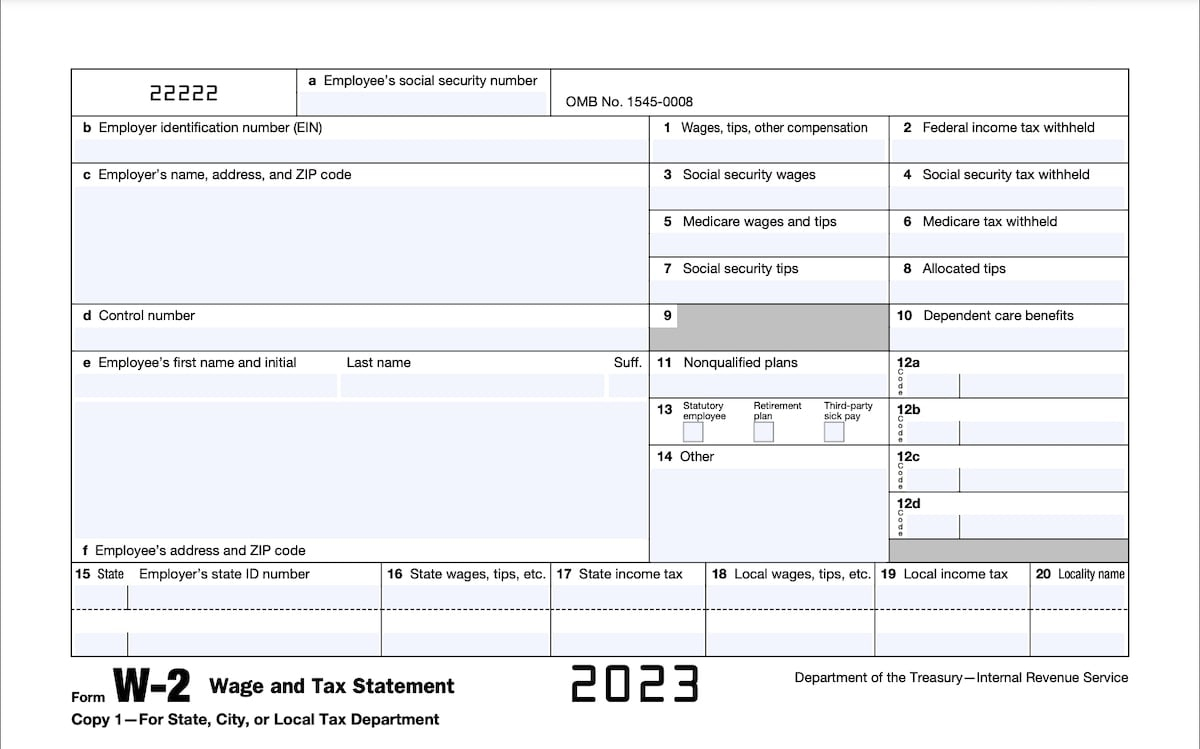

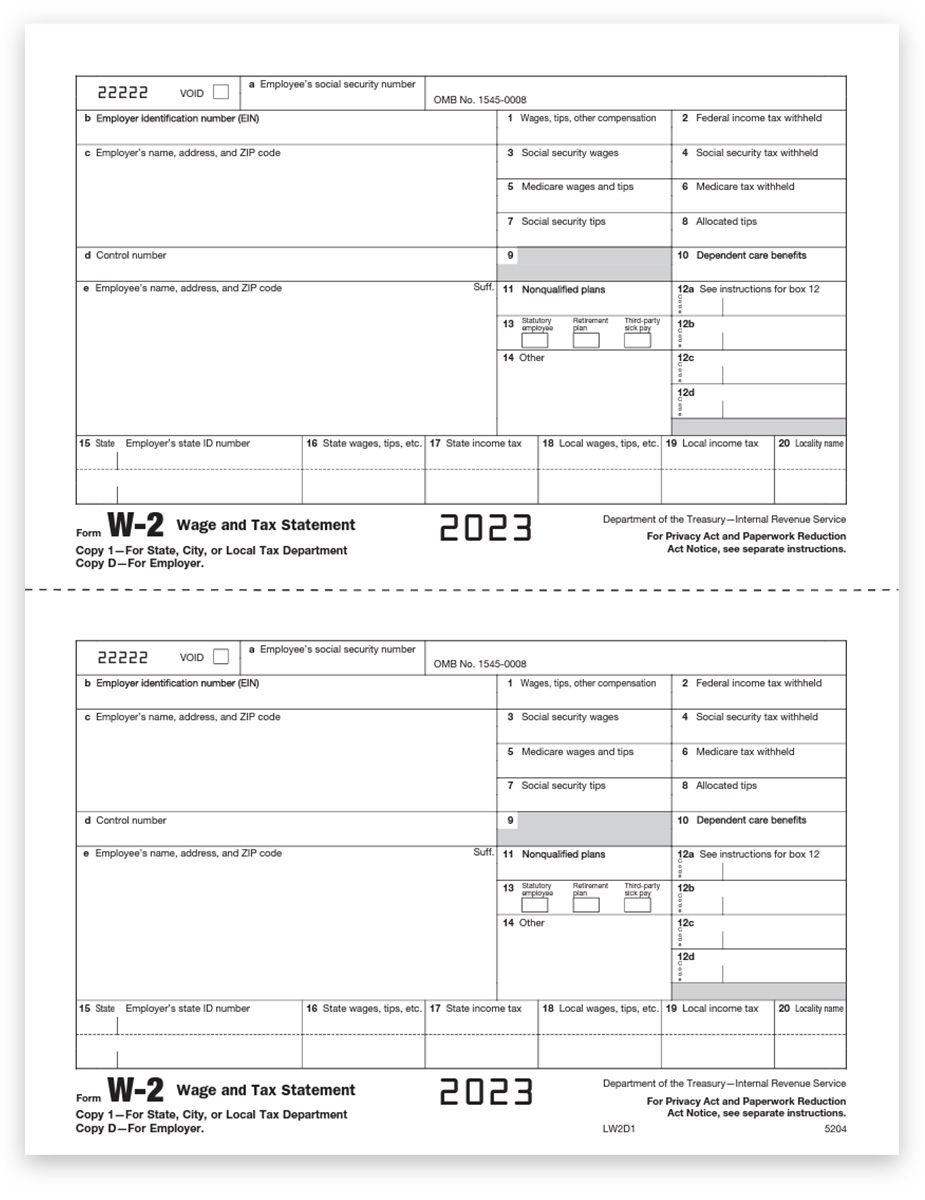

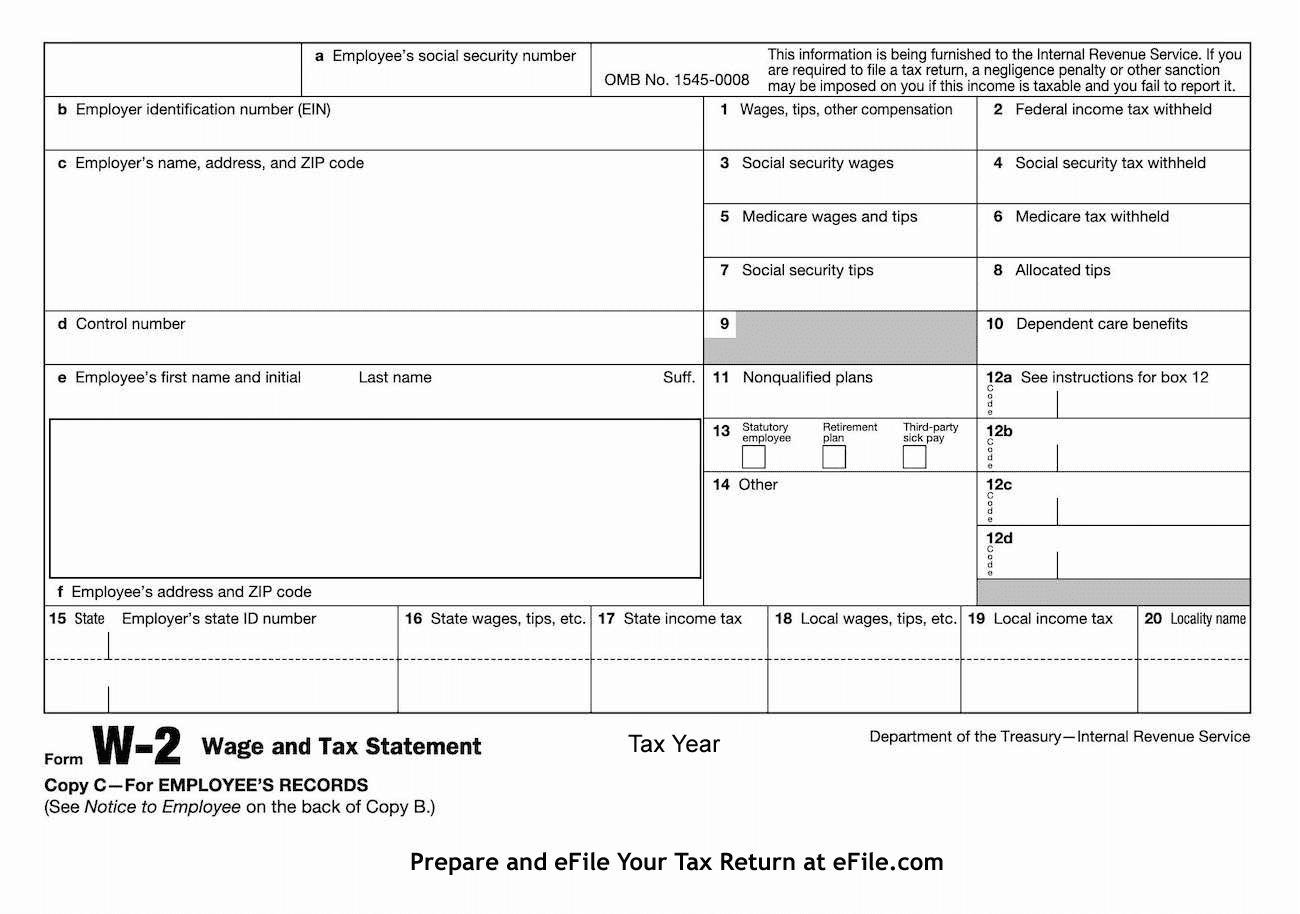

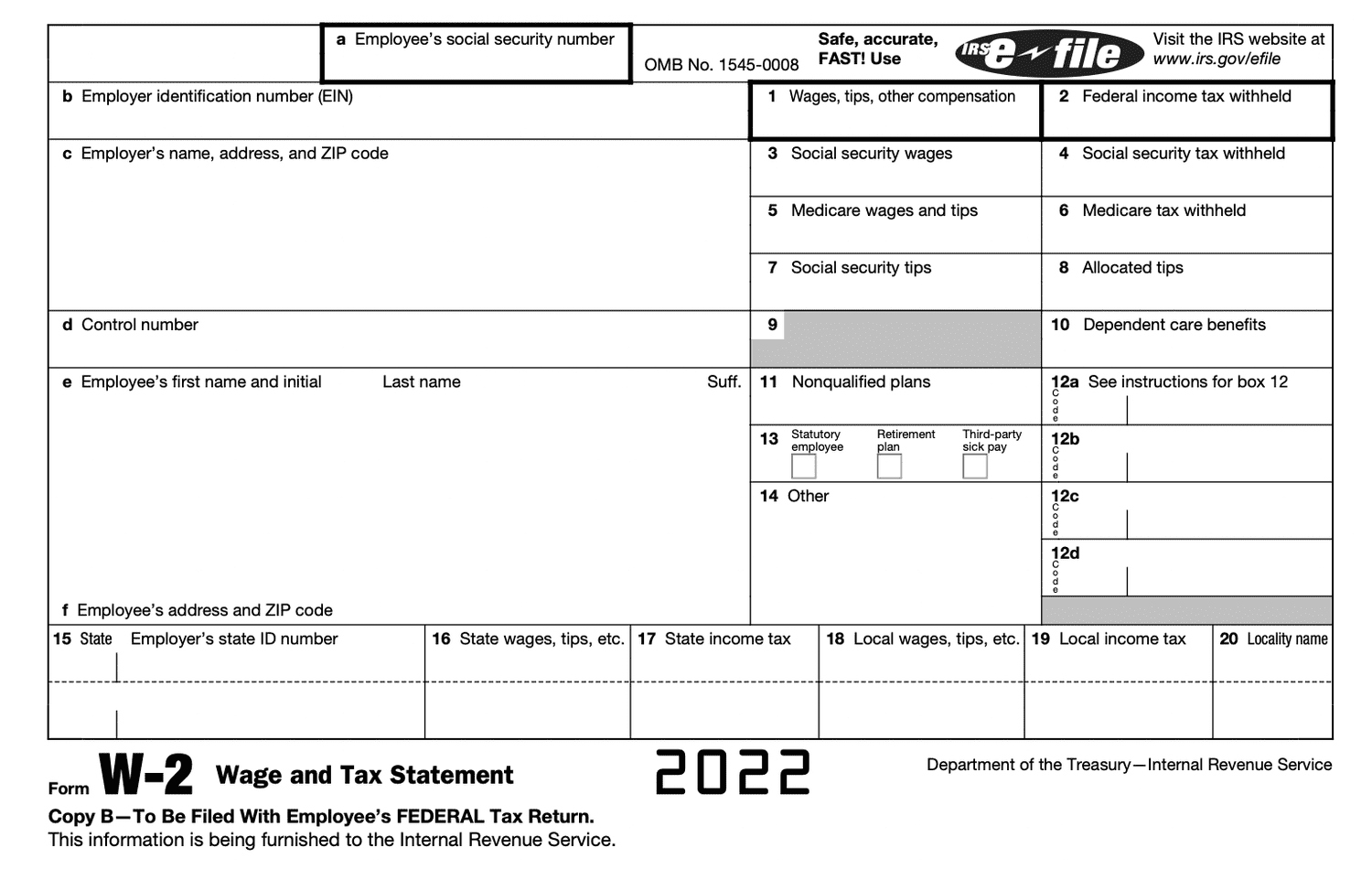

A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Magic of Your W2 Form

Have you ever received your W2 form in the mail and felt a sense of mystery and wonder? This seemingly ordinary piece of paper holds the key to unlocking the secrets of your income and taxes for the past year. But fear not, for we are here to help you discover the enchantment of your W2 form and understand what lies beneath its seemingly mundane exterior.

Discover the Enchantment of Your W2 Form!

