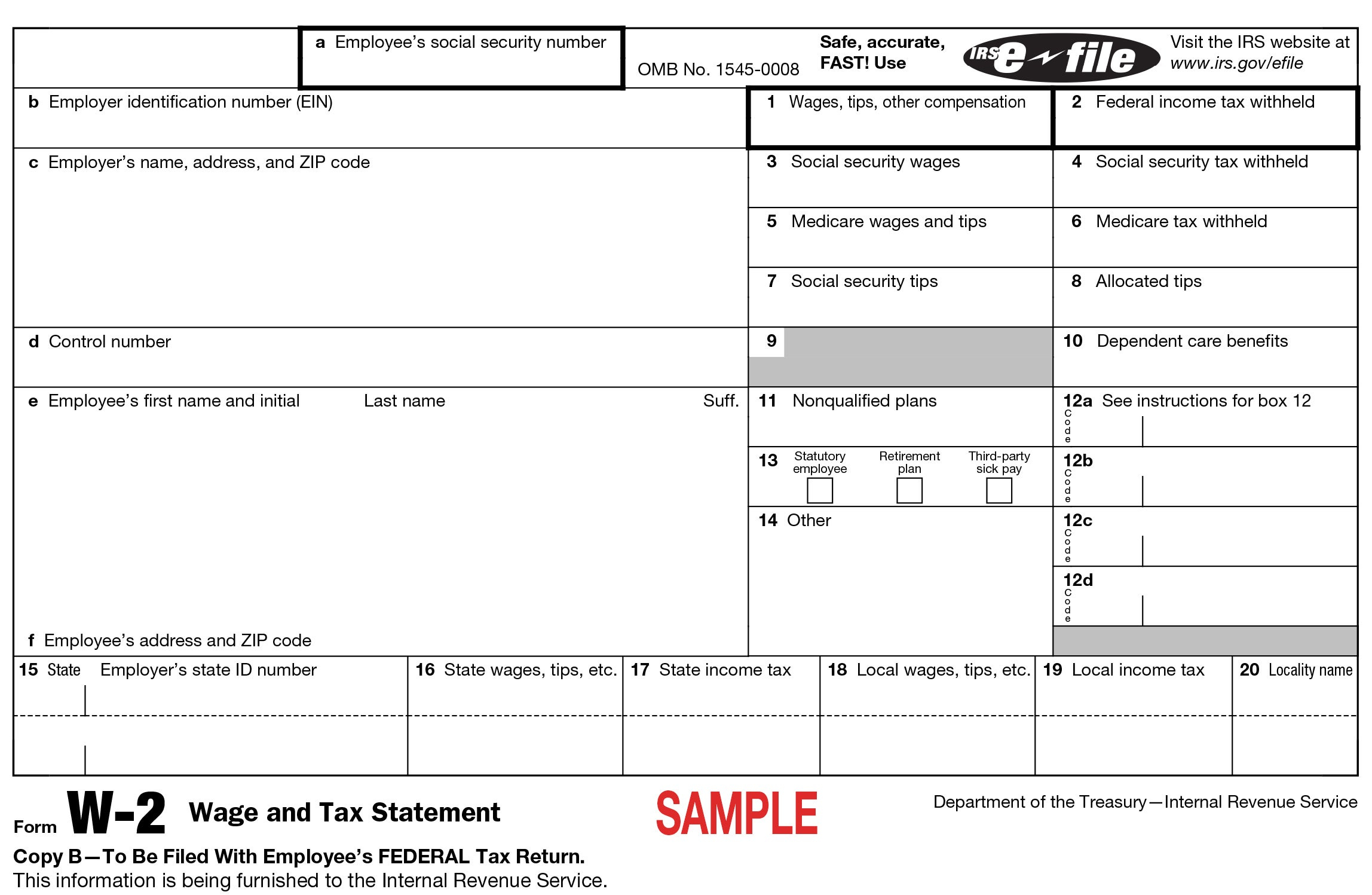

W2 Form Box 14 Category – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

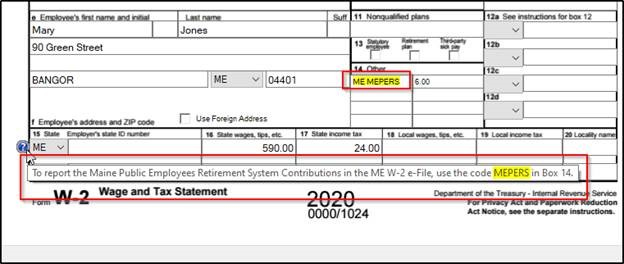

Unlocking the Secrets of Box 14 on Your W2 Form!

Have you ever glanced at your W2 form and wondered what on earth Box 14 is all about? Well, today is your lucky day because we are going to delve into the mysterious world of Box 14 and uncover its hidden treasures! This small box on your W2 form may seem insignificant at first glance, but it actually holds valuable information that can impact your taxes and financial planning. So, let’s roll up our sleeves and get ready to unlock the secrets of Box 14!

Delving Into the Hidden Treasures of Box 14: What You Need to Know!

Box 14 on your W2 form can contain a variety of codes and numbers that provide additional information about your earnings and deductions. Some common entries you may find in Box 14 include union dues, educational assistance payments, or employer-sponsored health insurance premiums. These codes and numbers can help you better understand your overall compensation package and may have an impact on your tax return. So, don’t overlook Box 14 – it’s a treasure trove of valuable details!

Another important thing to note about Box 14 is that the information it contains may not always be relevant to everyone. For example, if you are not a member of a union, you may not see any union dues listed in Box 14. Similarly, if your employer does not offer educational assistance or health insurance benefits, those sections may be left blank. It’s essential to review the information in Box 14 carefully and reach out to your employer or tax professional if you have any questions about the codes and numbers listed. Every detail counts when it comes to managing your finances effectively!

In conclusion, Box 14 on your W2 form may seem like a mystery at first, but with a little bit of investigation, you can uncover its hidden treasures and gain a better understanding of your financial situation. Take the time to review the information in Box 14 and make sure you understand how it may impact your taxes and overall financial planning. Don’t let this small box go unnoticed – it could hold the key to maximizing your earnings and deductions. Happy exploring, and may the secrets of Box 14 bring you financial clarity and peace of mind!

Below are some images related to W2 Form Box 14 Category

w2 form box 14 category, what category do i put for box 14 on w2, what does box 14 category mean on w2, what is box 14 on w2 category, , W2 Form Box 14 Category.

w2 form box 14 category, what category do i put for box 14 on w2, what does box 14 category mean on w2, what is box 14 on w2 category, , W2 Form Box 14 Category.