Box D On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unravel the Mystery of Box D on Your W2 Form!

Have you ever looked at your W2 form and felt like you were staring at hieroglyphics? Well, fear no more because we are here to help you crack the code! One of the most mysterious boxes on your W2 form is Box D, but don’t worry, we are going to guide you through understanding and deciphering it. So, grab your detective hat and let’s unravel the mystery of Box D together!

Crack the Code: A Guide to Understanding Box D!

Box D on your W2 form is where your employer reports the total amount of dependent care benefits they provided to you during the tax year. This can include things like payments towards a daycare or after-school program for your children. Understanding Box D is important because these benefits may be taxable and need to be reported on your tax return. By cracking the code of Box D, you can ensure that you are accurately reporting your income and deductions to the IRS.

Another important thing to note about Box D is that it may have a limit on the amount of dependent care benefits that can be excluded from your taxable income. If the amount in Box D exceeds this limit, the excess may need to be included in your total income for the year. It’s crucial to pay attention to this detail and seek guidance from a tax professional if you have any questions or concerns about how Box D may impact your tax return.

In conclusion, while Box D on your W2 form may seem like a daunting puzzle at first, with a little guidance and knowledge, you can easily crack the code and understand its significance. By taking the time to unravel the mystery of Box D, you can ensure that you are accurately reporting your income and deductions to the IRS, ultimately helping you to navigate the tax season with confidence. So, don’t be intimidated by Box D – embrace the challenge and conquer it like a true detective!

