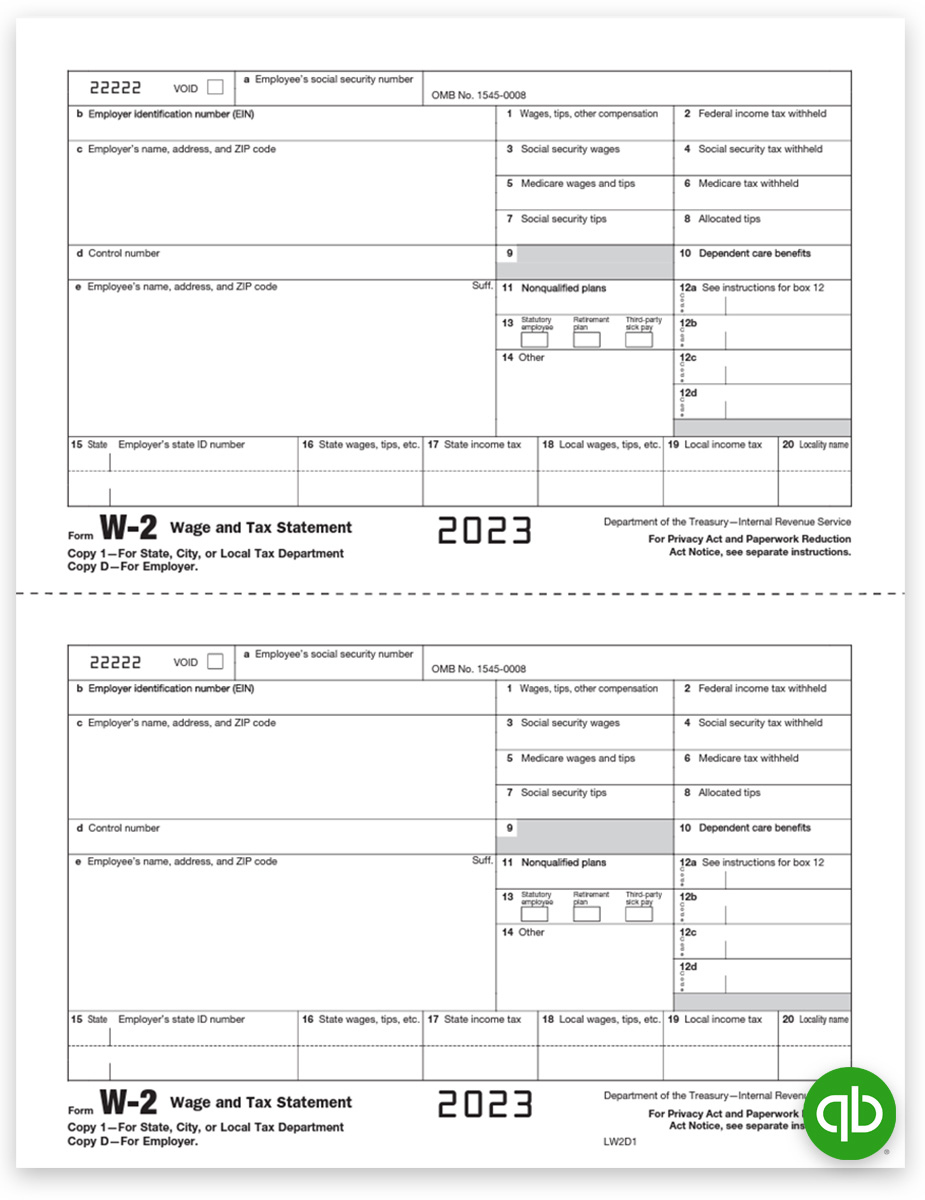

Quickbooks W2 And 1099 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Made Easy with QuickBooks W2 and 1099 Forms!

Are you ready to take the stress out of tax season? Look no further than QuickBooks W2 and 1099 forms! With these handy tools, you can simplify the process of filing your taxes and say goodbye to the headache of sorting through paperwork. Whether you’re a small business owner or a freelancer, QuickBooks has got you covered with easy-to-use forms that will make tax time a breeze.

Simplify Tax Season with QuickBooks W2 and 1099 Forms!

Gone are the days of scrambling to gather all your tax documents and trying to make sense of complicated forms. QuickBooks W2 and 1099 forms make it quick and easy to report your income and expenses, ensuring that you stay compliant with IRS regulations. With just a few clicks, you can generate accurate and professional-looking forms that will make filing your taxes a cinch. No more stress, no more confusion – just simple and straightforward tax preparation.

Say Goodbye to Stress and Hello to Easy Filing!

