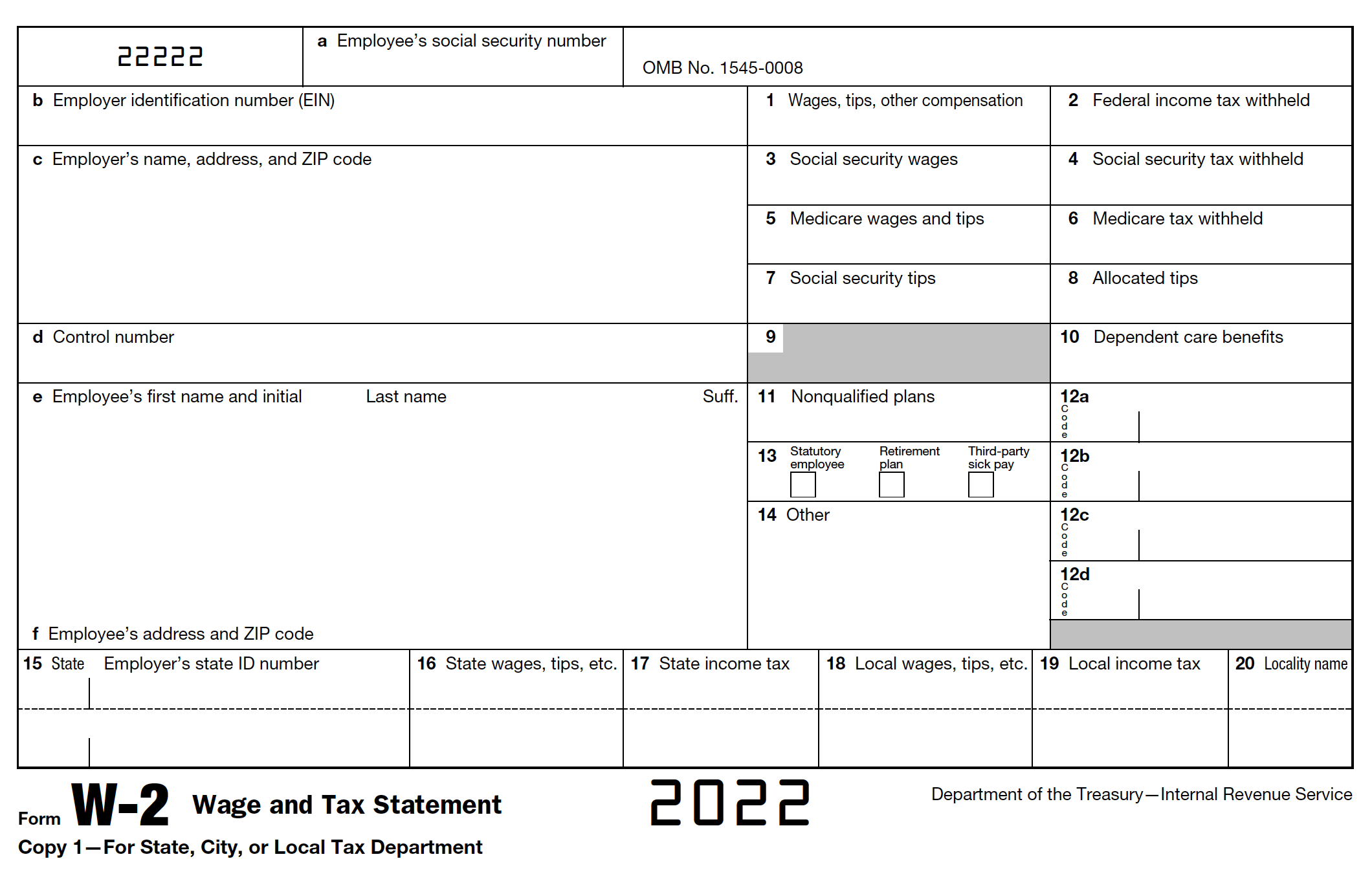

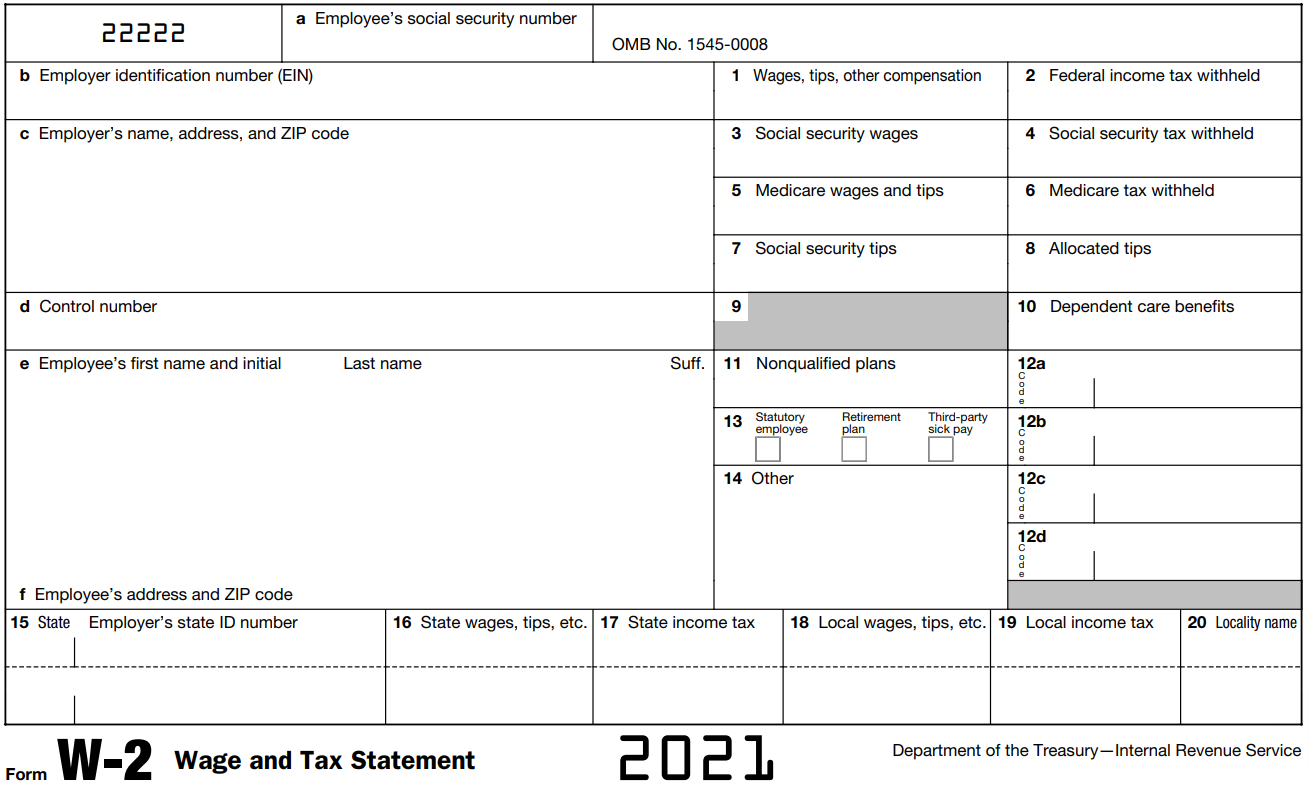

W2 Form Ma – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

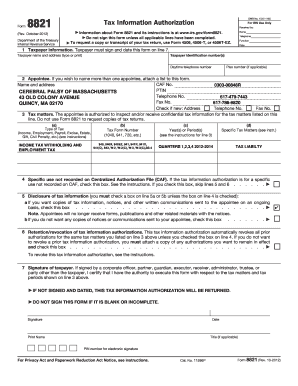

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximizing Your Refund: The Scoop on W2 Form Ma

Are you ready to unlock the full potential of your tax refund this year? Look no further than your trusty W2 form! While tax season can be a daunting time for many, understanding how to make the most of your W2 can lead to a substantial increase in your refund. With a little know-how and some strategic planning, you can maximize your refund and put those extra dollars to good use. Here’s the scoop on how to make the most of your W2 form this tax season.

Unleash Your Refund Potential: The Ultimate Guide

When it comes to maximizing your refund, your W2 form is your best friend. This crucial document provides a detailed summary of your earnings and tax withholdings for the year, giving you valuable insight into your financial situation. By carefully reviewing your W2 form and ensuring that all information is accurate, you can avoid costly mistakes that could impact your refund. Take the time to double-check your W2 for any errors or discrepancies, and reach out to your employer if you spot any inaccuracies.

Another key factor in maximizing your refund is taking advantage of all available tax deductions and credits. Your W2 form can provide valuable information on deductions such as contributions to retirement accounts, student loan interest payments, and healthcare expenses. By claiming these deductions on your tax return, you can lower your taxable income and increase your refund. Be sure to review your W2 form thoroughly to identify any potential deductions that you may have overlooked.

5 Tips for Mastering Your W2 Form Like a Pro

1. Keep track of important deadlines: Make sure to file your taxes on time to avoid penalties and maximize your refund potential.

2. Understand your tax bracket: Knowing which tax bracket you fall into can help you make informed decisions when it comes to deductions and credits.

