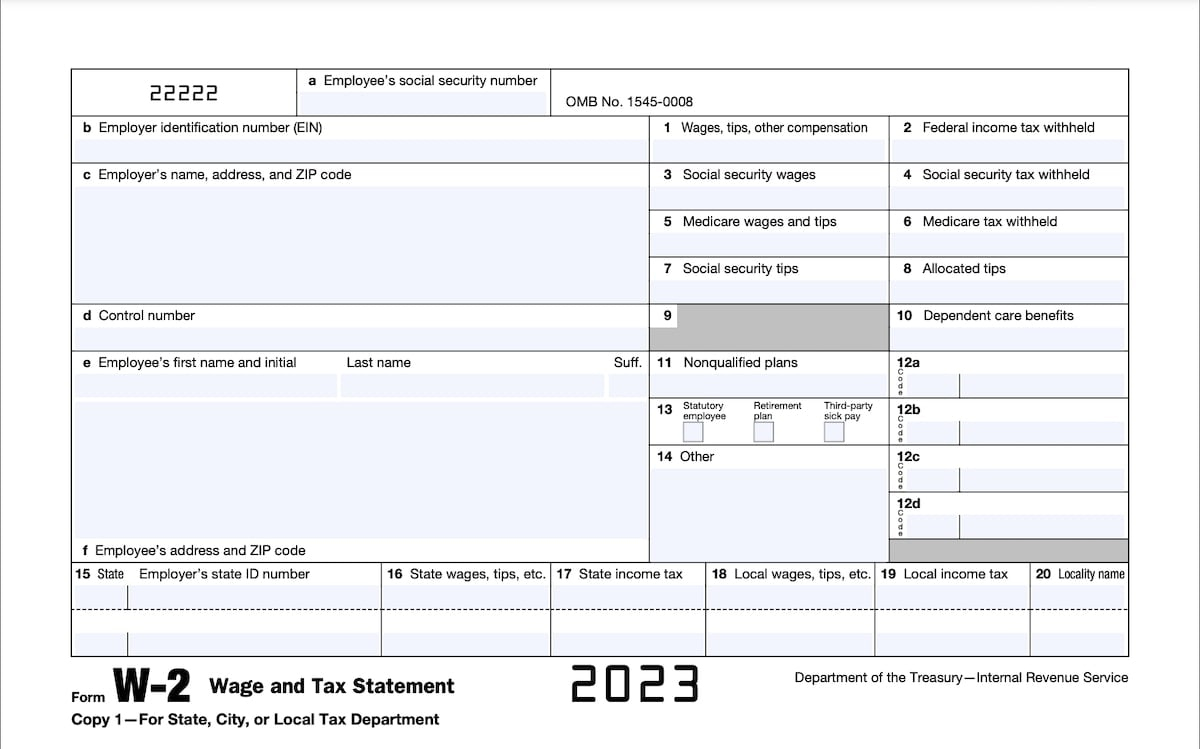

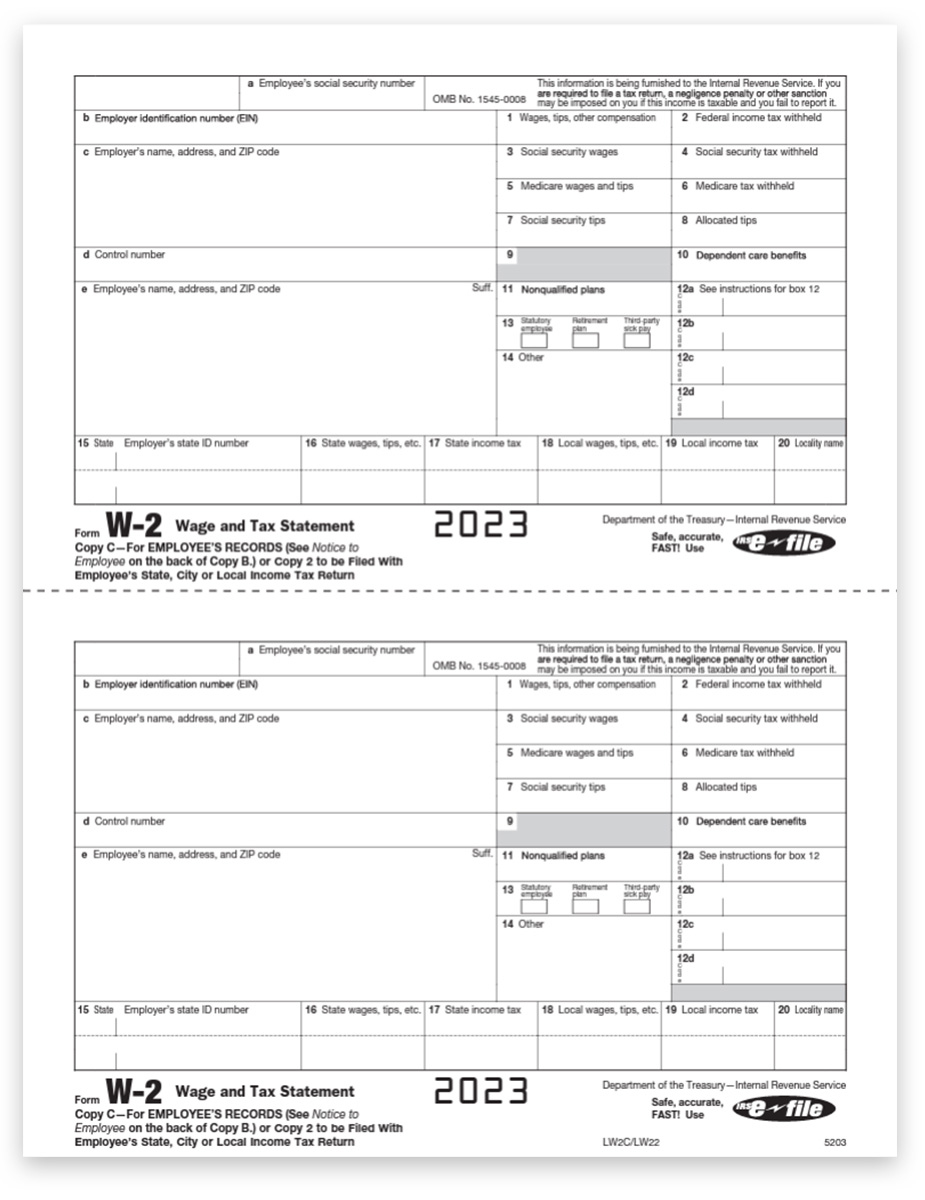

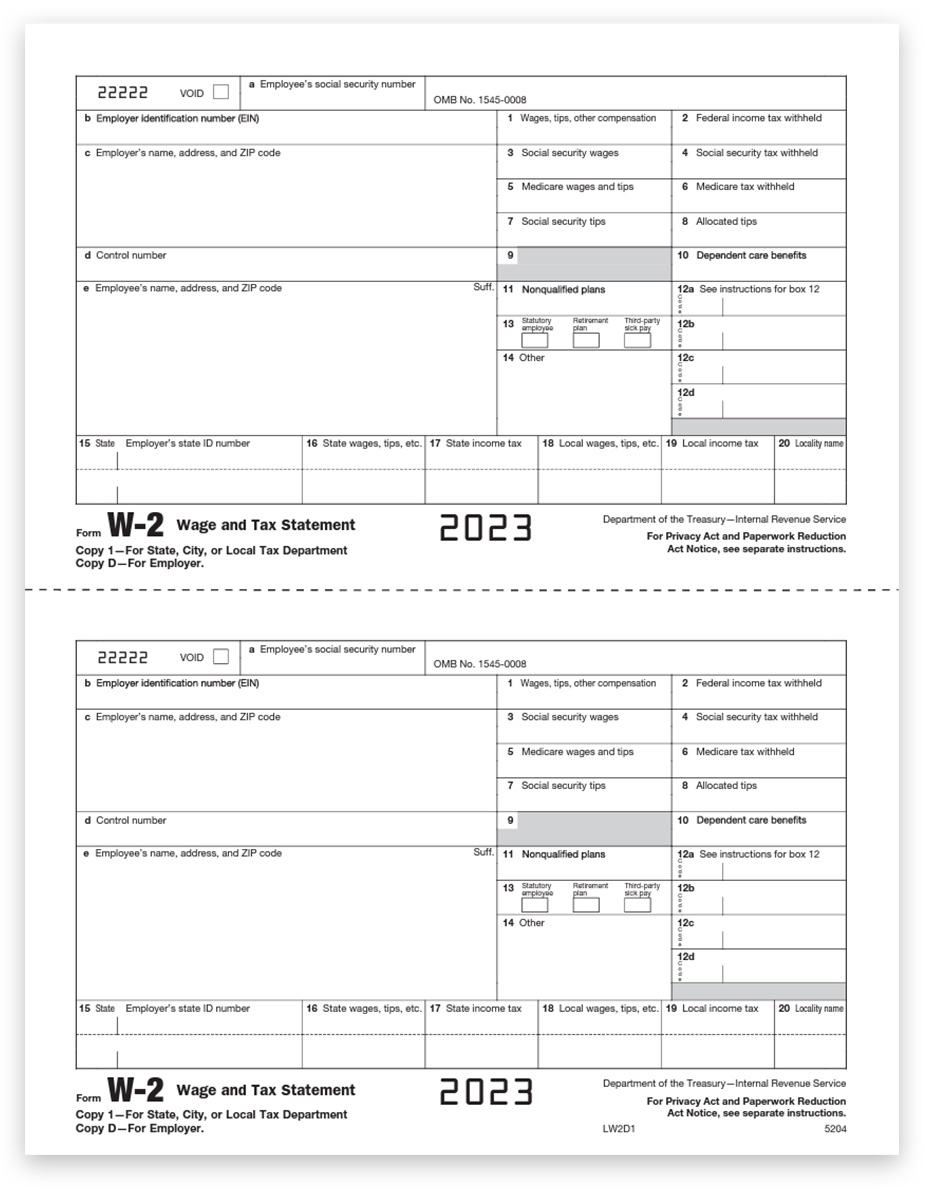

NC W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Magic of the NC W2 Form!

Are you ready to embark on a journey to tax success? Look no further than the NC W2 form! This magical document holds the key to unlocking the mysteries of your income and taxes. With just a few simple steps, you can uncover the joy of understanding your financial situation and take control of your tax season like never before. Say goodbye to the stress and confusion of tax time, and hello to the empowerment that comes with mastering the NC W2 form!

