IRS W2 Form Instructions – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mysteries of IRS W2 Forms: Your Step-by-Step Guide!

Have you ever received your W2 form in the mail and felt a wave of confusion wash over you? You’re not alone! Navigating the intricacies of IRS W2 forms can be a daunting task, but fear not – we’re here to help unravel the mysteries for you. With our step-by-step guide, you’ll be a W2 form pro in no time!

Navigating the Intricacies of IRS W2 Forms

The first step in deciphering your W2 form is understanding what each box represents. Box 1 shows your total wages for the year, including salary, bonuses, and other income. Box 2 displays the federal income tax that has been withheld from your paycheck throughout the year. Boxes 3 and 5 show your Social Security and Medicare wages, respectively. By familiarizing yourself with these key boxes, you’ll have a clearer picture of your tax situation.

Next, pay special attention to Box 12, which contains codes denoting various types of compensation, such as retirement plan contributions, health insurance premiums, and more. These codes can impact your tax liability, so it’s essential to review them carefully. Additionally, if you see any discrepancies or errors on your W2 form, be sure to contact your employer promptly for corrections. It’s crucial to ensure that your W2 form accurately reflects your earnings and tax withholdings.

Simplifying the Process: Your Step-by-Step Guide

To simplify the process of filing your taxes with your W2 form, gather all necessary documents, including your W2 form, any additional income statements, and receipts for deductions. Use a reliable tax preparation software or consult a tax professional to help you navigate the complexities of tax laws and regulations. Be sure to file your taxes by the deadline to avoid any penalties or interest charges.

Finally, once you’ve filed your taxes using your W2 form, keep a copy for your records and store it in a secure place. Your W2 form is a vital document that you may need for future financial transactions, such as applying for loans or mortgages. By following these steps and staying organized, you’ll have a better understanding of your tax obligations and be better prepared for tax season next year.

In conclusion, unraveling the mysteries of IRS W2 forms doesn’t have to be a daunting task. With our step-by-step guide, you can confidently navigate your W2 form and file your taxes with ease. By understanding the key components of your W2 form and following best practices for tax preparation, you’ll be on your way to financial success. Remember, knowledge is power – so arm yourself with the information you need to conquer tax season like a pro!

