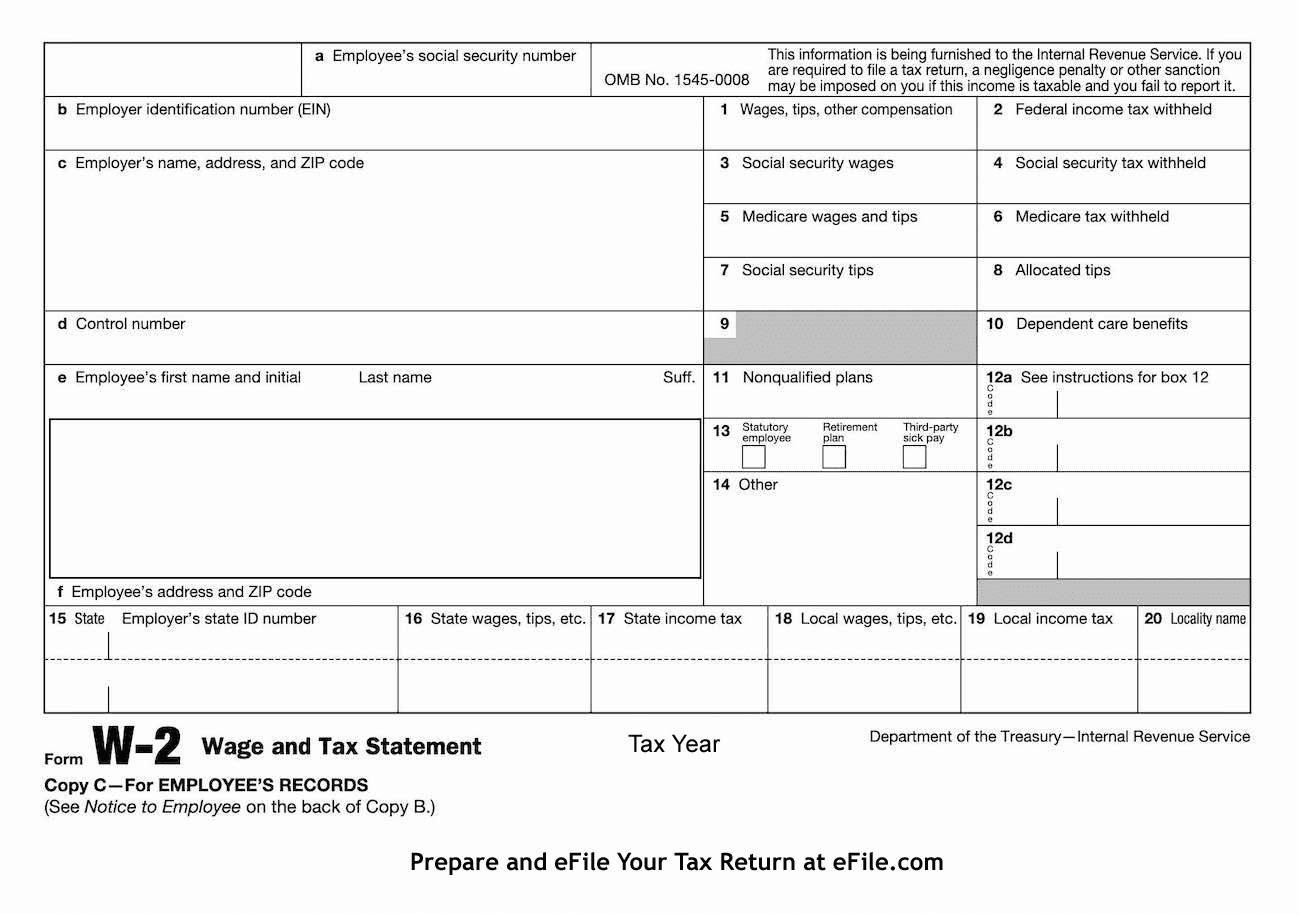

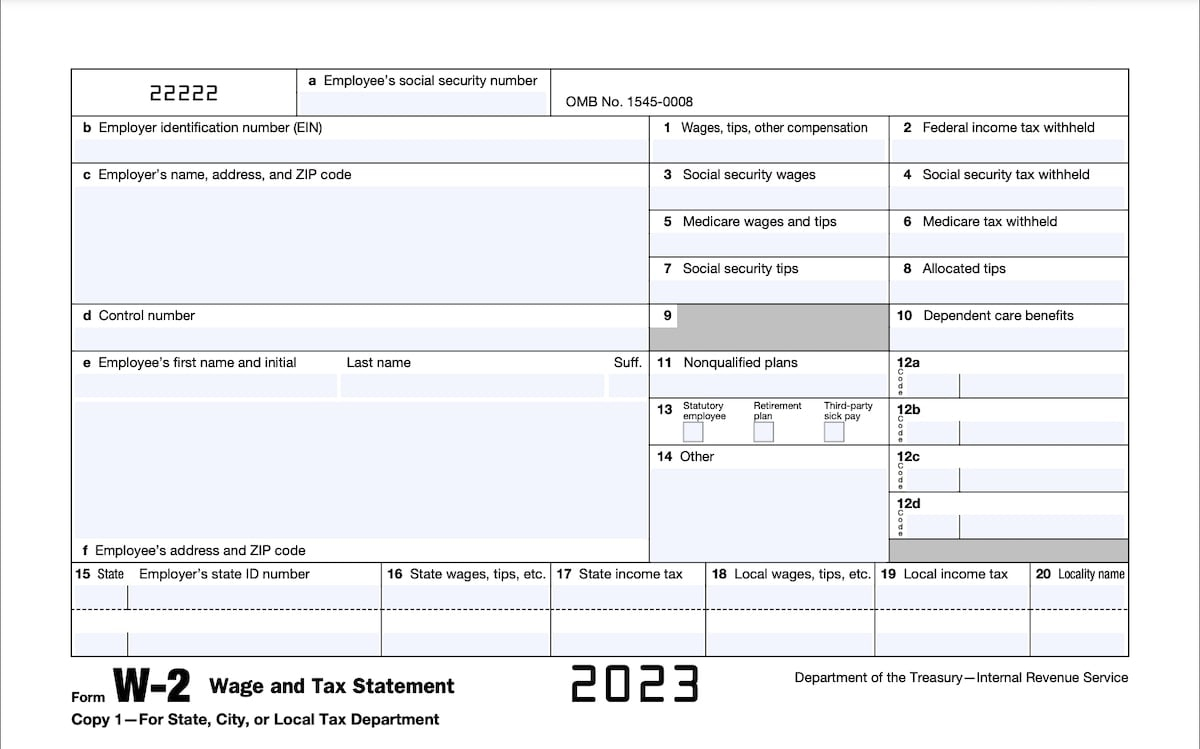

W2 Exempt Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Say Goodbye to Tax Worries with the W2 Exempt Form!

Are you tired of stressing out over tax season every year? Well, say goodbye to those worries because the W2 Exempt Form is here to save the day! This magical form allows you to exempt yourself from having taxes withheld from your paycheck, giving you more control over your finances and less stress when tax time rolls around. With the W2 Exempt Form, you can kiss your tax worries goodbye and enjoy a more relaxed approach to managing your money.

Not only does the W2 Exempt Form free you from the burden of tax withholding, but it also gives you the opportunity to put more money back in your pocket. By taking advantage of this form, you can increase your take-home pay and have more cash on hand to spend or save as you please. Imagine the possibilities of having extra money each month to treat yourself to a fancy dinner, go on a weekend getaway, or save up for that dream vacation. The W2 Exempt Form truly is a game-changer when it comes to managing your finances.

So why continue to stress over taxes when you can simply fill out a W2 Exempt Form and kiss those worries goodbye? Take control of your financial future and enjoy the peace of mind that comes with knowing you have more money in your pocket. Say goodbye to tax season stress and hello to a brighter, more financially secure future with the W2 Exempt Form by your side. It’s time to take charge of your finances and start living your best life without the worry of taxes weighing you down.

Discover How to Kiss Your Tax Stress Goodbye with W2 Exempt Form!

The W2 Exempt Form may seem like a small piece of paper, but its impact on your financial well-being is anything but insignificant. By opting to exempt yourself from tax withholding, you can take control of your finances and alleviate the stress that often comes with tax season. Instead of dreading tax time each year, embrace the freedom and flexibility that the W2 Exempt Form provides. Say goodbye to tax stress and hello to a more relaxed and empowered approach to managing your money.

