W2 Form Box 16 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of W2 Form Box 16: Your Ticket to Tax Savings!

Are you ready to uncover the hidden treasures that lie within Box 16 of your W2 form? Get ready to embark on a journey of tax savings and financial empowerment as we delve into the powerful benefits that Box 16 has to offer. This often overlooked section of your W2 form holds the key to unlocking valuable tax deductions and credits that could put more money back in your pocket. So, grab your magnifying glass and join us as we explore the magic of Box 16!

Unleash the Power of Box 16 on Your W2 Form!

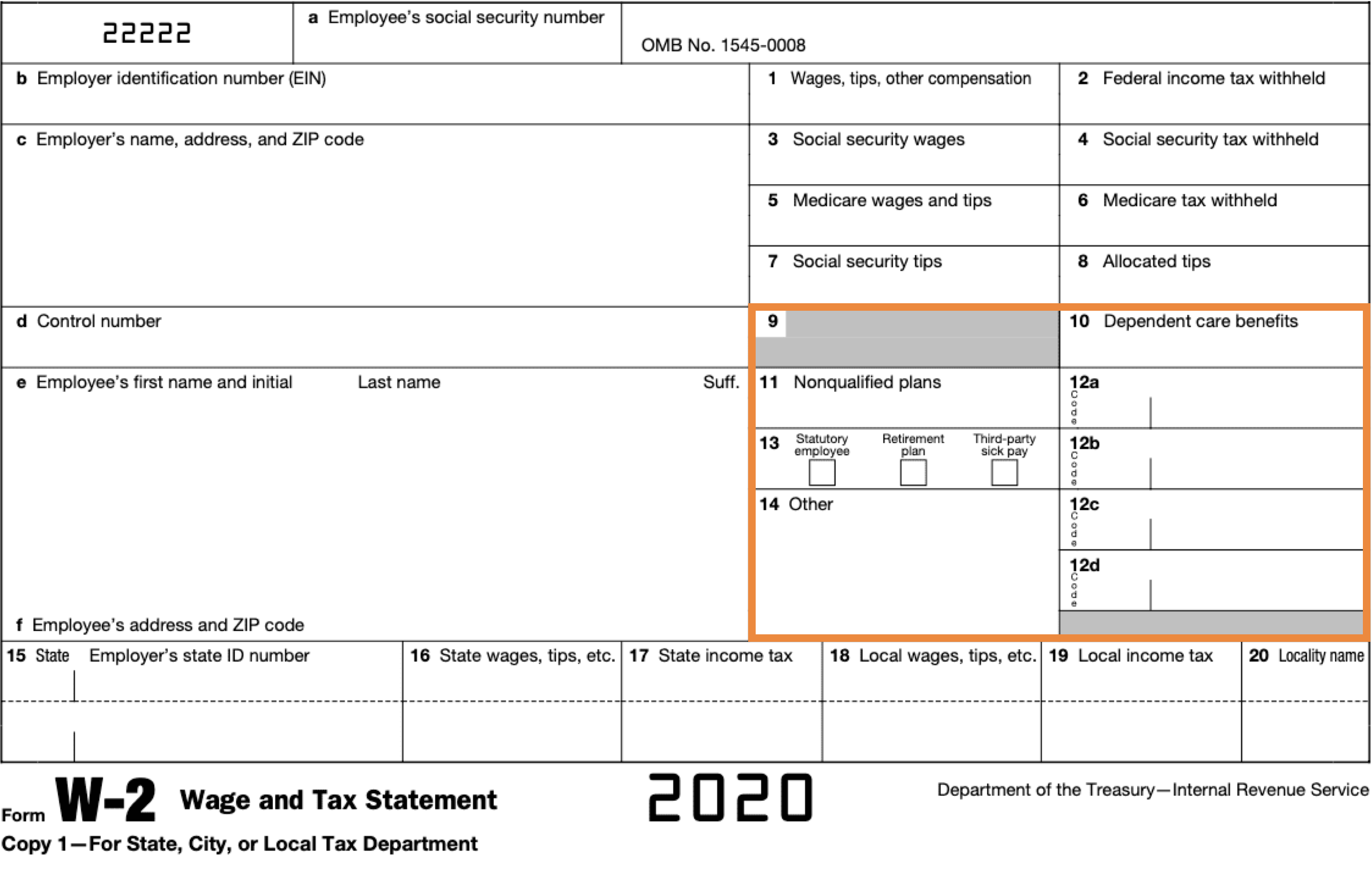

Box 16 of your W2 form contains valuable information about your state wages, tips, and other compensation. This seemingly innocuous box is actually a goldmine of tax-saving opportunities that you won’t want to miss out on. By taking the time to understand and leverage the information in Box 16, you can potentially reduce your tax liability and maximize your refund. So, don’t let this hidden gem go unnoticed – unleash the power of Box 16 and watch your tax savings soar!

