Multiple W2 Forms From Same Employer – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

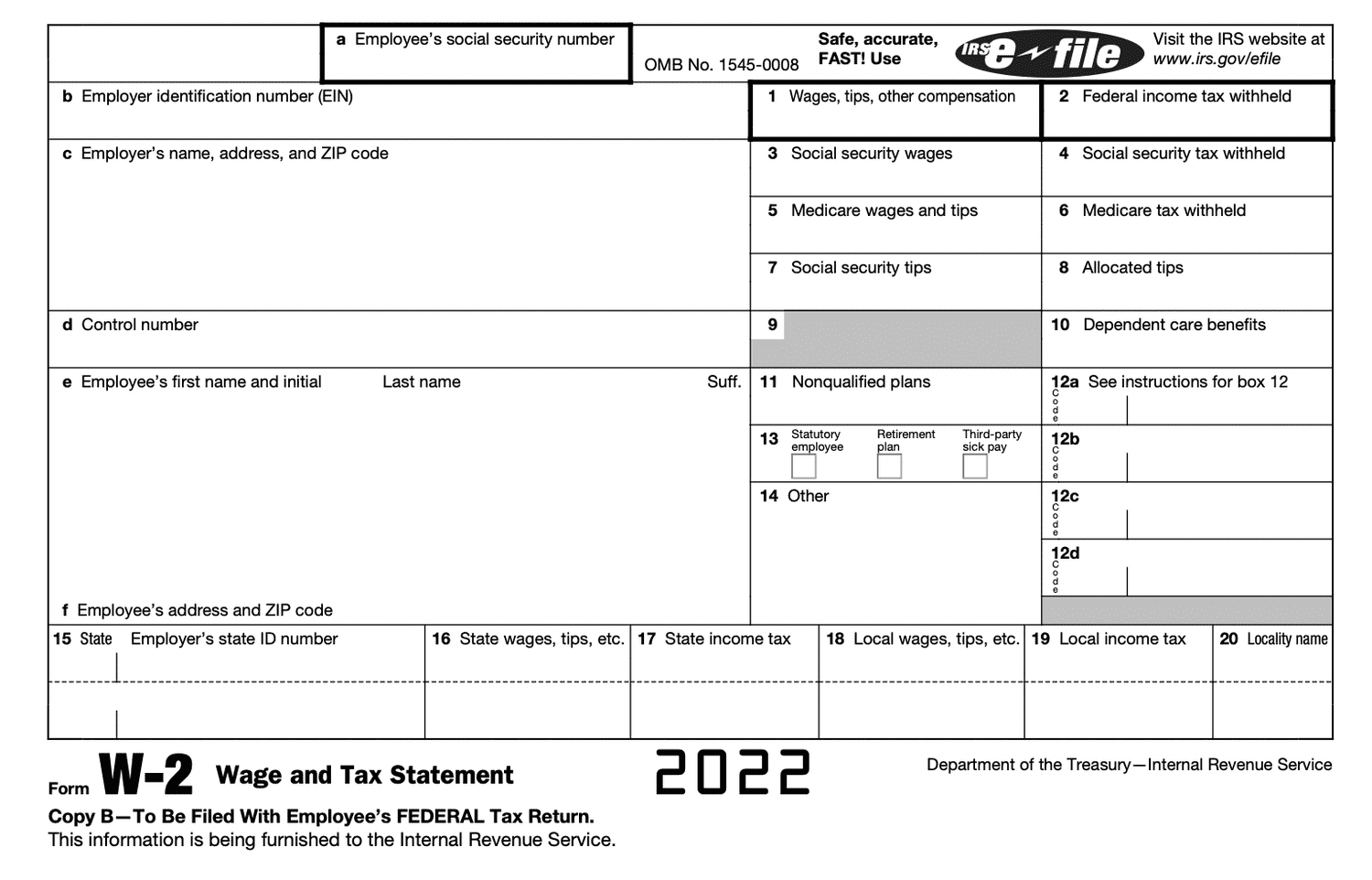

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Fun: Juggling Multiple W2s from Your Favorite Employer

Who says tax season has to be boring? If you’re lucky enough to receive multiple W2s from your favorite employer, consider it a double dose of fun! While juggling multiple W2s may seem daunting at first, with the right approach, you can breeze through tax season with a smile on your face. So, grab your calculator and get ready to tackle those W2s like a pro!

Juggling Multiple W2s: A Double Dose of Fun!

Receiving multiple W2s from the same employer can happen for a variety of reasons. Perhaps you worked in different departments or locations throughout the year, or maybe you received a promotion that resulted in a change in your tax information. Whatever the case may be, having multiple W2s is a sign of growth and opportunity within your favorite company. Instead of feeling overwhelmed, embrace the challenge and see it as a chance to showcase your versatility and adaptability.

