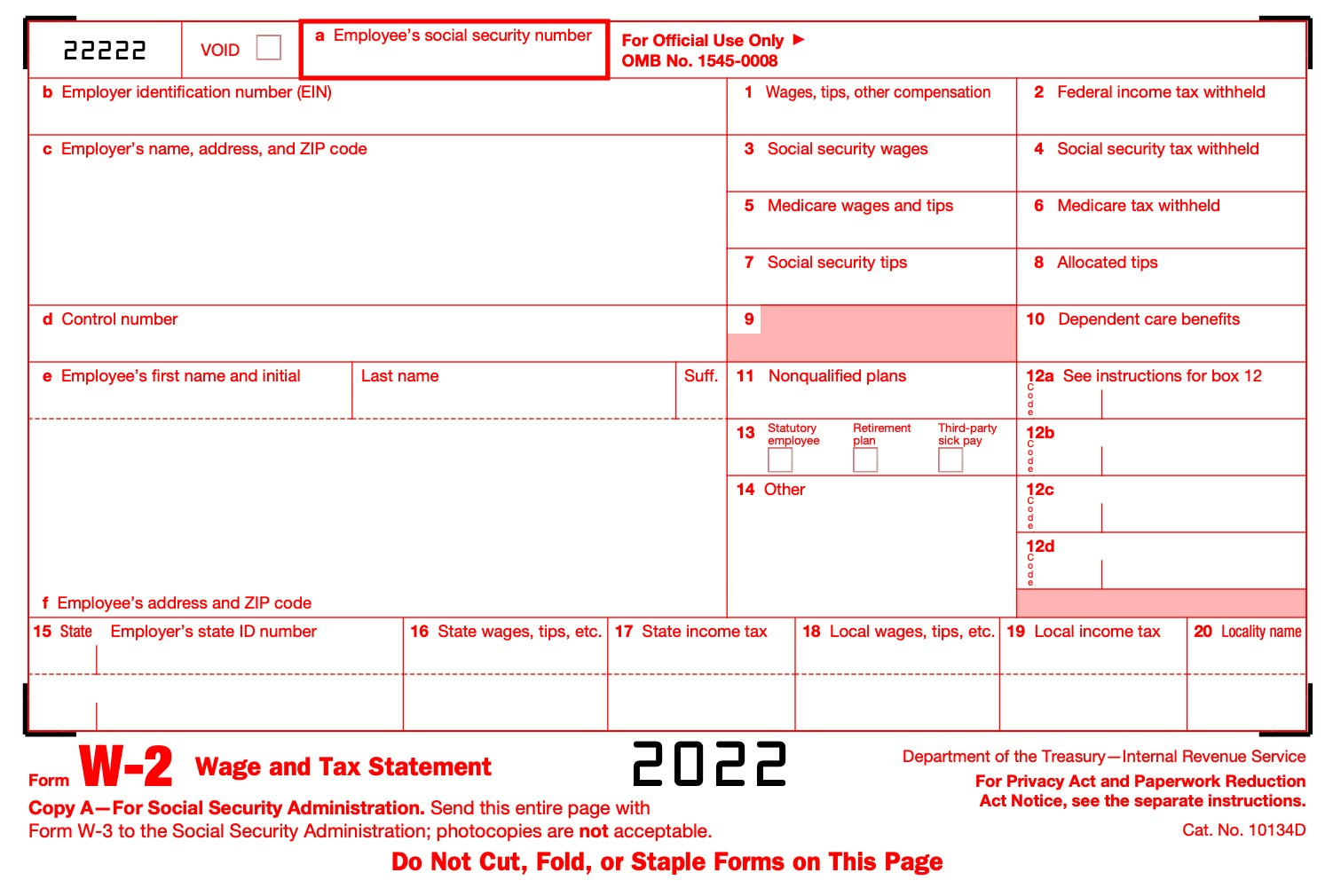

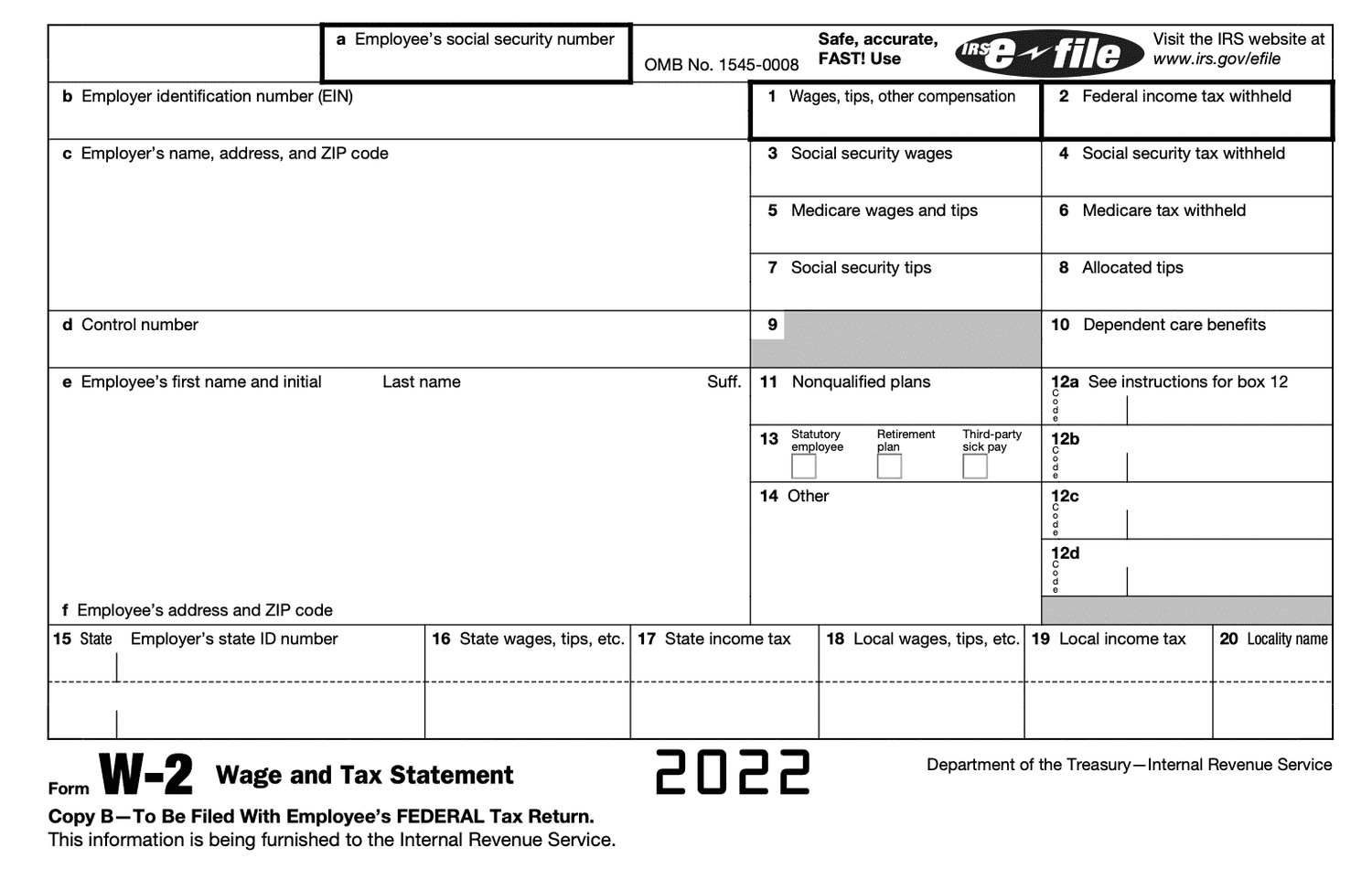

How To Do W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

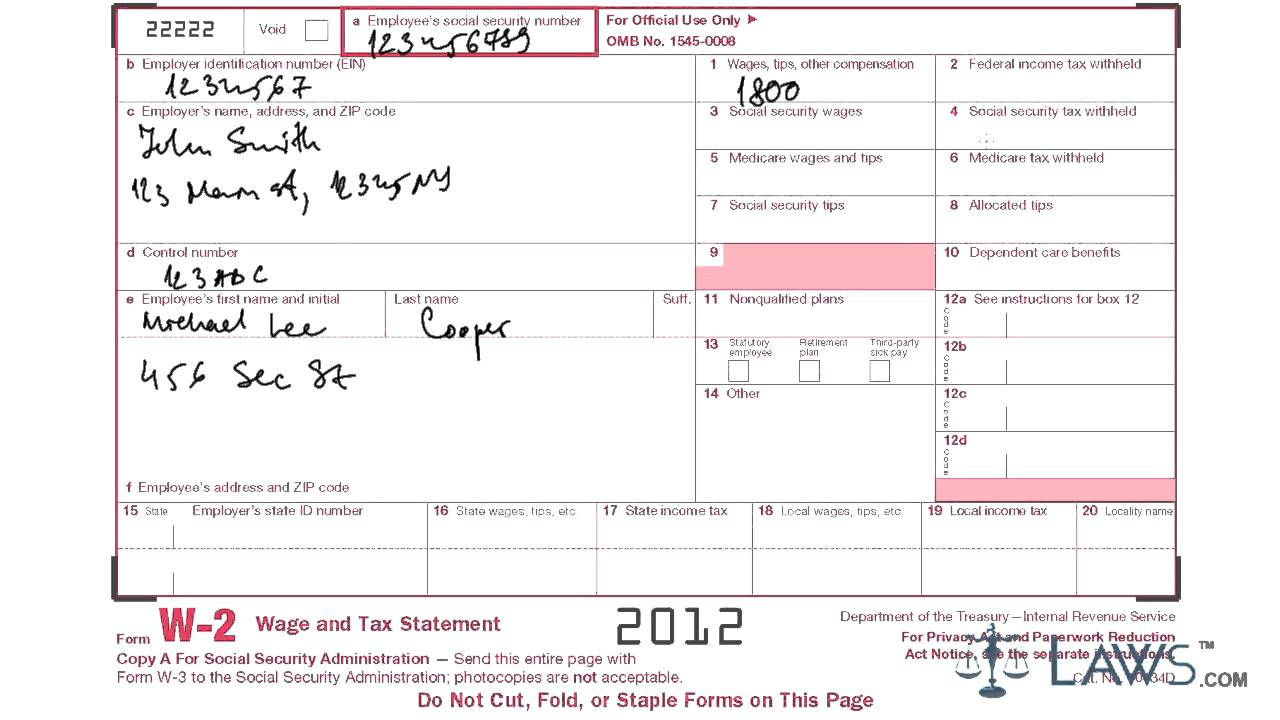

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

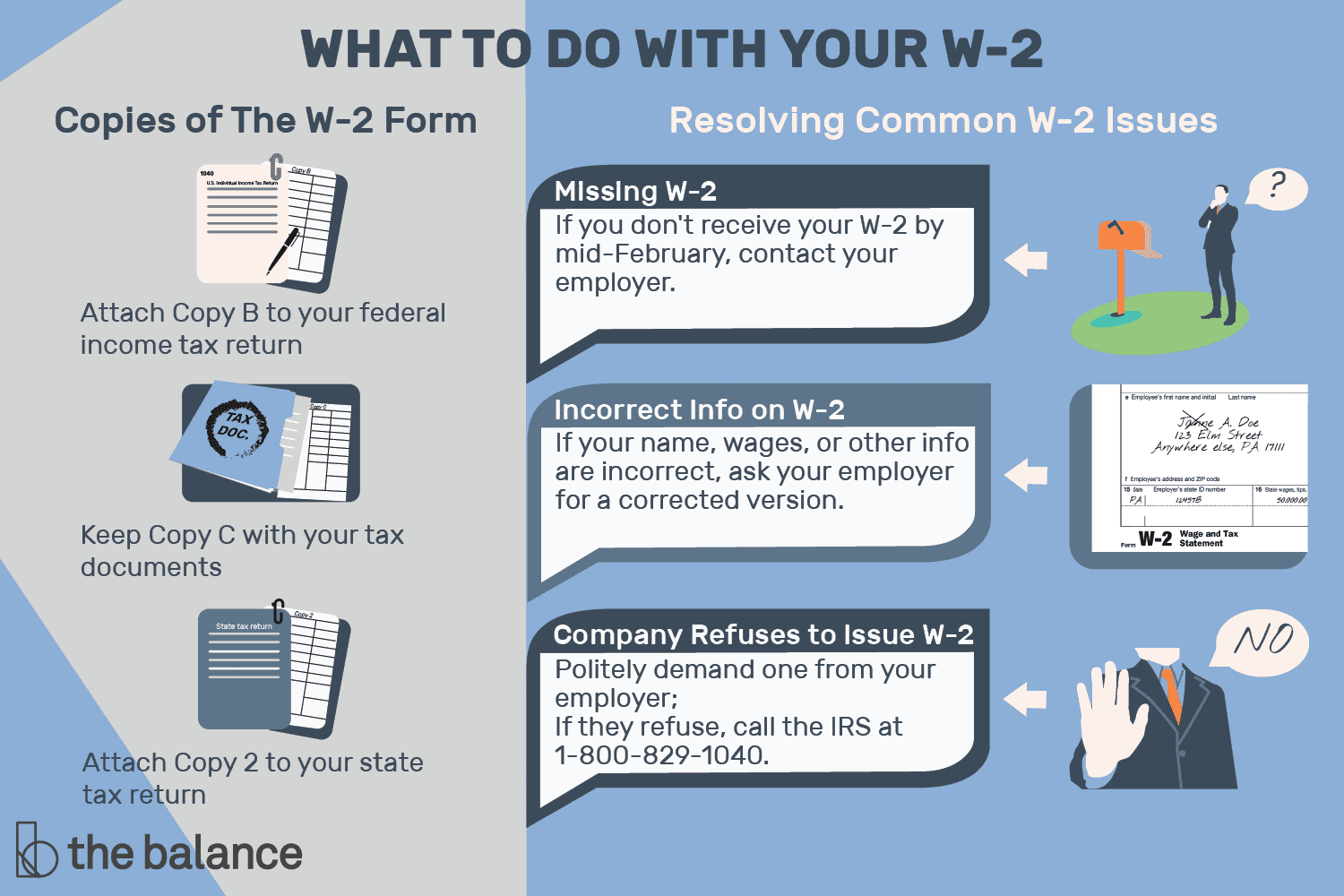

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Welcome to W2 Wonderland!

Welcome to the magical world of W2 Wonderland, where the mysteries of your W2 form are waiting to be unraveled! As tax season approaches, it’s time to dive into the intricate details of your W2 form and take control of your financial future. Don’t let the numbers and boxes intimidate you – with a little guidance, you’ll be navigating through W2 Wonderland like a pro in no time!

