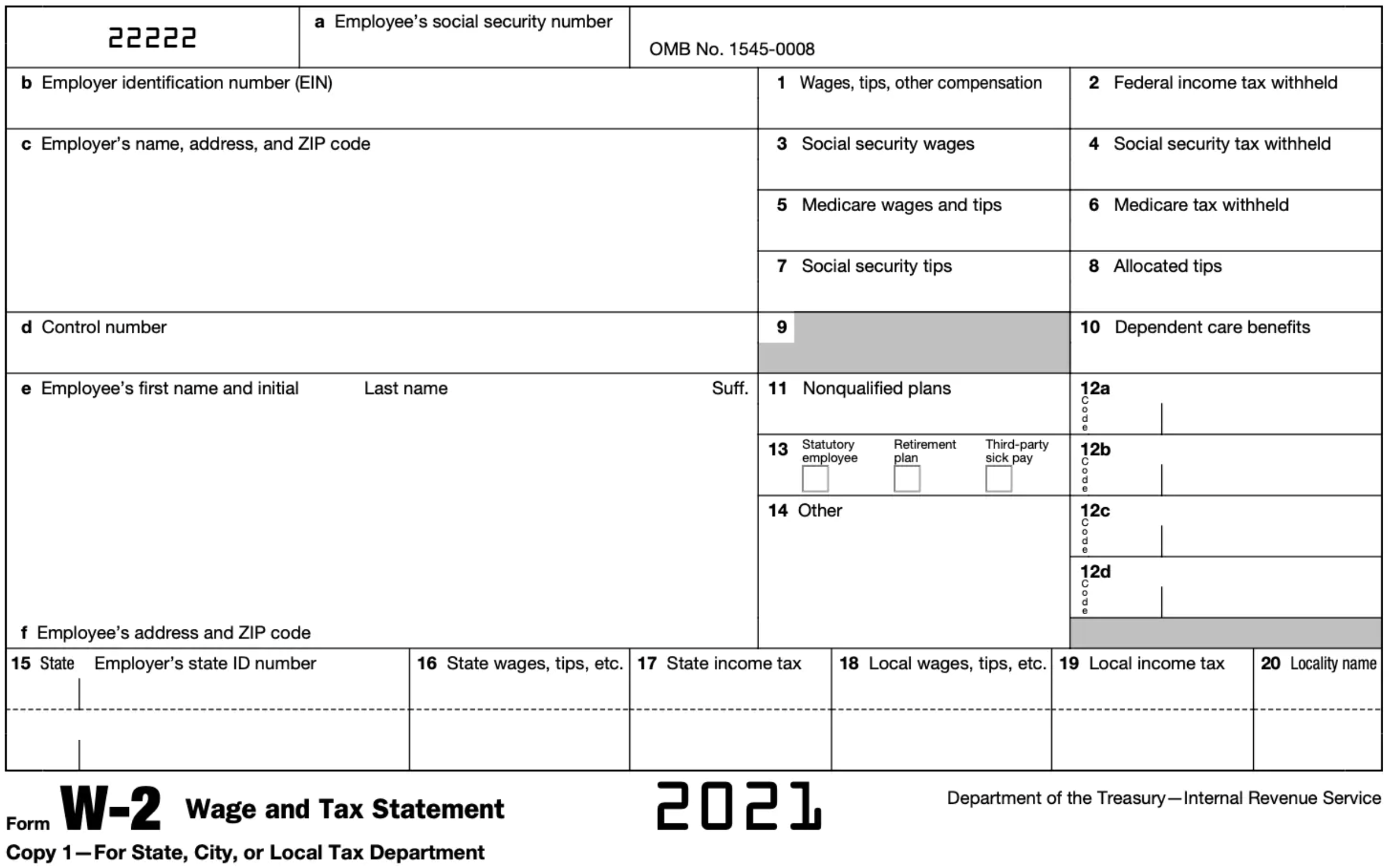

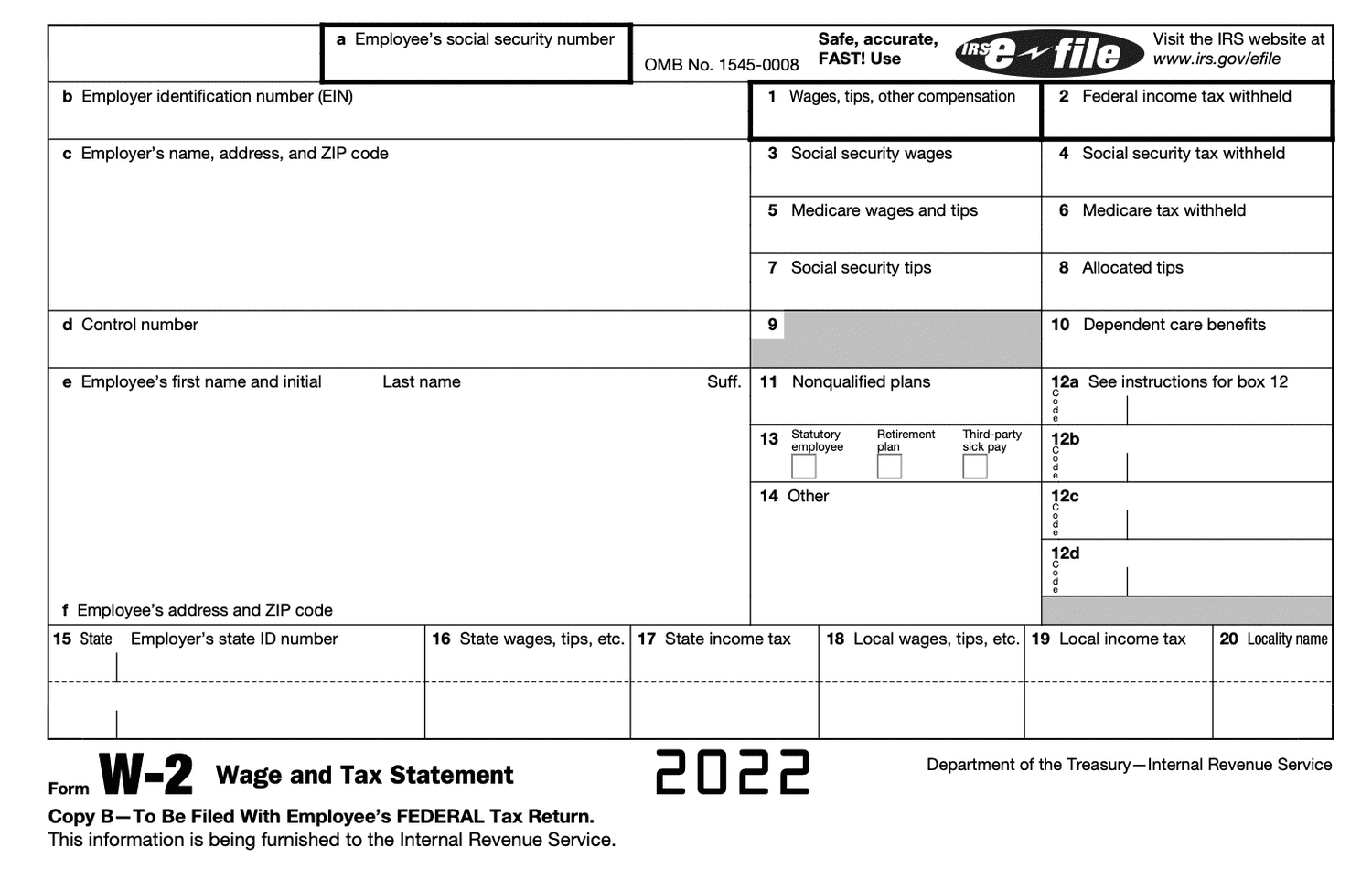

W2 And 1099 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Enchantment of W2s and 1099s!

Ah, tax season – a time filled with paperwork, calculations, and a hint of magic! While the mention of W2s and 1099s may not sound exciting at first, these documents hold the key to unlocking a world of financial possibilities. Let’s dive into the mystical realm of tax forms and discover the secrets they hold!

