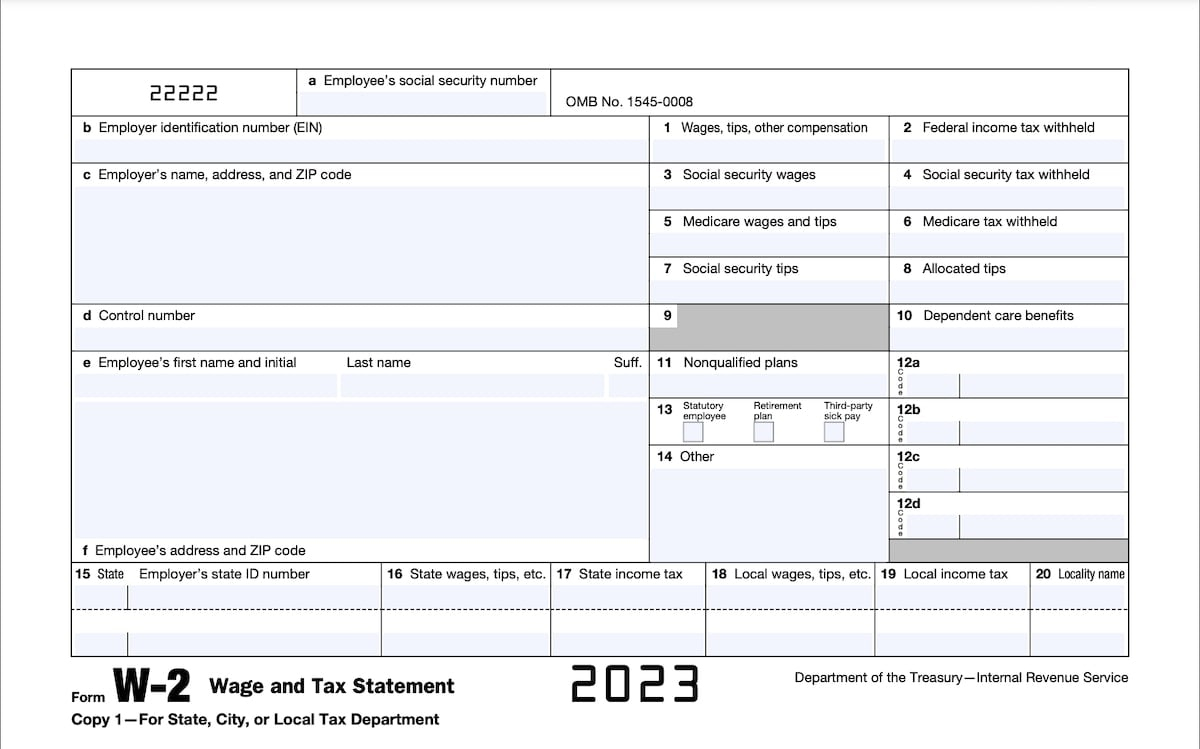

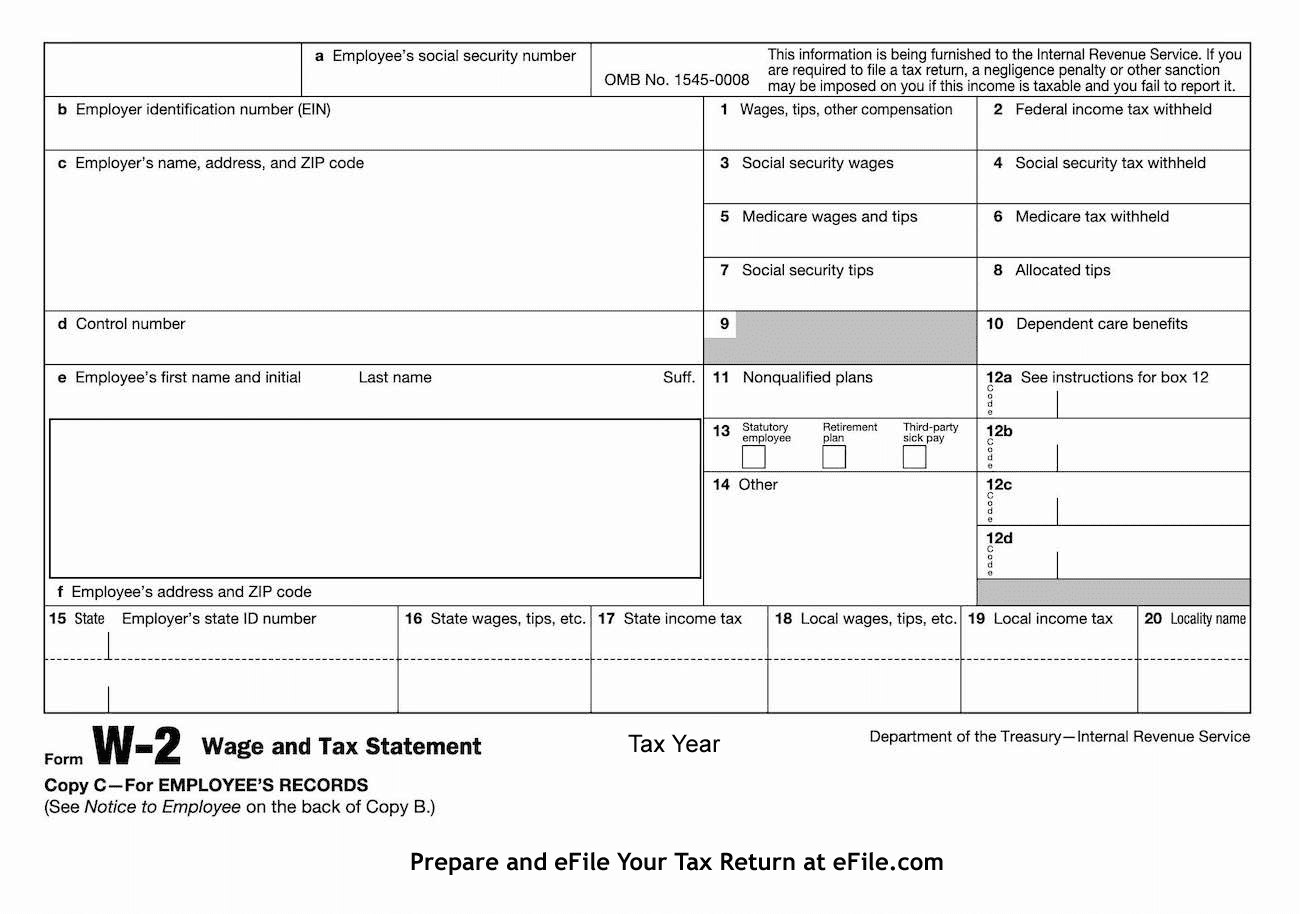

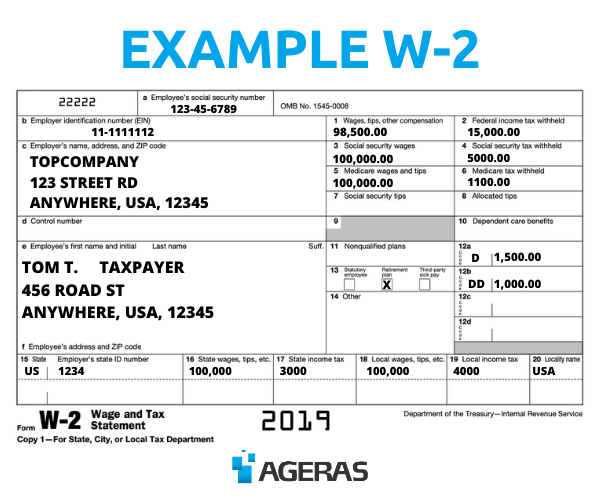

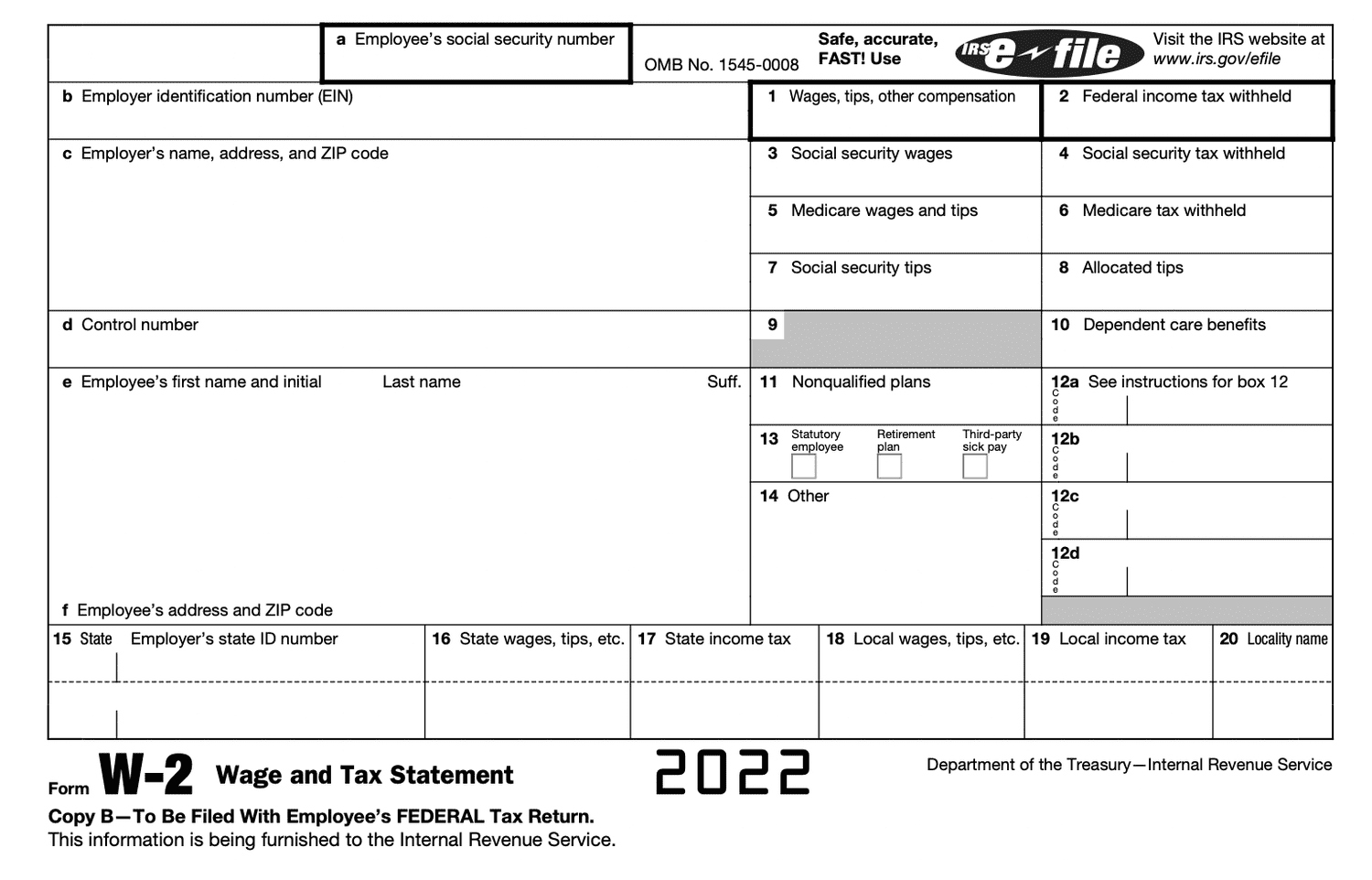

When Do You Receive A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Ready to Glow Up: It’s Time to Shine with Your W2 Form!

Are you ready to take your financial game to the next level? It’s time to shine with your W2 form! This magical piece of paper holds the key to unlocking your tax refunds and getting a clear picture of your earnings for the year. By getting your W2 form early, you can start planning your financial goals and dreams with confidence and clarity. So, get ready to glow up and show the world what you’re made of!

Brighten Your Day: Tips for Getting Your W2 Form Early!

