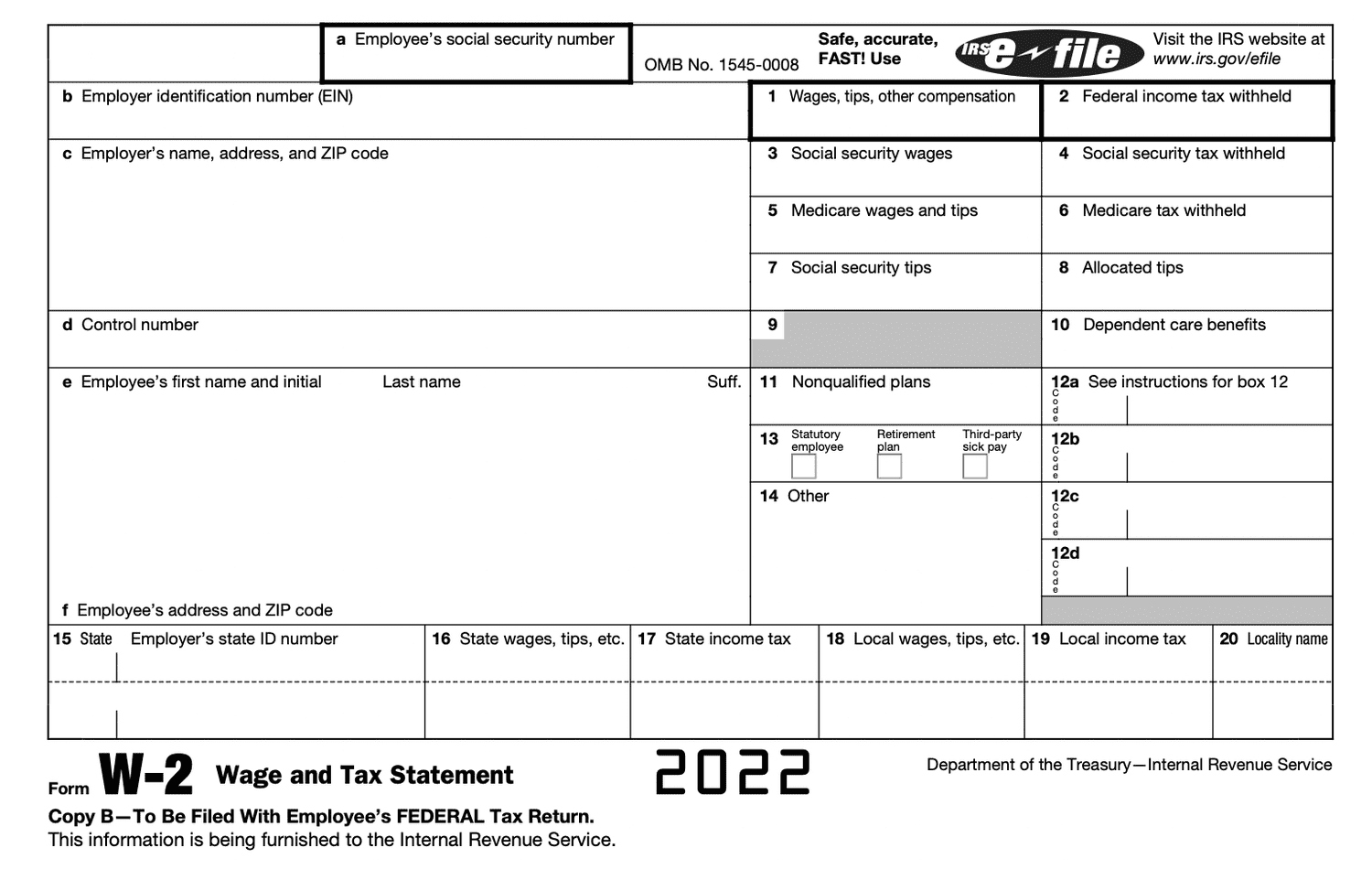

1099 W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Magic of the 1099 W2 Form

Hooray! It’s that time of year again – tax season! While the thought of filling out tax forms may not exactly spark joy for most people, understanding and mastering the 1099 W2 form can actually be quite empowering. This seemingly mysterious form holds the key to unlocking valuable information about your income and taxes. So, let’s dive in and demystify the magic of the 1099 W2 form!

