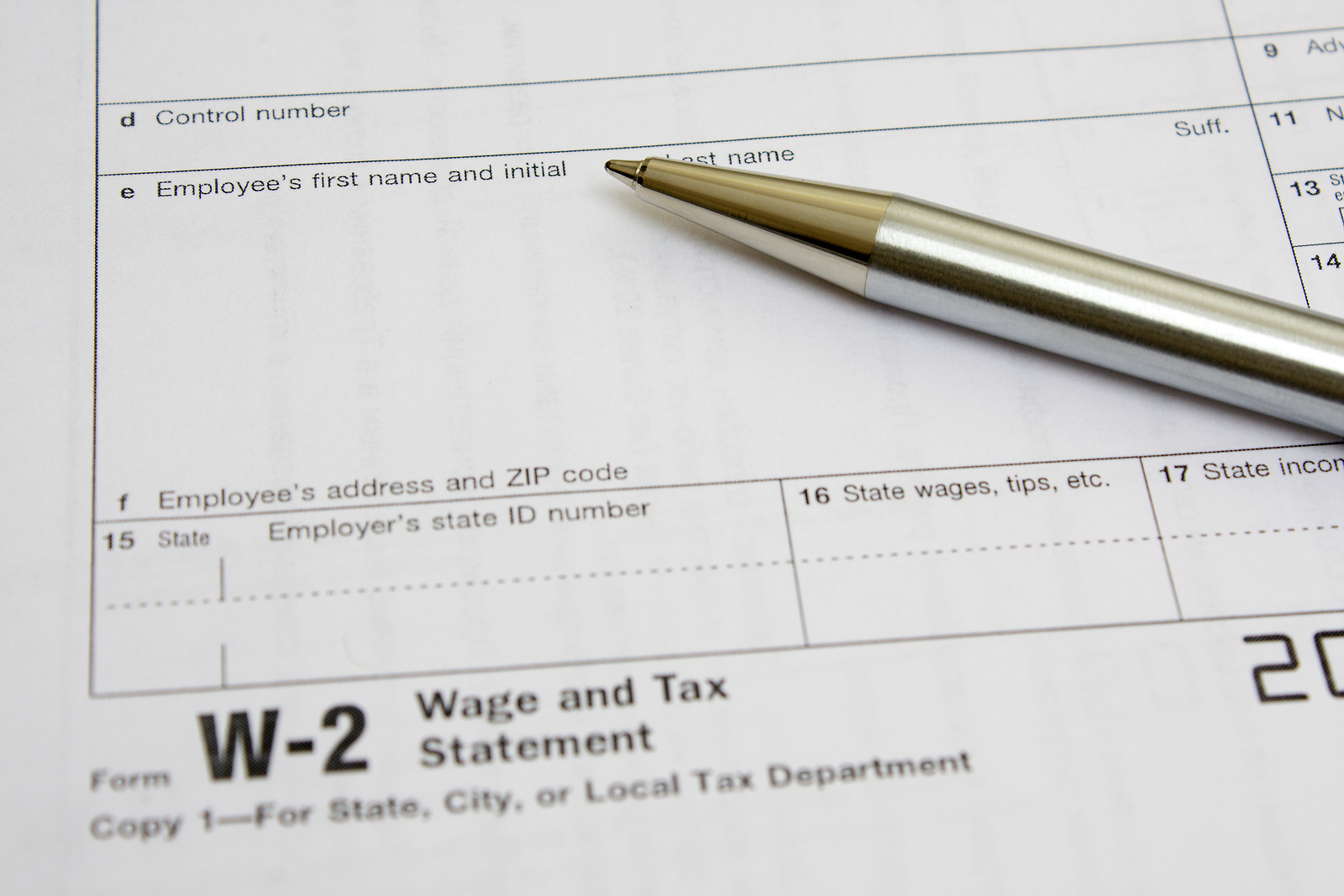

How Do I Get Old W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Journey back in time: Rediscovering your old W2 forms!

Do you ever find yourself reminiscing about the good old days, wondering what your past self was up to? Whether you’re feeling nostalgic or need to access old financial records, your W2 forms can provide a treasure trove of information about your past earnings and taxes. These seemingly mundane documents can hold the key to unlocking memories and financial insights from years gone by. So, embark on a journey back in time and rediscover your old W2 forms!

As you sift through old files and rummage through dusty boxes in search of your lost W2 forms, you may find yourself on a scavenger hunt of sorts. The excitement of uncovering these hidden treasures from the past can be both thrilling and rewarding. Each W2 form represents a snapshot of a specific year in your life, capturing a moment in time when you were working hard and earning a living. So, dust off those old documents and get ready to embark on a journey down memory lane as you retrieve your old W2 forms.

While the process of retrieving old W2 forms may seem daunting at first, it doesn’t have to be a complicated or time-consuming task. With the right tools and resources at your disposal, you can easily uncover these valuable documents and gain access to important financial information from years past. Whether you need your old W2 forms for tax purposes, financial planning, or simply to satisfy your curiosity, there are steps you can take to retrieve these lost treasures and unlock the past. So, don your detective hat and get ready to unravel the mysteries of your financial history by retrieving your old W2 forms.

Uncover hidden treasures: How to retrieve lost W2 forms.