Unraveling the Mysteries of Your W2 Form

The first step in mastering your W2 form is understanding what each box and section represents. Your W2 form is a summary of your earnings and taxes withheld throughout the year, provided by your employer. Box 1 shows your total wages, while Box 2 displays the federal income tax withheld. Boxes 3 and 4 detail your Social Security and Medicare wages, respectively. By familiarizing yourself with these key components, you’ll gain a better understanding of your financial standing.

Next, take a closer look at any additional information provided on your W2 form, such as contributions to retirement accounts or health savings plans. These details can impact your tax liability and may offer opportunities for tax savings. Keep an eye out for any discrepancies or errors on your W2 form, as inaccuracies can lead to complications during tax filing. By double-checking the information and seeking clarification from your employer if needed, you’ll ensure a smooth and accurate tax return.

Now that you’ve uncovered the secrets of your W2 form, it’s time to put your newfound knowledge to use. Use the information on your W2 form to complete your tax return accurately and efficiently. Whether you’re filing independently or seeking professional assistance, having a solid grasp of your W2 form will empower you to make informed decisions about your taxes. With confidence and clarity, you’ll breeze through tax season and emerge from W2 Wonderland victorious!

In conclusion, mastering your W2 form is a crucial step in taking control of your financial well-being. By familiarizing yourself with the key elements of your W2 form and staying vigilant for any errors or discrepancies, you can ensure a smooth and successful tax filing process. Embrace the magic of W2 Wonderland and use your newfound knowledge to navigate through tax season with confidence and ease. Happy tax filing!

Below are some images related to How To Do W2 Form

how to do w2 form, how to file w2 form, how to file w2 forms in quickbooks desktop, how to get w-2 form from adp, how to get w2 form, , How To Do W2 Form.

how to do w2 form, how to file w2 form, how to file w2 forms in quickbooks desktop, how to get w-2 form from adp, how to get w2 form, , How To Do W2 Form.