W2 Form For Employees – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping Your W2: Your Ticket to Tax Time Cheer!

As the end of the year approaches, many people start to feel the stress of tax season looming on the horizon. However, your W2 form doesn’t have to be a source of anxiety and dread. In fact, it can be your ticket to tax time cheer! Unwrapping your W2 can reveal valuable information that will help you file your taxes with confidence and ease. So grab a cup of hot cocoa, put on your favorite holiday sweater, and let’s dive into the joy of unwrapping your W2 form!

The Joy of Unwrapping Your W2 Form

There’s something undeniably exciting about receiving your W2 form in the mail or via email. It’s like unwrapping a present that contains all the information you need to conquer tax season like a champ. As you carefully unfold the crisp paper and examine the numbers, you’ll start to piece together your financial year and gain a deeper understanding of your income, taxes withheld, and potential deductions. Think of your W2 as a puzzle that, once solved, will unlock the door to a stress-free tax filing experience.

Unwrapping your W2 can also be a moment of reflection and gratitude. As you review your earnings and contributions over the past year, you may feel a sense of accomplishment for all the hard work you’ve put in. Your W2 is not just a piece of paper – it’s a tangible reminder of your dedication and perseverance. So take a moment to celebrate your achievements and recognize the progress you’ve made towards your financial goals. After all, tax time isn’t just about numbers and calculations; it’s about acknowledging your efforts and setting yourself up for success in the year ahead.

Unlocking the Secrets of Your W2: A Guide to Tax Time Happiness

Navigating your W2 form can feel like decoding a cryptic message, but fear not – we’re here to help! Understanding the different boxes and codes on your W2 can empower you to make informed decisions when filing your taxes and maximize your potential refunds. From Box 1 (Wages, Tips, Other Compensation) to Box 12 (Codes for specific deductions), each section of your W2 holds valuable information that can impact your tax liability. So grab a highlighter, a calculator, and let’s dive into the world of tax time happiness!

One of the most important aspects of your W2 is Box 2, which shows the total federal income tax withheld from your paychecks throughout the year. This number plays a crucial role in determining whether you owe additional taxes or are entitled to a refund. By comparing the amount withheld with your actual tax liability, you can avoid any surprises come tax time and ensure you’re not leaving money on the table. Understanding this key component of your W2 will give you peace of mind and help you navigate the tax filing process with confidence.

In conclusion, unwrapping your W2 form doesn’t have to be a dreaded task. Instead, it can be a source of joy, reflection, and empowerment. By exploring the numbers and codes on your W2, you can gain a deeper understanding of your financial situation, make informed decisions when filing your taxes, and set yourself up for success in the year ahead. So embrace the process of unwrapping your W2, and let it be your ticket to tax time cheer!

