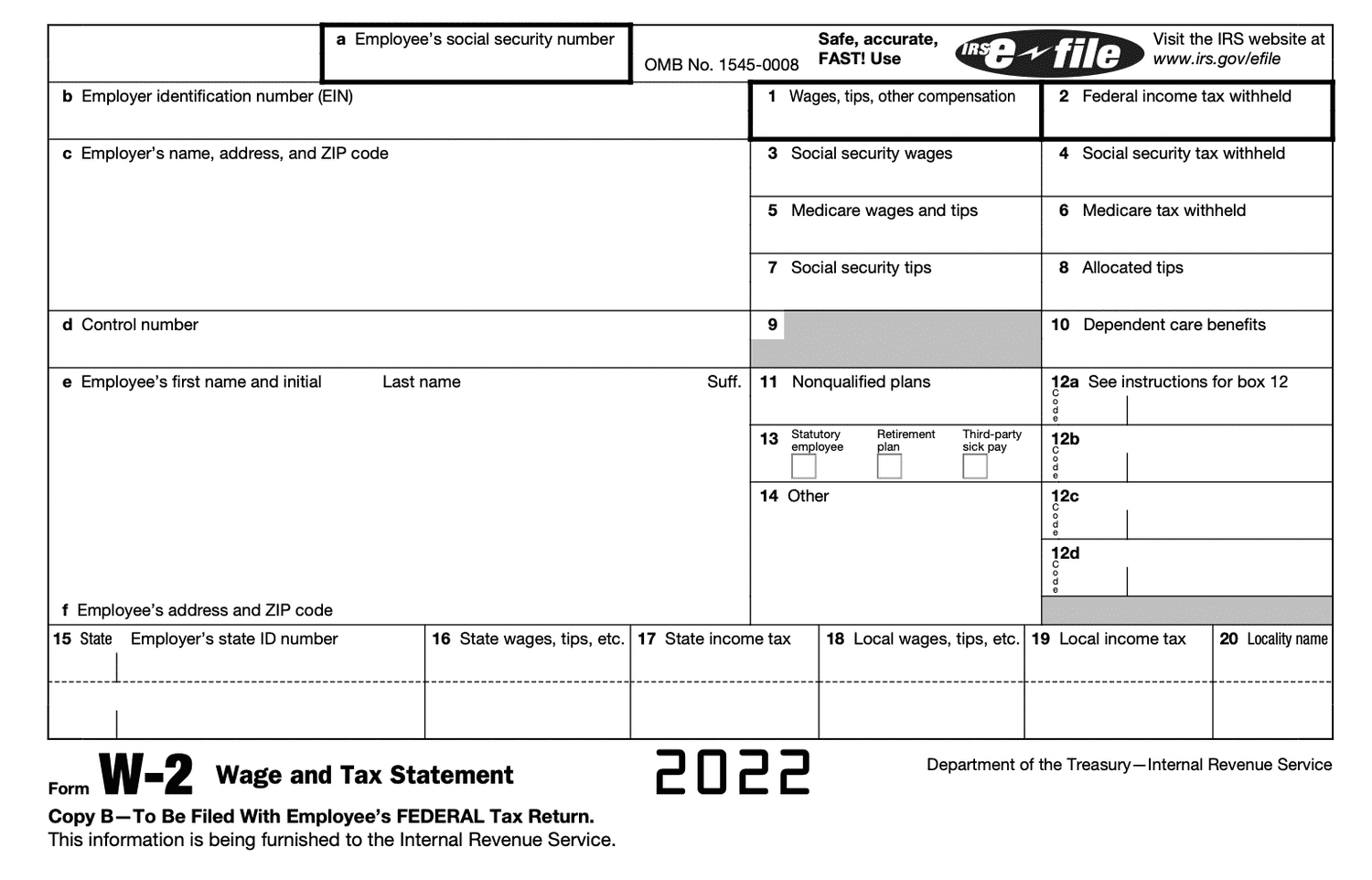

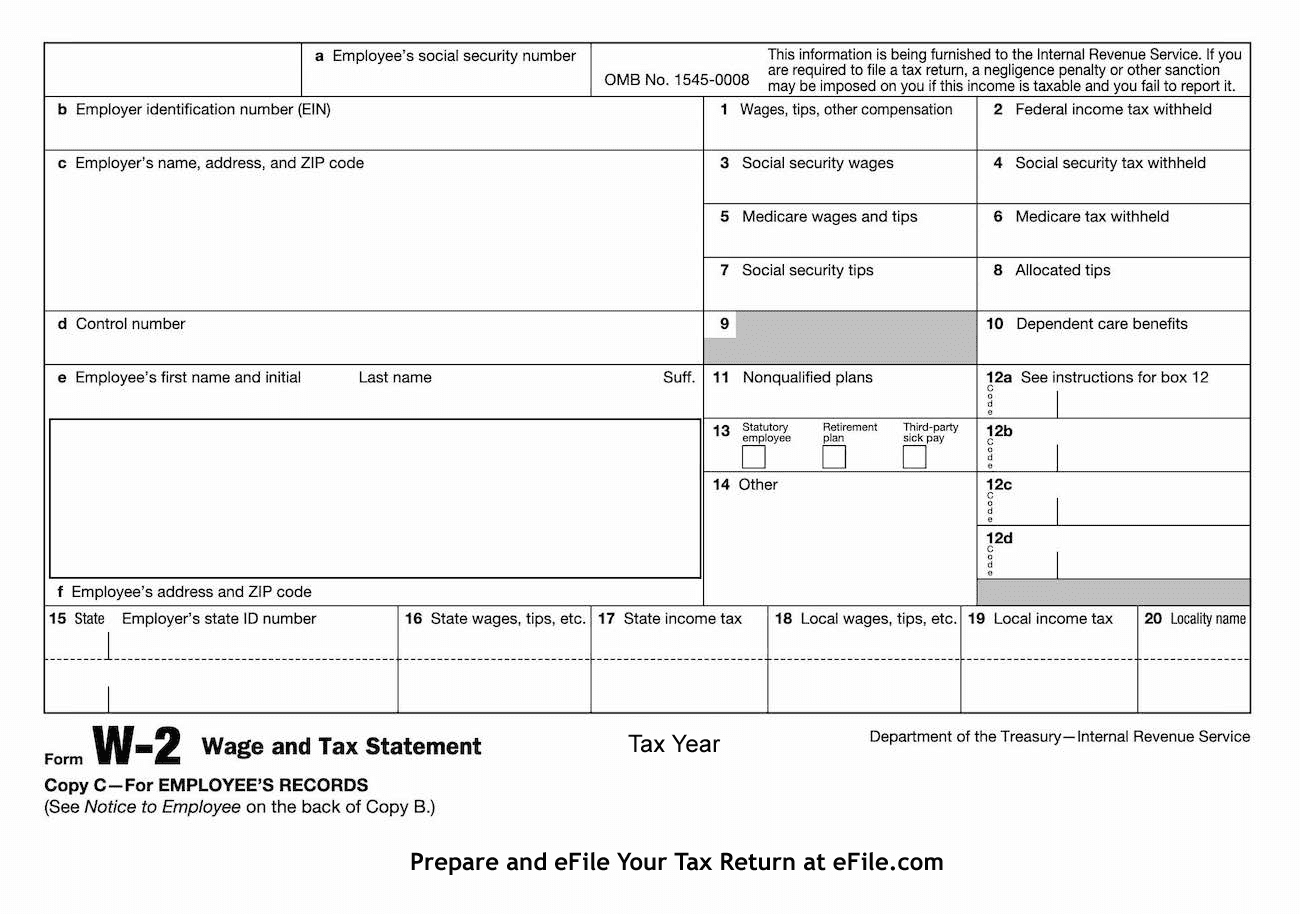

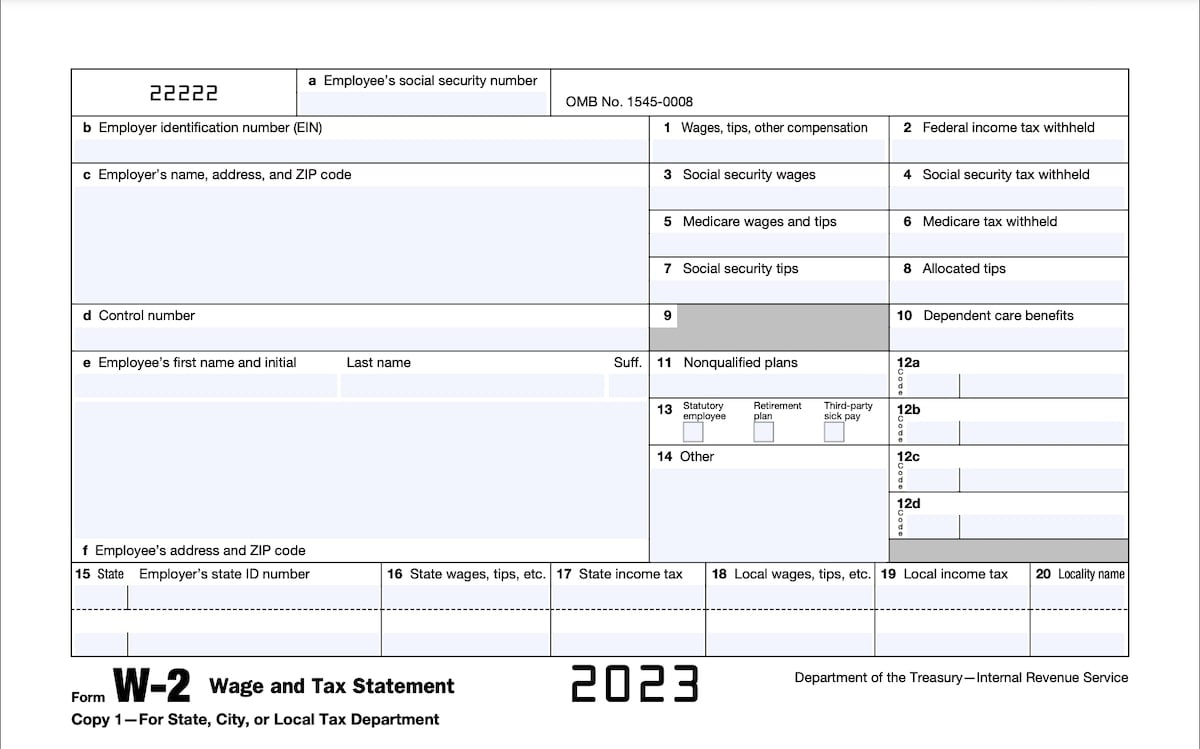

How To Get My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncover Your Hidden Tax Gems!

Ah, tax season – a time of year that can either fill you with dread or excitement, depending on how prepared you are. One of the most important documents you’ll need to have in hand when filing your taxes is your W2 form. This seemingly mundane piece of paper holds the key to unlocking potential tax refunds and ensuring that you comply with IRS regulations. But how do you go about snagging this elusive treasure trove of information? Fear not, for we are here to guide you through the process!

When it comes to uncovering your hidden tax gems, the first step is to reach out to your employer. Your employer is required by law to provide you with your W2 form by January 31st of each year. If you haven’t received your W2 by this date, don’t panic – mistakes happen, and