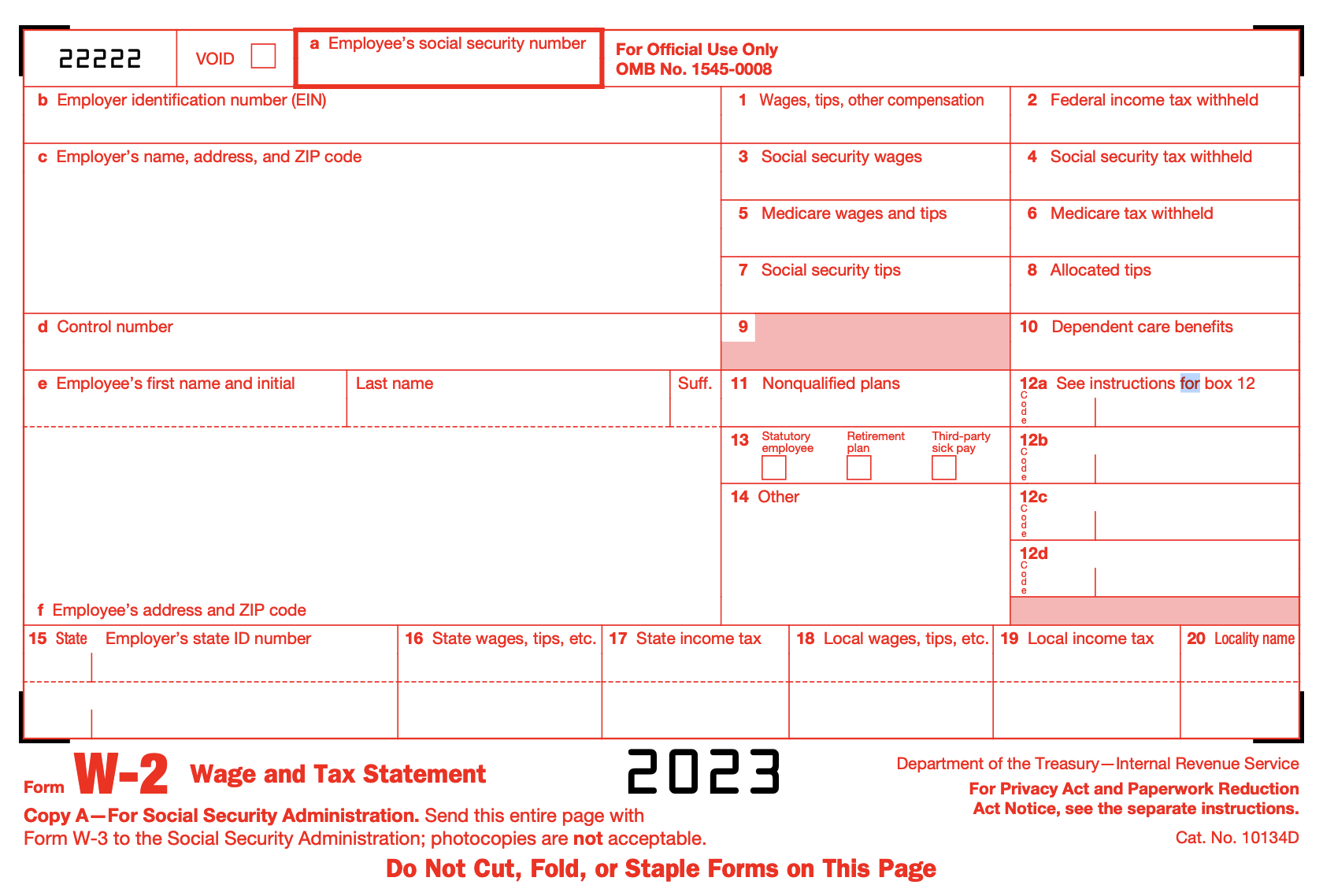

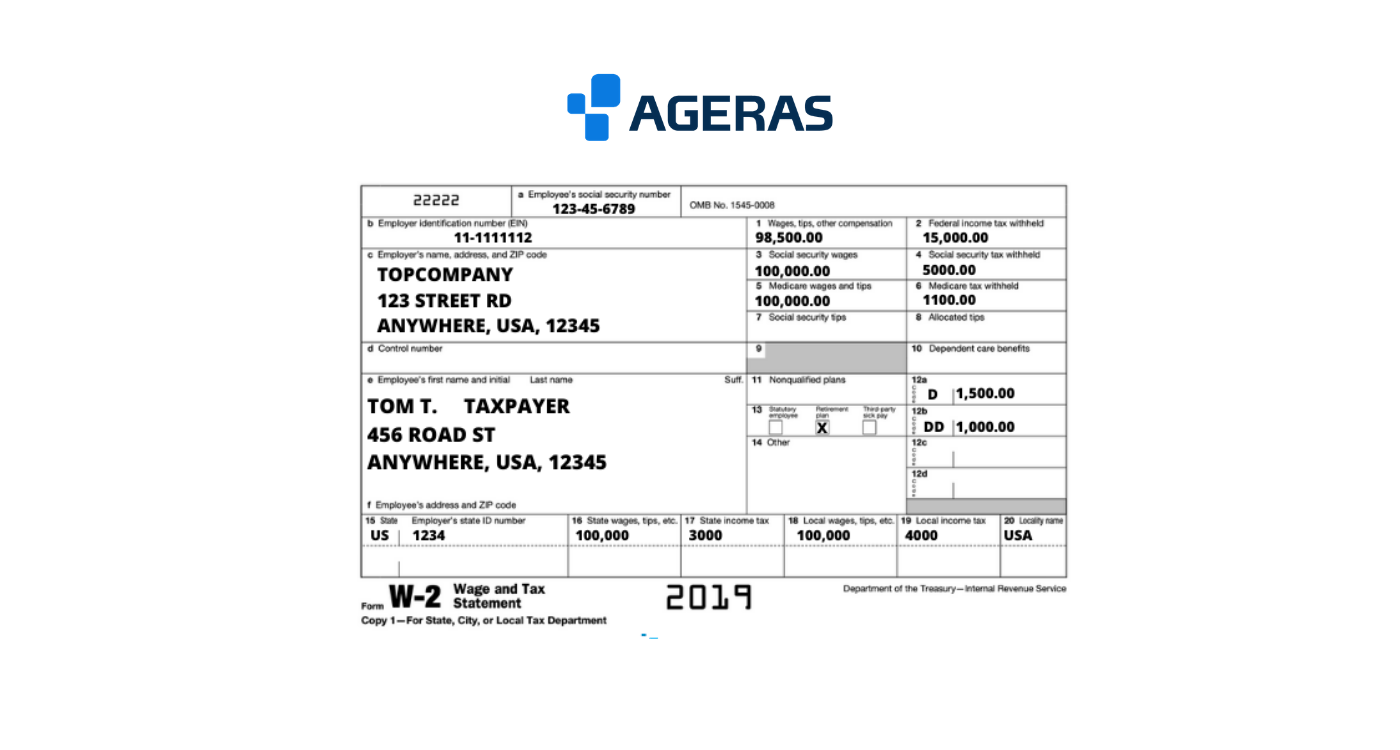

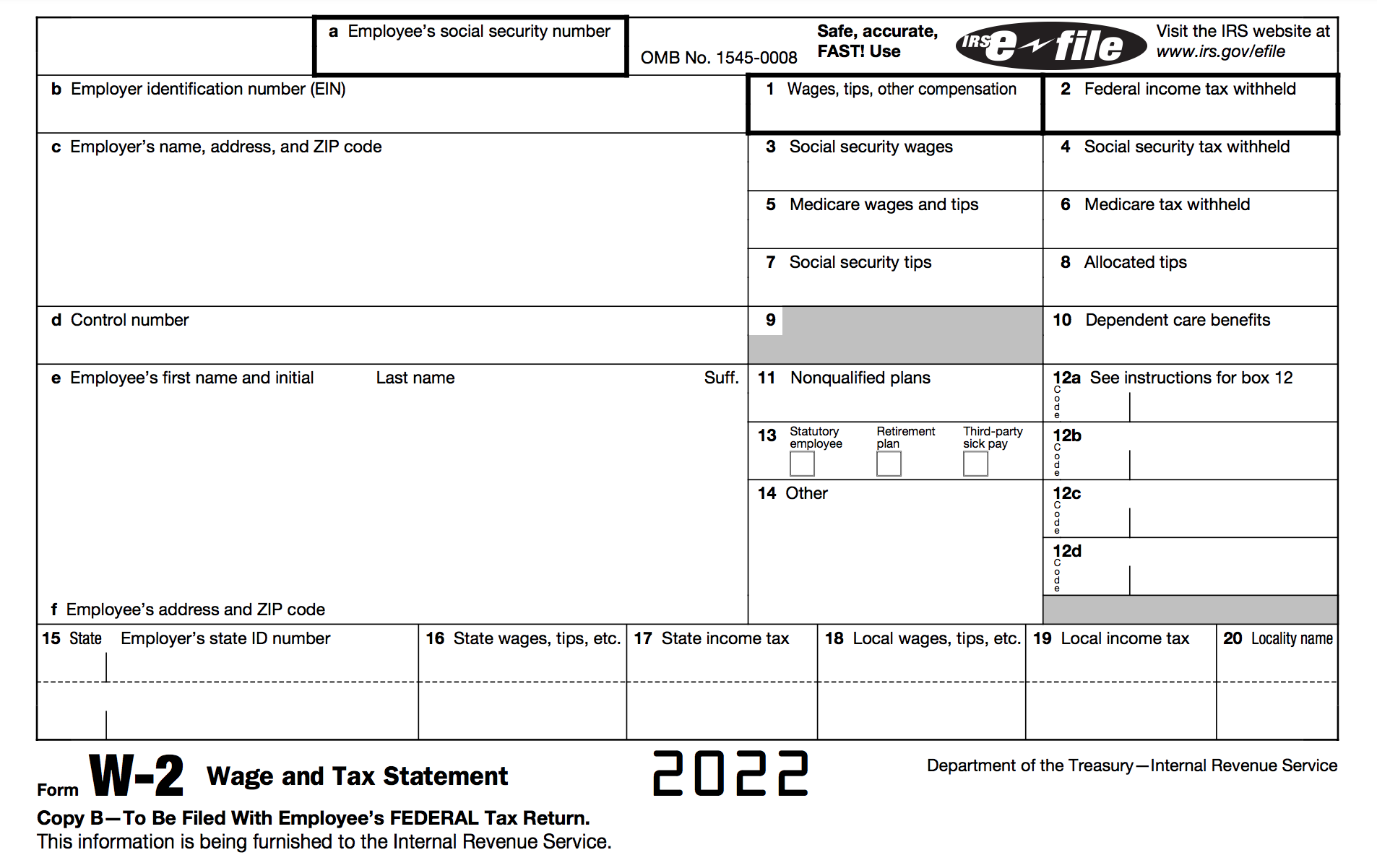

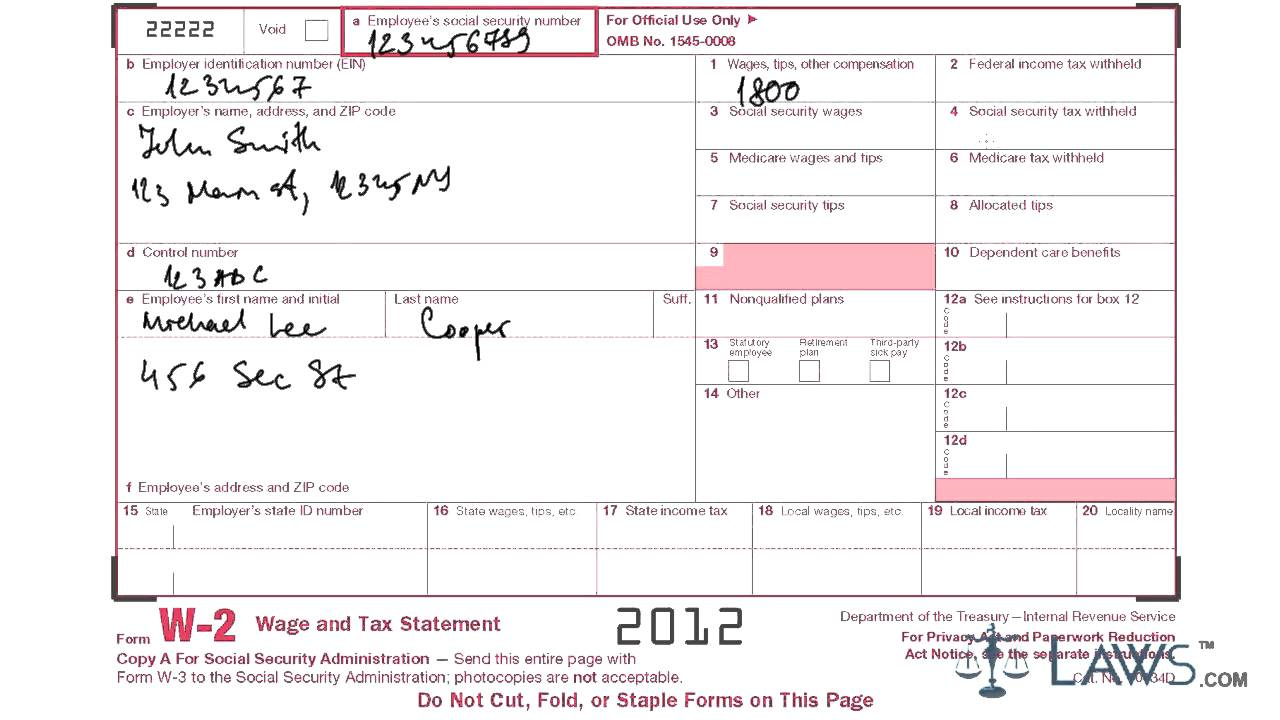

W2 Form How To Fill Out – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering the Art of W2 Form Completion

Are you ready to unleash your inner W2 wizard and conquer the daunting task of completing your W2 form with ease? Don’t let the complex maze of numbers and boxes intimidate you – with a little guidance and some helpful tips, you’ll be well on your way to mastering the art of W2 form completion. So grab your favorite pen and get ready to tackle this important document like a pro!

Unleash Your Inner W2 Wizard

The key to becoming a W2 form expert is to familiarize yourself with the different sections and boxes on the form. Take some time to carefully read through the instructions provided by your employer, as they will often include helpful tips on how to accurately fill out each section. Remember, accuracy is key when it comes to your W2 form, so double-check your entries before submitting the document.