If you’ve misplaced or lost your old W2 forms, fear not! There are several ways you can retrieve these valuable documents and gain access to the financial information they contain. One option is to contact your former employers directly and request copies of your old W2 forms. Many employers keep records of past employees’ W2 forms for several years and can provide you with copies upon request.

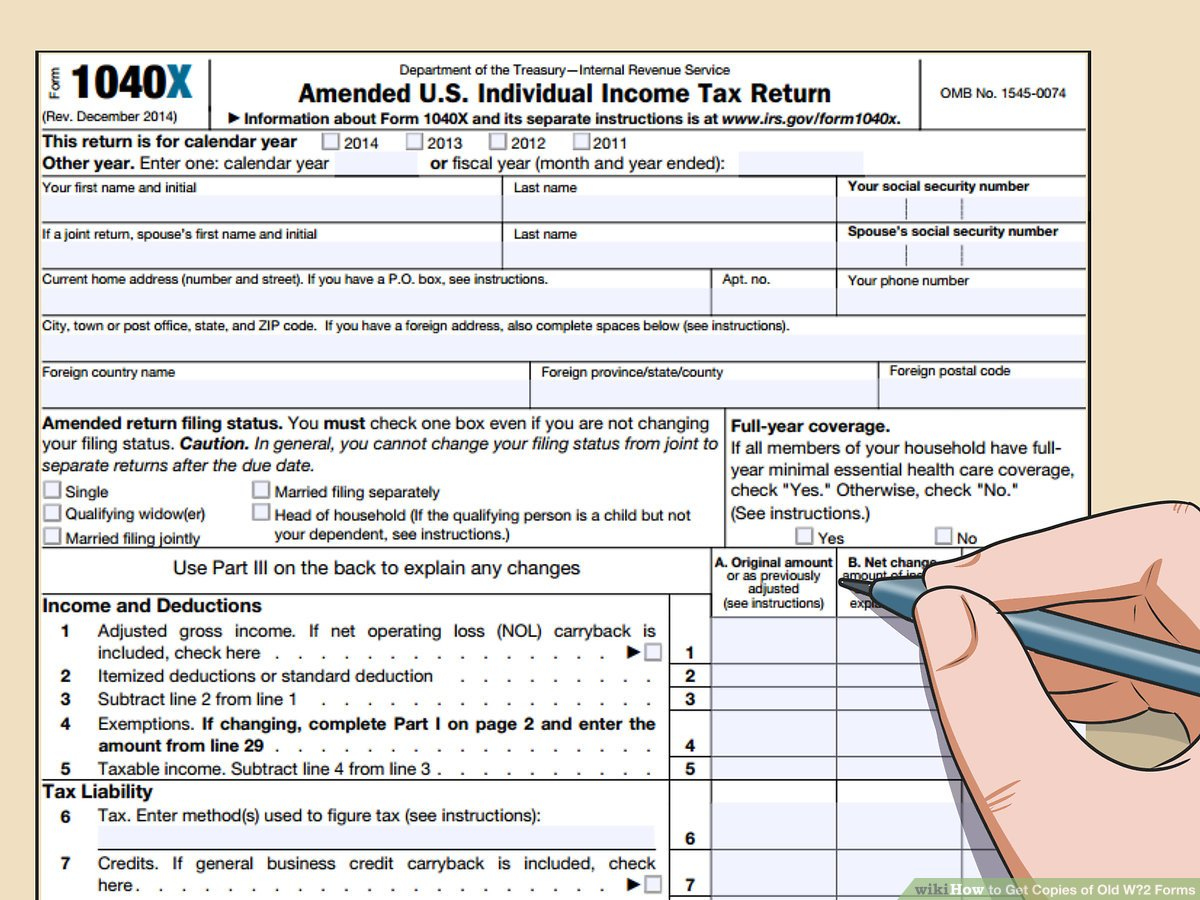

Another way to retrieve lost W2 forms is to access them through the Internal Revenue Service (IRS). The IRS keeps copies of old tax returns, including W2 forms, for up to seven years. You can request a transcript of your old tax return, which will include copies of your W2 forms, by filling out Form 4506-T or requesting it online through the IRS website. This can be a convenient option for those who are unable to contact their former employers or for individuals who need W2 forms from multiple employers.

If all else fails, you can also reach out to a tax professional or accountant for assistance in retrieving your old W2 forms. These professionals have experience navigating the complexities of tax records and can help you obtain the documents you need to unlock the past. With determination and a little bit of sleuthing, you can uncover these hidden treasures and gain access to valuable financial information from years gone by.

In conclusion, retrieving old W2 forms can be a rewarding experience that allows you to journey back in time and rediscover your past earnings and taxes. Whether you’re driven by nostalgia or need the information for practical purposes, don’t hesitate to embark on this quest to unlock the past. By following the steps outlined above and utilizing the resources available to you, you can retrieve your lost W2 forms and gain access to a wealth of financial insights from years gone by. So, dust off those old files and start digging – the treasures of your financial history await!

Below are some images related to How Do I Get Old W2 Forms

can you find your old w2 online, how can i get previous w2 forms, how can i retrieve old w2 forms, how do i get old w2 forms, how to get old w2 forms fast, , How Do I Get Old W2 Forms.

can you find your old w2 online, how can i get previous w2 forms, how can i retrieve old w2 forms, how do i get old w2 forms, how to get old w2 forms fast, , How Do I Get Old W2 Forms.