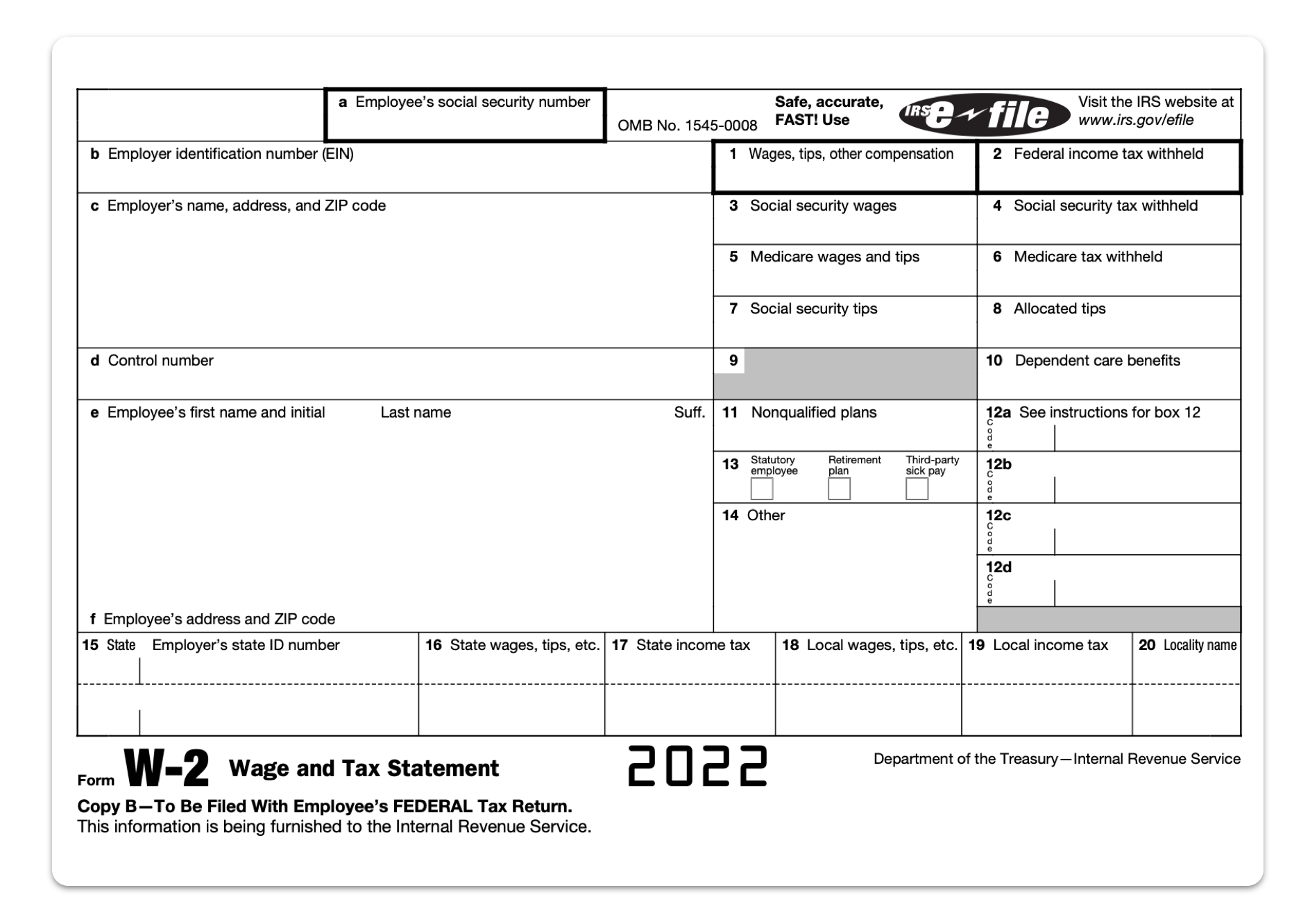

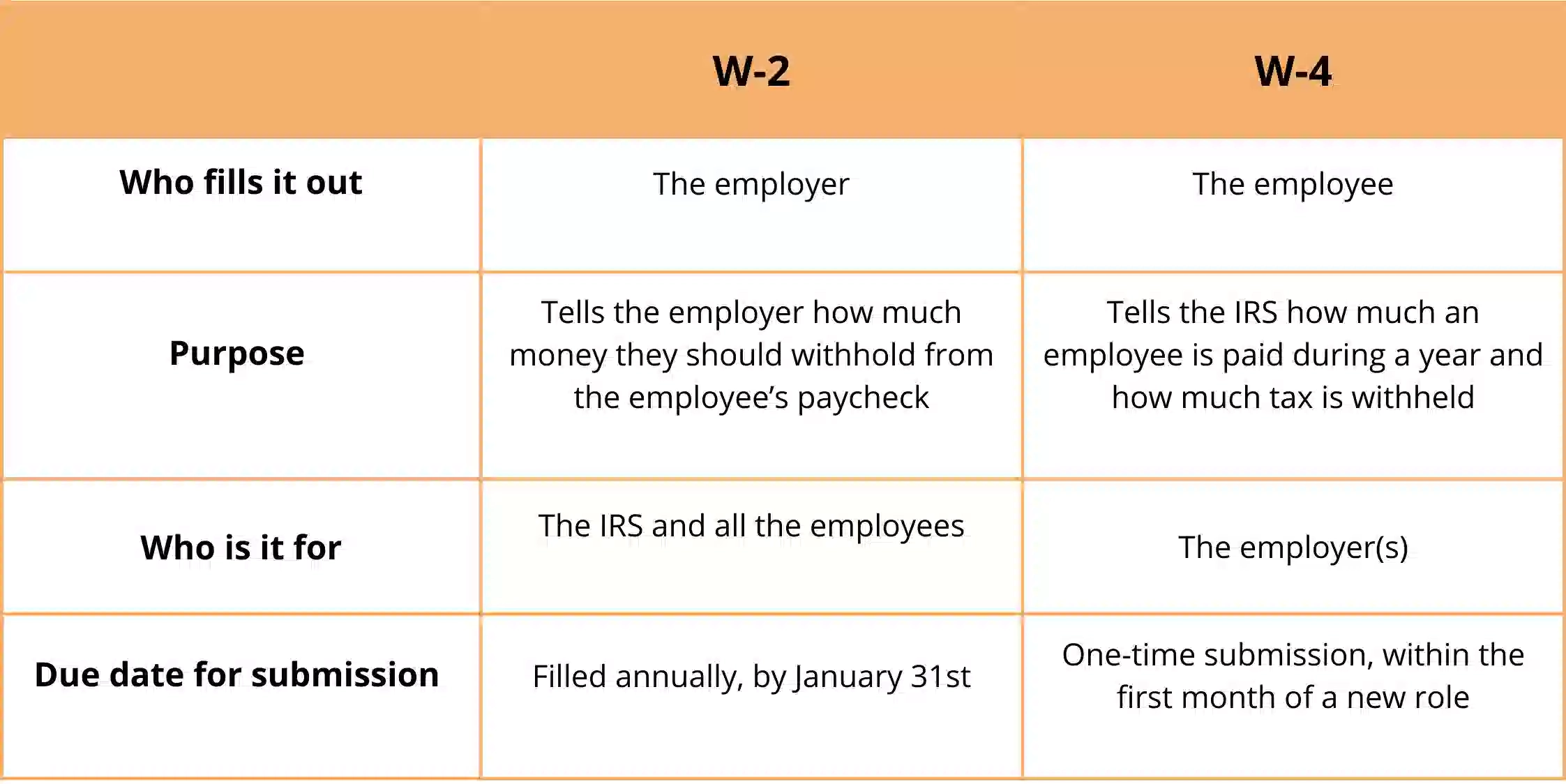

W2 Vs W4 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

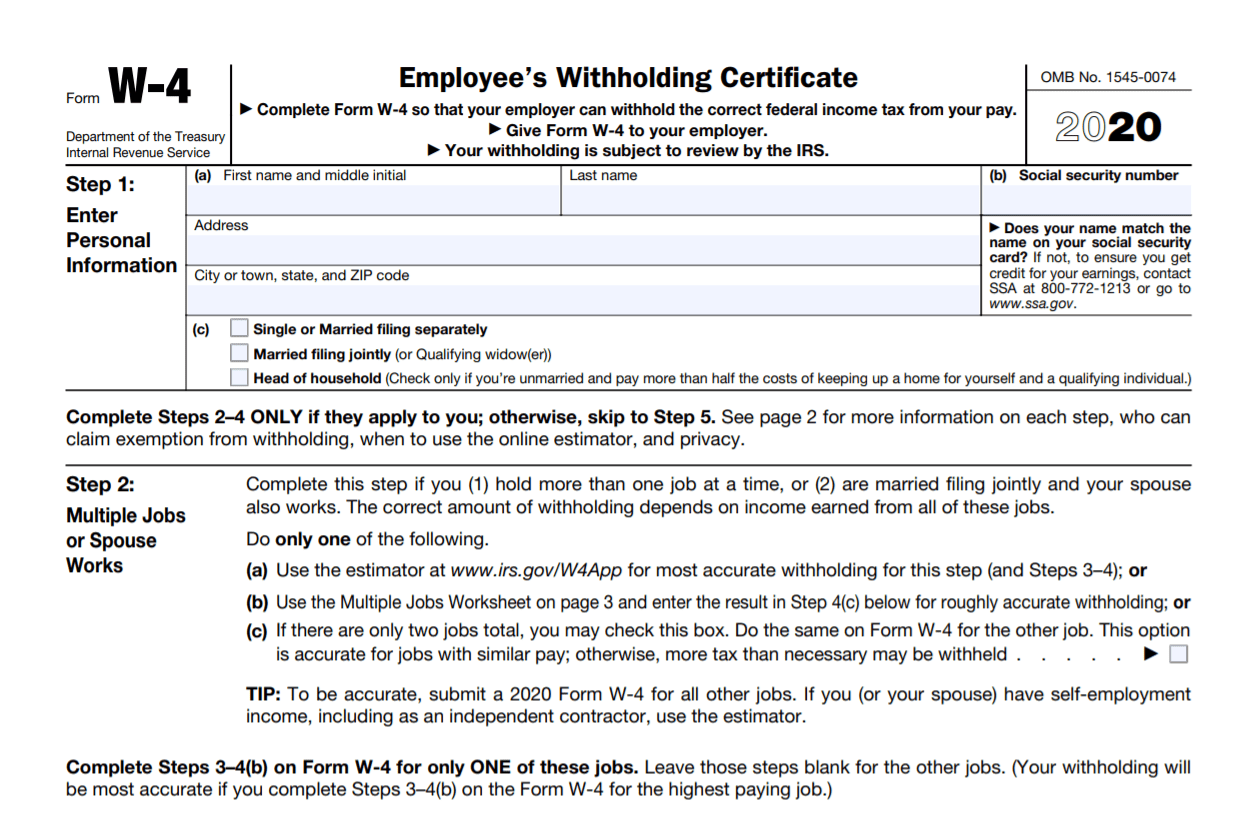

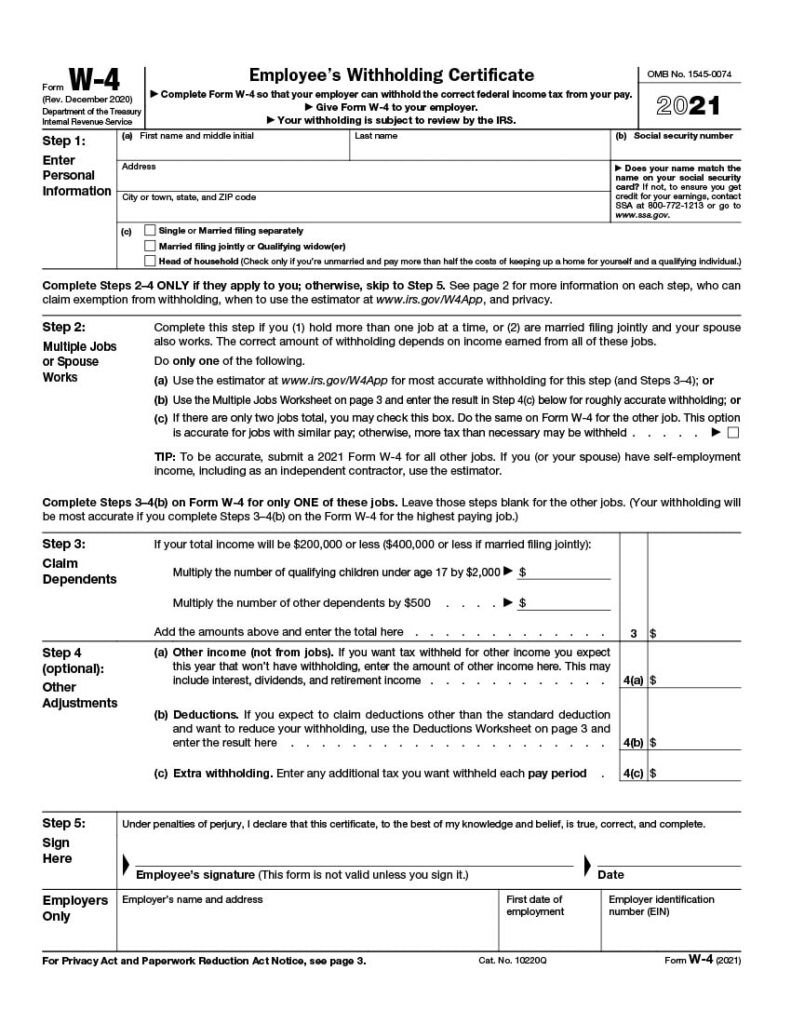

Decoding the Dance of W2 vs W4: What’s Your Tax Form Style?

Tax season is upon us, and for many, that means deciphering the dance between the W2 and W4 tax forms. These two forms can often seem like a mysterious duo, each with its own unique style and personality. But fear not, as we are here to help you unravel the complexities of these tax forms and determine which one best suits your tax form style.

Unveiling the Mysterious Dance of W2 vs W4

