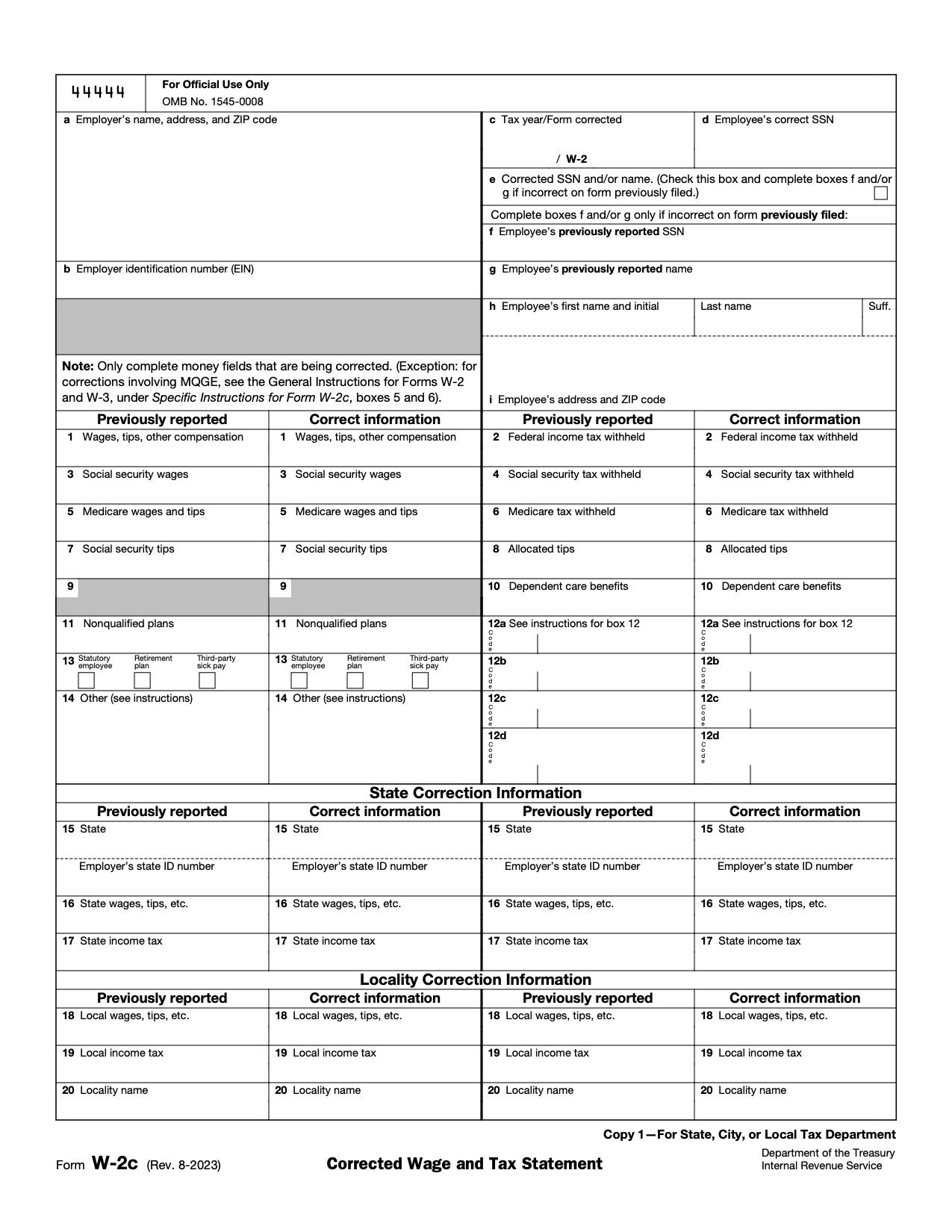

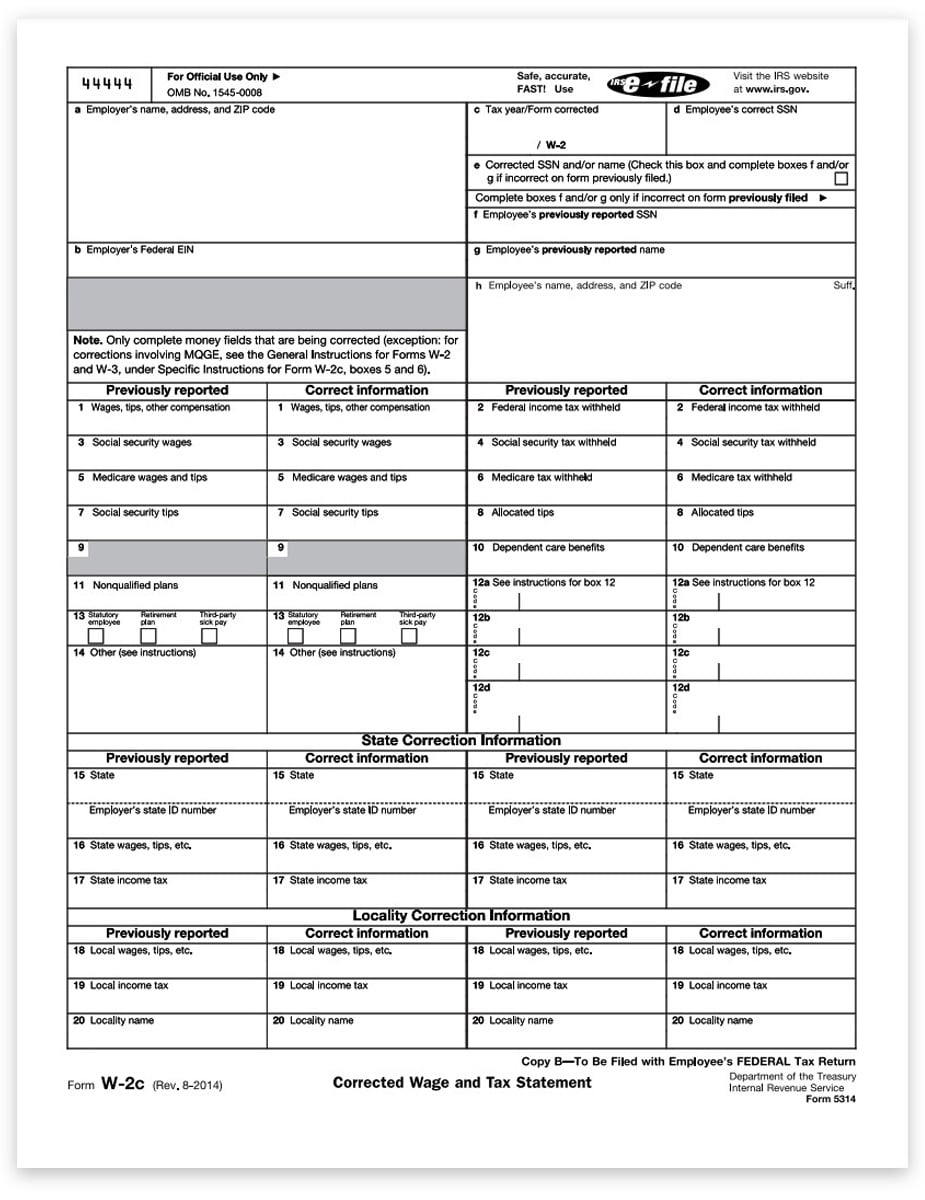

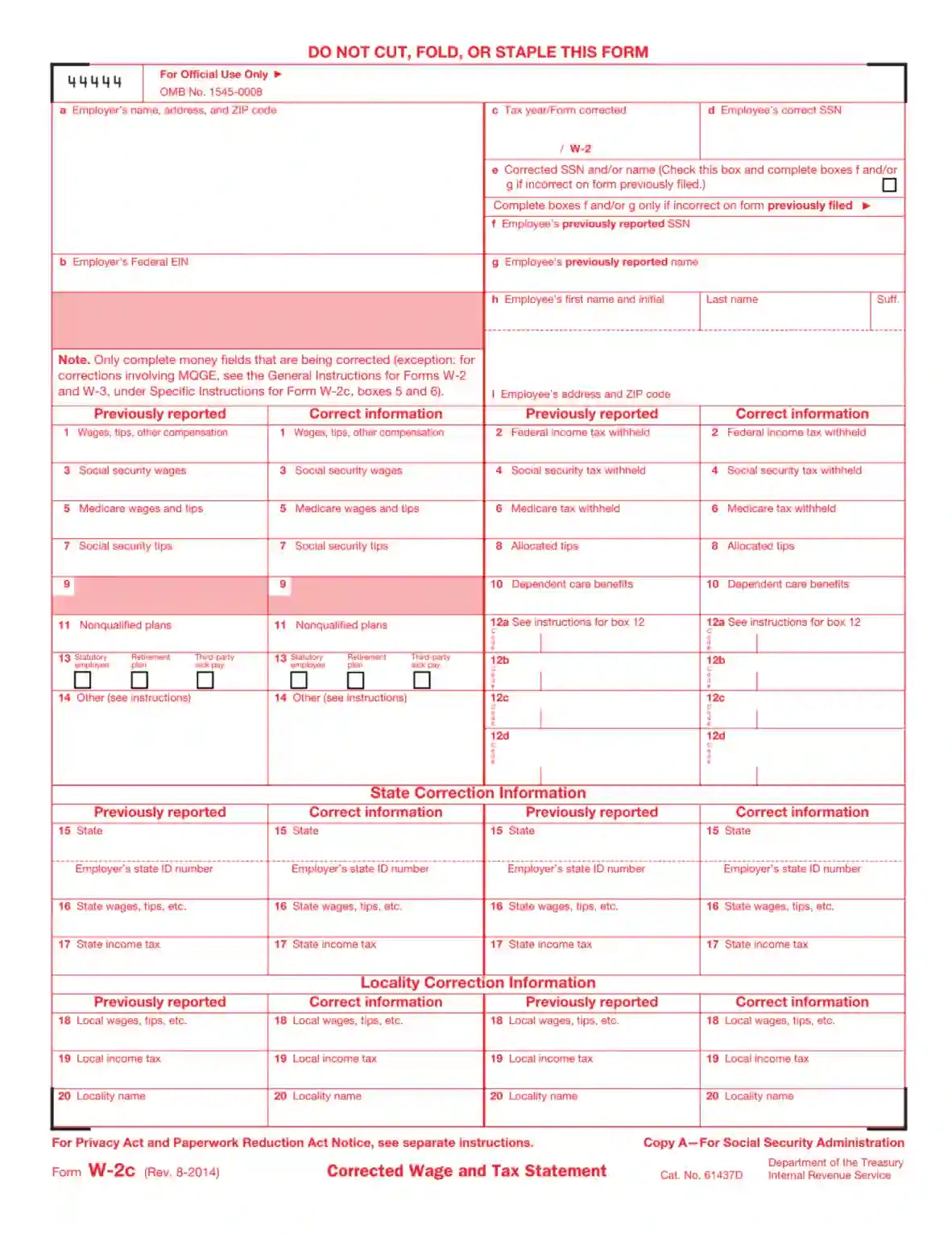

Amended W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Boost Your Refund: The Joy of Filing an Amended W2 Form

Are you eagerly awaiting your tax refund but feeling like you might have missed out on claiming all your deductions and credits? Well, fret not! The amended W2 form is your golden ticket to potentially boosting your refund and putting a little extra cash back in your pocket. Discover the joy of filing an amended W2 form and maximizing your tax return this year!

Amended W2 Form: Your Ticket to a Bigger Refund!

The amended W2 form allows you to make corrections to your original W2 form if you’ve identified errors or omissions that could impact your tax refund. This could include updating your income, deductions, or credits that were not accurately reported the first time around. By taking the time to review and amend your W2 form, you could potentially uncover additional tax savings that you may have missed out on initially. It’s like finding hidden treasure in the form of a bigger refund!

