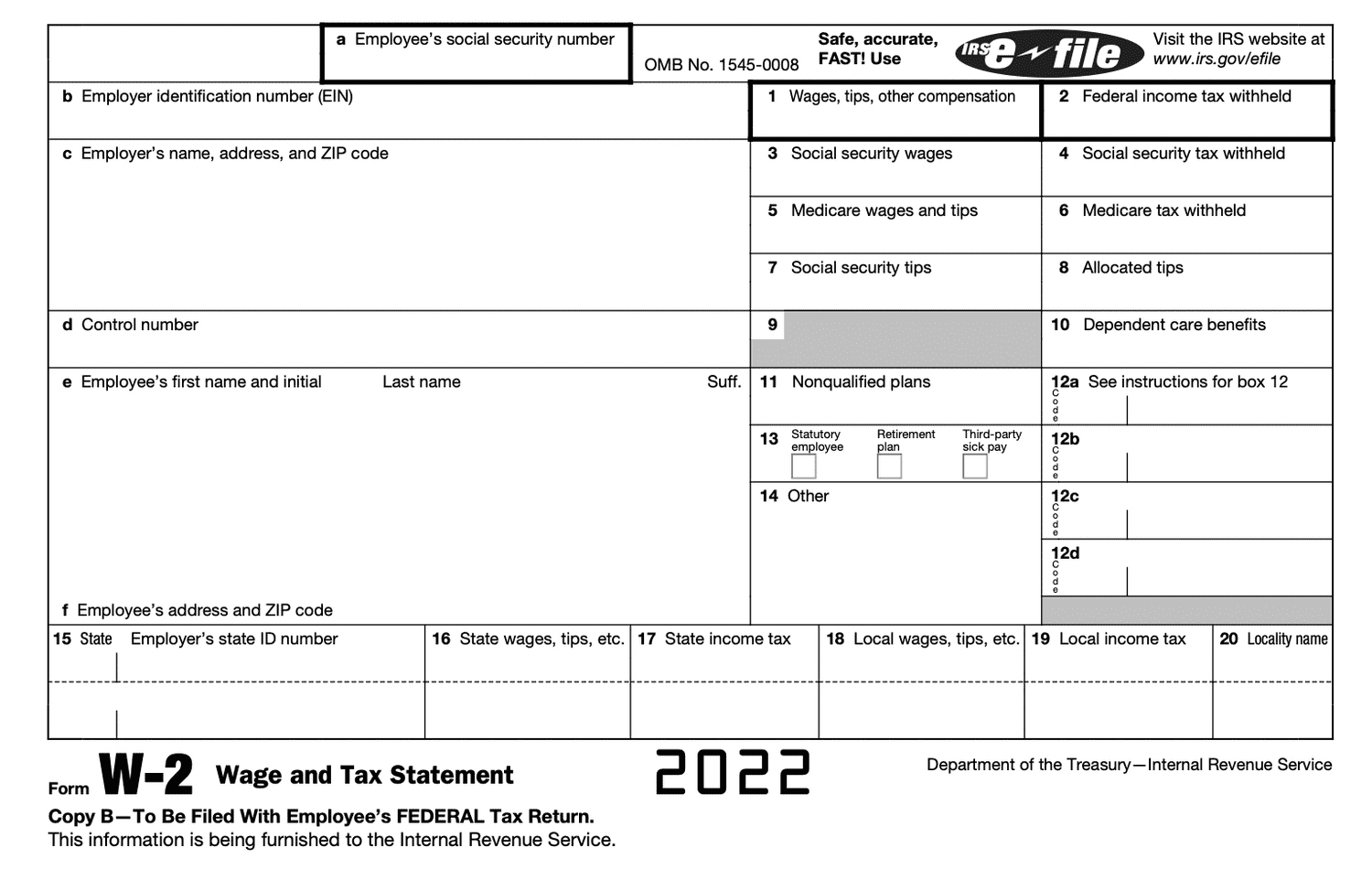

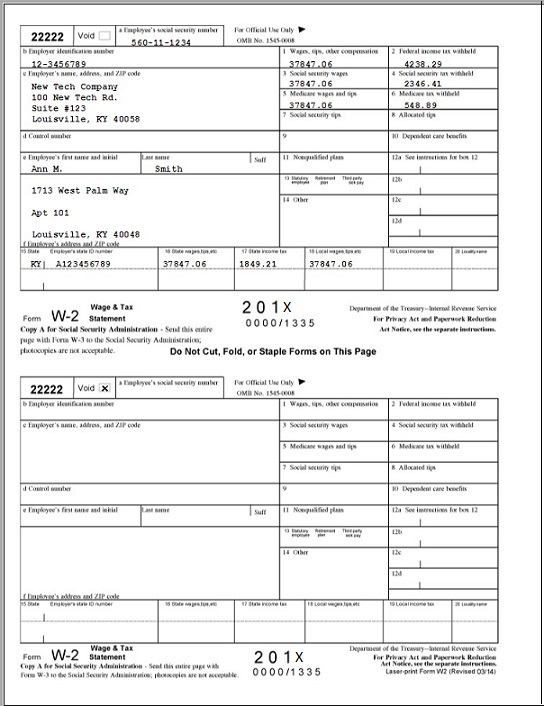

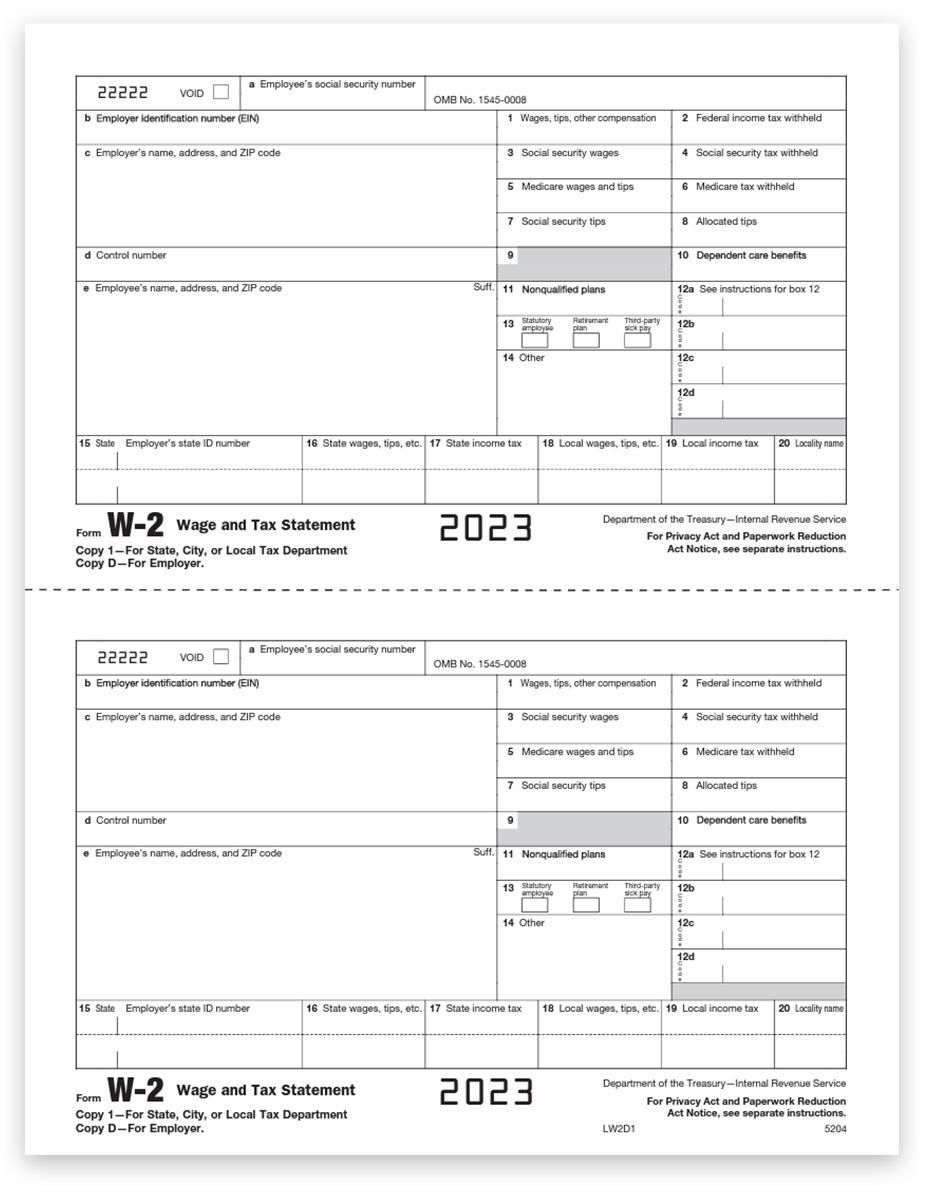

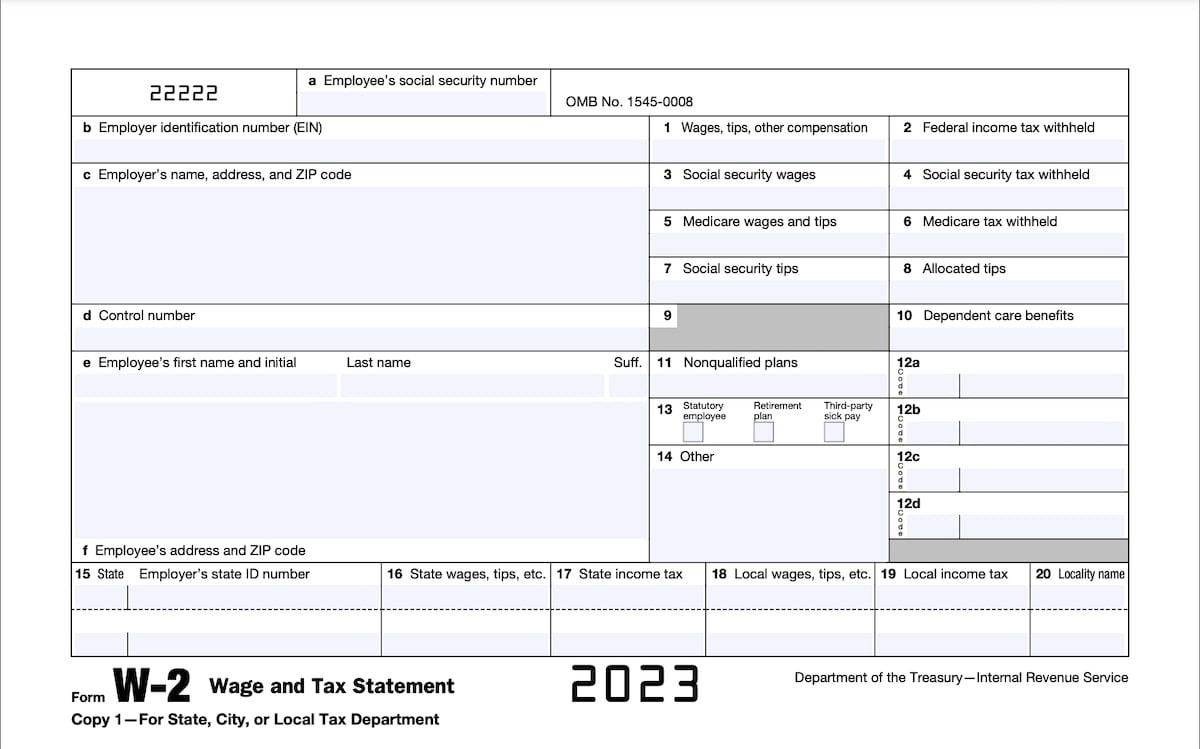

What Is The W2 Form For – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Mystery of the W2 Form: Your Ticket to Tax Season Success!

Tax season can be a stressful time for many, but fear not! The key to navigating through the labyrinth of taxes lies within the humble W2 form. This seemingly cryptic document holds the secrets to unlocking your tax season triumph. By decoding the W2 form and understanding its contents, you can breeze through tax season with confidence and ease.

Decoding the W2 Form: Your Key to Understanding Taxes!

The W2 form is like a treasure map that leads you through the maze of taxes. It provides a snapshot of your income, taxes withheld, and other valuable information that the IRS needs to