W2 Form Allowances – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

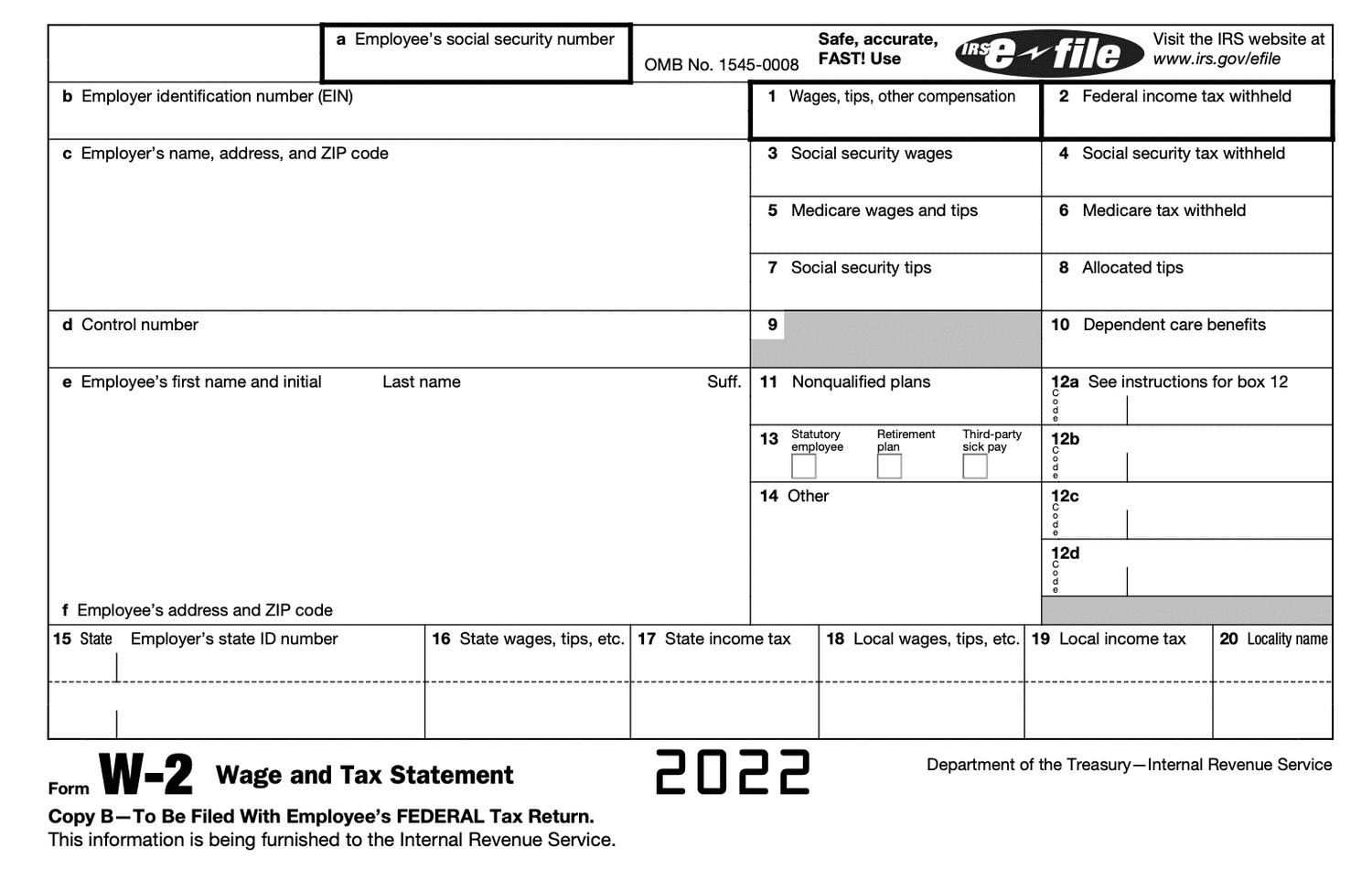

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Secrets to Maximizing Your W2 Form Allowances!