Filing an amended W2 form may seem like a daunting task, but the potential benefits far outweigh any initial hesitation. The process is relatively straightforward and can be done online or through the mail. By seizing the opportunity to correct any mistakes on your W2 form, you are not only ensuring that your tax return is accurate, but you are also giving yourself the chance to increase your refund amount. So why wait? Take the leap and experience the joy of potentially boosting your tax return with an amended W2 form today!

Discover the Joy of Boosting Your Tax Return with an Amended W2 Form!

Imagine the thrill of receiving a larger tax refund than you were expecting, all thanks to filing an amended W2 form. The joy of knowing that you maximized your tax savings and took full advantage of all available deductions and credits is truly unmatched. Don’t let the fear of the unknown hold you back from exploring the potential benefits of amending your W2 form. Embrace the opportunity to boost your refund and reap the rewards of your diligence and attention to detail. Your wallet will thank you in the end!

In conclusion, filing an amended W2 form can be a game-changer when it comes to maximizing your tax refund. Don’t miss out on the opportunity to potentially increase your refund amount and put more money back in your pocket. Embrace the process with enthusiasm and see where it takes you. The joy of boosting your tax return with an amended W2 form is waiting for you – all you have to do is take the first step towards claiming it!

Below are some images related to Amended W2 Form

amended w2 after filing, amended w2 form, can you amend a w2, how do you file an amended w-2, what is an amended w2, , Amended W2 Form.

amended w2 after filing, amended w2 form, can you amend a w2, how do you file an amended w-2, what is an amended w2, , Amended W2 Form.