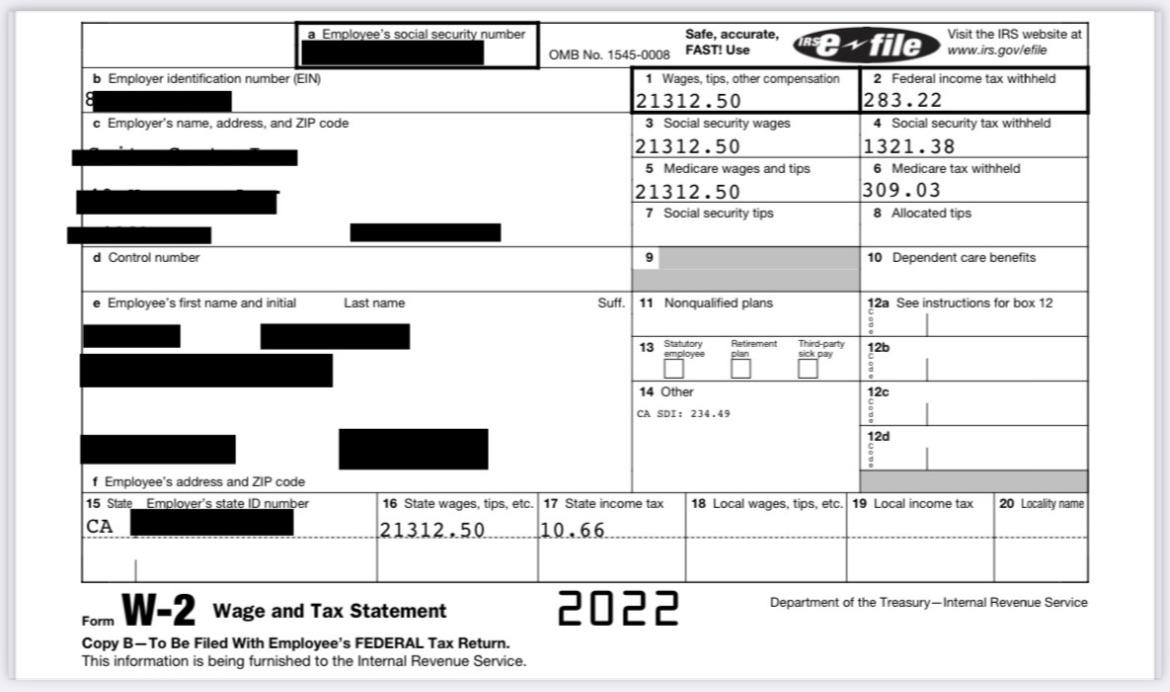

Tesla Former Employee W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

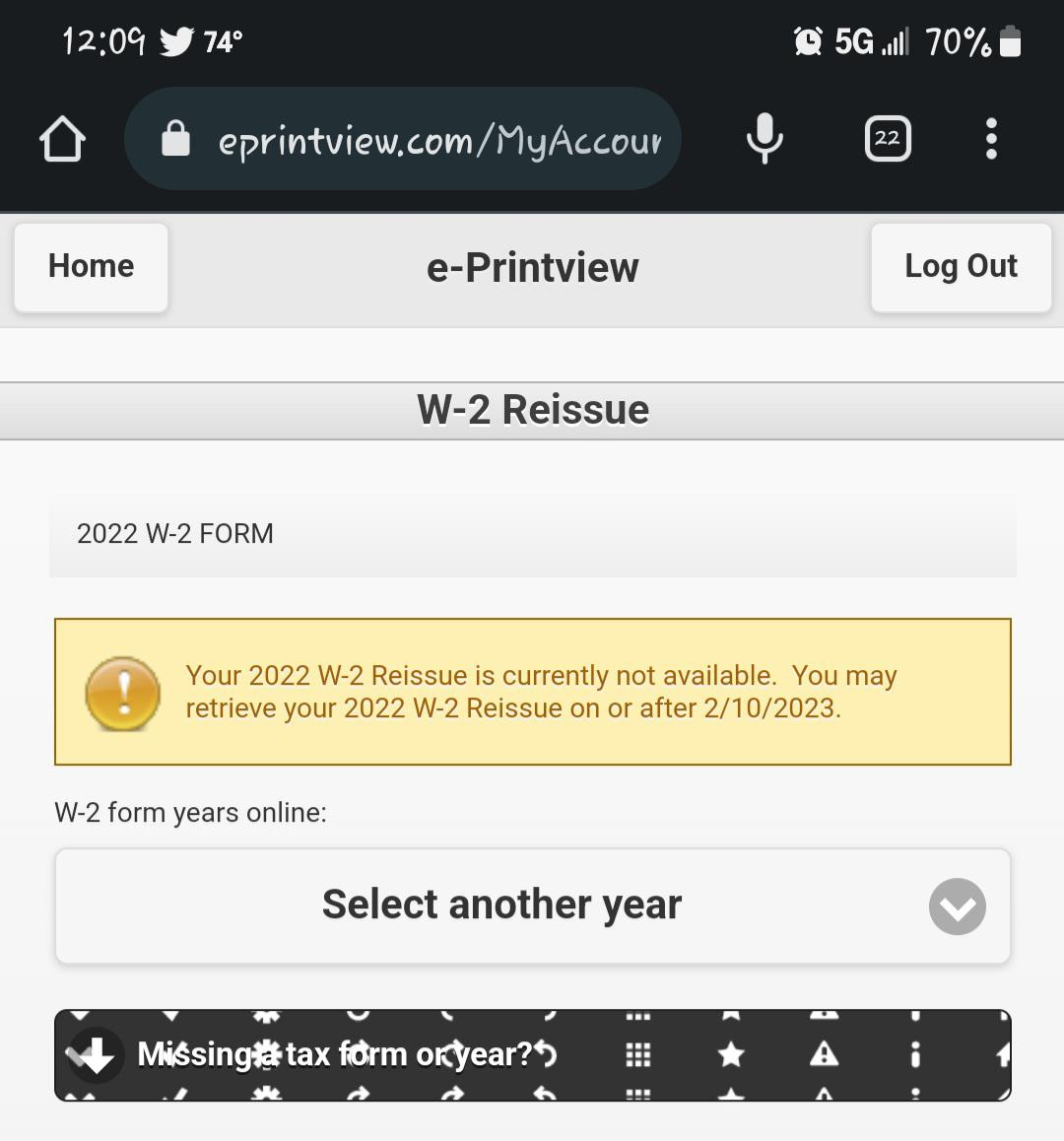

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Tesla Employee Tax Document Shenanigans

Ah, tax season – a time of stress, confusion, and perhaps a few surprises along the way. But what happens when you receive your W2 form from a company as innovative and cutting-edge as Tesla? Former employees have recently been experiencing a unique twist in their tax document unveiling, leading to some unexpected surprises that are causing quite the buzz in the Tesla community.

What Happens When You Open Your W2 at Tesla

Picture this: you eagerly tear open the envelope containing your W2 form, expecting the usual numbers and figures. But when you take a closer look, you notice something peculiar – a personalized message from Elon Musk himself, thanking you for your contribution to the future of sustainable transportation. Yes, that’s right – Tesla has been adding a personal touch to their employees’ tax documents, making the often-dreaded task of filing taxes a little more enjoyable.

But the surprises don’t stop there. Some former Tesla employees have reported finding hidden Easter eggs within their W2 forms, such as discount codes for Tesla merchandise or even invitations to exclusive events hosted by the company. It seems that Tesla is not only revolutionizing the automotive industry, but also the way employees experience tax season.

In the end, while tax season may always bring its fair share of headaches and frustrations, receiving a personalized and thoughtful touch from a company like Tesla can certainly make the process a bit more bearable. So, next time you open your W2 form and find a surprise waiting for you, remember to embrace the unexpected – after all, it’s all part of the Tesla experience.

