W2 Form Explanation – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

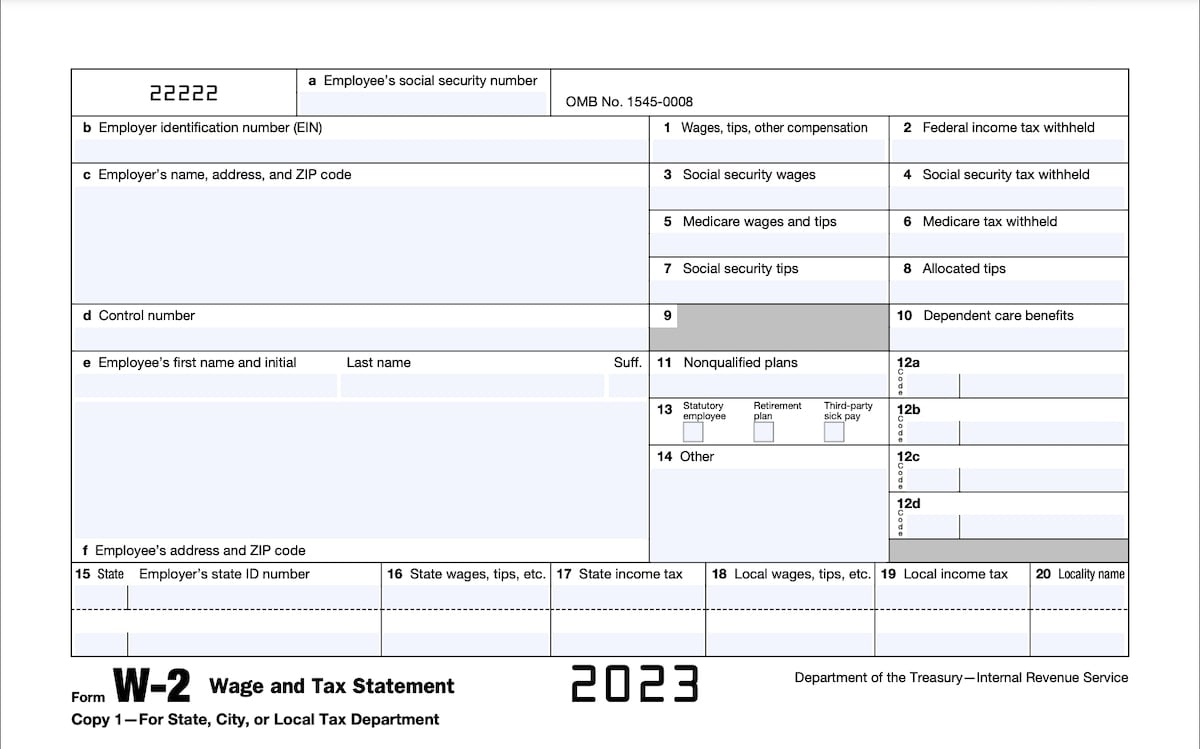

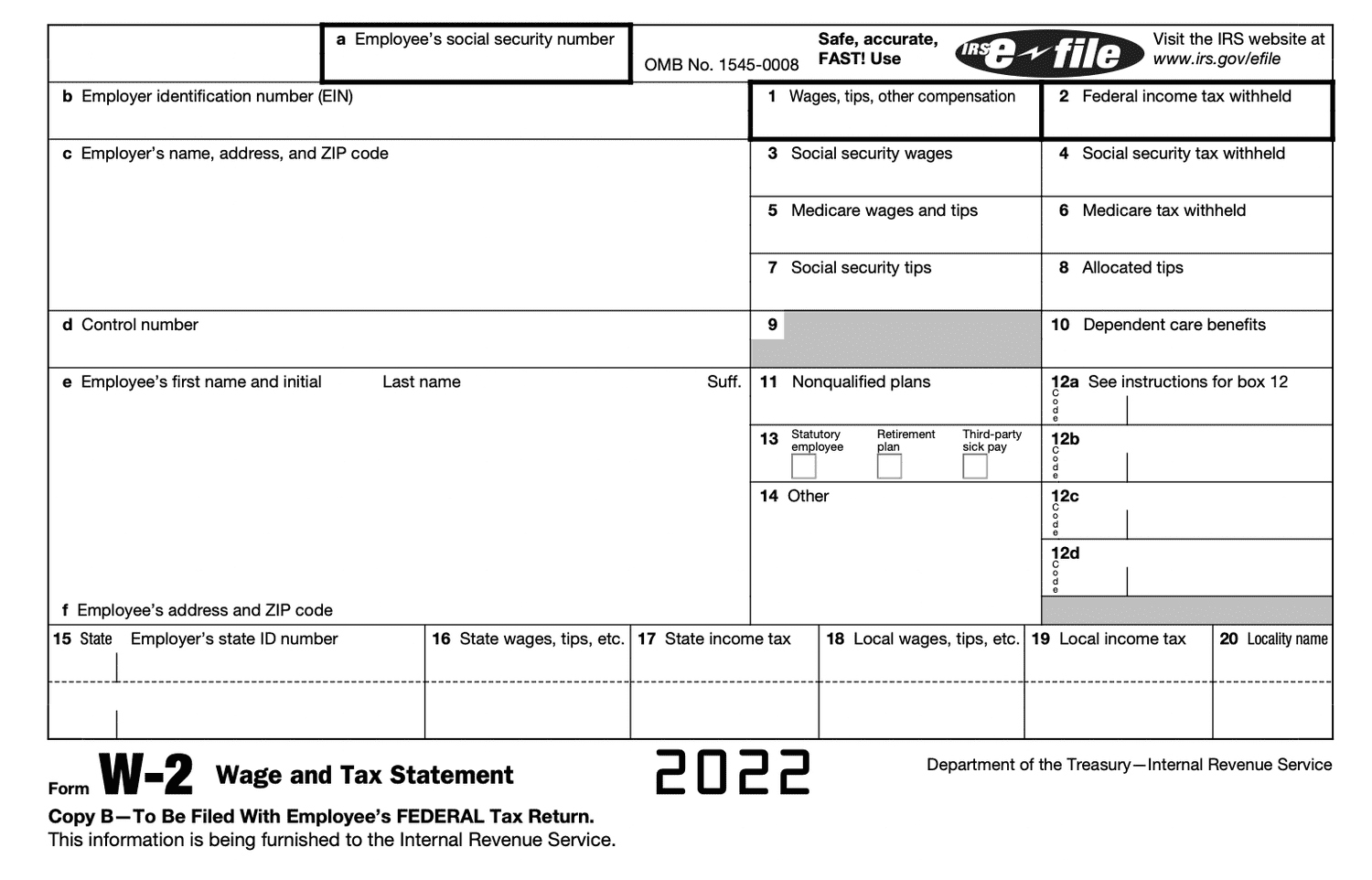

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

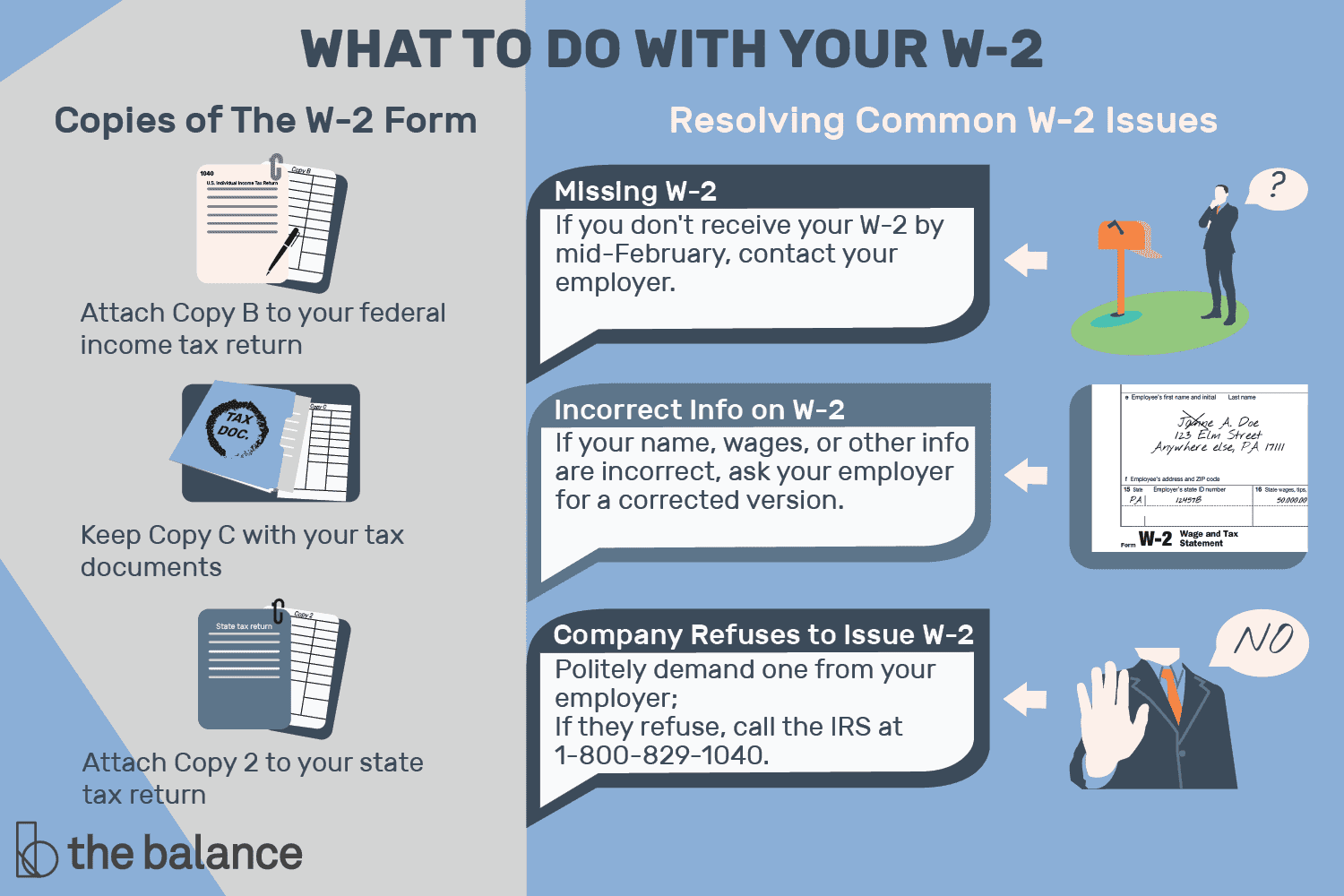

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unravel the Mystery: Demystifying Your W2 Form!

Are you overwhelmed every year when you receive your W2 form? Does it feel like you’re trying to crack a secret code to understand your earnings and taxes? Fear not, because we’re here to help you demystify the mystery of your W2 form! This essential document provides a detailed summary of your earnings and taxes withheld throughout the year. By breaking down the different sections and codes, you can gain a better understanding of your financial situation and make informed decisions.

One of the key sections of your W2 form is Box 1, which shows your total wages for the year. This includes not only your salary or hourly pay but also any bonuses, commissions, and other forms of income. Box 2 displays the federal income tax withheld from your paychecks, while Box 3 shows your total wages subject to Social Security tax. By carefully reviewing these sections and comparing them to your pay stubs, you can ensure accuracy and identify any discrepancies that may need to be addressed.