The NC W2 form is more than just a piece of paper – it’s a roadmap to financial freedom. By taking the time to explore and understand each section, you can gain valuable insights into your earnings, deductions, and tax obligations. Whether you’re a seasoned pro or a first-time filer, the NC W2 form is your guide to maximizing your tax refund and minimizing your tax liability. So don’t be intimidated – embrace the magic of the NC W2 form and let it lead you to tax success!

Let the NC W2 form be your guiding light through the murky waters of tax season. With its clear and concise layout, you’ll be able to easily navigate your way to a stress-free filing experience. From calculating your taxable income to understanding your withholdings, the NC W2 form is designed to simplify the tax process and ensure you don’t miss out on any potential deductions. So grab your NC W2 form with a smile on your face and let the joy of tax season begin!

Conclusion

In conclusion, the NC W2 form is not just a boring document – it’s your ticket to tax success! By embracing the magic of this form and taking the time to understand its intricacies, you can transform tax season from a dreaded chore into a delightful experience. So don’t let the fear of taxes hold you back – grab your NC W2 form, unlock the joy within, and let your financial journey begin!

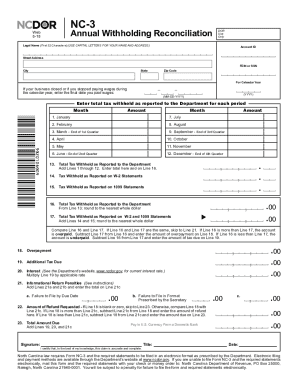

Below are some images related to Nc W2 Form

nc state retirement w2 form, nc state w2 form, nc w2 form, nc w2 form 2021, nc w2 form 2022, , Nc W2 Form.

nc state retirement w2 form, nc state w2 form, nc w2 form, nc w2 form 2021, nc w2 form 2022, , Nc W2 Form.