The W2 form is like the steady partner in this tax form dance. It is typically provided by your employer and outlines your earnings and taxes withheld throughout the year. Think of it as the reliable partner who has your back when it comes to reporting your income accurately to the IRS. On the other hand, the W4 form is more like the free-spirited dancer, allowing you to adjust your withholding allowances to ensure that you are paying the right amount of taxes throughout the year.

When it comes to choosing between the W2 and W4 forms, it’s important to consider your tax form personality. Are you someone who prefers stability and consistency, or do you thrive on flexibility and control? The W2 form may be the best fit for those who prefer a straightforward approach to tax reporting, while the W4 form might appeal to those who enjoy making adjustments to their withholding to optimize their tax situation. Ultimately, understanding your tax form style can help you navigate the dance between the W2 and W4 forms with confidence.

Let’s Break it Down: Your Tax Form Personality

If you find yourself gravitating towards the W2 form, you likely value simplicity and reliability when it comes to your taxes. You appreciate the ease of having your employer handle the bulk of your tax reporting, allowing you to focus on other aspects of your financial life. On the other hand, if the W4 form speaks to you, you may enjoy the flexibility of adjusting your withholding allowances to better align with your financial goals and preferences. You see your tax form as a tool that can help you take control of your tax situation and potentially maximize your tax refund.

In the end, whether you lean towards the W2 or W4 form, understanding your tax form style can help you make informed decisions when it comes to your taxes. By embracing the dance between these two forms, you can navigate tax season with confidence and ensure that you are meeting your tax obligations while also taking advantage of any opportunities to optimize your tax situation. So, embrace your tax form personality and let your inner dancer shine as you waltz through tax season with ease.

Below are some images related to W2 Vs W4 Form

is there a difference between w2 and w4, w2 vs w4 form, , W2 Vs W4 Form.

is there a difference between w2 and w4, w2 vs w4 form, , W2 Vs W4 Form.