When it comes to deciphering the codes on your W2 form, each letter and number serves a specific purpose in categorizing your income and taxes. For example, Code D represents elective deferrals to retirement plans, while Code E signifies contributions to a 401(k) or other employer-sponsored retirement account. Understanding these codes can help you track your deductions, credits, and contributions throughout the year. By taking the time to decode your W2 form, you can gain valuable insights into your financial health and plan for the future with confidence.

Discover the Secrets: Your W2 Form Simplified!

Your W2 form is more than just a piece of paper – it’s a treasure trove of information that can unlock the secrets of your earnings and taxes. By simplifying the complex terms and numbers on your W2 form, you can gain a clearer picture of your financial picture and make informed decisions about your money. Take the time to review each section of your W2 form, from your total wages to your tax withholdings, and ensure that everything adds up correctly.

One of the most important aspects of your W2 form is Box 4, which shows the total amount of Social Security tax withheld from your paychecks. This tax is calculated at a rate of 6.2% of your total wages, up to a certain income threshold. By comparing this amount to your pay stubs and ensuring accuracy, you can avoid any surprises when filing your taxes. Additionally, Box 6 displays the total amount of Medicare tax withheld, which is calculated at a rate of 1.45% of your total wages with no income limit.

In conclusion, your W2 form is a valuable tool that can help you understand your earnings, taxes, and contributions throughout the year. By unraveling the mystery and decoding the secrets of your W2 form, you can take control of your financial future and make informed decisions about your money. Remember to review each section carefully, compare the numbers to your pay stubs, and seek assistance if you have any questions or concerns. With a little bit of knowledge and a keen eye for detail, you can crack the code of your W2 form and pave the way to financial success!

Below are some images related to W2 Form Explanation

w2 form example, w2 form example 2022, w2 form example pdf, w2 form explain, w2 form explanation, , W2 Form Explanation.

w2 form example, w2 form example 2022, w2 form example pdf, w2 form explain, w2 form explanation, , W2 Form Explanation.