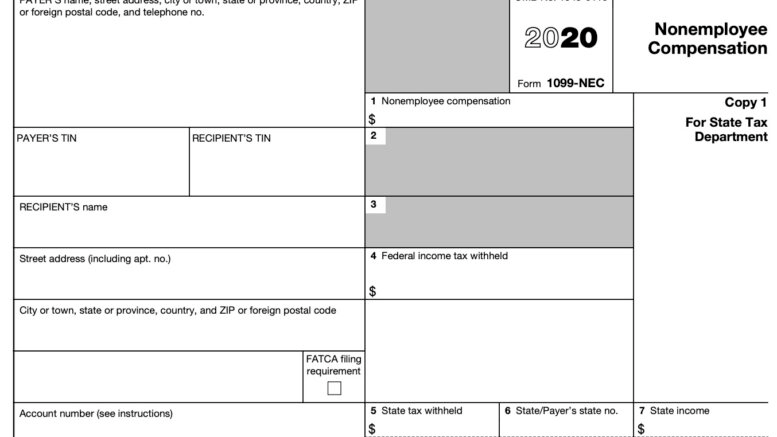

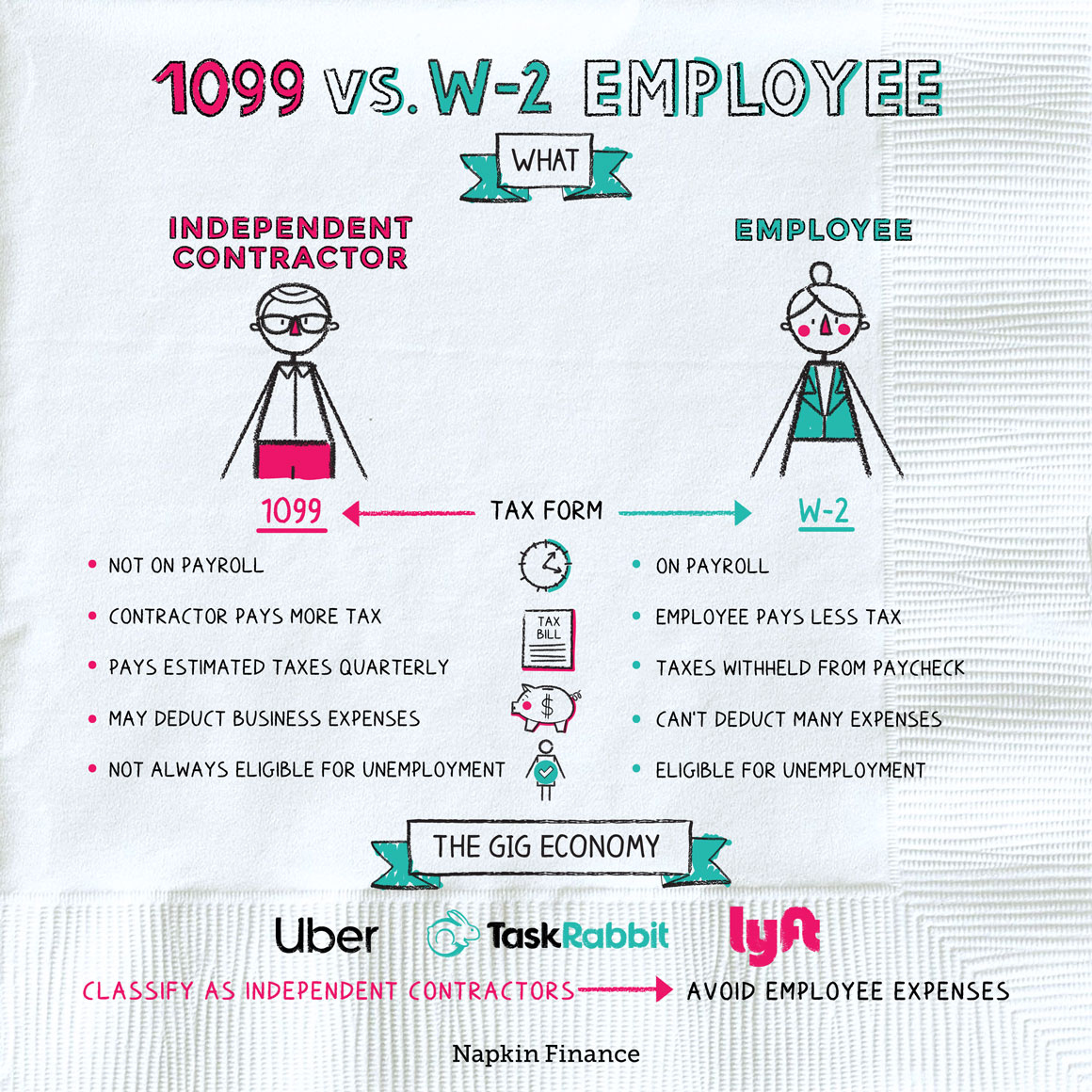

Unveiling the Mysteries of the 1099 W2 Form

Ah, the 1099 W2 form – a document that can either strike fear into the hearts of taxpayers or serve as a roadmap to financial clarity. But fear not, for we are here to guide you through the intricacies of this important form. The 1099 W2 form is used to report income earned from various sources, such as wages, salaries, tips, and other forms of compensation. It provides a detailed breakdown of your earnings and taxes withheld throughout the year, giving you a comprehensive view of your financial status.

