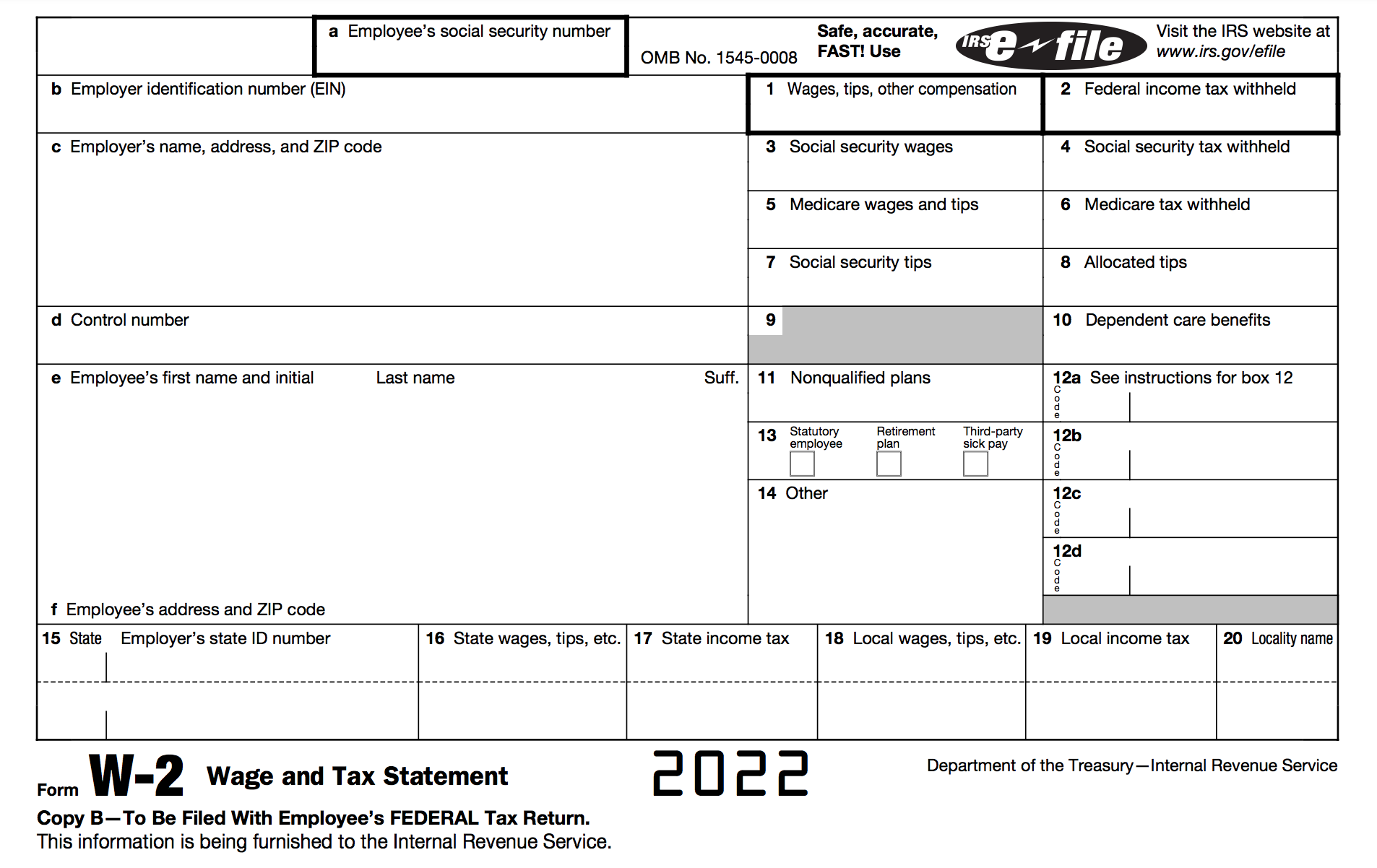

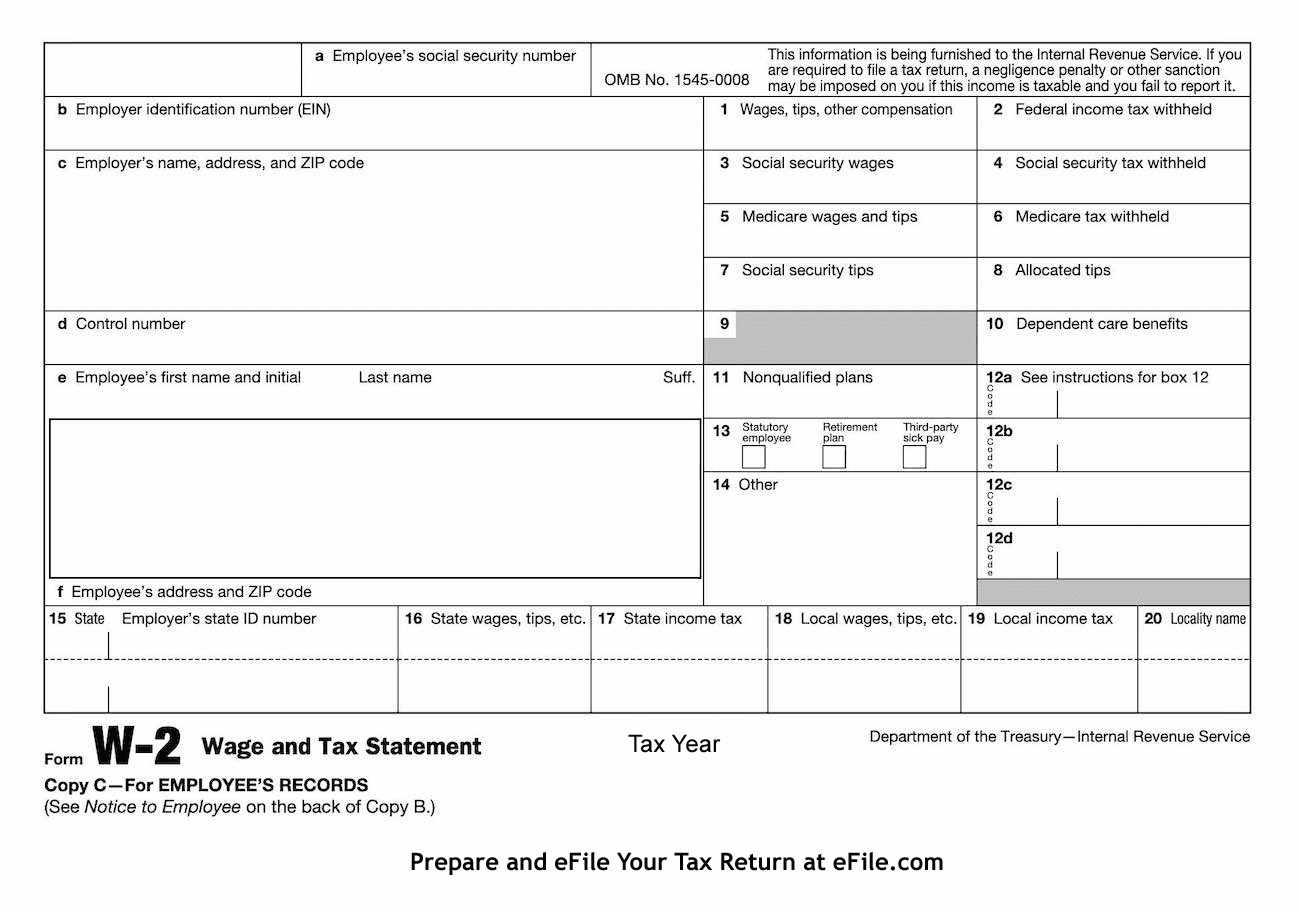

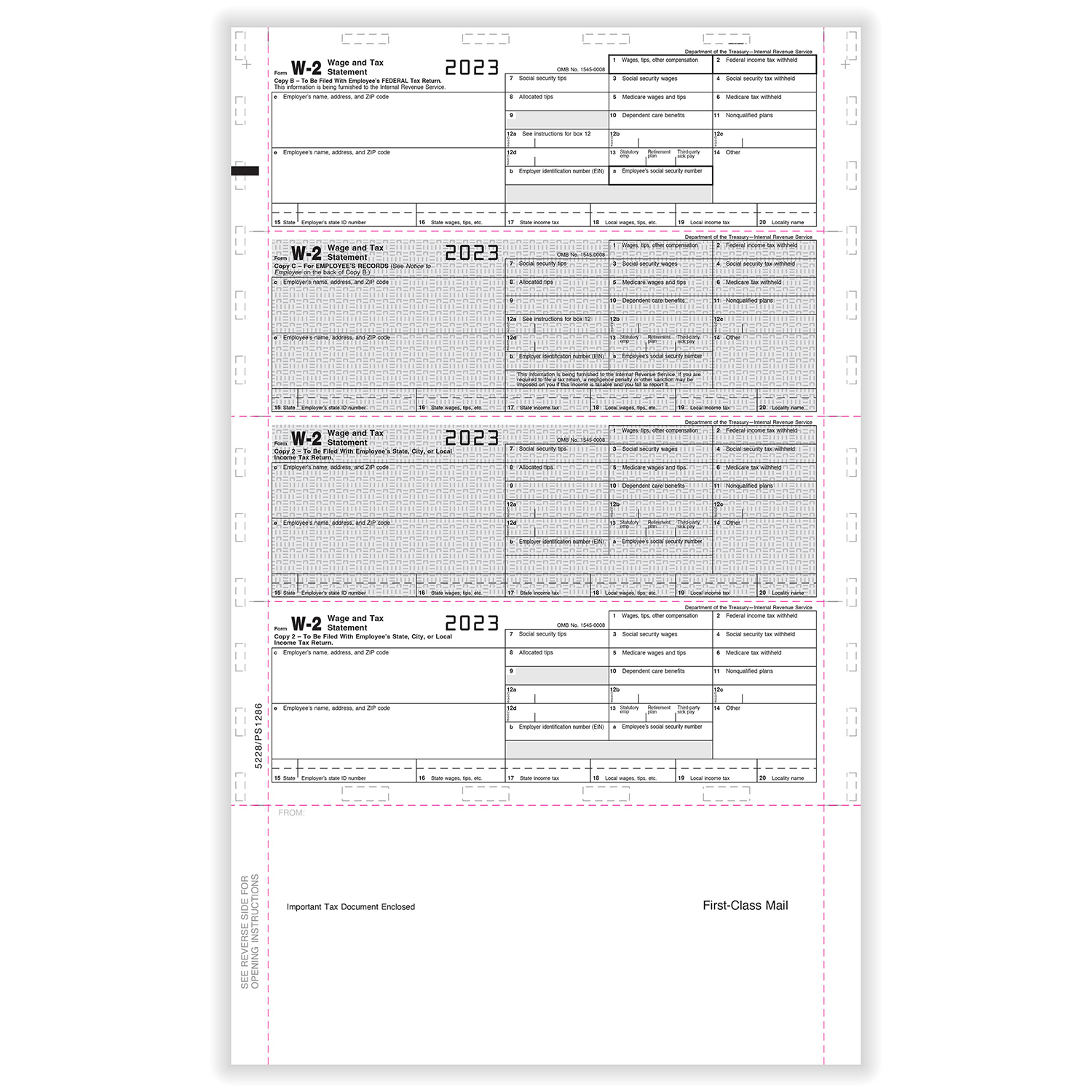

W2 Ez Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Say Goodbye to Tax Frustration!

Are you tired of spending hours struggling with complicated tax forms? Does the thought of filing your taxes leave you feeling anxious and overwhelmed? Say goodbye to tax frustration with the W2 Ez Form! This user-friendly tool is designed to make tax season a breeze, saving you time and stress. Gone are the days of pouring over confusing instructions and struggling to input your information correctly. With W2 Ez Form, you can whiz through your taxes with ease and confidence.

Forget about endless hours spent trying to decipher tax jargon and navigate confusing forms. The W2 Ez Form Advantage is here to revolutionize the way you file your taxes. This innovative tool simplifies the process, allowing you to input your information quickly and accurately. Whether you’re a seasoned tax filer or a first-time taxpayer, W2 Ez Form is designed to meet your needs and make tax season a breeze. With its intuitive interface and helpful prompts, you’ll wonder why you ever struggled with traditional tax forms.

With the W2 Ez Form Advantage, filing your taxes has never been easier or more efficient. Say goodbye to the stress and frustration of tax season and hello to a streamlined, hassle-free experience. Don’t let tax season get the best of you – take control with W2 Ez Form and whiz through your taxes with ease!

Below are some images related to W2 Ez Form

how can i find my w-2 forms, how to file an ez tax form, w2 ez form, what is the ez tax form, , W2 Ez Form.

how can i find my w-2 forms, how to file an ez tax form, w2 ez form, what is the ez tax form, , W2 Ez Form.