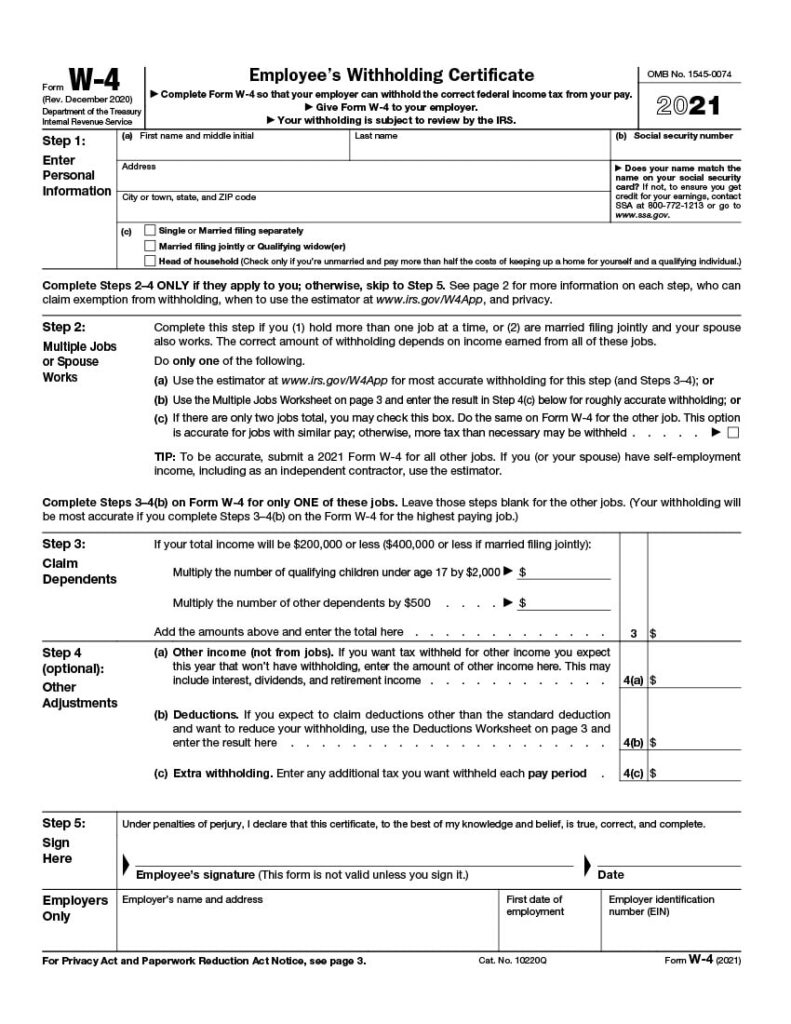

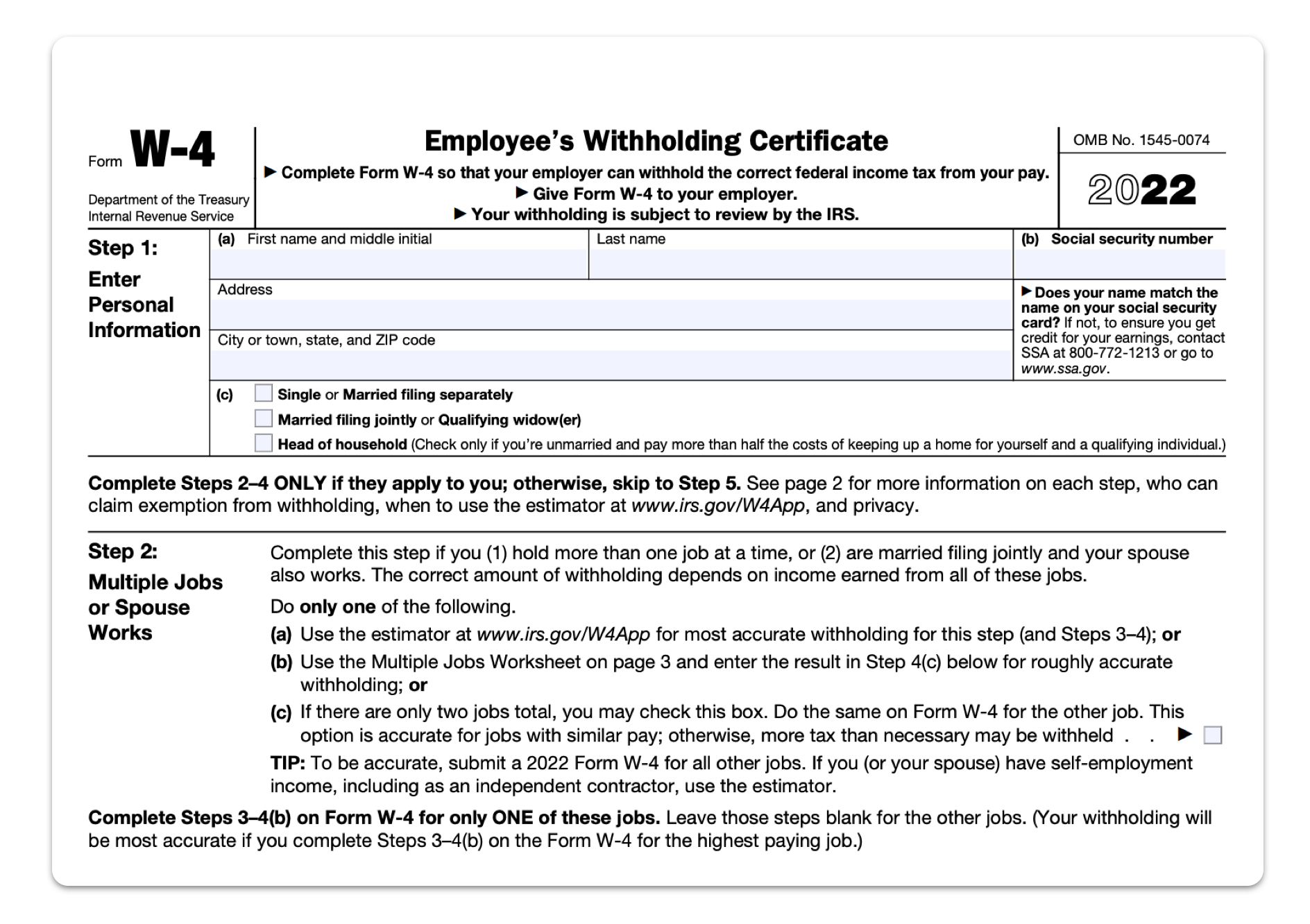

Are you ready to unlock the magic of your W2 form allowances and take control of your financial future? Understanding how to strategically adjust your allowances can make a significant impact on your take-home pay. By utilizing the right number of allowances, you can ensure that you are not overpaying in taxes throughout the year, giving you more money to put towards your goals and dreams. Whether you are looking to save for a vacation, pay off debt, or invest in your future, mastering your W2 form allowances is the key to achieving financial success.

When it comes to maximizing your W2 form allowances, it’s essential to take a closer look at your individual financial situation. By carefully evaluating your income, expenses, and financial goals, you can determine the optimal number of allowances to claim on your W2 form. Making strategic adjustments based on your specific circumstances can help you strike the perfect balance between receiving a larger paycheck each pay period and avoiding a hefty tax bill come tax season. With a bit of planning and foresight, you can unleash the power of your allowances and pave the way towards financial freedom.

Unleash the Power of Strategic Adjustments for Financial Freedom!

Imagine the possibilities that come with mastering the art of strategic adjustments on your W2 form allowances. By taking the time to review and update your allowances regularly, you can ensure that you are making the most of your income and minimizing your tax liability. Whether you are starting a new job, experiencing a major life change, or simply looking to optimize your finances, knowing how to adjust your allowances can put you on the fast track to financial success. With the right approach, you can unlock the magic of your W2 form allowances and achieve the financial freedom you deserve.

In conclusion, don’t underestimate the power of your W2 form allowances in shaping your financial future. By discovering the secrets to maximizing your allowances and unleashing the power of strategic adjustments, you can take control of your finances and work towards achieving your goals. Whether you are looking to save for a rainy day, invest in your future, or simply enjoy a more comfortable lifestyle, mastering your W2 form allowances is a crucial step towards financial freedom. So why wait? Start unlocking the magic of your W2 form allowances today and watch as your financial dreams become a reality!

Below are some images related to W2 Form Allowances

w2 form 2023 allowances, w2 form allowances, w2 form deductions, w2 form exemptions, w2 form exemptions explained, , W2 Form Allowances.

w2 form 2023 allowances, w2 form allowances, w2 form deductions, w2 form exemptions, w2 form exemptions explained, , W2 Form Allowances.