When juggling multiple W2s, organization is key. Make sure to keep all your tax documents in one safe place, so you can easily access them when it’s time to file your taxes. Take the time to review each W2 carefully, noting any discrepancies or changes in income. By staying on top of your tax information, you can avoid any surprises when it comes time to file. Remember, juggling multiple W2s is a test of your multitasking skills, so embrace the challenge and show off your ability to handle multiple responsibilities with ease.

How to Handle Multiple W2s Like a Pro

When it comes to handling multiple W2s from your favorite employer, communication is key. Reach out to your HR department if you have any questions or concerns about your tax documents. They can provide clarity on why you received multiple W2s and offer guidance on how to accurately report your income. Additionally, consider consulting with a tax professional to ensure you’re maximizing your deductions and credits. With the right support and resources, you can navigate the complexities of juggling multiple W2s like a pro.

As you embark on the journey of juggling multiple W2s from your favorite employer, remember to stay positive and have fun with the process. Tax season doesn’t have to be stressful – it can be an opportunity to showcase your financial savvy and organizational skills. So, grab your favorite pen, put on your thinking cap, and tackle those W2s with confidence and enthusiasm. With the right attitude and approach, you’ll breeze through tax season like a pro and emerge victorious on the other side.

In conclusion, juggling multiple W2s from your favorite employer can be a fun and rewarding experience. Embrace the challenge, stay organized, communicate effectively, and seek support when needed. With the right mindset and approach, you can handle multiple W2s like a pro and come out ahead during tax season. So, put on your tax hat and get ready to conquer those W2s with a smile on your face!

