W9 Vs W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

W9 or W2? Decoding the Tax Forms!

Are you feeling overwhelmed by the various tax forms that come your way during tax season? Fear not! We’re here to help you unravel the mystery behind two commonly confused forms – the W9 and the W2. By understanding the differences between these forms, you’ll be able to navigate the tax season with ease and confidence.

Unveiling the Mystery: W9 or W2?

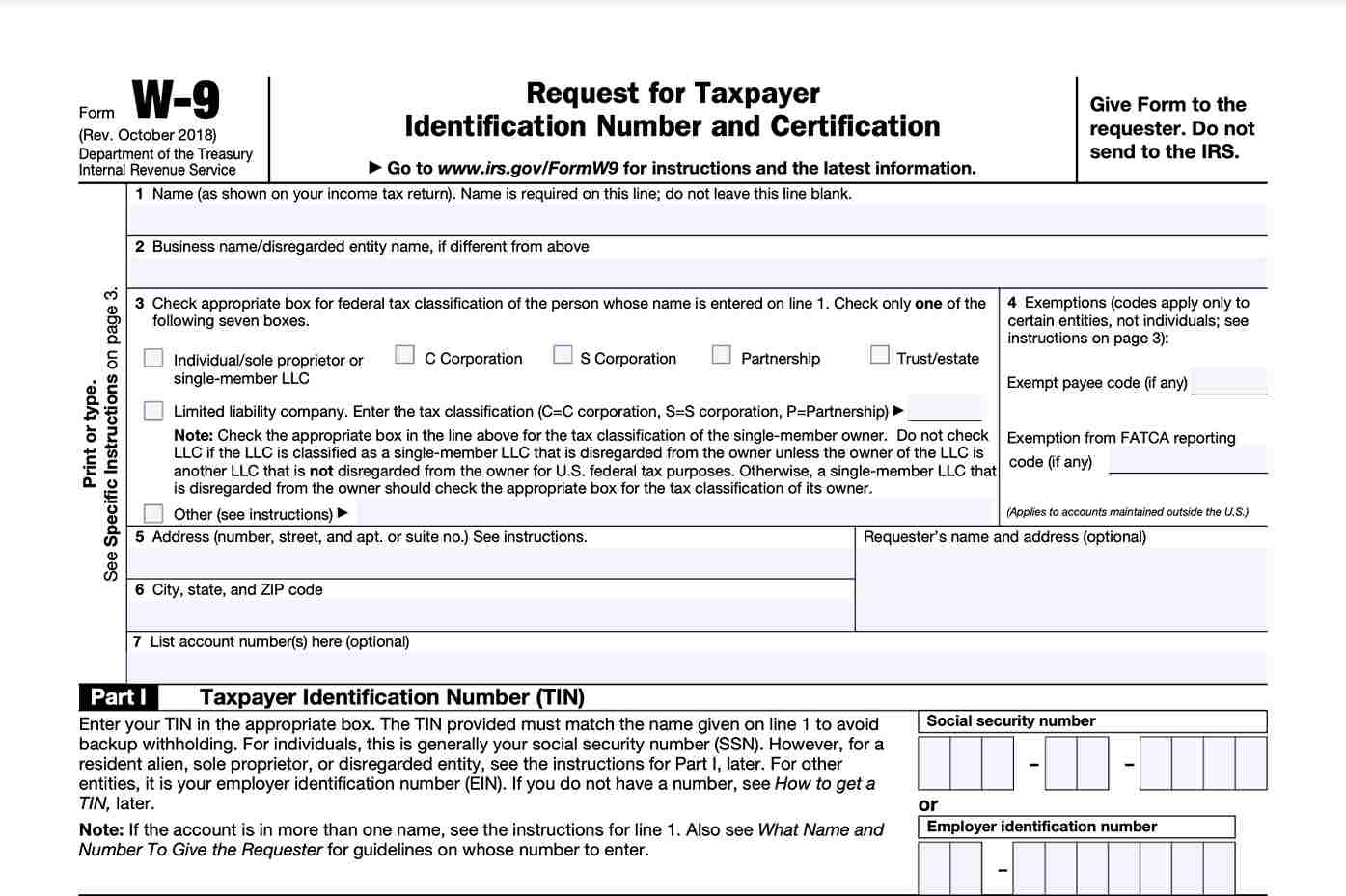

Let’s start with the W9 form. This form is typically used by companies to request information from independent contractors or freelancers. If you’ve ever worked as a freelancer or contractor, chances are you’ve been asked to fill out a W9 form. On the other hand, the W2 form is used by employers to report wages paid to employees during the year. If you’re a traditional employee, you’ll likely receive a W2 form from your employer by the end of January.