As you carefully unwrap your W2 form, you will be greeted with a wealth of information about your earnings and taxes. From the total amount of wages you earned to the amount of federal and state taxes withheld, your W2 form is like a treasure map guiding you through the intricacies of your financial life. Take a moment to marvel at the magic of how all these numbers come together to paint a picture of your financial health for the past year.

But the enchantment doesn’t stop there! Your W2 form also reveals important details about your retirement savings, such as contributions to your 401(k) or other retirement plans. It’s like discovering a hidden gem in a treasure chest, reminding you of the importance of planning for your future and setting aside money for the golden years ahead. So take a moment to appreciate the magic of your W2 form and the valuable information it provides about your financial well-being.

Unveiling the Secrets Behind Your W2 Form!

Now, let’s dive deeper into the secrets behind your W2 form. Did you know that the various boxes and codes on your W2 form hold clues about your tax liabilities and potential refunds? From the amount of Social Security and Medicare taxes withheld to any additional income you may have earned, each line on your W2 form tells a story about your financial journey over the past year. By unraveling these secrets, you can gain a better understanding of your tax situation and make informed decisions about your finances.

So the next time you receive your W2 form, don’t just file it away and forget about it. Take the time to unwrap the magic hidden within its pages and discover the valuable insights it provides about your income, taxes, and retirement savings. By understanding the enchantment of your W2 form, you can take control of your financial future and make informed decisions that will lead to a brighter tomorrow.

Below are some images related to A W2 Form

a w-2 form tells you, a w2 form, lost a w2 form, missing a w2 form, on a w2 form what is box 1, , A W2 Form.

a w-2 form tells you, a w2 form, lost a w2 form, missing a w2 form, on a w2 form what is box 1, , A W2 Form.