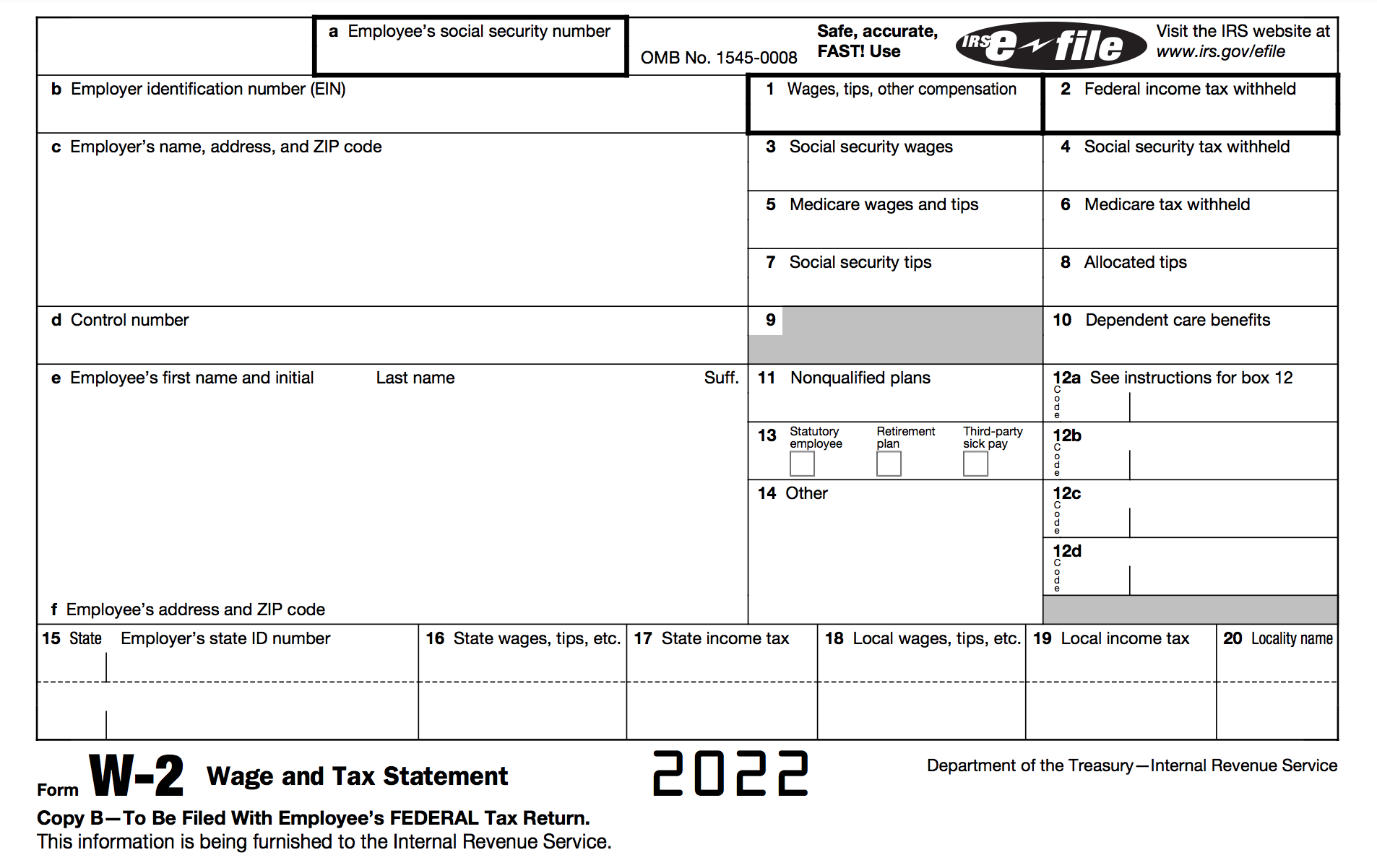

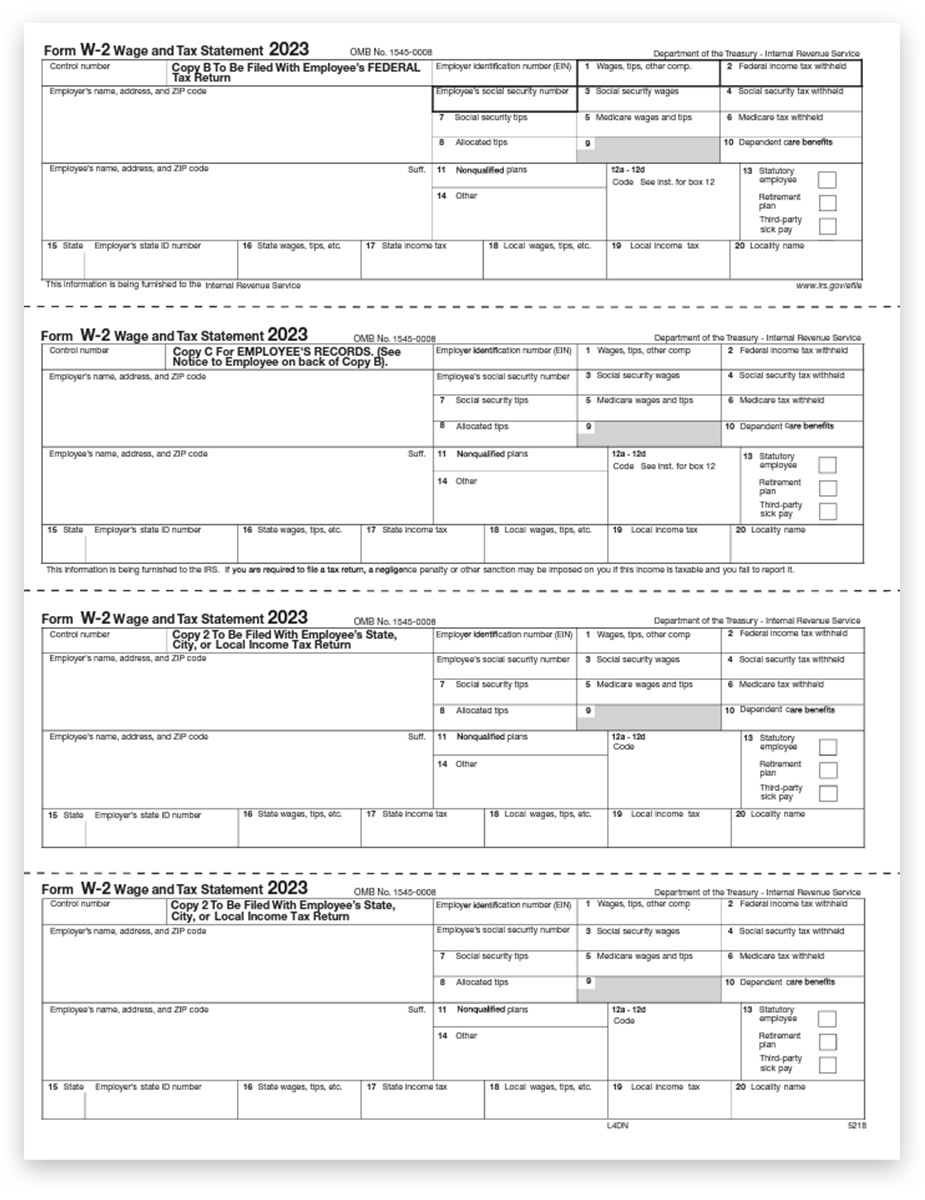

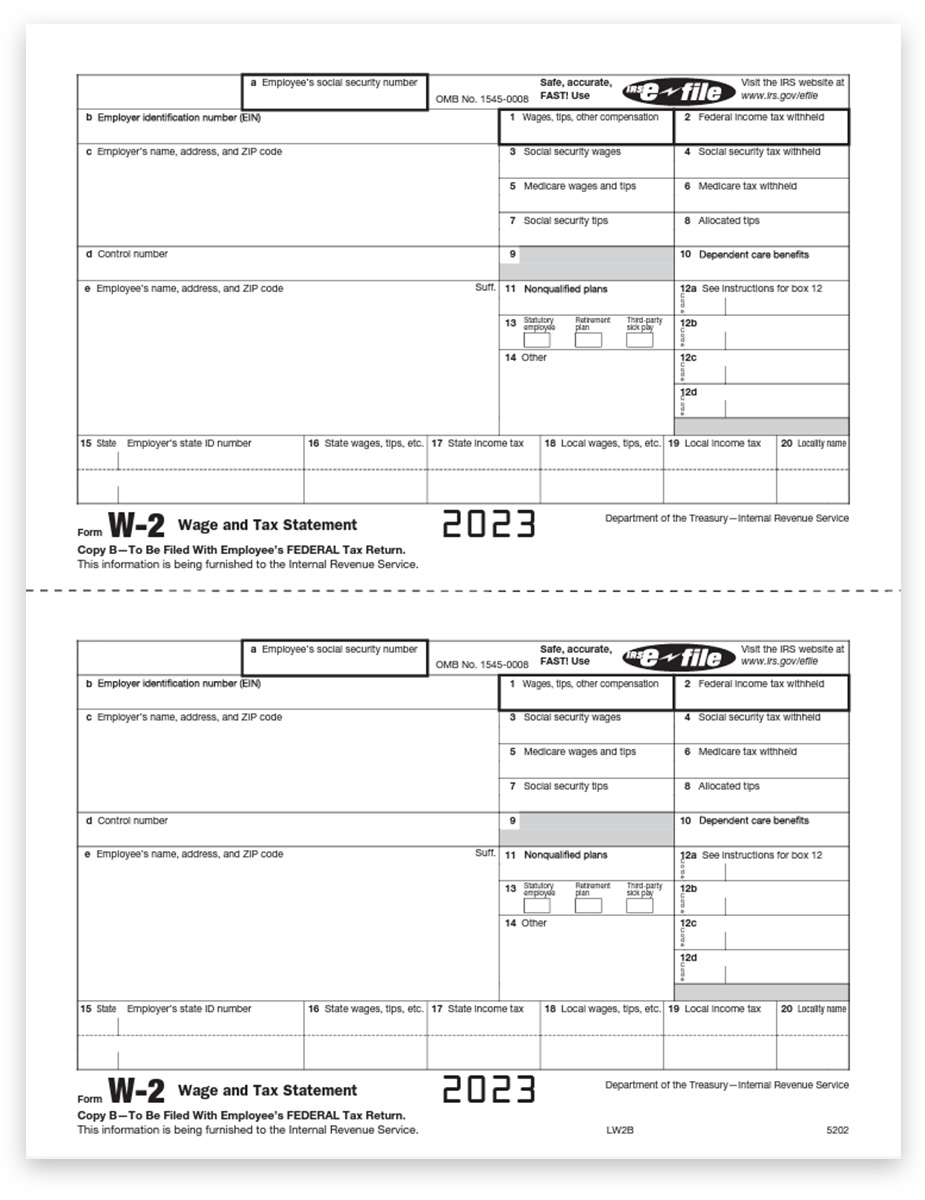

Best Buy W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Refund Potential with Best Buy W2 Forms!

Are you ready to make the most out of your tax refund this year? Look no further than your Best Buy W2 form! With the right approach and a little bit of know-how, you can maximize your refund potential and make sure you’re getting every penny you deserve. So grab your W2 form and let’s get started on unlocking those savings!

Maximize Your Tax Refund Potential!

When it comes to maximizing your tax refund, every dollar counts. Your Best Buy W2 form is the key to ensuring you’re taking advantage of all the deductions and credits available to you. Make sure to review your form carefully, checking