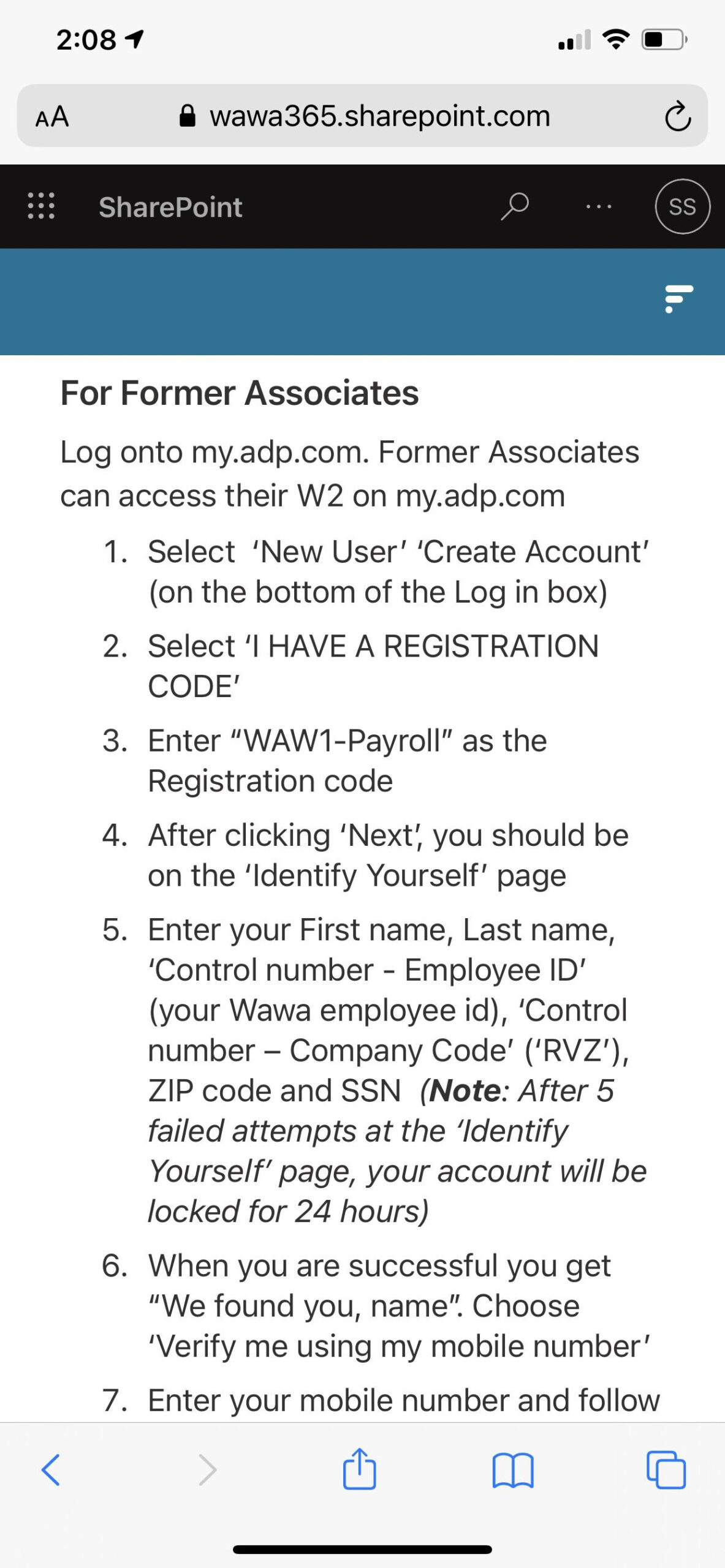

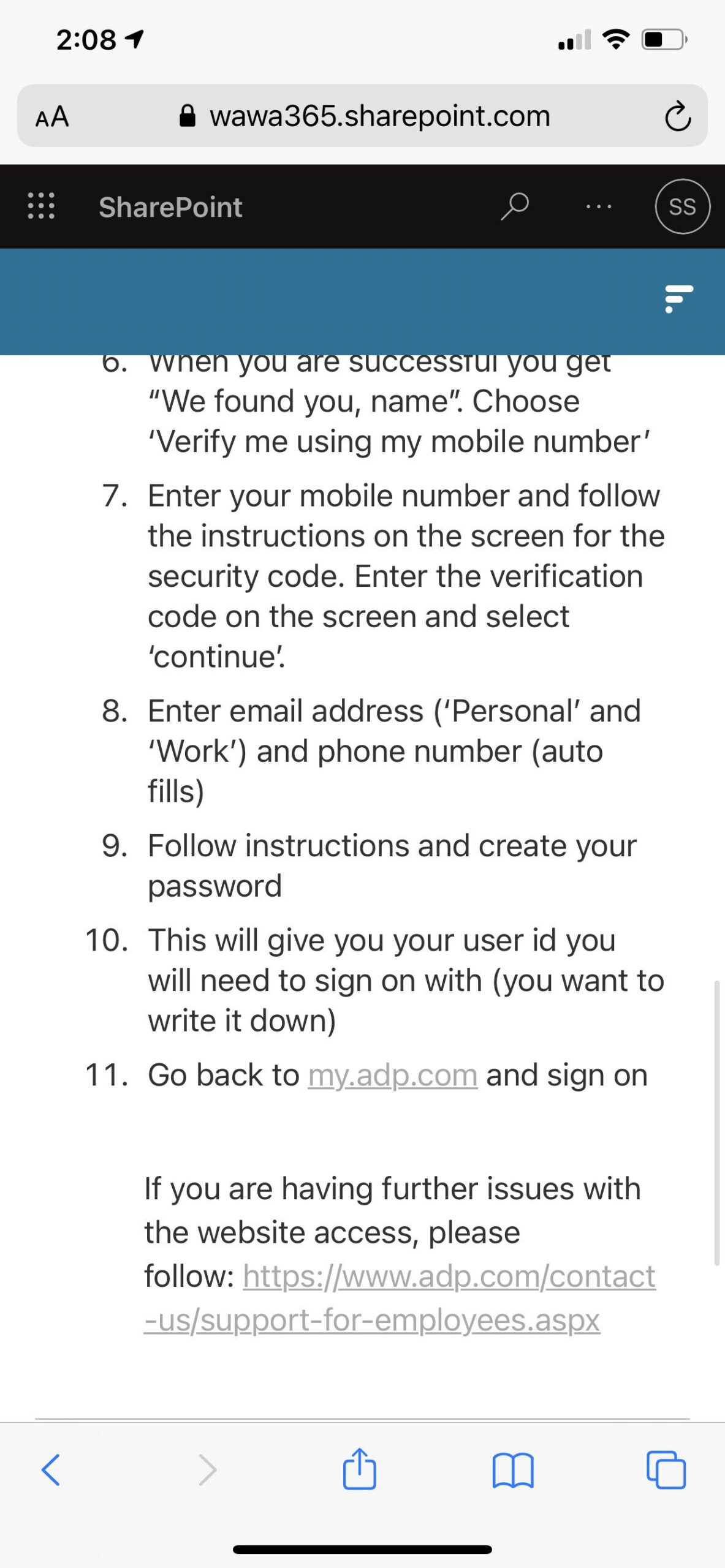

Below are some images related to Tesla Former Employee W2

how can i get my w2 from former employer, how to get w2 from former employee, how to get w2 from target former employee, tesla former employee w2, , Tesla Former Employee W2.

how can i get my w2 from former employer, how to get w2 from former employee, how to get w2 from target former employee, tesla former employee w2, , Tesla Former Employee W2.