With the W2 Exempt Form in hand, you have the power to make your money work for you. By keeping more of your paycheck each month, you can allocate those funds towards things that truly matter to you. Whether it’s investing in your future, treating yourself to something special, or simply building up your savings, the possibilities are endless when you have the W2 Exempt Form on your side. Don’t let tax worries hold you back any longer – take the leap and discover how liberating it can be to kiss your tax stress goodbye with this simple yet powerful form.

In a world filled with financial uncertainties, the W2 Exempt Form offers a sense of control and security that is truly priceless. By taking advantage of this form, you can say goodbye to the anxiety and worry that often accompany tax season, and instead focus on building a brighter financial future for yourself. So why wait any longer? Fill out your W2 Exempt Form today and start reaping the benefits of a stress-free approach to taxes. Say goodbye to tax worries and hello to a more empowered and confident financial outlook with the W2 Exempt Form by your side.

In conclusion, the W2 Exempt Form is a powerful tool that can help you take control of your financial future and say goodbye to tax worries once and for all. By exempting yourself from tax withholding, you can enjoy more money in your pocket each month and relieve the stress that often comes with tax season. Don’t let taxes hold you back – embrace the freedom and flexibility that the W2 Exempt Form provides and start living your best financial life today!

Below are some images related to W2 Exempt Form

can i change my w2 to exempt, can i file exempt on my w2, how to fill out w2 form exempt, w2 exempt form, w2 exempt meaning, , W2 Exempt Form.

can i change my w2 to exempt, can i file exempt on my w2, how to fill out w2 form exempt, w2 exempt form, w2 exempt meaning, , W2 Exempt Form.