it’s possible that your employer simply overlooked sending it out. Politely remind them of their obligation and request a copy of your W2 as soon as possible. In most cases, you can also access your W2 online through your employer’s payroll system, so be sure to check there as well.

Once you’ve successfully secured your W2 form, it’s time to dive into the treasure trove of information it holds. Your W2 provides a detailed summary of your earnings, taxes withheld, and other important financial details from the past year. This information is crucial for accurately filing your taxes and ensuring that you don’t miss out on any potential deductions or credits. Take the time to review your W2 carefully, double-checking that all the information is accurate and up-to-date. If you spot any errors, be sure to reach out to your employer to have them corrected promptly.

Discover the Secrets to Snagging Your W2 Form!

In the age of digital technology, accessing your W2 form has never been easier. Many employers now offer online portals where you can securely download your W2 with just a few clicks. If you’re unsure of how to access your W2 online, reach out to your HR department for guidance. They’ll be able to provide you with step-by-step instructions on how to navigate the system and retrieve your W2 in no time. Alternatively, you can also use tax preparation software or online services to import your W2 directly into your tax return, streamlining the filing process even further.

Remember, your W2 form is not just a piece of paper – it’s a valuable tool that can help you maximize your tax savings and ensure that you’re in good standing with the IRS. By taking the time to uncover your hidden tax gems and snagging your W2 form, you’ll be well on your way to a stress-free tax season. So don your metaphorical treasure-hunting hat, sharpen your tax knowledge, and get ready to unlock the financial rewards that await you! Happy hunting, and may your tax refunds be bountiful!