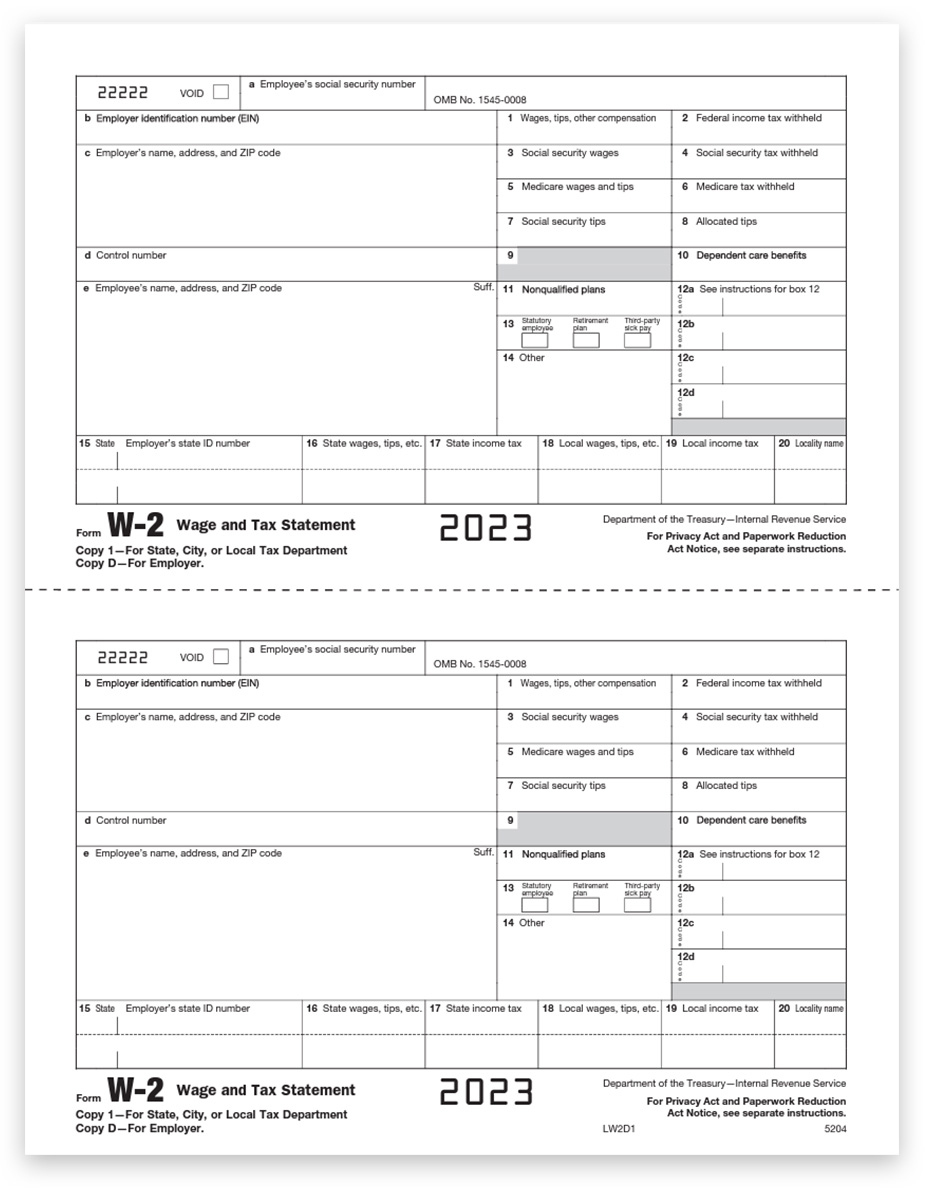

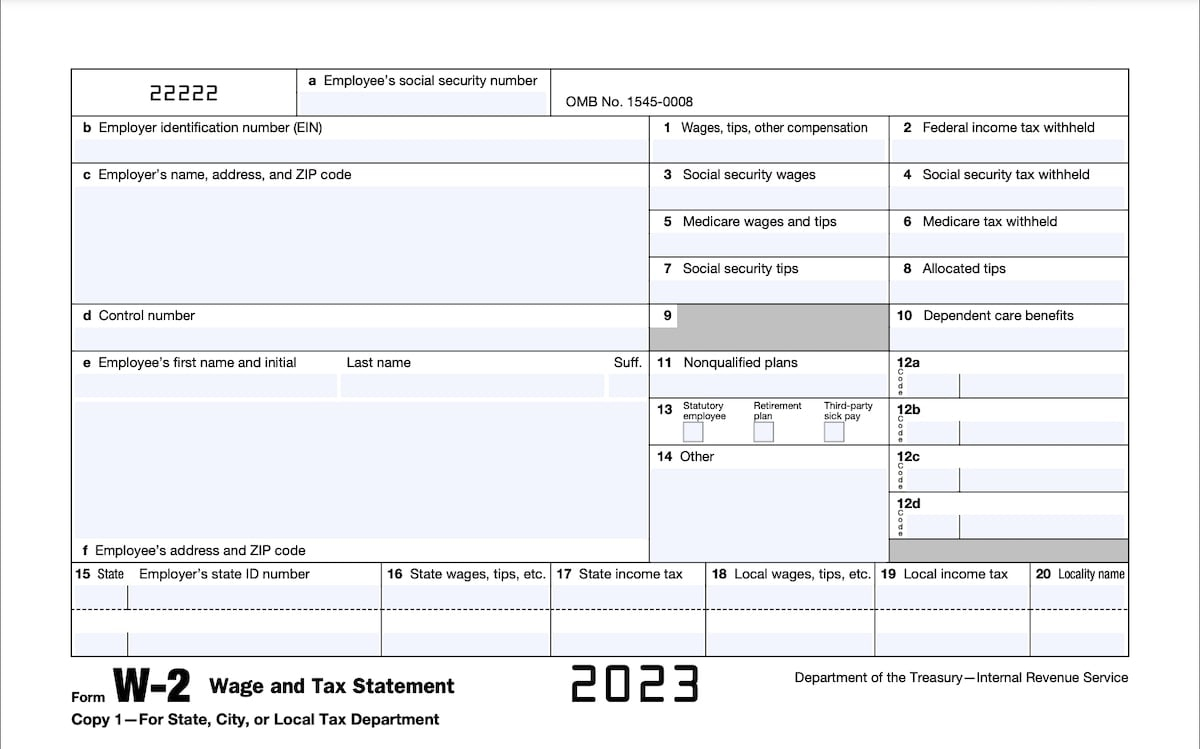

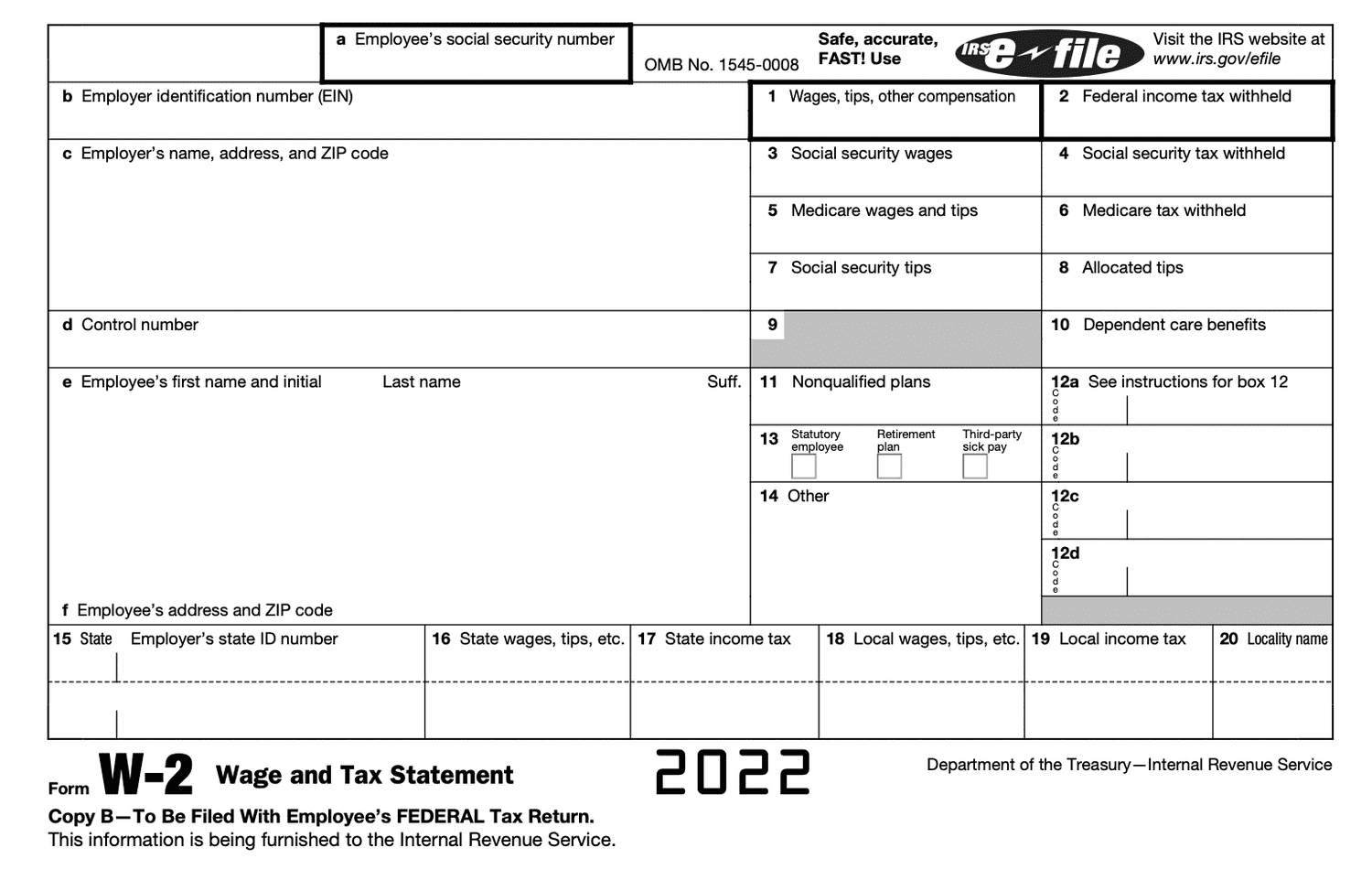

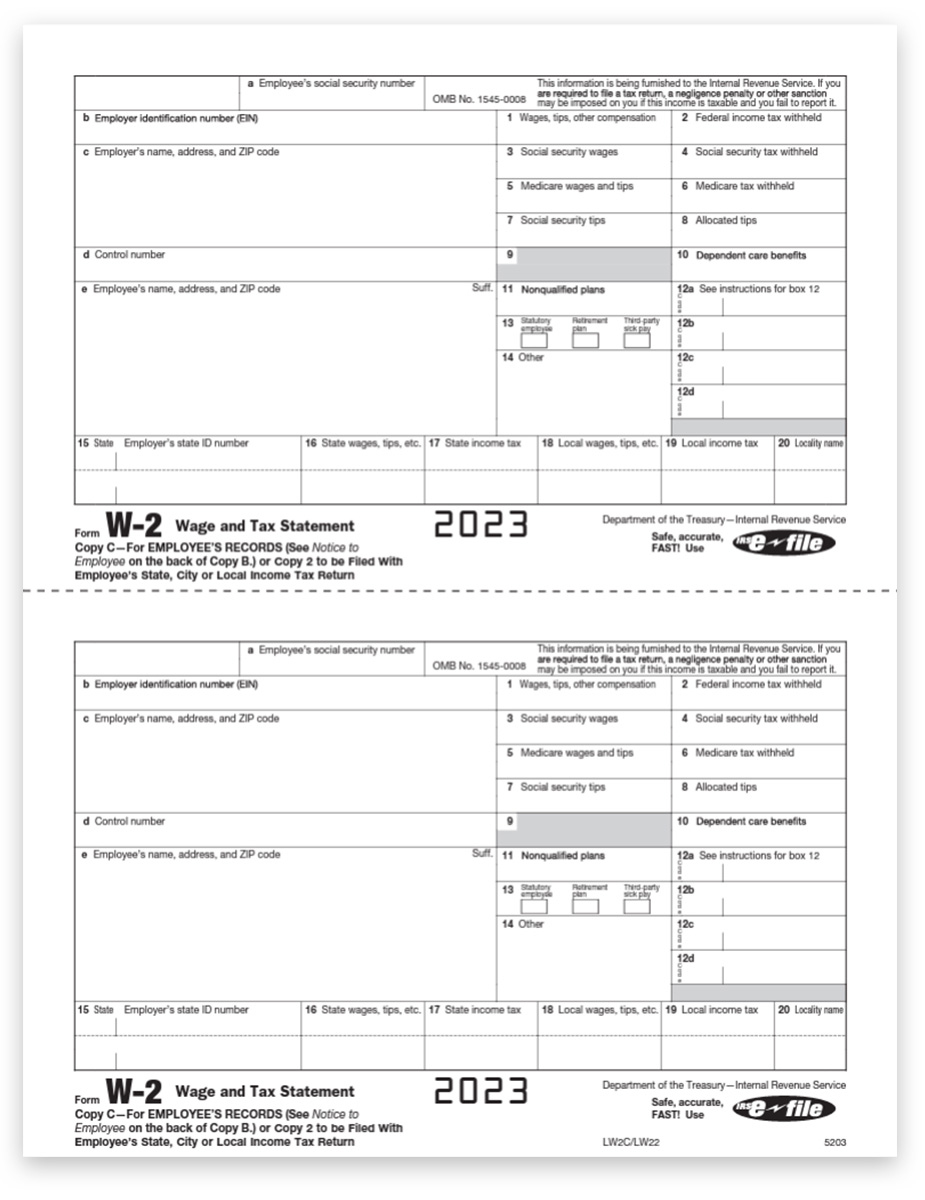

Below are some images related to W2 Form For Employees

how do you w2 an employee, printable w2 form for employees, w-2 form for employee to fill out, w2 form 2022 for employee to fill out, w2 form for employees, , W2 Form For Employees.

how do you w2 an employee, printable w2 form for employees, w-2 form for employee to fill out, w2 form 2022 for employee to fill out, w2 form for employees, , W2 Form For Employees.