UCSF Former Employee W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

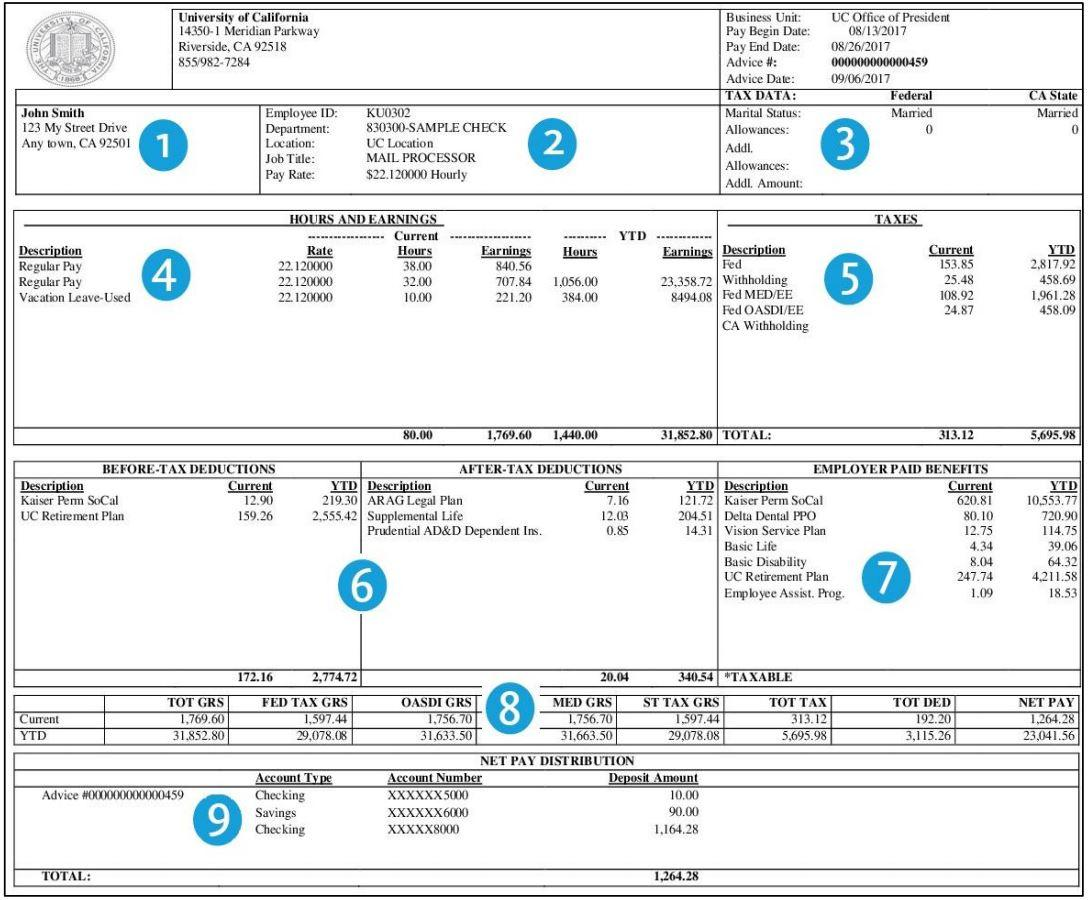

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling Your UCSF Former Employee W2!

Are you a former employee of UCSF eagerly awaiting your W2 form? Well, the wait is over because it’s time to unveil the magic of getting your hands on that important document! Your W2 holds the key to unlocking financial opportunities and ensuring you stay on top of your tax obligations. So, let’s dive in and discover the secrets to obtaining your UCSF former employee W2!

Discover the Magic: Getting Your UCSF Former Employee W2!

The first step to unveiling your UCSF former employee W2 is to visit the UCSF employee portal or contact the human resources department. They will provide you with the necessary information and guide you through the process of accessing your W2. Make sure to have your employee ID and other relevant details handy to expedite the process. Once you have the information, you can easily download and print your W2 for tax filing purposes.

Next, ensure that all your personal information, such as your address and contact details, are up to date in the UCSF system. This will ensure that your W2 reaches you in a timely manner and that there are no delays in receiving important tax documents. Stay in touch with the HR department to make any necessary changes and updates to your information to avoid any potential issues.

Lastly, once you have unveiled your UCSF former employee W2, take the time to review it carefully. Verify that all the information, such as your income, deductions, and taxes withheld, is accurate. If you notice any discrepancies or have any questions, don’t hesitate to reach out to the HR department for clarification. By staying on top of your tax documents, you can ensure a smooth and stress-free tax filing process.

