File W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Welcome to W2 Wonderland!

Are you ready to tackle your W2 form with ease? Welcome to W2 Wonderland, where filing your form is a breeze! Whether you’re a seasoned pro or a first-time filer, we’ve got all the tips and tricks you need to make the process smooth and stress-free. Say goodbye to confusion and hello to organization – let’s dive in and make filing your W2 a walk in the park!

Tips for Filing Your Form with Ease

1. **Gather all your documents:** Before you even think about filling out your W2 form, make sure you have all the necessary documents in one place. This includes your W2 form from your employer, any additional income forms, and any receipts or documentation for deductions you plan to claim. Having everything organized and ready to go will save you time and headaches in the long run.

2. **Double-check your information:** One of the most common mistakes people make when filing their W2 form is entering incorrect information. Make sure to double-check all your personal details, such as your name, social security number, and address, to ensure everything is accurate. A small mistake now could lead to major headaches later on, so take the time to review your information carefully.

3. **Use online resources:** Don’t be afraid to use online resources to help you file your W2 form with ease. There are plenty of websites and software programs available that can walk you through the process step by step, making it easy to input your information and file electronically. These resources can also help you maximize your deductions and ensure you’re getting the most out of your tax return.

Conclusion

Filing your W2 form doesn’t have to be a daunting task. With the right tools and tips, you can navigate the process with ease and confidence. By gathering all your documents, double-checking your information, and utilizing online resources, you’ll be well on your way to filing your W2 form like a pro. So, don’t stress – embrace the process and enjoy the satisfaction of a job well done in W2 Wonderland!

