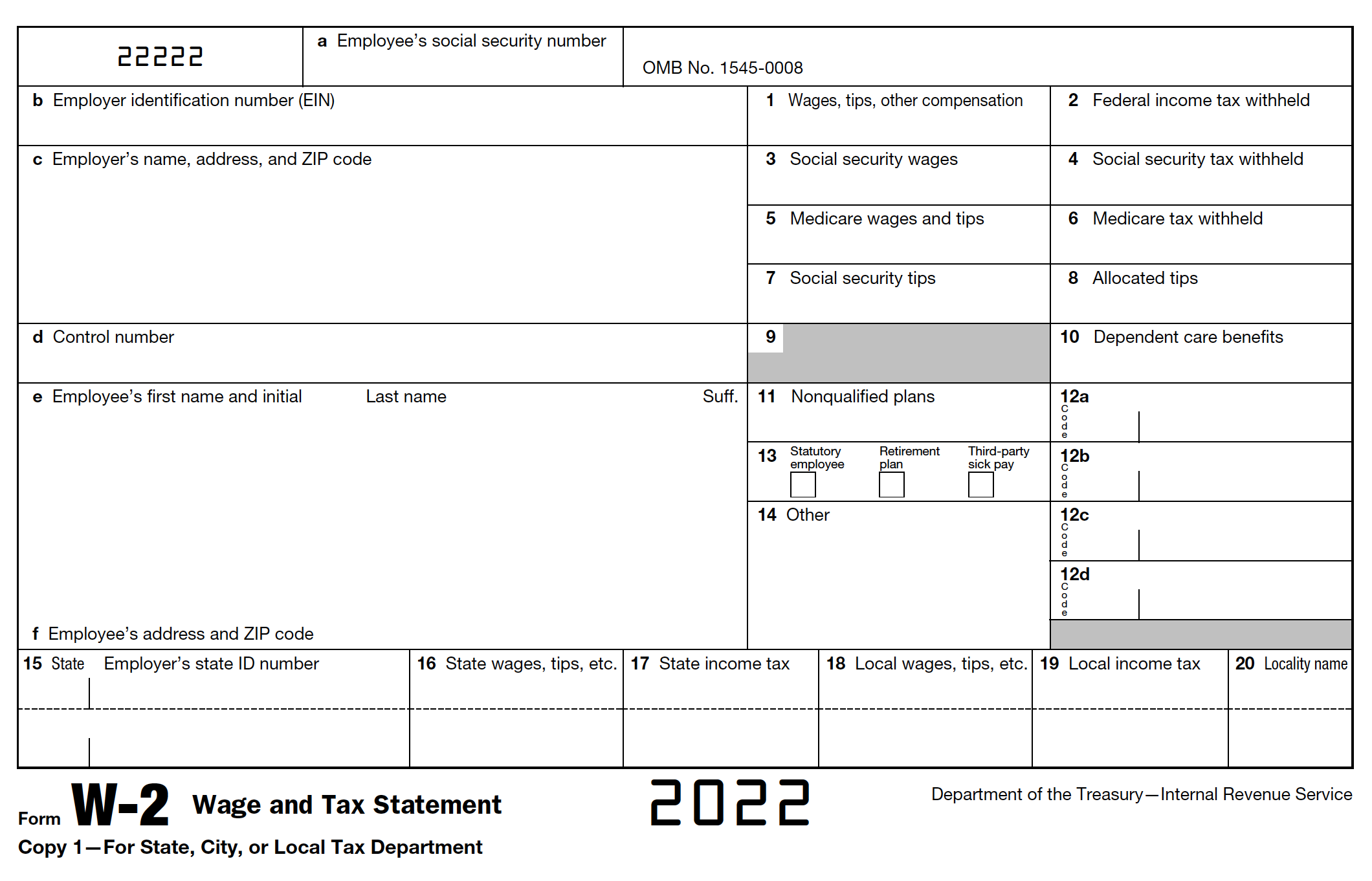

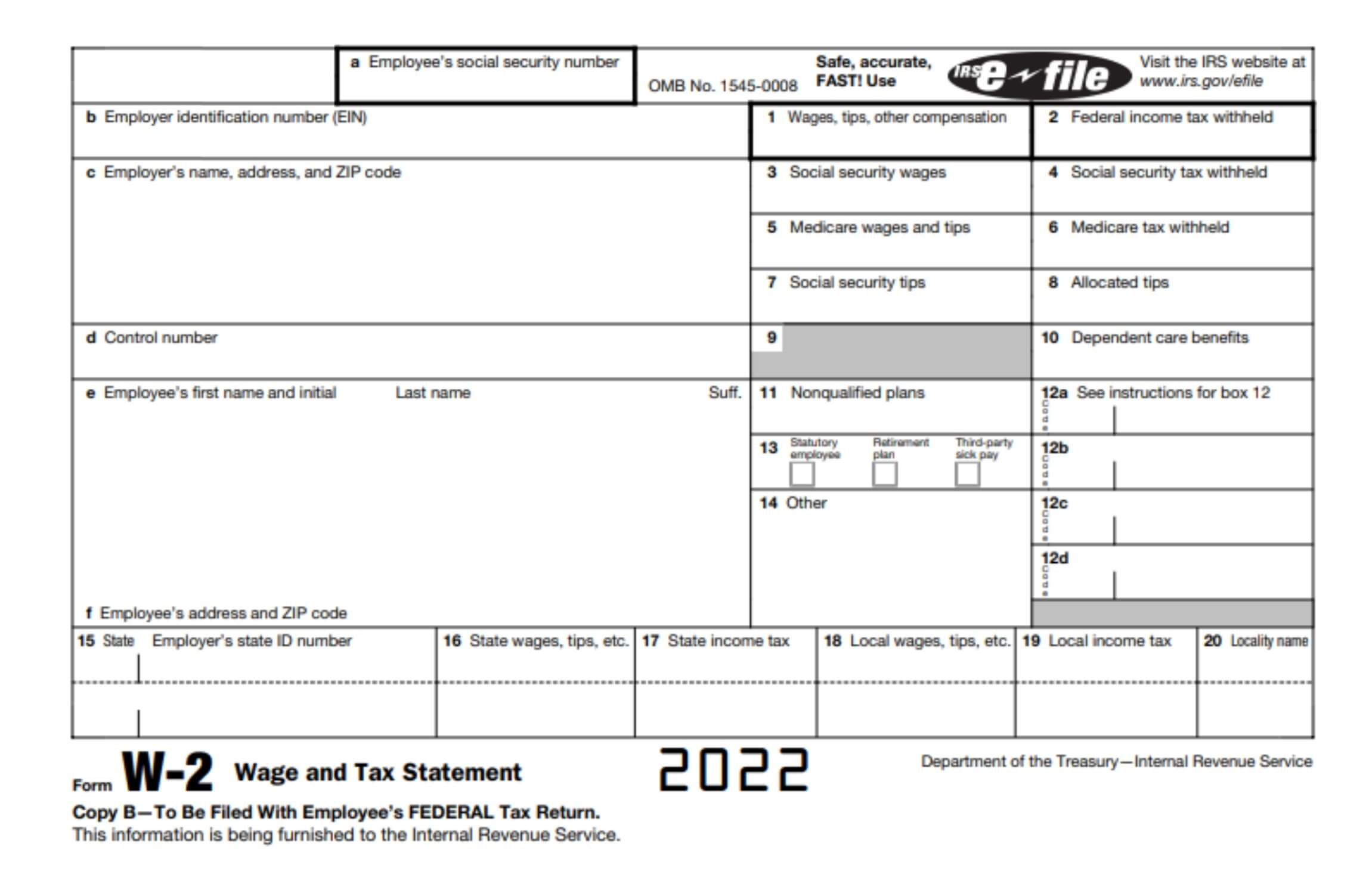

Form W2 Box 12 Code C – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Cracking the Code: Unveiling the Magic of W2 Box 12 Code C

Have you ever received your W2 form and felt like you were staring at a puzzle waiting to be solved? Among the many boxes and codes, one in particular stands out as a mysterious enigma – Box 12 Code C. But fear not, for we are here to unravel the secrets behind this magical code and help you understand its significance.

The Enigma of W2 Box 12 Code C

When you first glance at your W2 form, you may be puzzled by the presence of Box 12 Code C. What does it mean? Where did it come from? Is it a secret message from the IRS? Rest assured, Box 12 Code C is not a cryptic code sent to confuse you, but rather a specific identifier that represents certain types of payments or benefits you may have received throughout the year.

In most cases, Box 12 Code C indicates the amount of money that has been contributed towards your health savings account (HSA) by both you and your employer. This contribution is pre-tax, meaning it can lower your taxable income and potentially save you money on your taxes. So, far from being a mysterious symbol, Box 12 Code C is actually a valuable piece of information that can help you better understand your financial situation.

Deciphering the Secret Behind Box 12 Code C

Now that you know the basic meaning behind Box 12 Code C, it’s time to delve deeper into its significance. Understanding this code can provide you with insight into your healthcare benefits, tax savings, and overall financial health. By deciphering the secret behind Box 12 Code C, you can make informed decisions about your HSA contributions and maximize the benefits available to you.

In addition to HSA contributions, Box 12 Code C may also represent other types of payments or benefits, such as employer-provided health insurance or adoption assistance. By carefully examining this code and consulting with a financial advisor if necessary, you can ensure that you are taking full advantage of all the benefits and deductions available to you. So, don’t let Box 12 Code C remain a mystery – unlock its magic and harness its power to improve your financial well-being.

In conclusion, Box 12 Code C may seem like a cryptic symbol at first, but with a little knowledge and understanding, you can unravel its secrets and use it to your advantage. By recognizing the significance of this code and taking the time to decipher its meaning, you can gain valuable insights into your financial situation and make informed decisions about your taxes and benefits. So, embrace the magic of Box 12 Code C and let it guide you towards a brighter financial future.

Below are some images related to Form W2 Box 12 Code C

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] in Form W2 Box 12 Code C](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-in-form-w2-box-12-code-c.jpg)

form w-2 box 12 code c, is w2 box 12 code w taxable, w2 box 12 w code, w2 for box 12 codes, w2 form box 12a code c, , Form W2 Box 12 Code C.

form w-2 box 12 code c, is w2 box 12 code w taxable, w2 box 12 w code, w2 for box 12 codes, w2 form box 12a code c, , Form W2 Box 12 Code C.