Ein Number On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Key to Your Financial Magic

Have you ever looked at your W2 form and wondered what those numbers and letters mean? Well, hidden within that sea of information lies a powerful key that unlocks the magic of your financial identity – your Employer Identification Number (EIN). This unique nine-digit number, assigned by the IRS, is like a secret code that connects you to your employer and shapes your tax filings. Understanding the significance of your EIN number can help you navigate the complexities of your financial world with confidence and ease.

Your EIN number is more than just a random set of digits on a piece of paper. It is the gateway to a wealth of financial information that can empower you to make informed decisions about your taxes, benefits, and overall financial well-being. By recognizing the power of your EIN number, you can take control of your financial destiny and harness its magic to unlock a brighter future for yourself and your loved ones. So, the next time you hold your W2 form in your hands, remember that the key to your financial magic lies within that tiny set of numbers – your EIN.

Unleash the Power of Your EIN Number

Your EIN number is more than just a reference point for tax purposes; it is a symbol of your professional identity and financial stability. By understanding the significance of your EIN number, you can unleash its power to streamline your tax filings, track your income accurately, and access important financial benefits. Whether you are a seasoned professional or a first-time employee, your EIN number is the key to unlocking a world of financial opportunities and securing your financial future.

When you embrace the magic of your EIN number, you open the door to a wealth of possibilities that can enhance your financial well-being and empower you to achieve your goals. From tax deductions and retirement savings to insurance coverage and employment benefits, your EIN number plays a crucial role in shaping your financial landscape. So, the next time you receive your W2 form, take a moment to appreciate the power of your EIN number and the endless possibilities it holds for your financial success. Unlock the magic of your EIN number and watch as your financial dreams become a reality.

In conclusion, your EIN number on the W2 form is not just a random set of digits; it is the key to unlocking the magic of your financial identity. By understanding the significance of your EIN number and embracing its power, you can navigate the complexities of your financial world with confidence and ease. So, the next time you receive your W2 form, remember to look beyond the numbers and letters to discover the hidden treasure that lies within – your EIN number. Embrace the magic of your EIN number and take control of your financial destiny today!