In conclusion, unveiling your UCSF former employee W2 is a straightforward process that can be easily accomplished with the right guidance and information. By following the step-by-step guide and staying proactive in updating your personal information, you can ensure a seamless experience in obtaining and reviewing your W2. So, embrace the magic of financial empowerment and unlock the potential of your UCSF former employee W2 today!

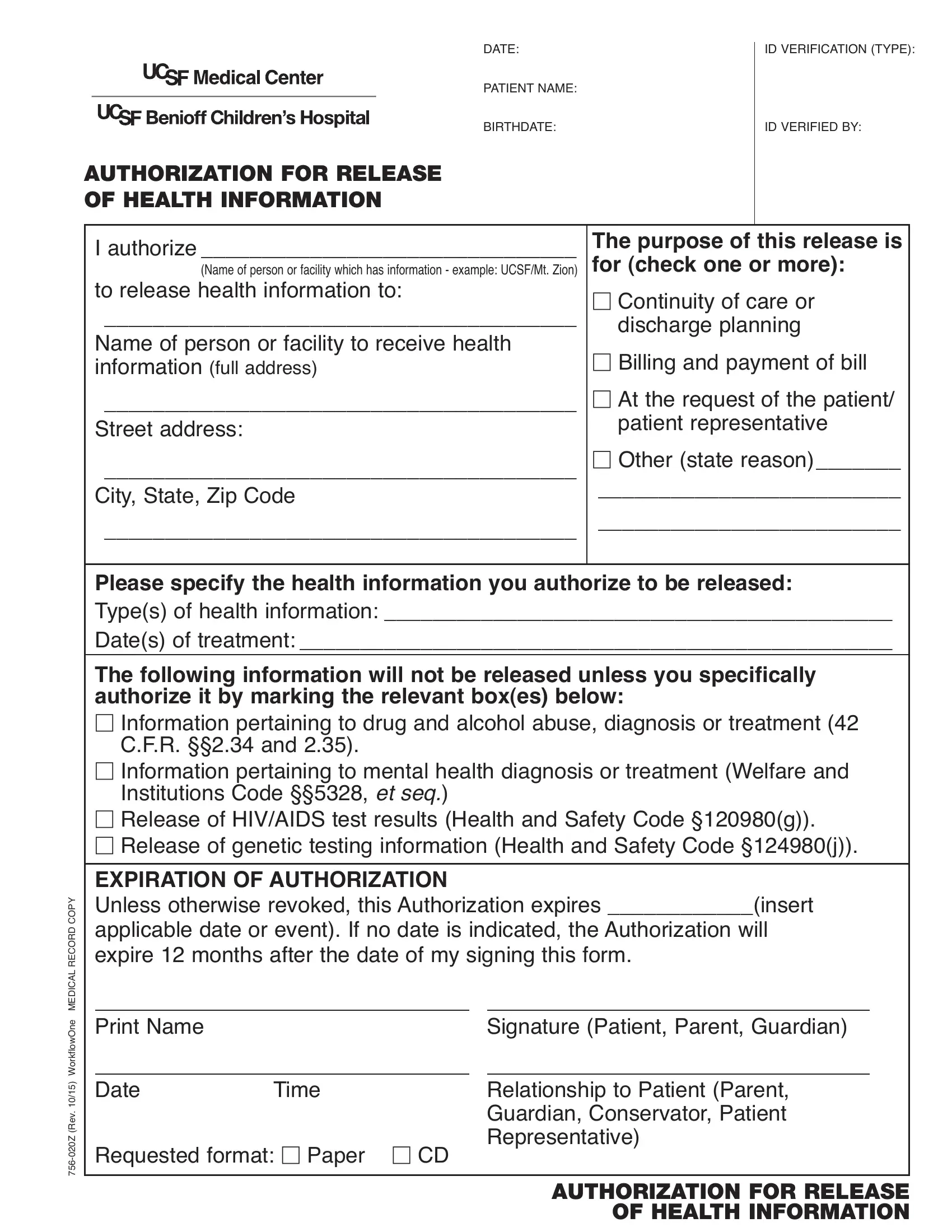

Below are some images related to Ucsf Former Employee W2

how can i get my w2 from former employer, how do former employees get w2, how do i get my w2 from past employers, how to get w2 from former employee, ucsf former employee w2, , Ucsf Former Employee W2.

how can i get my w2 from former employer, how do former employees get w2, how do i get my w2 from past employers, how to get w2 from former employee, ucsf former employee w2, , Ucsf Former Employee W2.