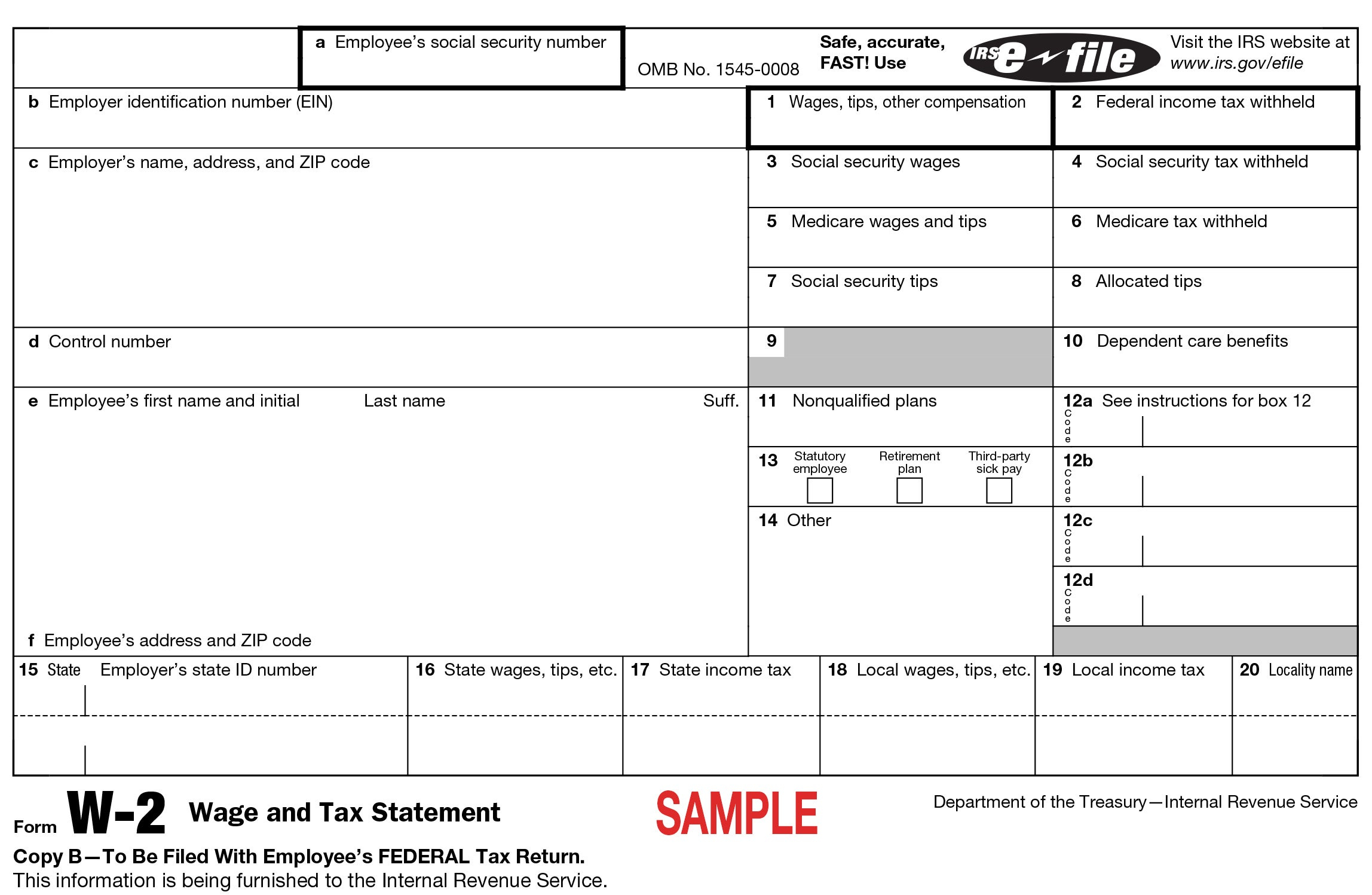

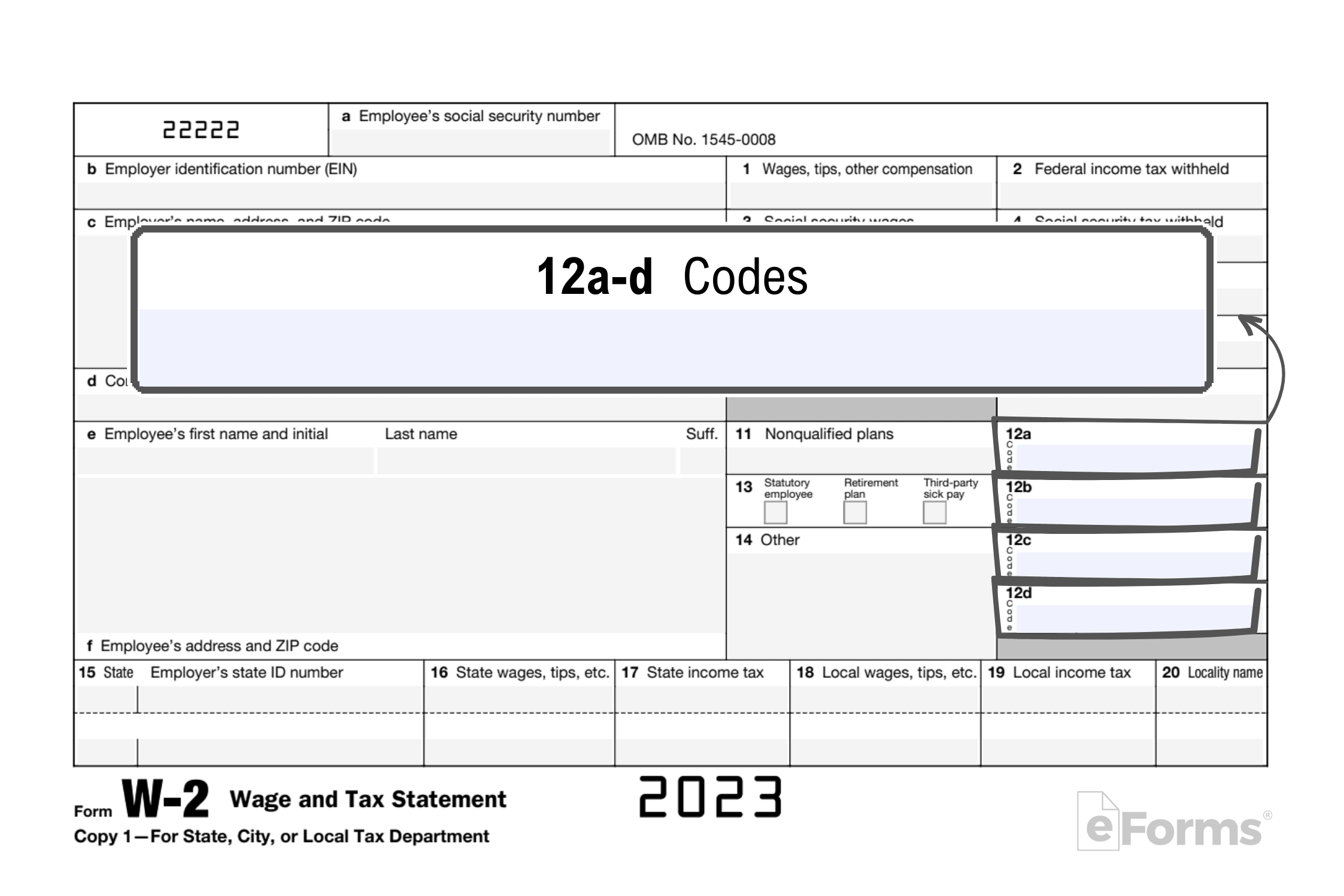

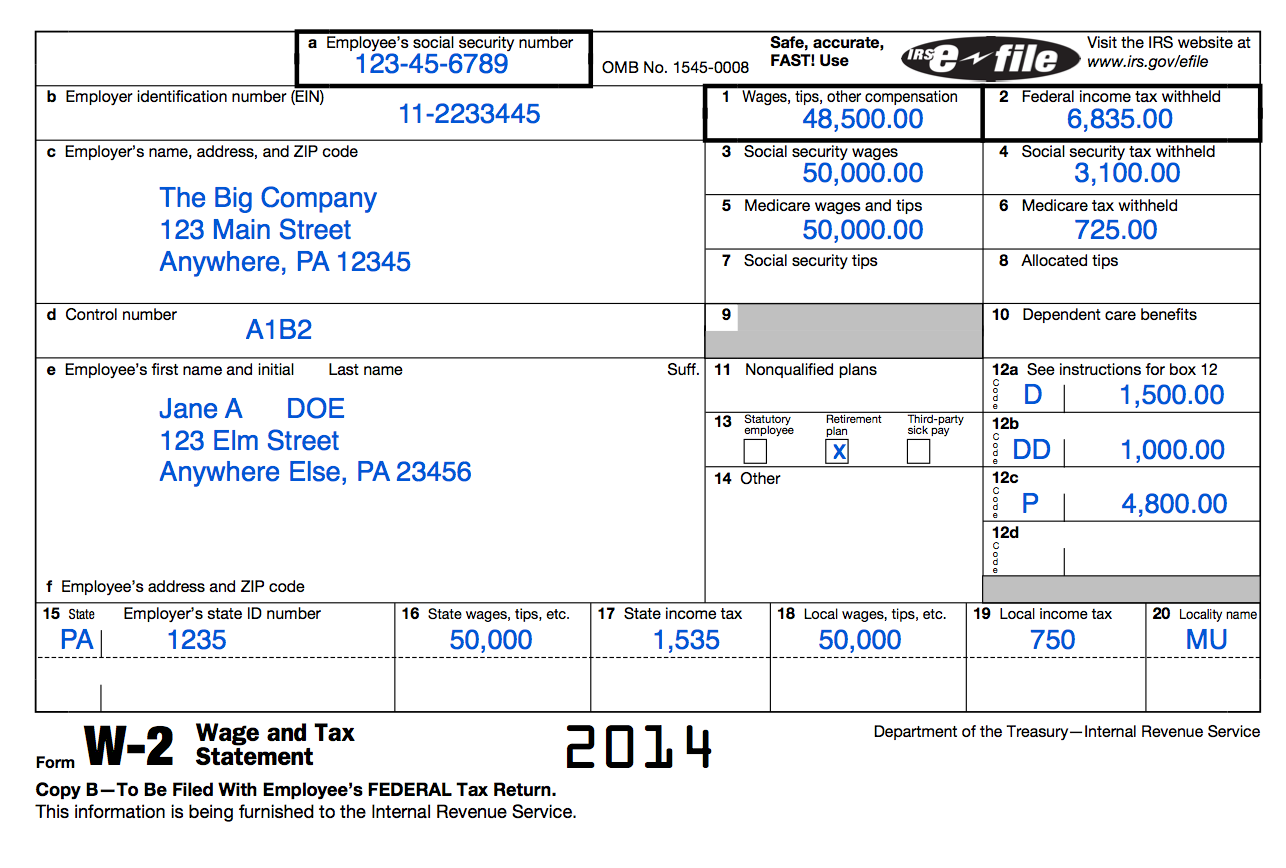

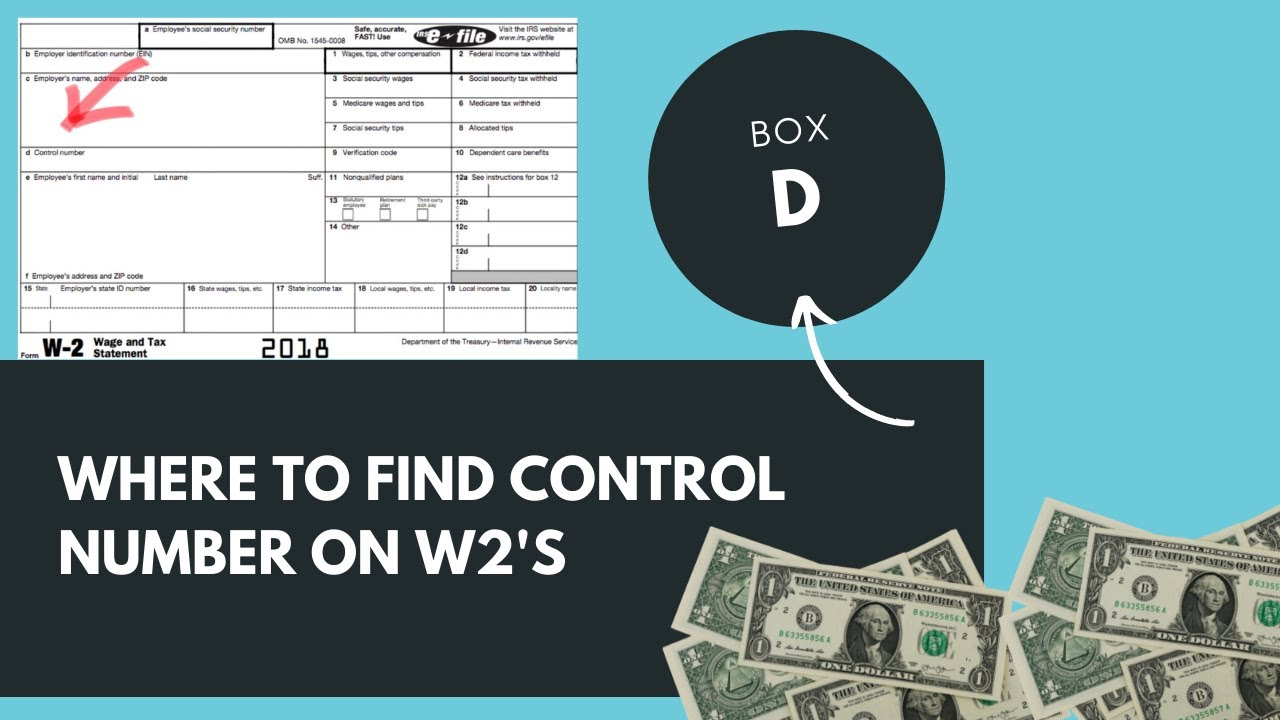

Below are some images related to Box D On W2 Form

box 12a on w2 form, box d on w2 form, box d on w2 form 2021, what is box d on w2, where is box d on my w2 form, , Box D On W2 Form.

box 12a on w2 form, box d on w2 form, box d on w2 form 2021, what is box d on w2, where is box d on my w2 form, , Box D On W2 Form.