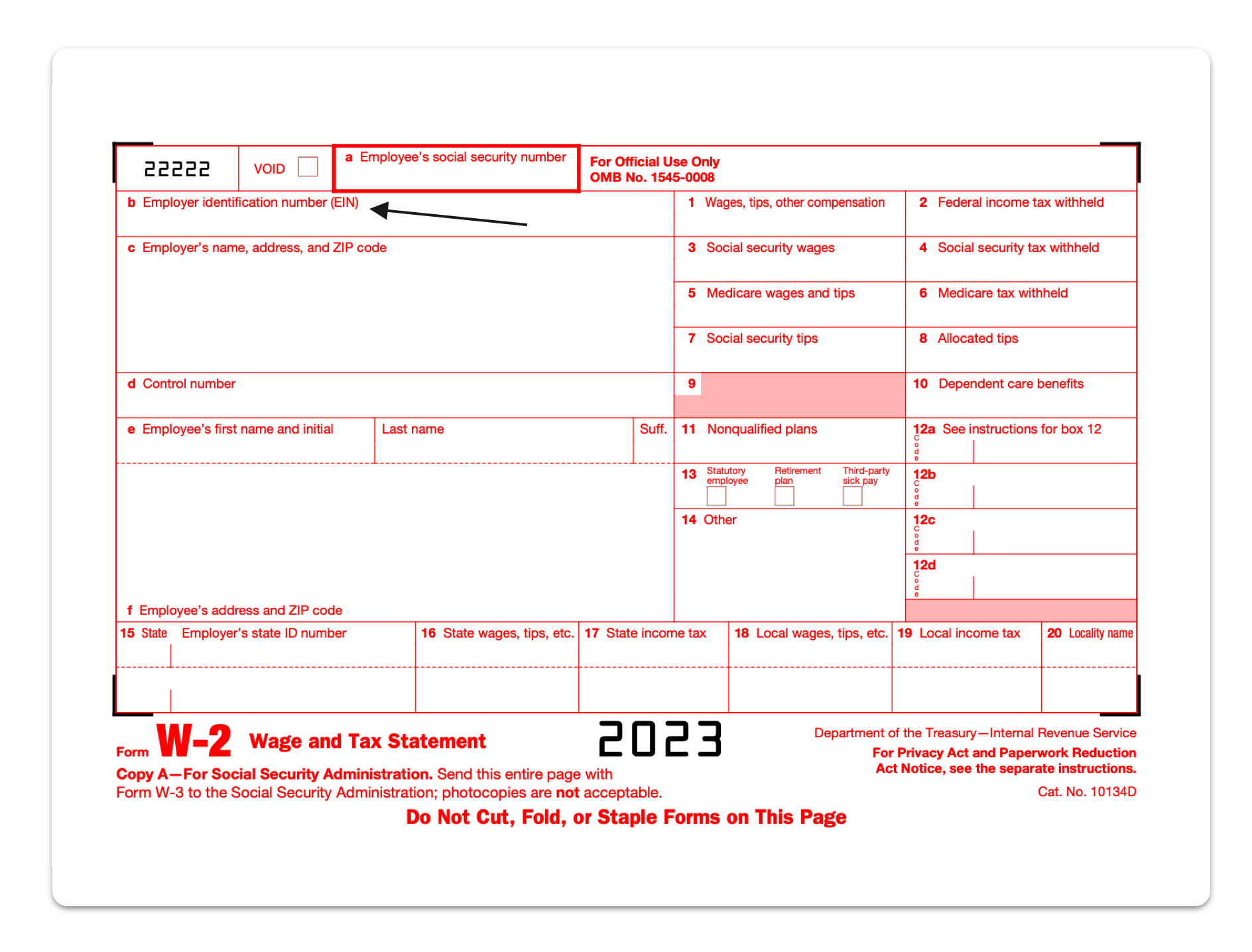

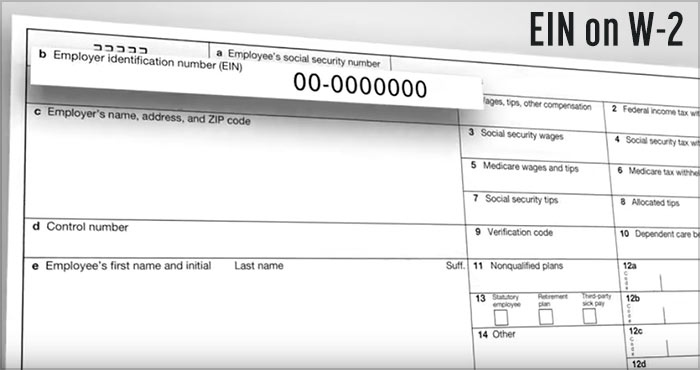

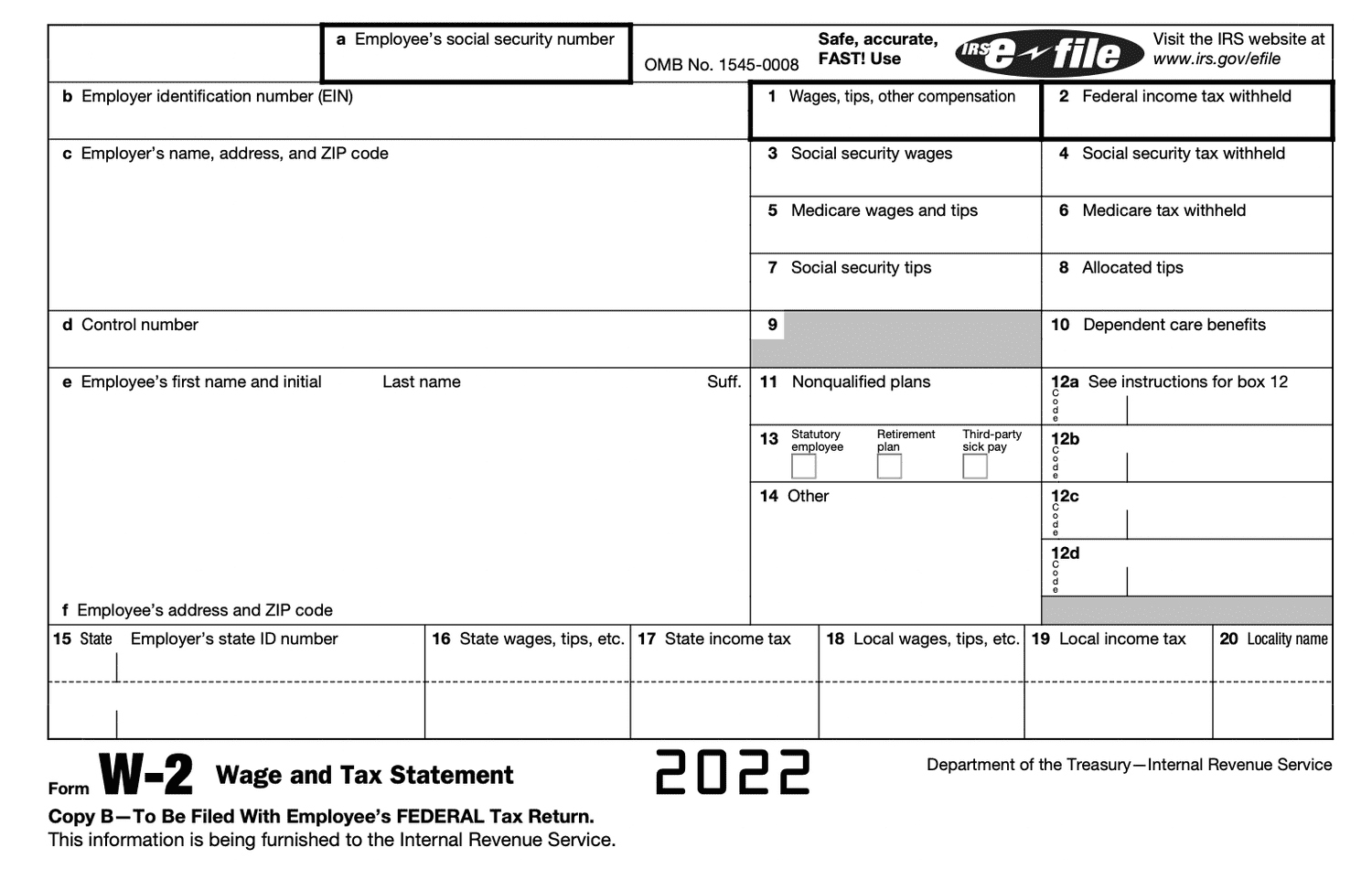

Below are some images related to Ein Number On W2 Form

ein number on w2 form, ein on w2 form, find w2 with ein number, is ein on w2, tax id number on w2 form, , Ein Number On W2 Form.

ein number on w2 form, ein on w2 form, find w2 with ein number, is ein on w2, tax id number on w2 form, , Ein Number On W2 Form.