3. Seek professional help if needed: If you’re unsure about how to navigate your W2 form or maximize your refund, don’t hesitate to seek assistance from a tax professional.

4. Consider investing in tax software: Investing in tax software can make the process of filing your taxes easier and help you identify deductions you may have missed.

5. Stay organized throughout the year: Keeping track of important financial documents and receipts can make tax season a breeze and ensure that you’re prepared to maximize your refund.

In conclusion, mastering your W2 form is key to maximizing your tax refund and making the most of your financial situation. By following these tips and taking the time to review your W2 form carefully, you can ensure that you’re getting the refund you deserve. So, grab your W2 form and get ready to unleash your refund potential this tax season!

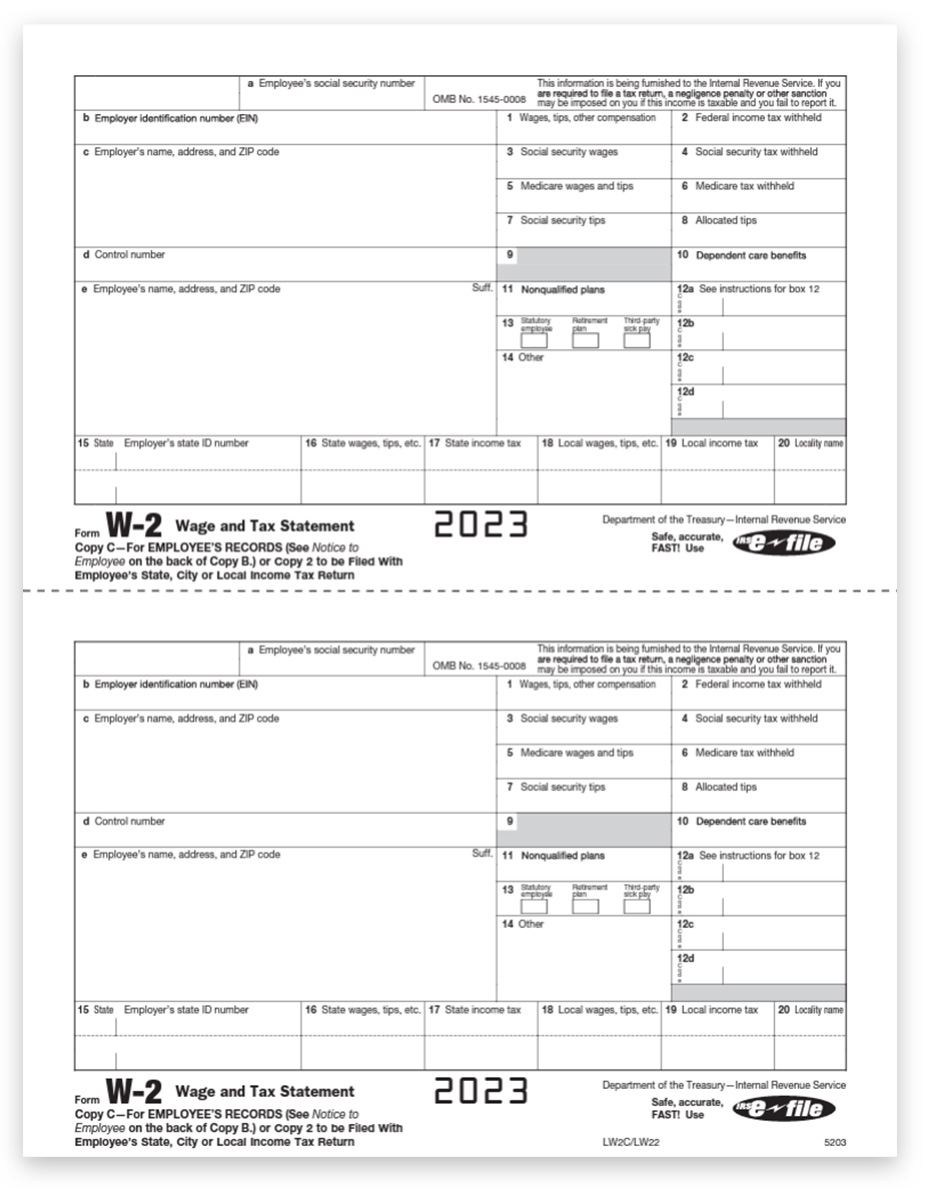

Below are some images related to W2 Form Ma

w2 form ma, w2 form macy’s, w2 form mail, w2 form mailing deadline, w2 form maker, , W2 Form Ma.

w2 form ma, w2 form macy’s, w2 form mail, w2 form mailing deadline, w2 form maker, , W2 Form Ma.