In conclusion, obtaining your W2 form is a crucial step in the tax-filing process, and it doesn’t have to be a daunting task. By following the tips and tricks outlined in this article, you can easily uncover your hidden tax gems and snag your W2 form with ease. Remember to stay proactive, reach out to your employer if necessary, and take advantage of online resources to simplify the process. With a little bit of effort and a positive attitude, you’ll be well on your way to unlocking your tax treasure and reaping the rewards that come with it. Happy tax season, and happy hunting!

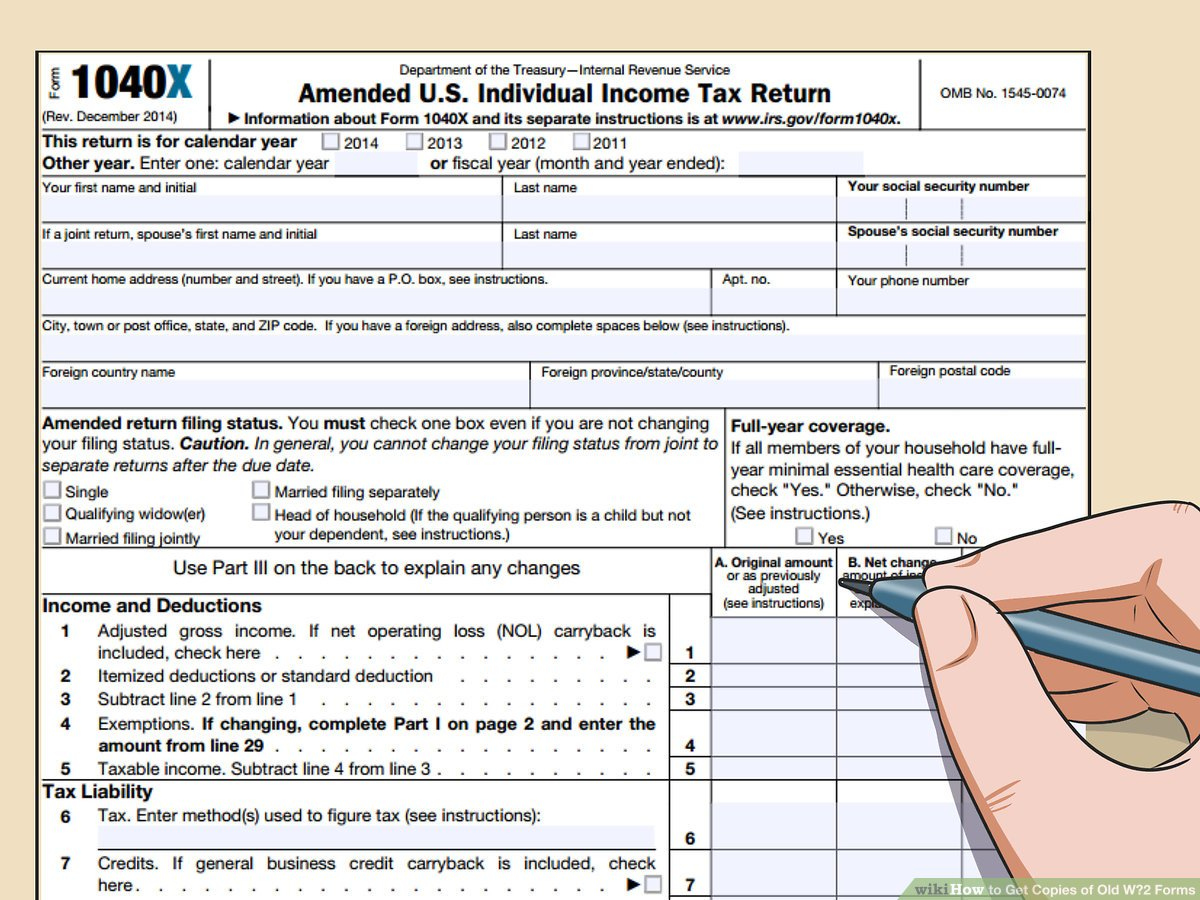

Below are some images related to How To Get My W2 Form

how to get my w2 form, how to get my w2 form 2021, how to get my w2 form 2023, how to get my w2 form from amazon, how to get my w2 form from doordash, , How To Get My W2 Form.

how to get my w2 form, how to get my w2 form 2021, how to get my w2 form 2023, how to get my w2 form from amazon, how to get my w2 form from doordash, , How To Get My W2 Form.