But wait, there’s more! Box 16 doesn’t just provide you with valuable information about your earnings – it also gives you insight into any state income tax that was withheld throughout the year. This information is crucial for accurately reporting your state tax liability and ensuring that you’re not paying more than you owe. By paying close attention to the numbers in Box 16 and cross-referencing them with your state tax laws, you can ensure that you’re taking full advantage of any available tax credits and deductions. So, don’t overlook this important section of your W2 form – it could be the key to unlocking significant tax savings!

Discover How Box 16 Can Maximize Your Tax Savings!

Ready to take your tax savings to the next level? Box 16 is here to help! By carefully reviewing the information in this section of your W2 form, you can uncover opportunities to reduce your tax liability and increase your refund. Whether you’re eligible for state-specific tax credits, deductions, or benefits, Box 16 holds the key to unlocking these valuable savings. So, roll up your sleeves and get ready to dive into the details – your financial future will thank you for it!

In conclusion, don’t underestimate the power of Box 16 on your W2 form. This often overlooked section holds the key to unlocking valuable tax savings and maximizing your refund. By taking the time to understand the information in Box 16 and leveraging it to your advantage, you can potentially reduce your tax liability and keep more money in your pocket. So, embrace the magic of Box 16 and watch as your tax savings soar to new heights!

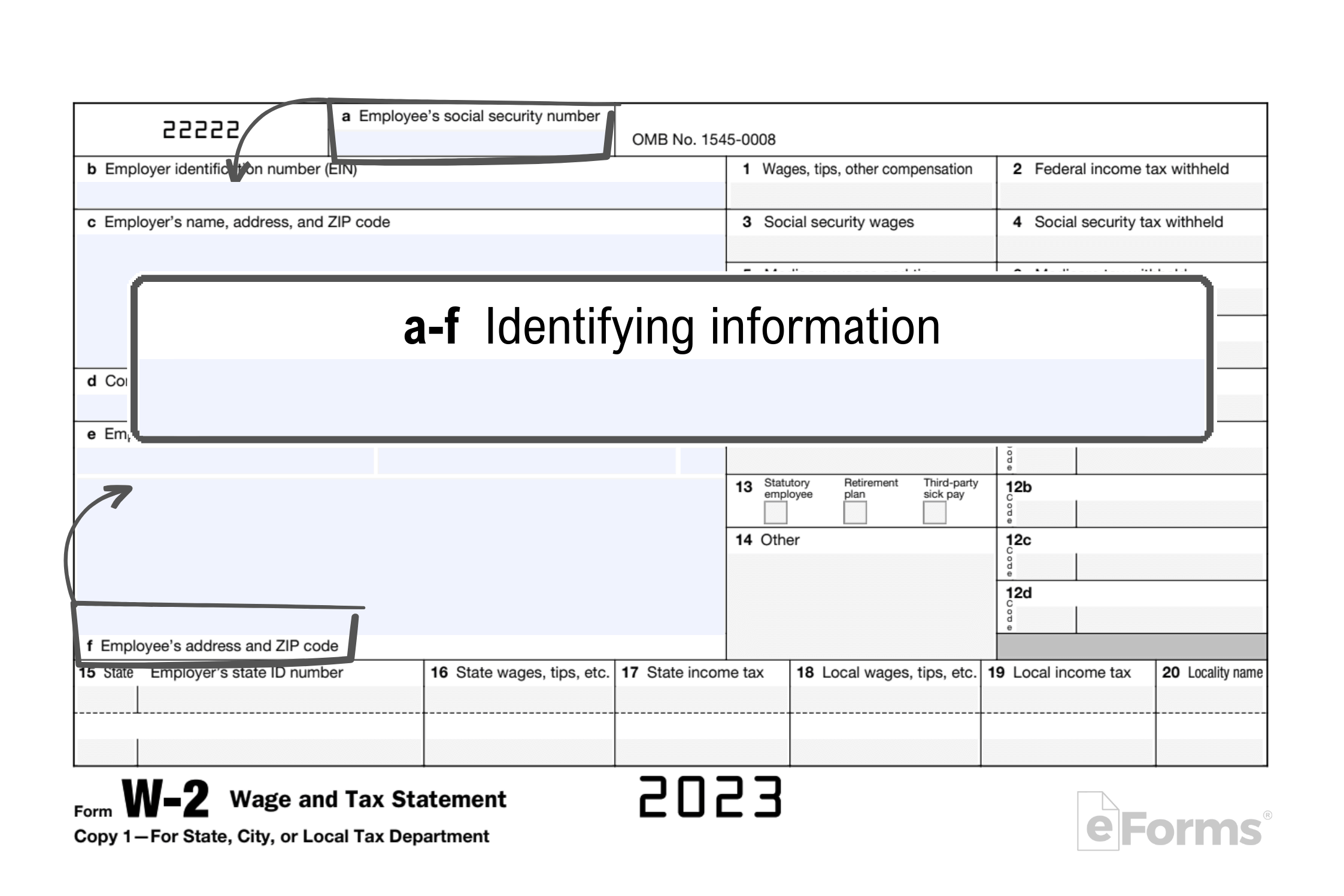

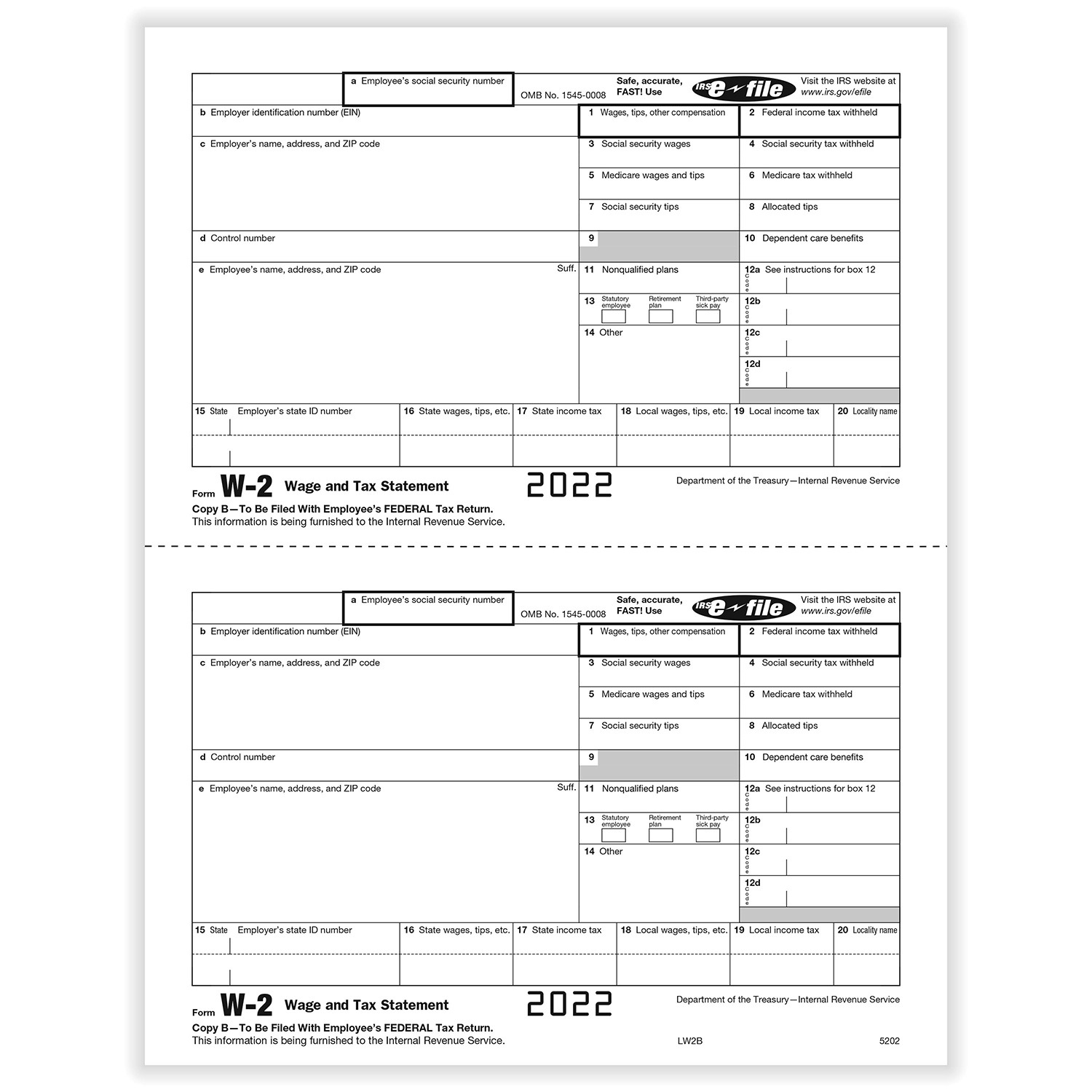

Below are some images related to W2 Form Box 16

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] with W2 Form Box 16](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-with-w2-form-box-16.jpg) w2 form box 16, what does box 16 on w2 mean, what is box 16 on my w2, what is shown in form w-2 box 16, why is box 16 blank on my w2, , W2 Form Box 16.

w2 form box 16, what does box 16 on w2 mean, what is box 16 on my w2, what is shown in form w-2 box 16, why is box 16 blank on my w2, , W2 Form Box 16.