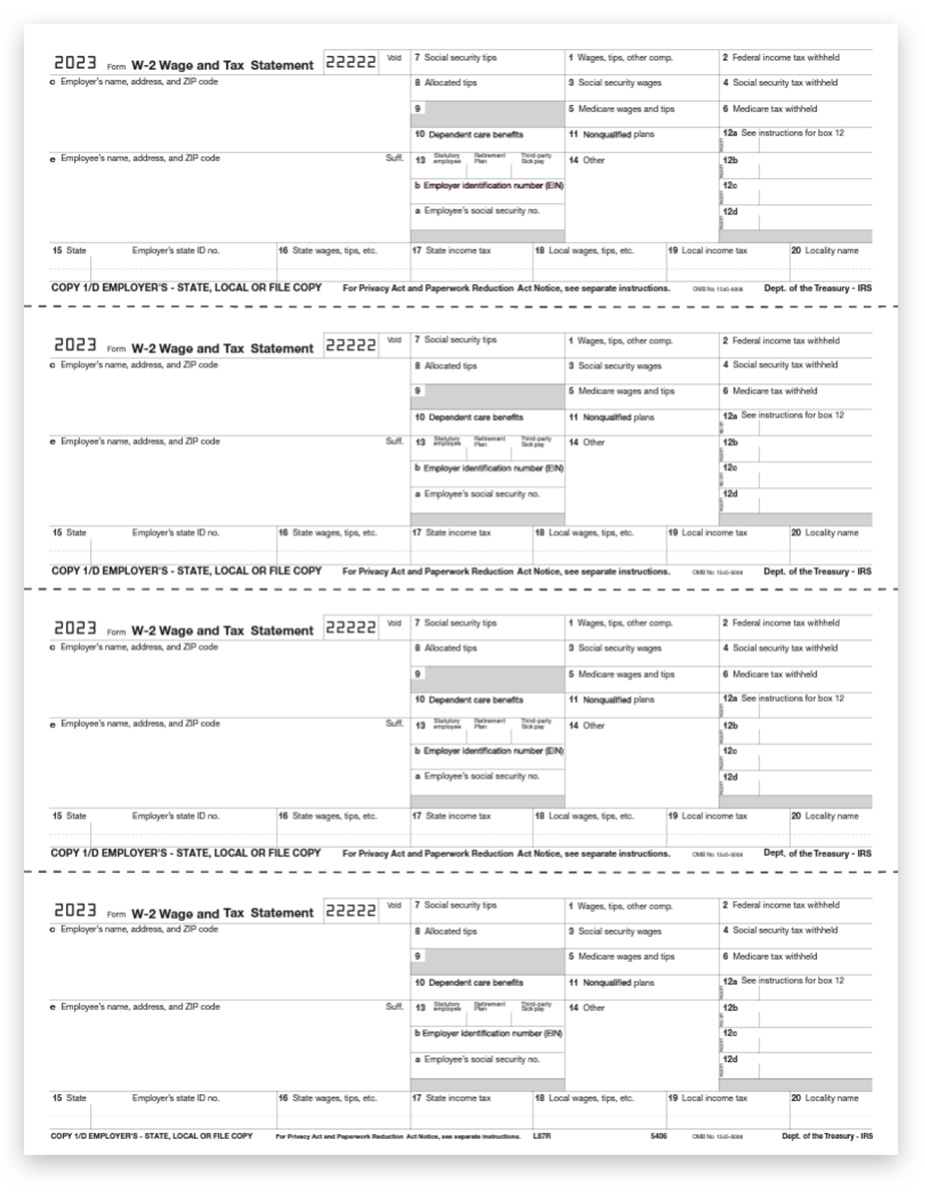

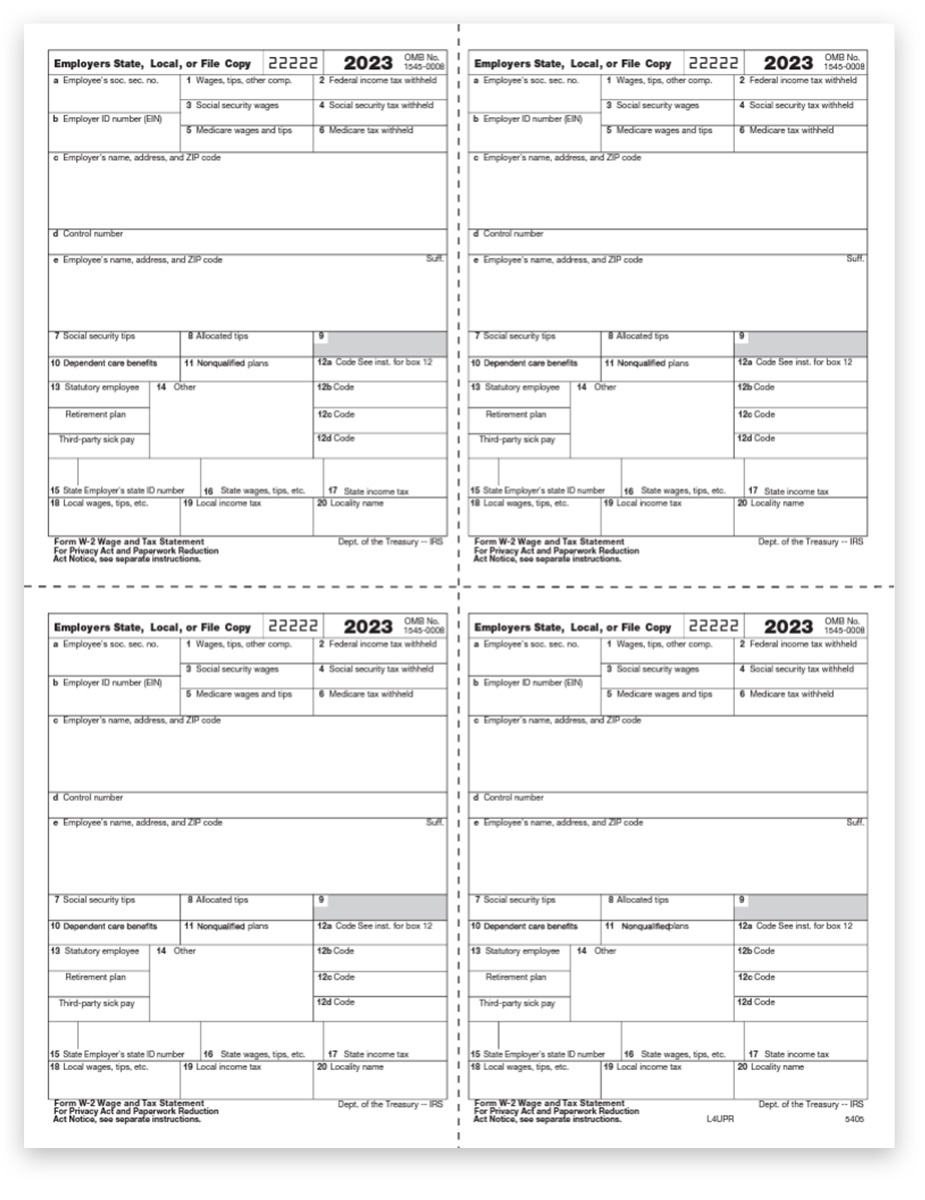

Below are some images related to Multiple W2 Forms From Same Employer

can you get two w2 from same employer, i got two w2 forms from same employer, multiple w2 forms from different employers, multiple w2 forms from different employers turbotax, multiple w2 forms from same employer, , Multiple W2 Forms From Same Employer.

can you get two w2 from same employer, i got two w2 forms from same employer, multiple w2 forms from different employers, multiple w2 forms from different employers turbotax, multiple w2 forms from same employer, , Multiple W2 Forms From Same Employer.