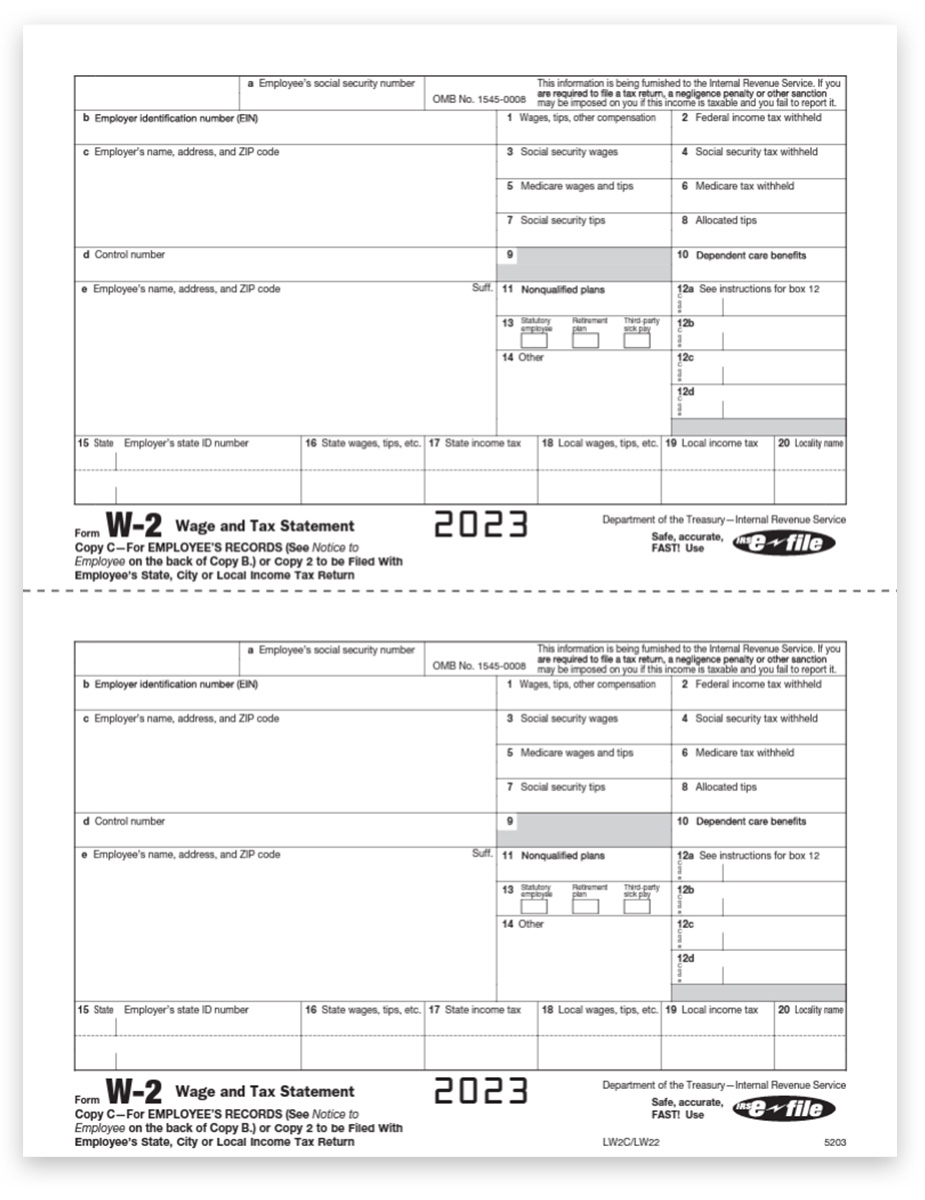

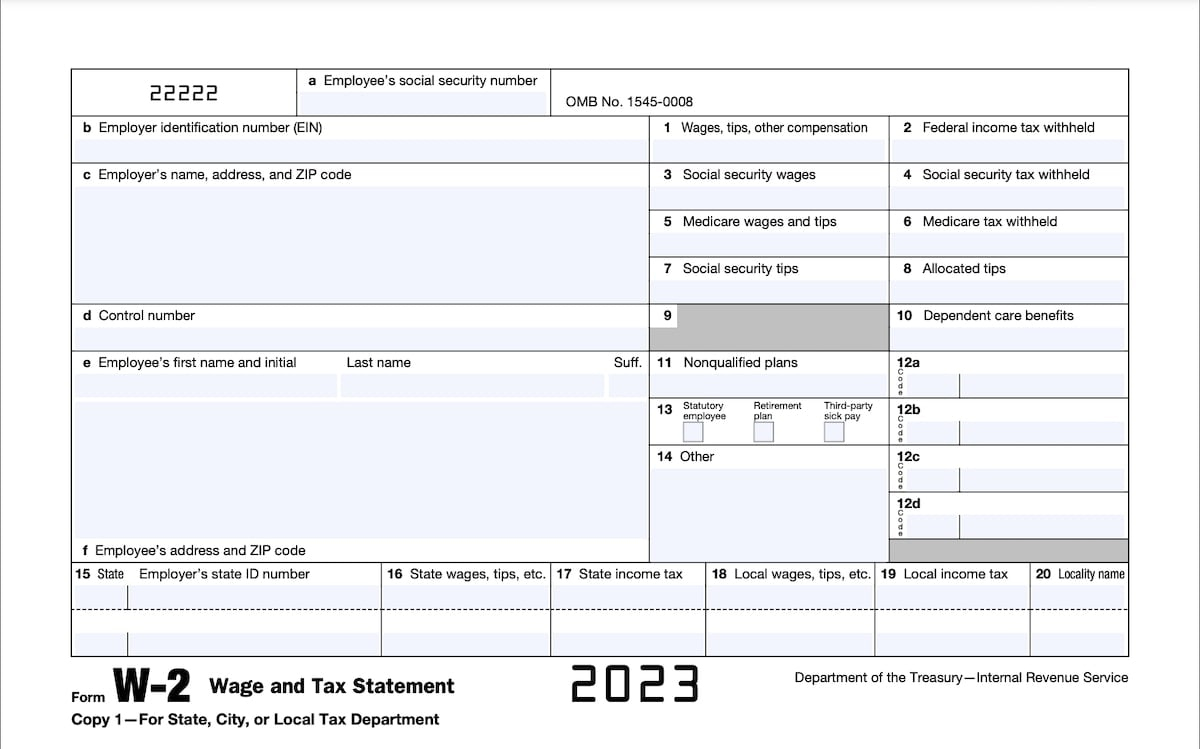

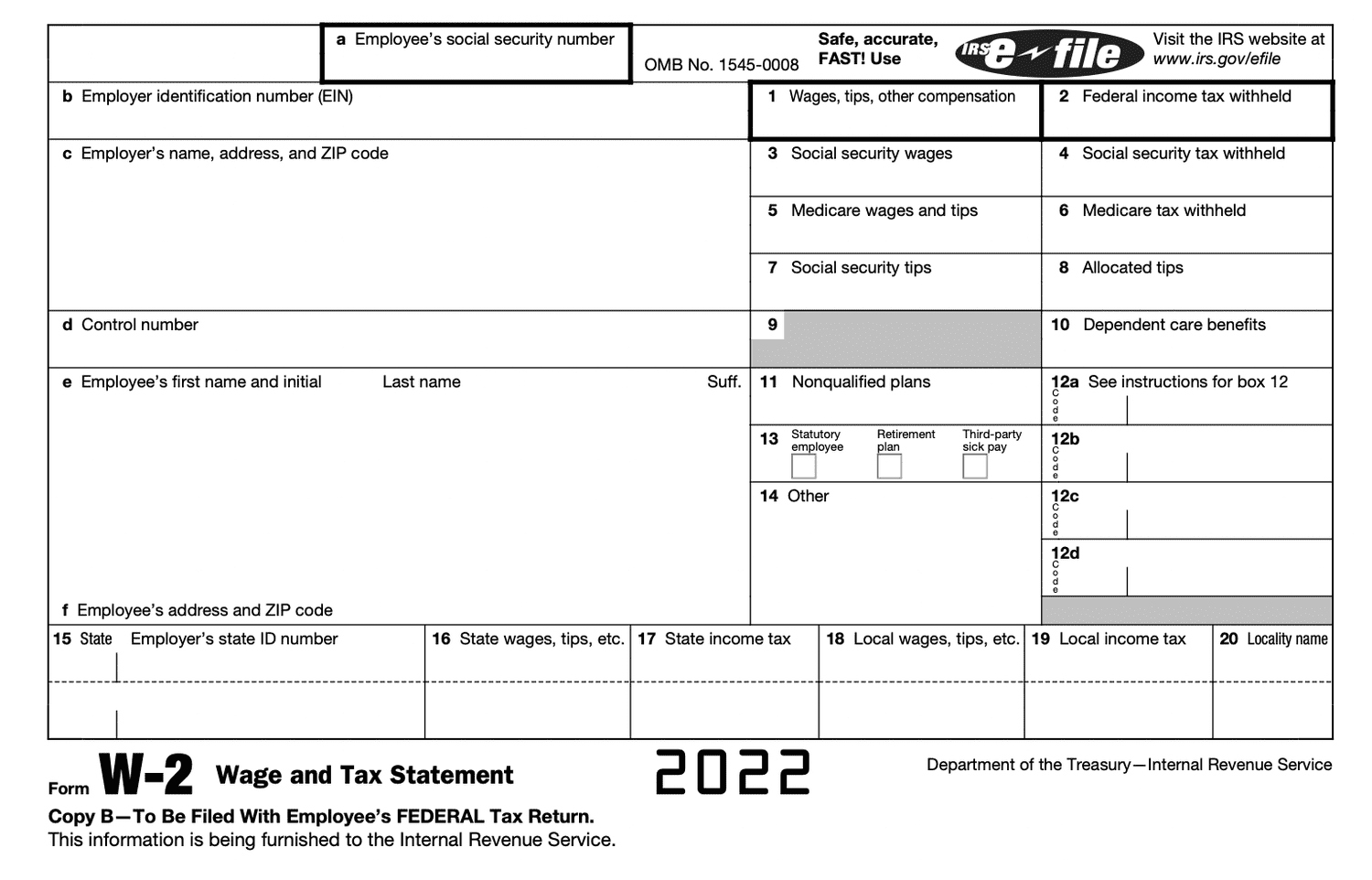

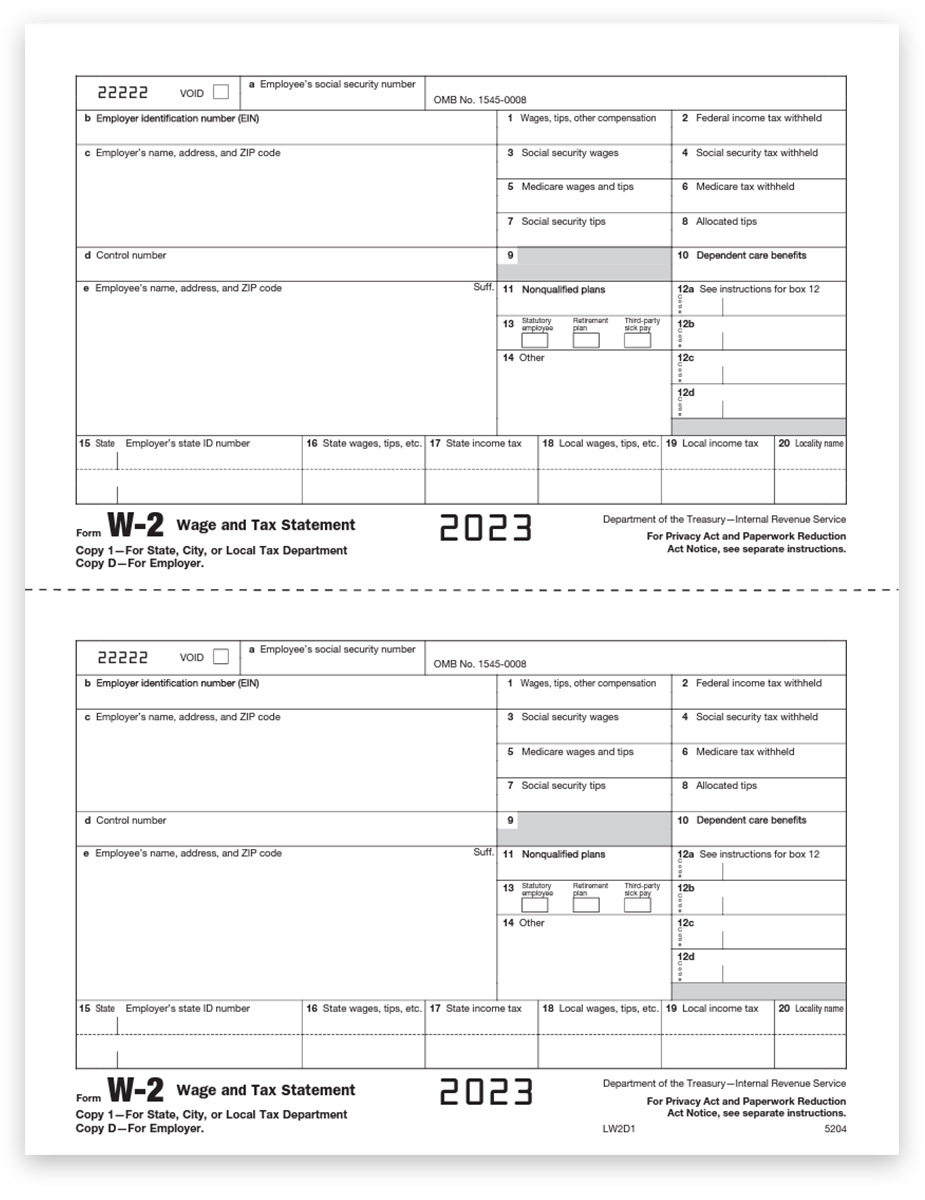

Below are some images related to File W2 Form

file forms w2 and w3 electronically, file w2 forms electronically, file w2 forms online, file your w-2 forms, filing multiple w2 forms, , File W2 Form.

file forms w2 and w3 electronically, file w2 forms electronically, file w2 forms online, file your w-2 forms, filing multiple w2 forms, , File W2 Form.