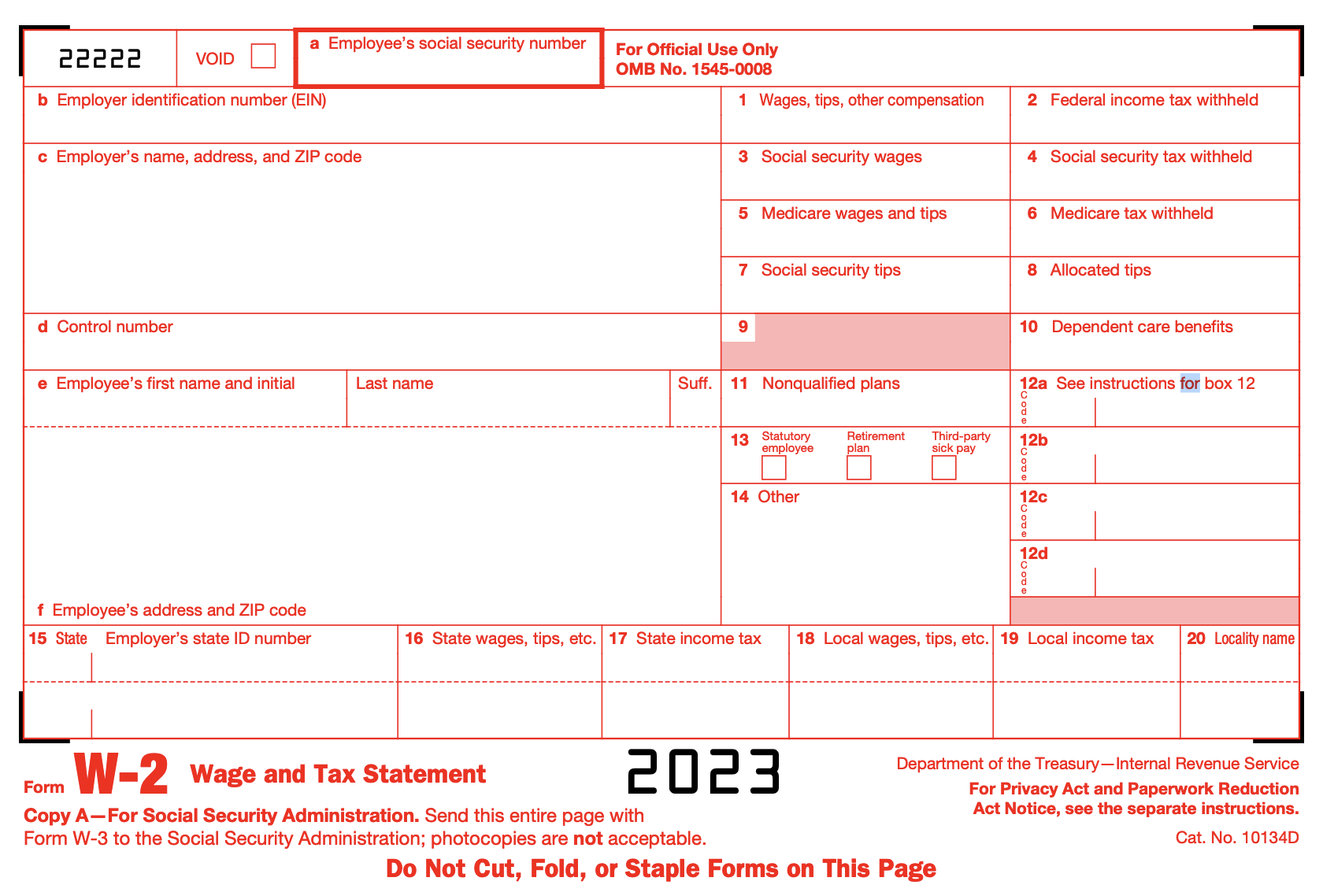

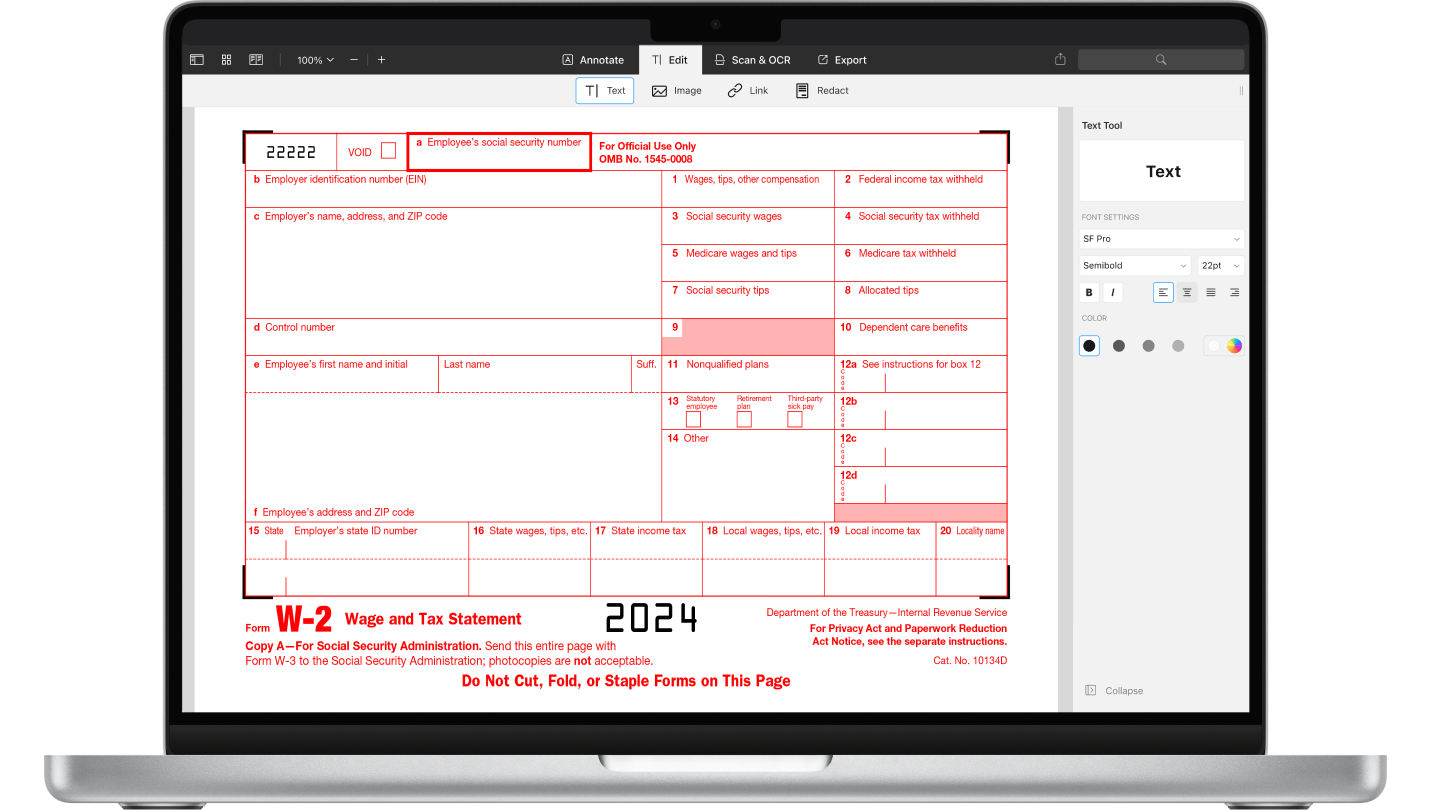

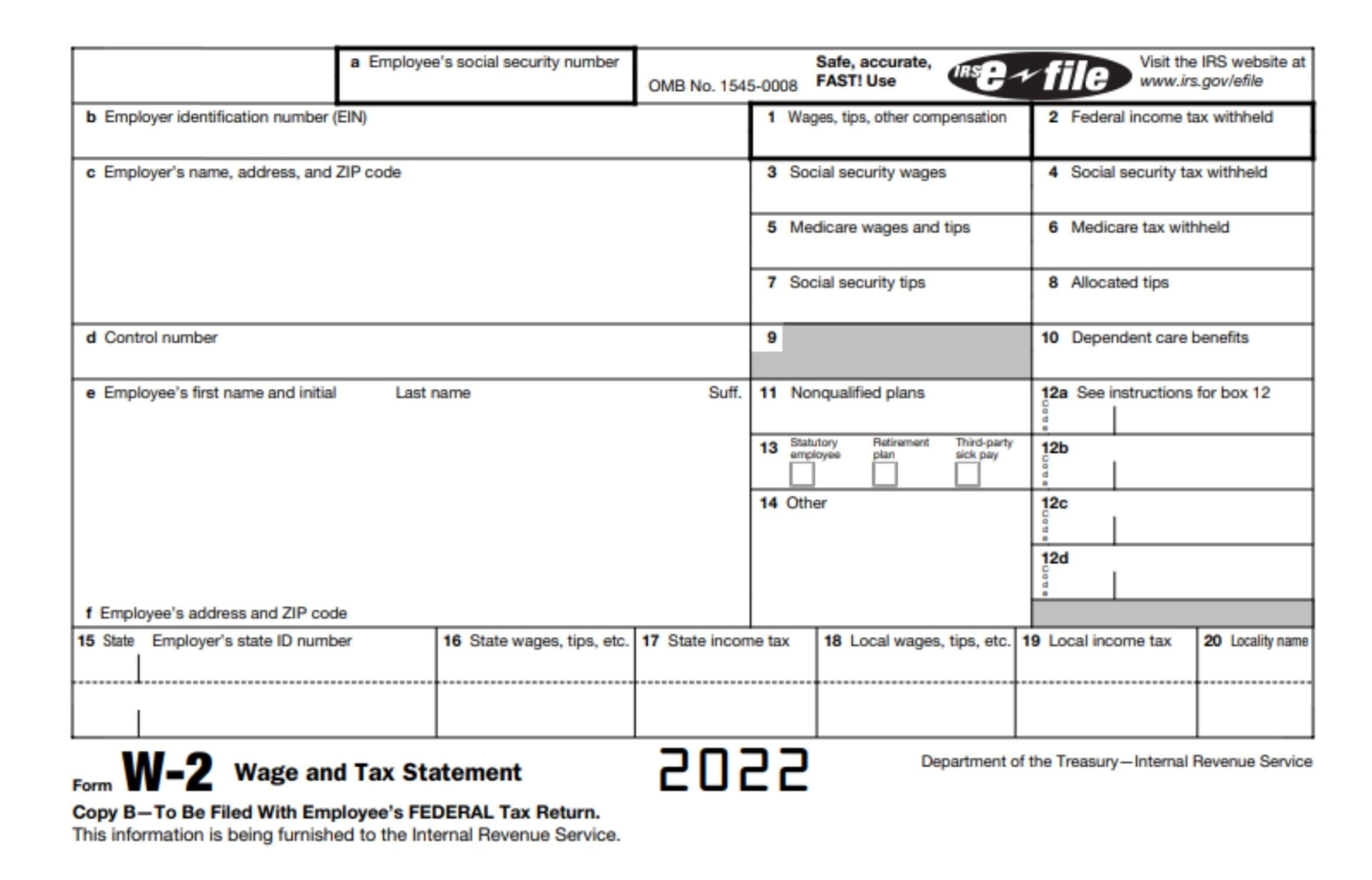

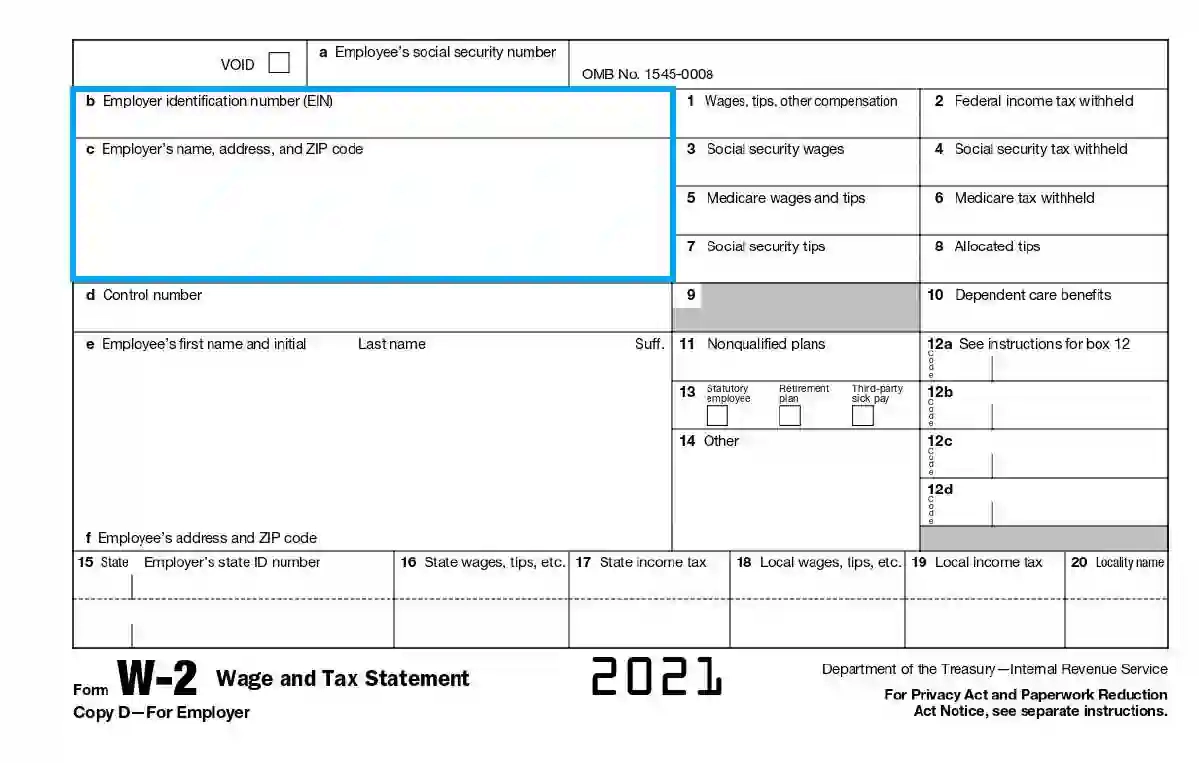

Below are some images related to Irs W2 Form Instructions

irs form w-2 instructions 2021, irs form w-2 instructions 2022, irs form w2-g instructions, irs w2 form instructions, irs w2 form instructions 2022, , Irs W2 Form Instructions.

irs form w-2 instructions 2021, irs form w-2 instructions 2022, irs form w2-g instructions, irs w2 form instructions, irs w2 form instructions 2022, , Irs W2 Form Instructions.