for any errors or missing information that could impact your refund amount. And don’t forget to keep all your receipts and documentation organized to support any deductions you claim. By being thorough and diligent, you can make sure you’re getting the most out of your refund this tax season!

Get the Most Out of Your Best Buy W2 Form!

Your Best Buy W2 form contains valuable information about your income, taxes withheld, and other relevant financial details. Take the time to review each section carefully, making note of any discrepancies or questions you may have. If you’re unsure about how to interpret certain sections of the form, don’t hesitate to seek guidance from a tax professional or financial advisor. By fully understanding your W2 form, you can ensure you’re taking full advantage of all the tax benefits available to you and maximizing your refund potential.

In conclusion, your Best Buy W2 form is a powerful tool that can help you unleash your refund potential this tax season. By taking the time to review and understand your form, you can make sure you’re getting every dollar you deserve. So don’t delay – grab your W2 form today and start preparing for a refund that will leave you smiling all the way to the bank!

Below are some images related to Best Buy W2 Forms

best buy w2 forms, does walmart sell w2 forms, how do i get copies of my w2 forms, how to get my w2 from best buy, where can i get a copy of my w2 forms, , Best Buy W2 Forms.

best buy w2 forms, does walmart sell w2 forms, how do i get copies of my w2 forms, how to get my w2 from best buy, where can i get a copy of my w2 forms, , Best Buy W2 Forms.