Say goodbye to hours spent poring over spreadsheets and receipts, and hello to a streamlined tax filing process with QuickBooks W2 and 1099 forms. These tools are designed to save you time and hassle, allowing you to focus on what really matters – running your business. With QuickBooks, you can trust that your tax information is accurate and up-to-date, giving you peace of mind during tax season. So why stress when you can simplify with QuickBooks?

In conclusion, don’t let tax season overwhelm you. With QuickBooks W2 and 1099 forms, you can easily navigate the ins and outs of tax preparation and filing. Say goodbye to stress and hello to easy filing with QuickBooks – your trusted partner in simplifying tax time. So why wait? Make tax season a breeze with QuickBooks W2 and 1099 forms today!

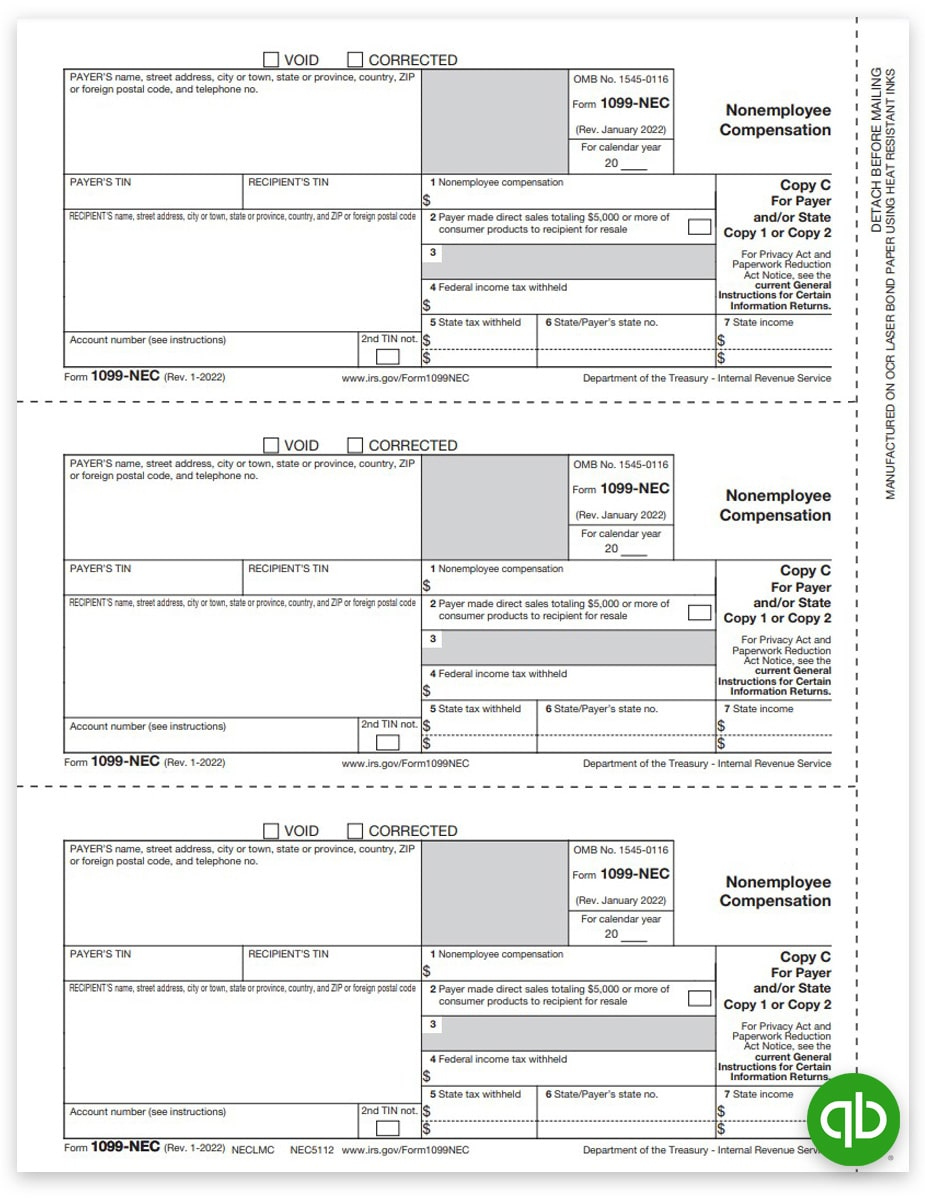

Below are some images related to Quickbooks W2 And 1099 Forms

does quickbooks do 1099 forms, does quickbooks print 1099 forms, quickbooks w2 and 1099 forms, what 1099 forms are compatible with quickbooks, where to get w2 and 1099 forms, , Quickbooks W2 And 1099 Forms.

does quickbooks do 1099 forms, does quickbooks print 1099 forms, quickbooks w2 and 1099 forms, what 1099 forms are compatible with quickbooks, where to get w2 and 1099 forms, , Quickbooks W2 And 1099 Forms.