1. **Stay in the Know**: Keep an eye out for communication from your employer regarding the distribution of W2 forms. Make sure your contact information is up to date so you don’t miss any important updates or deadlines.

2. **Be Proactive**: Don’t wait around for your W2 form to magically appear in your mailbox. Reach out to your employer or HR department to inquire about the expected timeline for W2 distribution. You can also check online portals or payroll systems for electronic copies.

3. **Double Check**: Once you receive your W2 form, take a moment to review it for any errors or discrepancies. It’s better to catch any mistakes early on so you can get them corrected before filing your taxes. And remember, if you have multiple jobs or sources of income, make sure you receive a W2 from each employer.

Conclusion

Getting your W2 form early is not just about checking off another task on your to-do list. It’s about taking control of your financial future and setting yourself up for success. So, don’t be afraid to shine bright like a diamond and show the world what you’re capable of. With a little bit of planning and proactive effort, you can make this tax season your best one yet!

Below are some images related to When Do You Receive A W2 Form

when do we start receiving w2 forms, when do you fill out a w2 form, when do you get a w2 form, when do you get your w2 form, when do you receive a w2 form, , When Do You Receive A W2 Form.

when do we start receiving w2 forms, when do you fill out a w2 form, when do you get a w2 form, when do you get your w2 form, when do you receive a w2 form, , When Do You Receive A W2 Form.