One helpful tip for mastering the W2 form is to gather all the necessary information and documents before you begin. This includes details such as your Social Security number, earnings from the previous year, and any deductions or credits you may be eligible for. By organizing your information beforehand, you can streamline the completion process and ensure that you don’t miss any important details.

When completing your W2 form, it’s important to pay attention to detail and avoid any common errors that could delay processing. Be sure to enter all information accurately and legibly, and double-check your entries before submitting the form. With a little practice and attention to detail, you’ll soon be well on your way to mastering the art of W2 form completion like a true wizard.

Simplifying the W2 Form Maze

Navigating the maze of boxes and numbers on the W2 form can be a daunting task, but fear not – there are some simple strategies you can use to simplify the process. One helpful tip is to use a highlighter or colored pen to mark off each section as you complete it, ensuring that you don’t miss any important details. This visual aid can help you stay organized and focused as you work your way through the form.

Another effective strategy for simplifying the W2 form completion process is to break it down into smaller, manageable tasks. Rather than trying to tackle the entire form in one sitting, set aside dedicated time each day to work on a specific section. By breaking the process into smaller steps, you can avoid feeling overwhelmed and ensure that you complete the form accurately and on time.

Lastly, don’t be afraid to seek help if you encounter any challenges or have questions while completing your W2 form. Your employer’s HR department or a tax professional can provide valuable guidance and assistance to help you navigate the form with confidence. Remember, mastering the art of W2 form completion is a skill that can be learned with practice and patience – so don’t hesitate to ask for help along the way.

In conclusion, mastering the art of W2 form completion is a valuable skill that can save you time and stress during tax season. By unleashing your inner W2 wizard and simplifying the form completion process, you can tackle this important document with confidence and accuracy. So grab your pen, gather your information, and get ready to conquer the W2 form maze like a true pro!

Below are some images related to W2 Form How To Fill Out

how to fill out w2 form exempt, how to fill out w2 form for new job, how to fill out w2 form if single, how to fill out w2 form married, w2 form 2022 for employee to fill out, , W2 Form How To Fill Out.

how to fill out w2 form exempt, how to fill out w2 form for new job, how to fill out w2 form if single, how to fill out w2 form married, w2 form 2022 for employee to fill out, , W2 Form How To Fill Out.