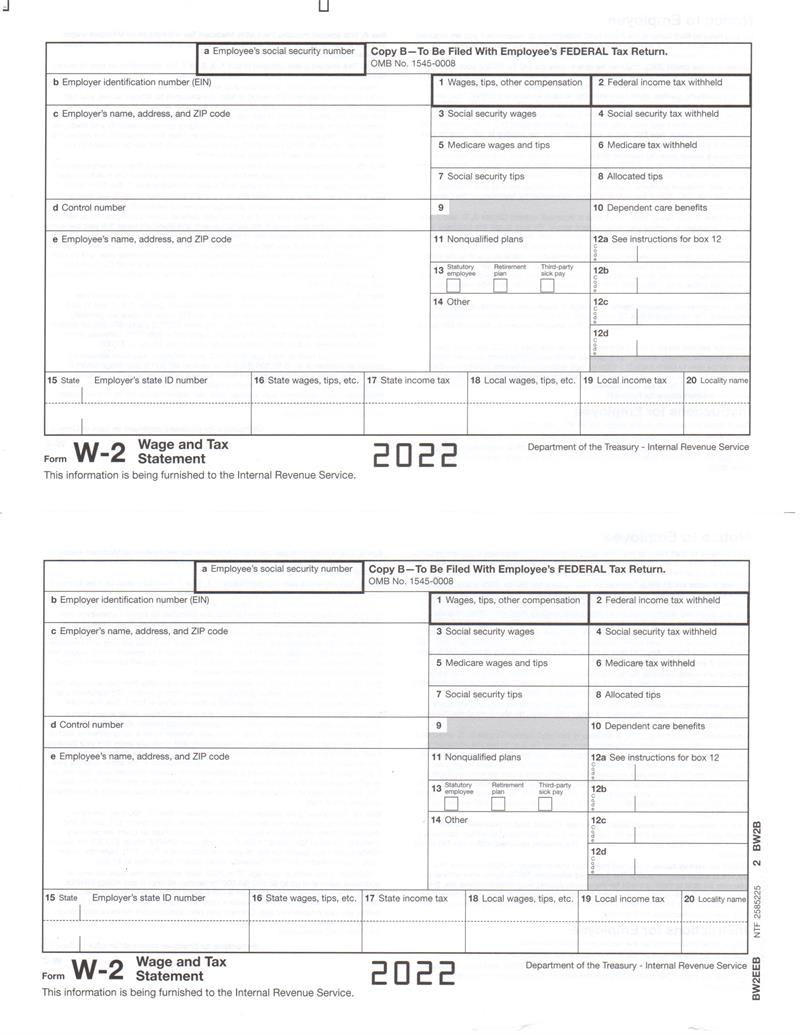

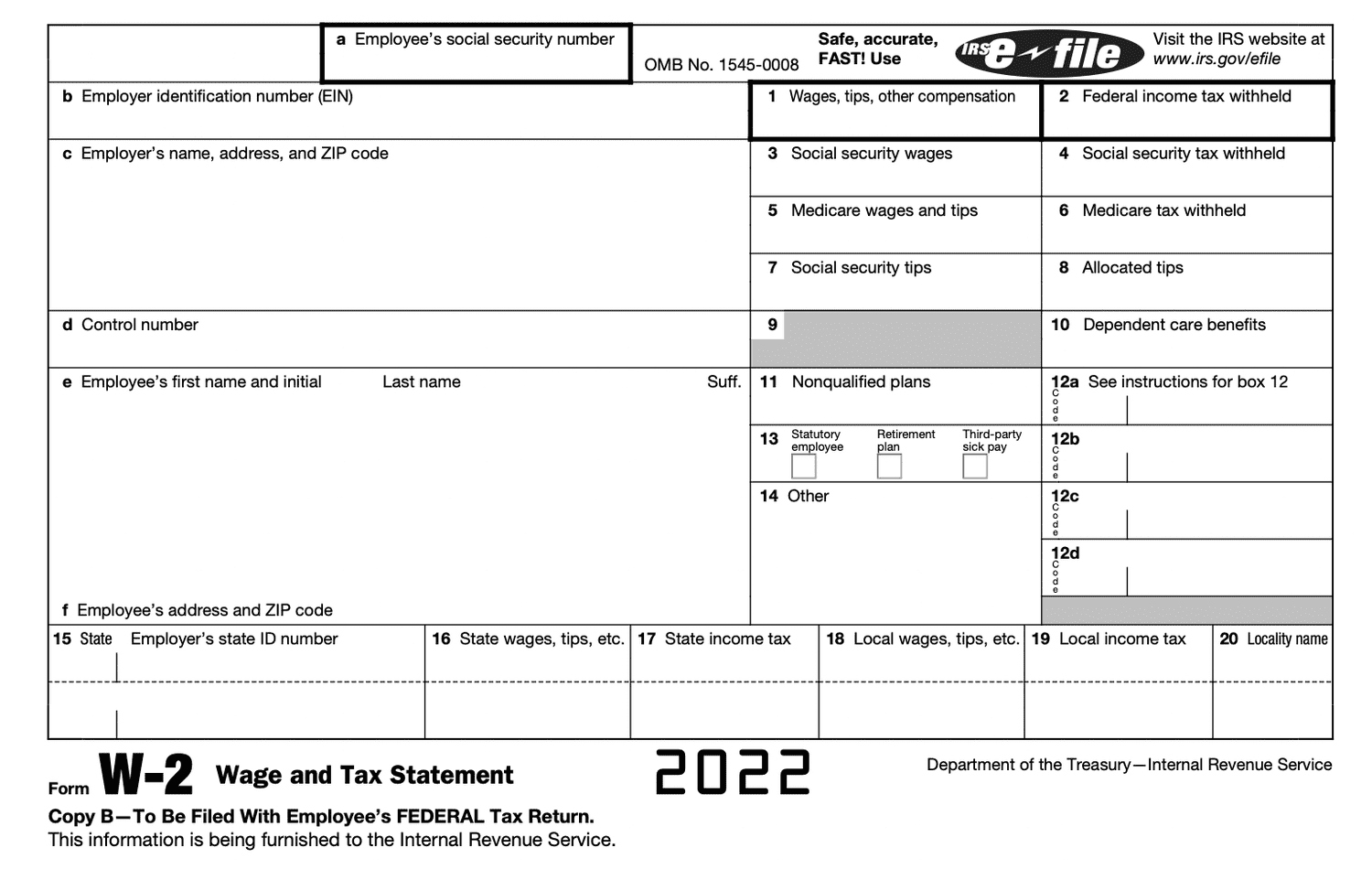

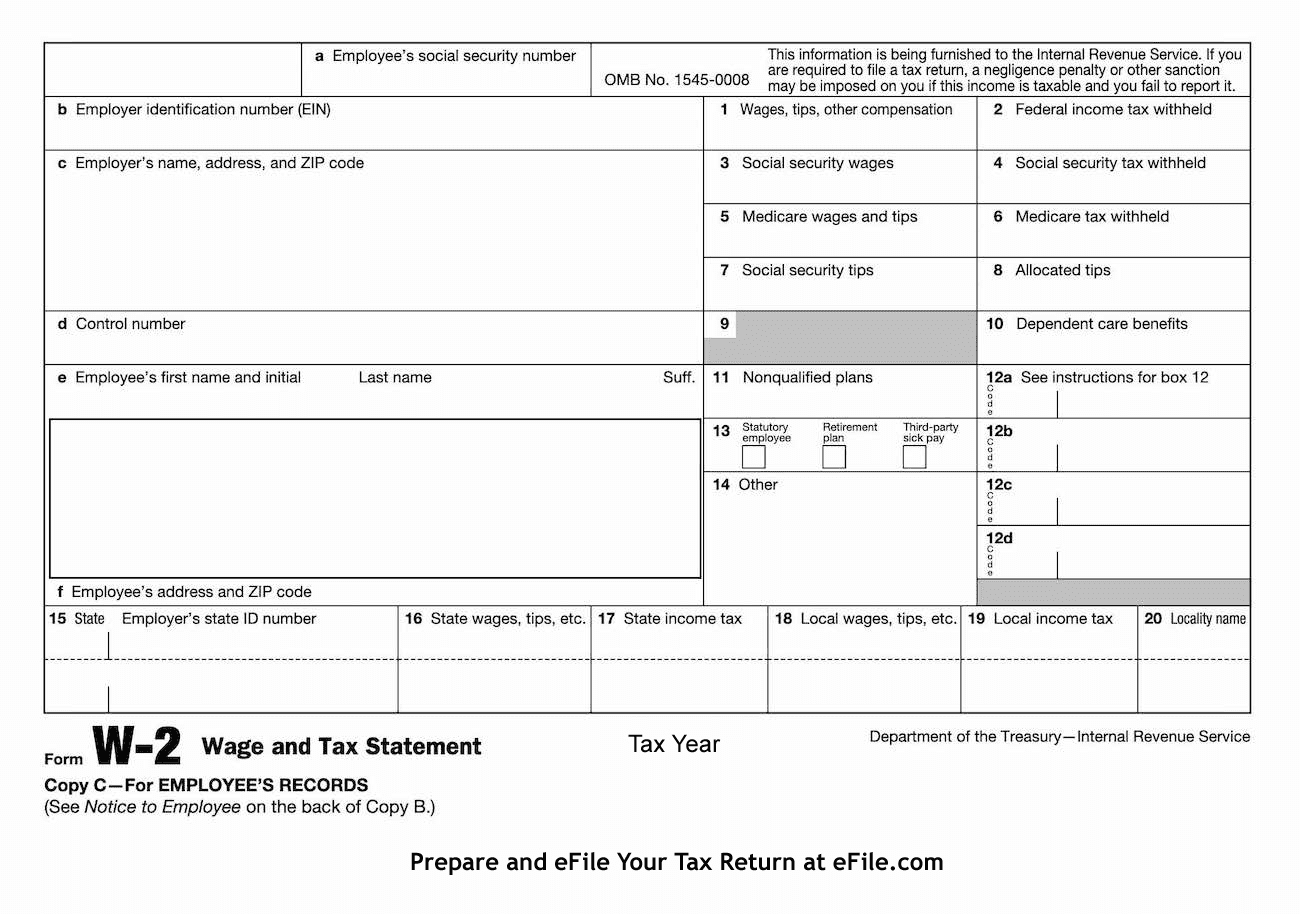

Form 1040 W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of Form 1040 W2: Your Ticket to Tax Success!

Tax season can often feel like a daunting puzzle, with forms and numbers swirling around like a whirlwind. But fear not, for Form 1040 W2 is here to save the day! This magical document holds the key to unlocking your tax success and making the process a breeze. Let’s dive in and discover the mysteries behind Form 1040 W2!

Discover the Mysteries Behind Form 1040 W2!

