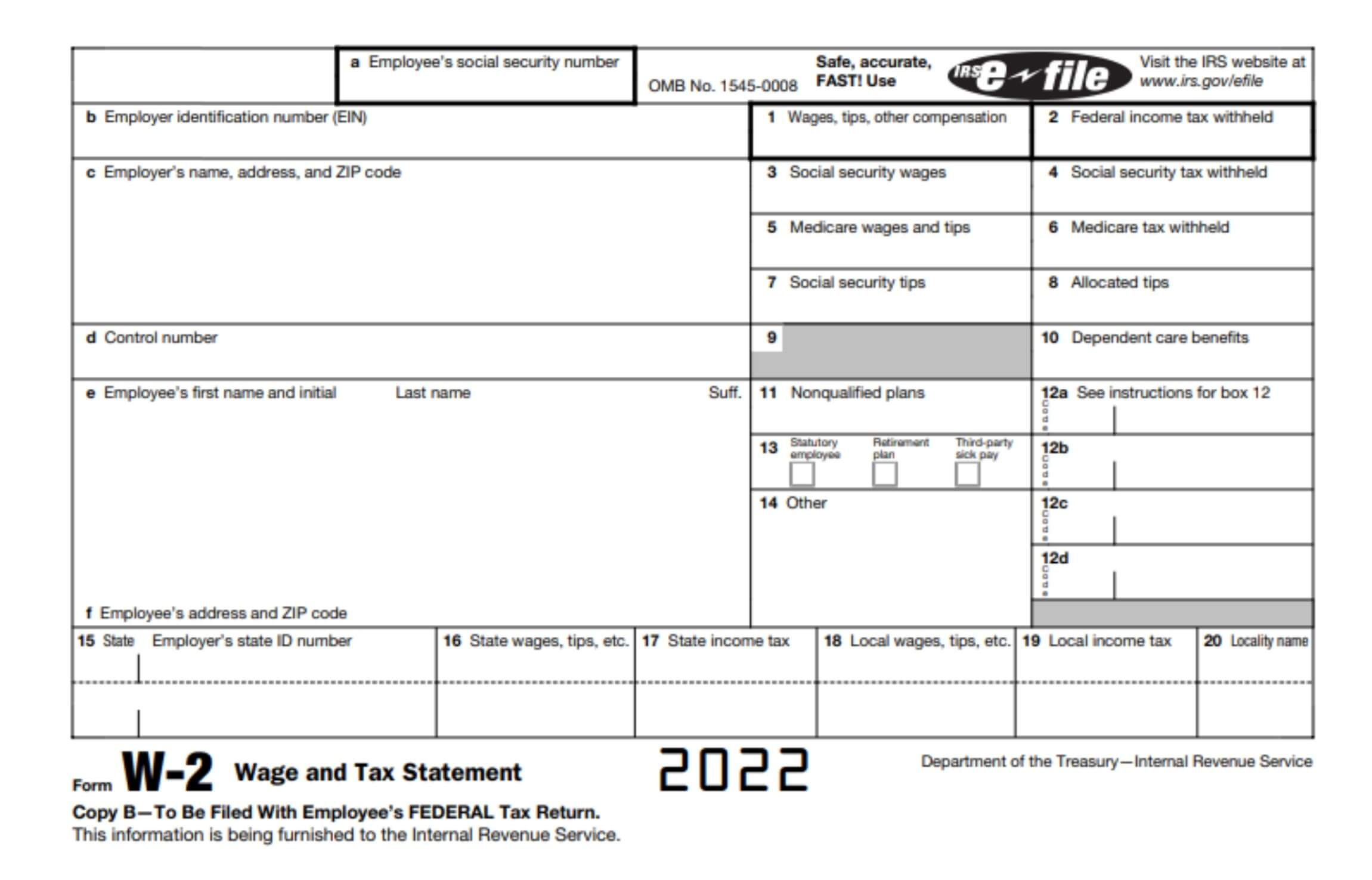

Form W2 Box 12 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding the Intricacies of Form W2 Box 12: A Comprehensive Guide

Ah, the infamous Form W2 Box 12 – a maze of letters and numbers that can leave even the most seasoned employee scratching their head in confusion. But fear not, for I am here to unravel the mystery and guide you through this enigmatic section of your W2 form. So grab your magnifying glass and let’s dive into the world of employee benefits!

When you receive your W2 form at the end of the year, you may notice Box 12 tucked away in the corner, filled with cryptic codes like D, E, and AA. But fear not, each of these codes corresponds to a specific type of employee benefit that you may have received throughout the year. From contributions to retirement plans to employer-provided health insurance, Box 12 is a treasure trove of information about the perks and benefits you enjoyed as an employee.

To make sense of the codes in Box 12, you’ll need to refer to the accompanying instructions provided by the IRS. These instructions will help you decipher the meaning behind each code and understand how it impacts your tax situation. So don’t be intimidated by the jumble of letters and numbers – with a little guidance, you’ll soon be a pro at decoding the intricacies of Form W2 Box 12.

Navigating the Labyrinth of Employee Benefits on Your W2 Form

Employee benefits come in all shapes and sizes, from health insurance to tuition assistance to commuter benefits. And each of these benefits is reflected in Box 12 of your W2 form, giving you a comprehensive overview of the perks you enjoyed as an employee. So take a closer look at Box 12 and discover the hidden gems that await you!

One of the most common codes you may encounter in Box 12 is code D, which represents elective deferrals to a retirement plan such as a 401(k). This code signifies the amount of money you set aside from your paycheck for retirement savings, which may be tax-deferred or even tax-free. So if you see code D on your W2 form, pat yourself on the back for taking a proactive step towards securing your financial future.

In addition to retirement contributions, you may also come across codes like E for employer-provided educational assistance or AA for designated Roth contributions. Each of these codes sheds light on the various benefits you received from your employer throughout the year, giving you a clearer picture of the total compensation package you enjoyed. So embrace the labyrinth of employee benefits on your W2 form and celebrate the perks that make your job not just a paycheck, but a valuable investment in your future.

In conclusion, Form W2 Box 12 may seem like a daunting puzzle at first, but with a little guidance and perseverance, you can unravel the mystery and uncover the wealth of information it holds. So the next time you receive your W2 form, don’t shy away from Box 12 – embrace it as a roadmap to the employee benefits that make your job more than just a 9 to 5. Happy decoding!

Below are some images related to Form W2 Box 12

![Form W-2 Box 12 Codes | Codes And Explanations [Chart] with regard to Form W2 Box 12](https://ezambiablog.com/wp-content/uploads/2024/02/form-w-2-box-12-codes-codes-and-explanations-chart-with-regard-to-form-w2-box-12.jpg) form w2 box 12, form w2 box 12 aa, form w2 box 12 code d, form w2 box 12 code dd, form w2 box 12 code w, , Form W2 Box 12.

form w2 box 12, form w2 box 12 aa, form w2 box 12 code d, form w2 box 12 code dd, form w2 box 12 code w, , Form W2 Box 12.