Discover the Secrets Behind W2s and 1099s!

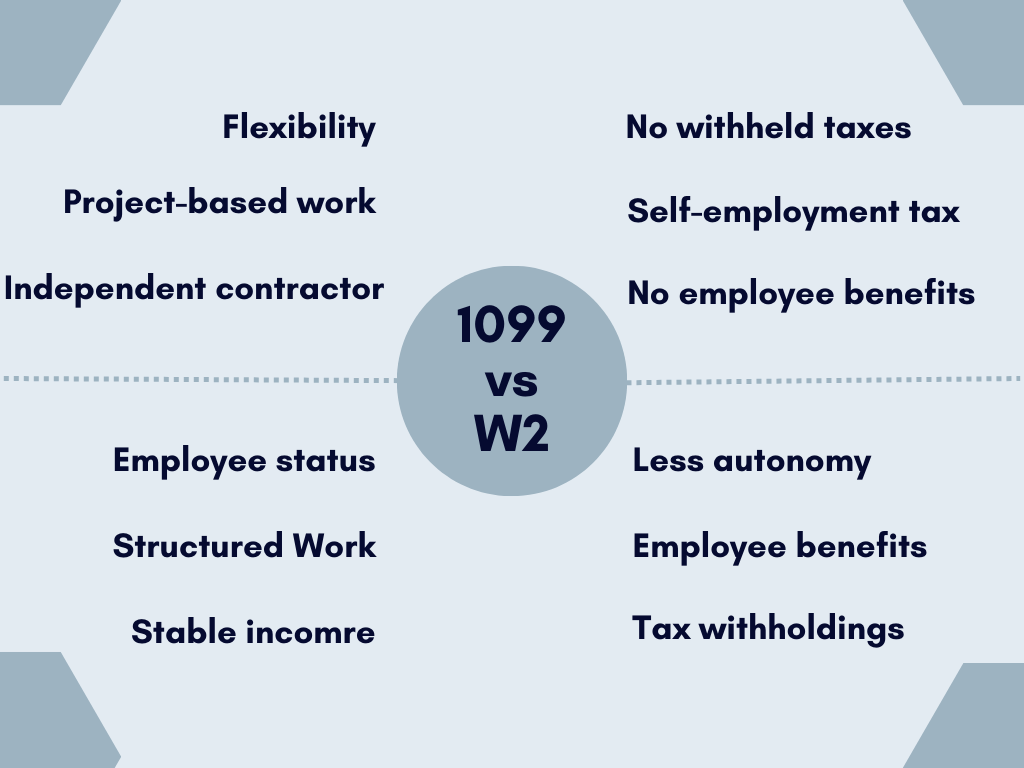

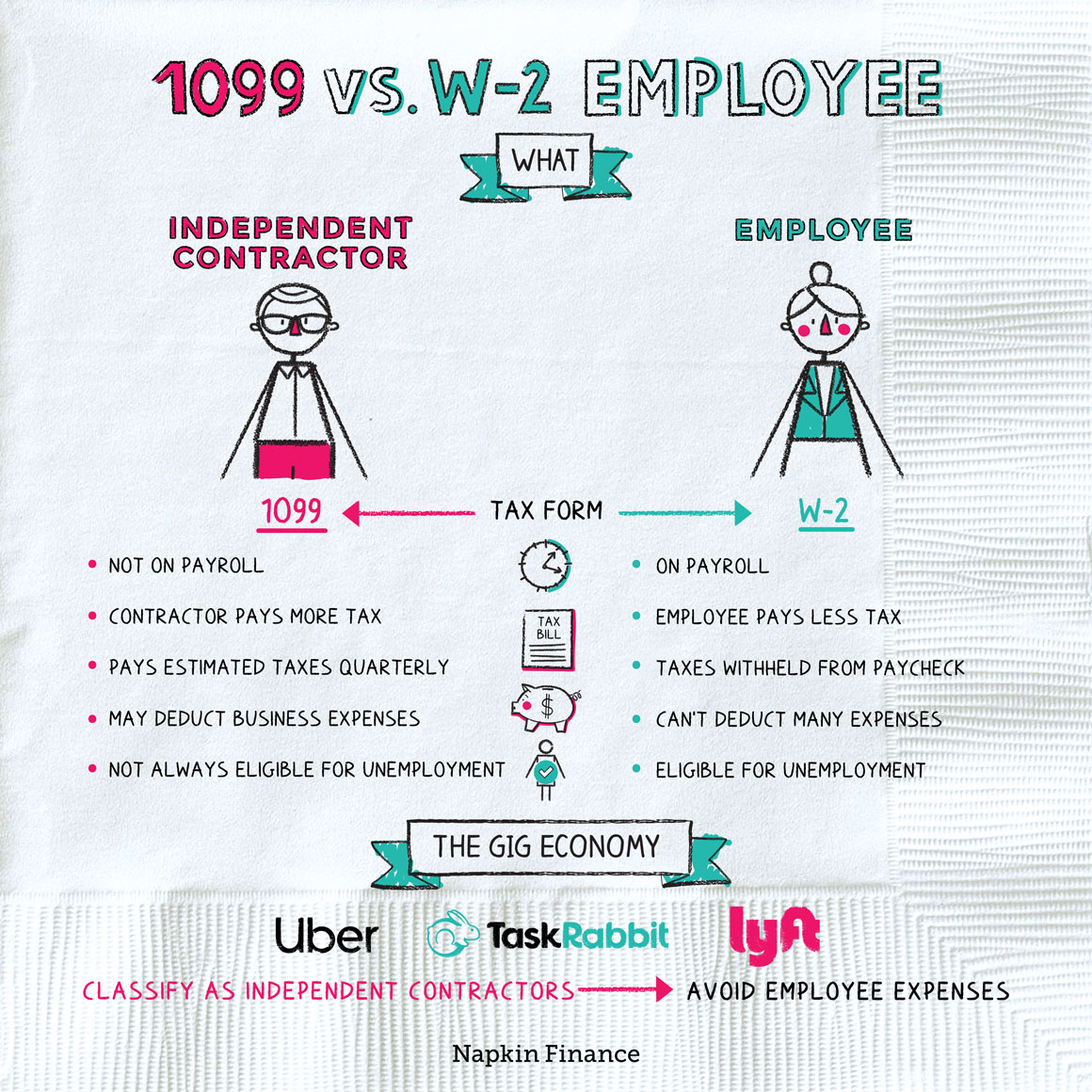

W2s and 1099s are like hidden treasures waiting to be unearthed. The W2 form, provided by employers, details your earnings and taxes withheld throughout the year. It’s a snapshot of your annual income and a crucial piece in the tax puzzle. On the other hand, the 1099 form is for independent contractors and freelancers, showcasing income from clients or gigs. Understanding these forms is like mastering a spell – it empowers you to take control of your finances with confidence.

Unraveling the codes and numbers on your W2 and 1099 forms can feel like decrypting an ancient manuscript. But fear not – with a bit of guidance, you can navigate through the complexities and emerge victorious. These forms not only provide insight into your income but also offer opportunities for deductions and credits. By embracing the magic of W2s and 1099s, you can harness their power to optimize your tax return and make the most of your financial situation.

Peek behind the curtain of W2s and 1099s, and you’ll find a world of enchantment waiting to be explored. These documents hold the key to unlocking a realm of financial knowledge and potential savings. So, embrace the magic of tax season, arm yourself with knowledge, and let the spellbinding journey of W2s and 1099s lead you to prosperity and financial success!

Below are some images related to W2 And 1099 Forms

order w2 and 1099 forms from irs, quickbooks w2 and 1099 forms, w2 and 1099 forms, w2 and 1099-misc from same employer, w2/aca/1099 forms, , W2 And 1099 Forms.

order w2 and 1099 forms from irs, quickbooks w2 and 1099 forms, w2 and 1099 forms, w2 and 1099-misc from same employer, w2/aca/1099 forms, , W2 And 1099 Forms.