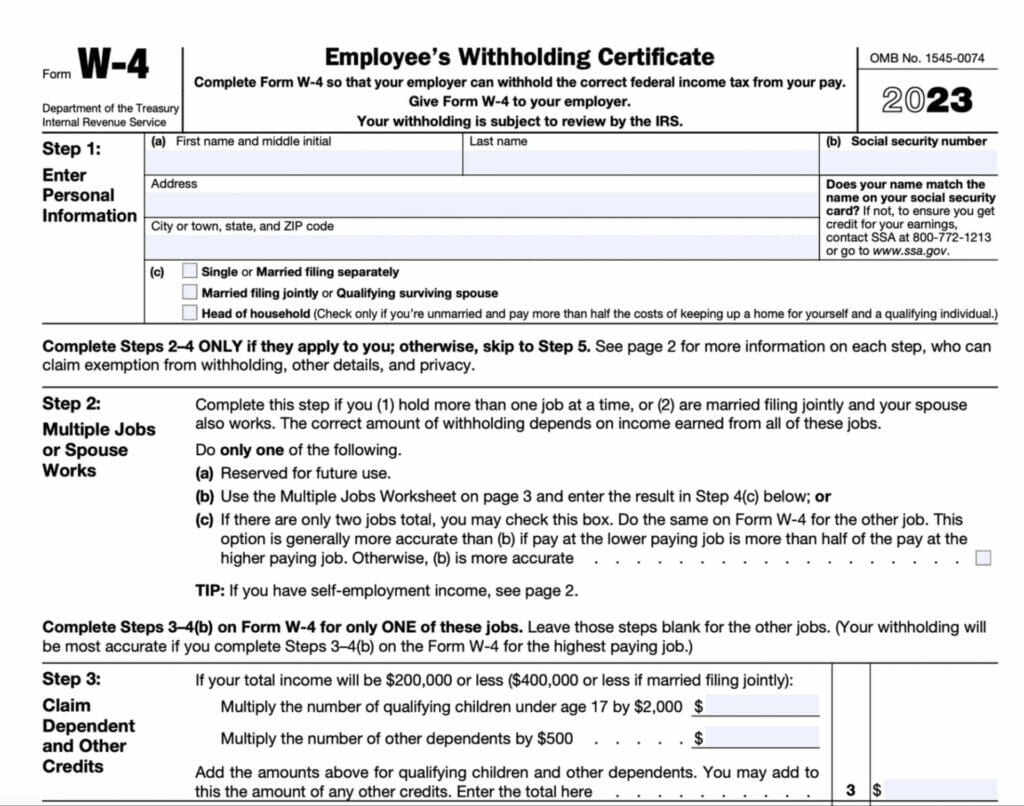

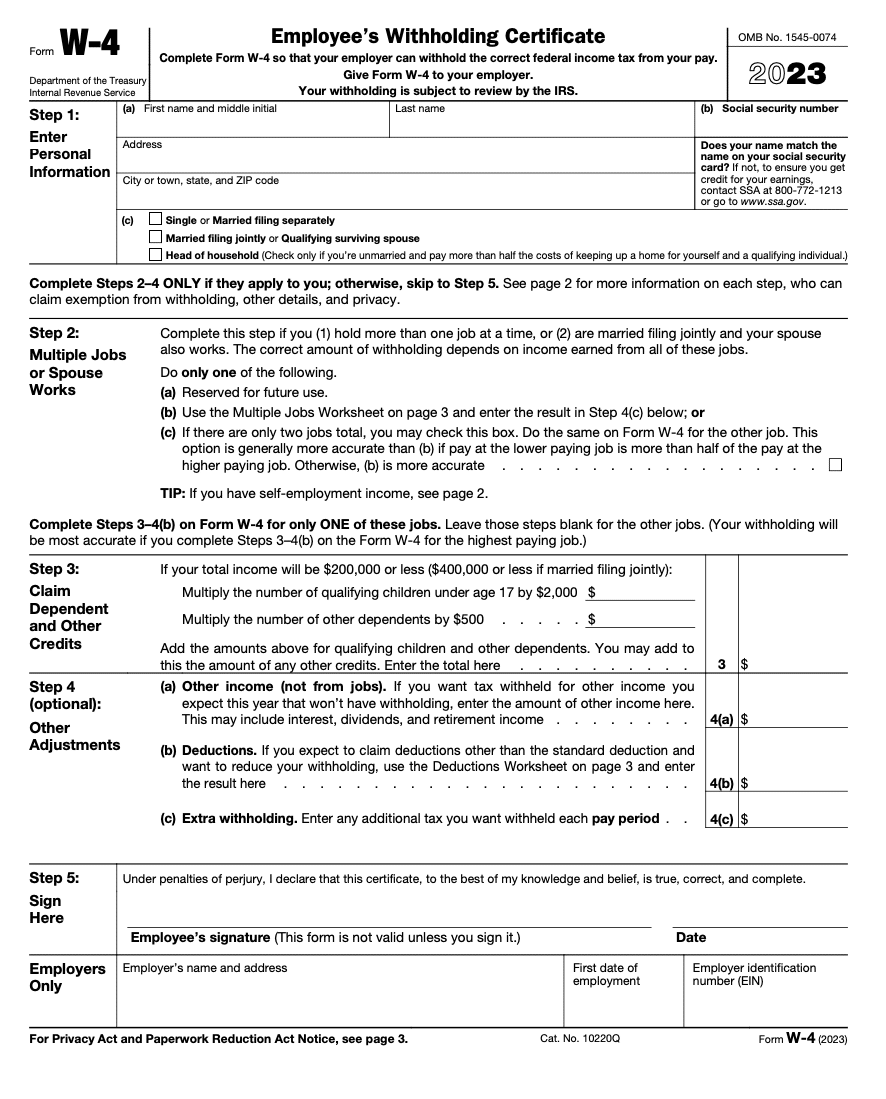

It’s important to note that the information provided on these forms is crucial for accurately reporting your income to the IRS. The W9 form requires your name, address, and taxpayer identification number, while the W2 form includes details such as your wages, taxes withheld, and other compensation. By understanding the purpose of each form, you can ensure that you’re providing the right information to the right parties.

Navigating Tax Forms with Ease!

Now that you understand the basics of the W9 and W2 forms, it’s time to navigate through tax season with ease. Make sure to keep track of all the forms you receive, whether it’s a W9 from a client or a W2 from your employer. Organize your documents and set aside time to review them carefully before filing your taxes. If you have any questions or concerns, don’t hesitate to reach out to a tax professional for guidance.

Remember, tax season doesn’t have to be a daunting experience. By staying informed and proactive, you can tackle those tax forms with confidence. So, whether you’re filling out a W9 as a freelancer or reviewing your W2 as an employee, rest assured that you have the knowledge and resources to decode those tax forms like a pro!

In conclusion, understanding the differences between the W9 and W2 forms is key to navigating tax season successfully. By staying organized, informed, and proactive, you can breeze through tax season with ease. So, embrace the challenge, decode those tax forms, and conquer tax season like a boss!

Below are some images related to W9 Vs W2 Form

1099 vs w9 vs w2, difference w9 and w2, w9 vs w2 form, what is w9 vs w2, , W9 Vs W2 Form.

1099 vs w9 vs w2, difference w9 and w2, w9 vs w2 form, what is w9 vs w2, , W9 Vs W2 Form.