calculate your tax liability. Understanding the different boxes on the W2 form is crucial to ensuring that you are reporting your income accurately and maximizing your tax deductions. From Box 1 (Wages, tips, other compensation) to Box 6 (Medicare tax withheld), each box tells a story of your financial year.

One of the most important sections of the W2 form is Box 2, which shows the total amount of federal income tax withheld from your paychecks throughout the year. This information is essential for determining whether you will receive a tax refund or owe additional taxes. By comparing the amount of tax withheld with your actual tax liability, you can avoid any surprises come tax filing time. Deciphering the numbers on your W2 form can empower you to take control of your finances and make informed decisions about your tax situation.

Unlocking the Secrets of Your W2 Form for Tax Season Triumph!

With a little bit of patience and some guidance, you can unravel the mysteries of the W2 form and set yourself up for tax season success. Take the time to review each section of your W2 form carefully and seek help from a tax professional if needed. By understanding the information provided on your W2 form, you can ensure that you are filing your taxes accurately and efficiently. So, embrace the challenge of tax season and let your W2 form be your guiding light towards financial freedom!

Below are some images related to What Is The W2 Form For

what does the w2 form do, what is a w-2 form in canada, what is form w2-g, what is the purpose of the w2 form, what is the w2 form for, , What Is The W2 Form For.

what does the w2 form do, what is a w-2 form in canada, what is form w2-g, what is the purpose of the w2 form, what is the w2 form for, , What Is The W2 Form For.