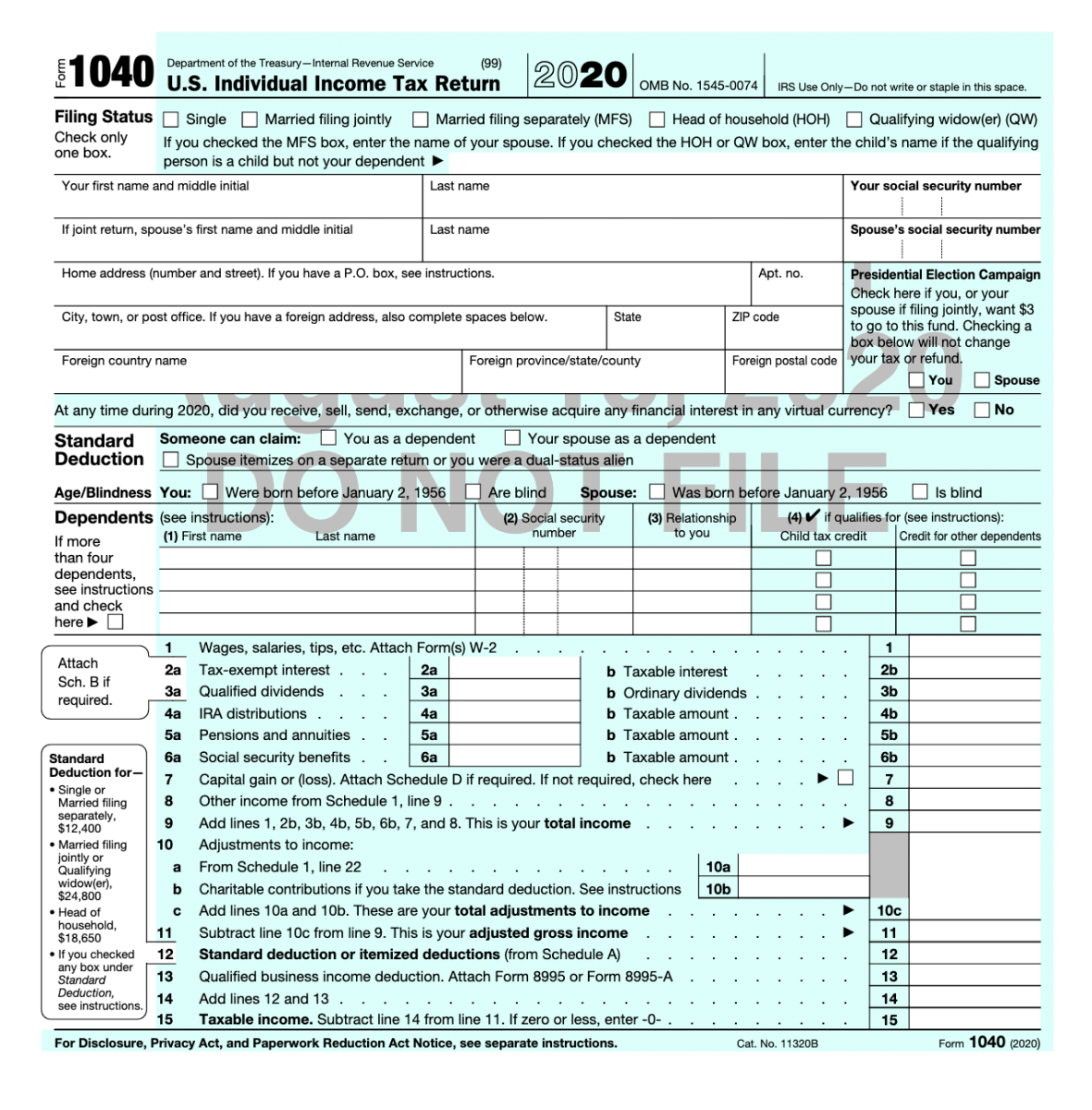

Form 1040 W2 is like a treasure map that guides you through the intricate world of taxes. It provides a detailed breakdown of your income, deductions, and credits, helping you paint a clear picture of your financial situation. By unraveling the secrets hidden within this form, you can uncover valuable insights into how you can optimize your tax planning and maximize your refunds. So grab your magnifying glass and get ready to embark on a thrilling tax adventure!

Form 1040 W2 is not just a tool for reporting your income—it’s a powerful weapon in your tax planning arsenal. By understanding the information contained in this form, you can turbocharge your tax strategy and make savvy financial decisions. From identifying potential deductions to exploring tax credits that could lower your liability, Form 1040 W2 is your roadmap to a successful tax season. So don your cape and mask, for you are about to become a tax-saving superhero!

Turbocharge Your Tax Planning with Form 1040 W2!

As you delve deeper into the world of Form 1040 W2, you’ll uncover a wealth of opportunities to optimize your tax situation. By analyzing your income sources, deductions, and credits, you can craft a personalized tax plan that puts more money back in your pocket. Whether you’re a seasoned tax pro or a first-time filer, Form 1040 W2 is your trusty sidekick in navigating the complex tax landscape. So roll up your sleeves and get ready to conquer your taxes like never before!

In conclusion, Form 1040 W2 is not just a piece of paper—it’s your ticket to tax success. By embracing the magic of this form and unlocking its mysteries, you can take control of your financial future and achieve your tax goals with ease. So don’t be afraid to dive into the world of Form 1040 W2 and unleash your inner tax wizard. With a little know-how and a touch of creativity, you’ll be well on your way to mastering the art of tax planning and securing a brighter financial future. Happy filing!

Below are some images related to Form 1040 W2

1040 form attach w2, 1040 form different than w2, form 1040 vs w2, form 1040 w2, form 1040 w2 worksheet, , Form 1040 W2.

1040 form attach w2, 1040 form different than w2, form 1040 vs w2, form 1040 w2, form 1040 w2 worksheet, , Form 1040 W2.