Understanding the different sections of the 1099 W2 form is crucial to accurately reporting your income and filing your taxes. From Box 1, which shows your total wages, to Box 4, which displays the amount of federal income tax withheld, each section plays a vital role in painting a clear picture of your financial standing. By decoding the information contained in each box, you can gain valuable insights into your income streams and tax obligations. So, grab your magnifying glass and let’s unravel the mysteries of the 1099 W2 form together!

Discover the Secrets to Mastering Your 1099 W2 Form

Now that you’ve familiarized yourself with the ins and outs of the 1099 W2 form, it’s time to put your newfound knowledge to good use. By mastering the art of deciphering your 1099 W2 form, you can take control of your financial destiny and make informed decisions about your taxes. Whether you’re a seasoned taxpayer or a first-time filer, understanding the intricacies of this form can help you maximize deductions, avoid penalties, and ensure compliance with tax laws. So, roll up your sleeves and get ready to unlock the magic of the 1099 W2 form – you’ve got this!

In conclusion, the 1099 W2 form may seem like a daunting document at first glance, but with a little patience and guidance, you can demystify its contents and harness its power to your advantage. By unveiling the mysteries of the 1099 W2 form and mastering its secrets, you can navigate the complex world of taxes with confidence and ease. So, embrace the magic of the 1099 W2 form and let it be your trusted companion on your journey to financial success. Happy filing!

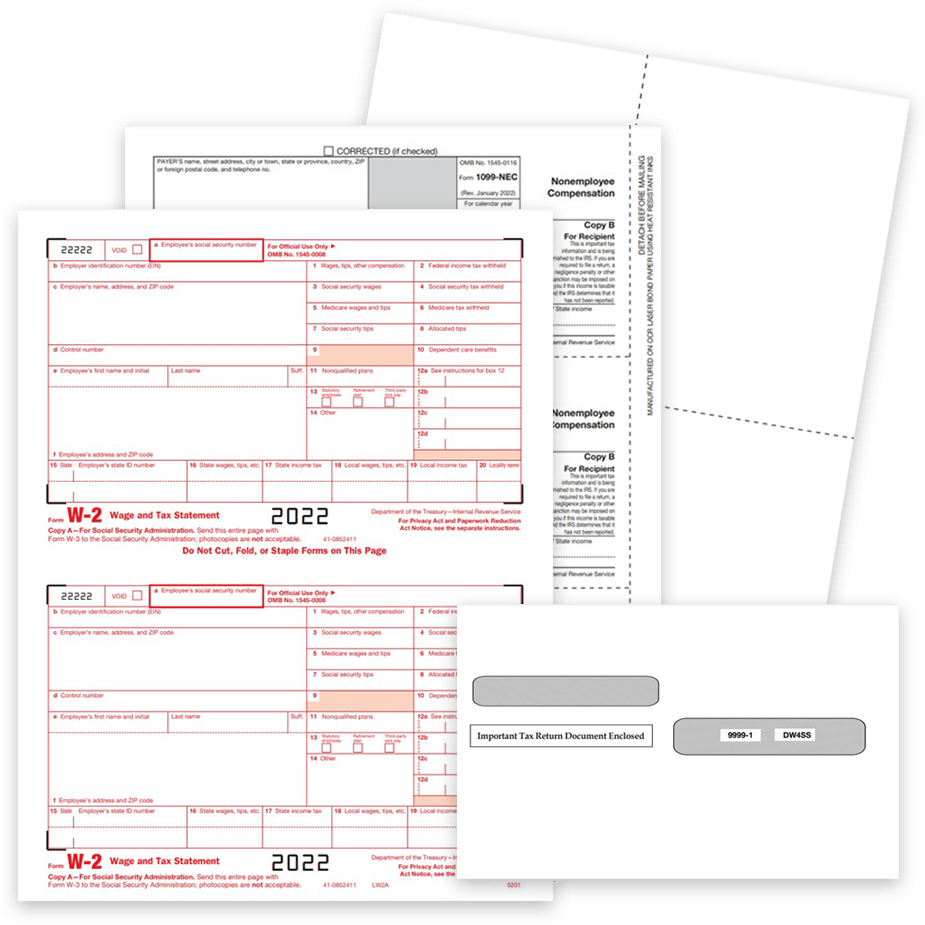

Below are some images related to 1099 W2 Form

1099 vs w2 form, 1099 w2 form, can i file my 1099 with my w2, define w2 1099 form, do 1099 employees get a w2, , 1099 W2 Form.

1099 vs w2 form, 1099 w2 form, can i file my 1099 with my w2, define w2 1099 form, do 1099 employees get a w2, , 1099 W2 Form.