When Are W2 And 1099 Forms Due – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Rocking Into Tax Season

Are you ready to rock and roll into tax season? It’s that time of year again when we all gather our receipts, statements, and documents to tackle our taxes. While it may not be the most exciting task, it’s essential to stay on top of your finances and ensure you meet all the necessary deadlines. With a little preparation and organization, you can breeze through tax season like a pro and maybe even get a nice refund at the end!

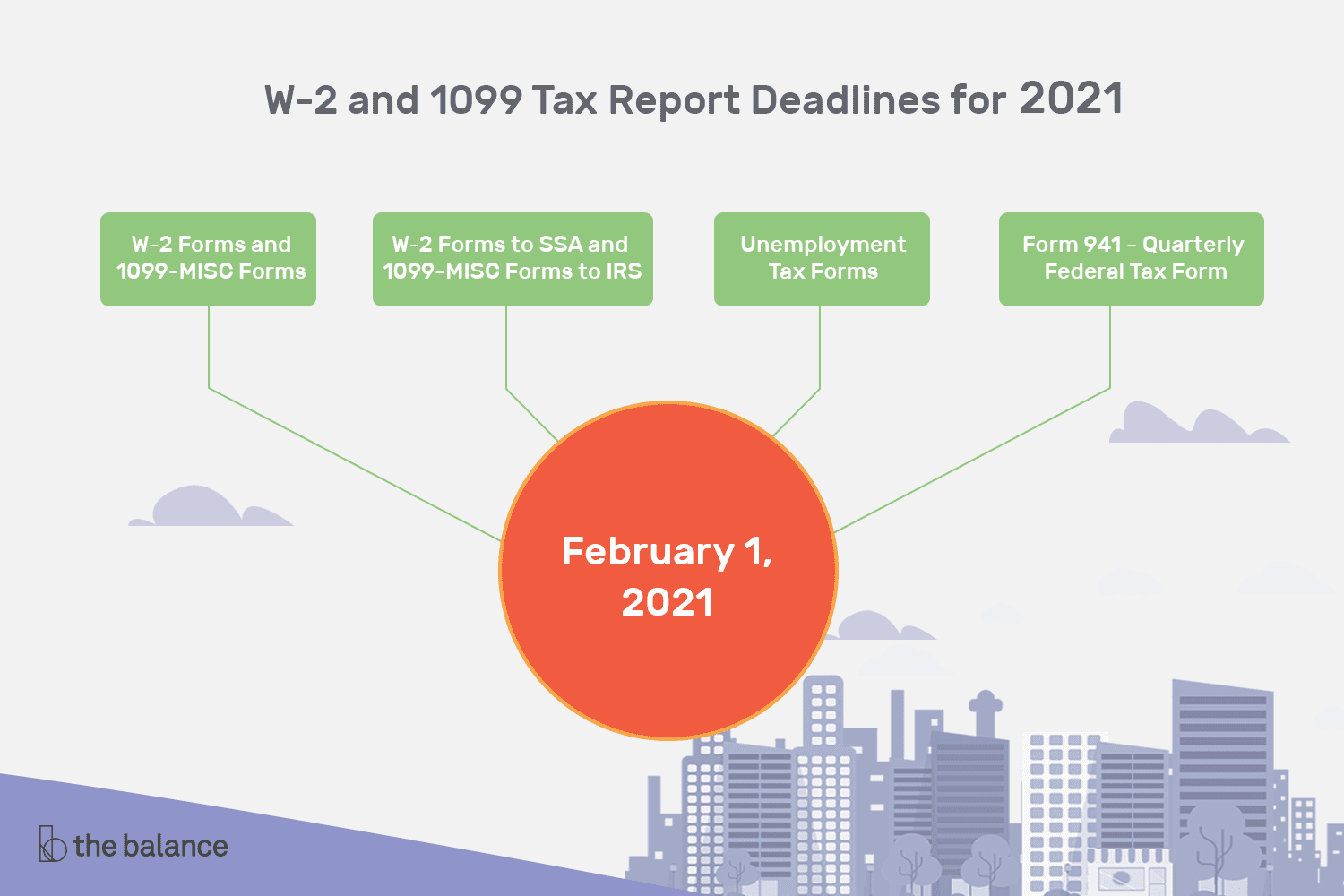

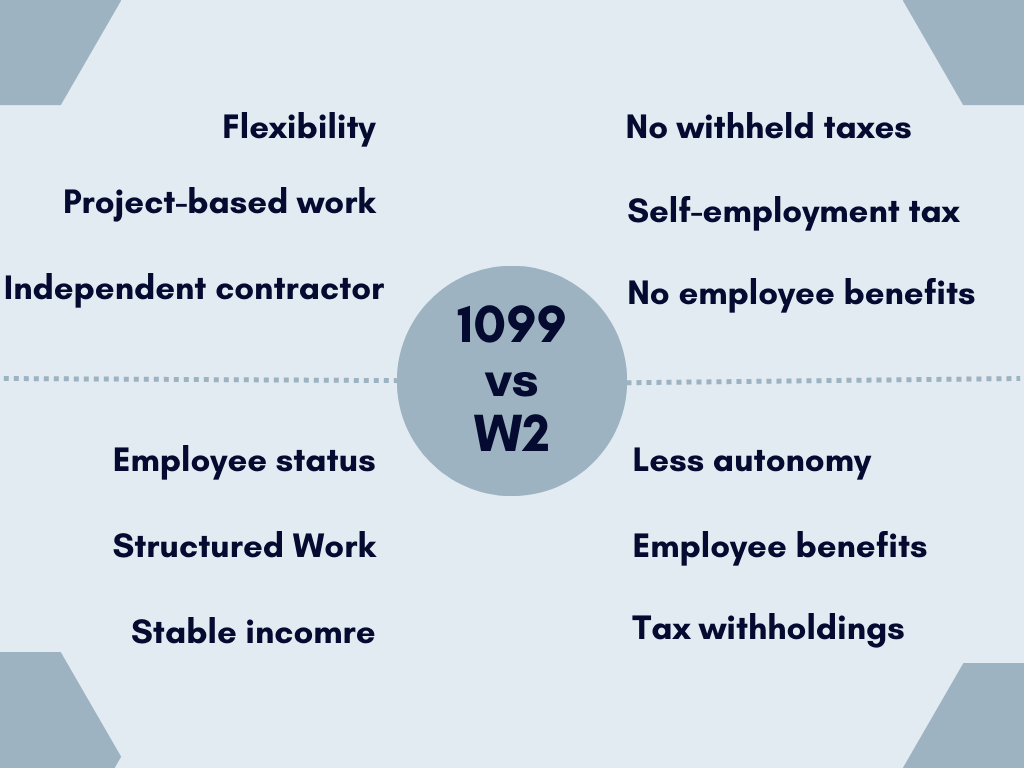

Don’t Miss W2 and 1099 Deadlines!

One of the most critical aspects of tax season is ensuring you receive all the necessary forms from your employers and clients. For employees, the W2 form is essential for reporting your income and taxes withheld throughout the year. Similarly, if you are a freelancer or contractor, you will need to gather all your 1099 forms from clients who paid you more than $600 in a year. These forms are crucial for accurately reporting your income and ensuring you pay the correct amount of taxes. Be sure to keep an eye out for these forms in your mailbox or inbox and reach out to your employer or client if you haven’t received them by the end of January.

Conclusion

Tax season doesn’t have to be a daunting task if you stay organized and on top of deadlines. By preparing early, gathering all necessary forms, and staying informed about the latest tax laws, you can make the process smooth and stress-free. So, get ready to rock tax season by ensuring you don’t miss the W2 and 1099 deadlines. With a little effort and attention to detail, you’ll be on your way to filing your taxes accurately and efficiently. Happy tax season, rockstars!

Below are some images related to When Are W2 And 1099 Forms Due

do i have to file my w2 and 1099 together, w2 and 1099 filing deadline, when are w2 and 1099 forms due, when should 1099 forms be received, , When Are W2 And 1099 Forms Due.

do i have to file my w2 and 1099 together, w2 and 1099 filing deadline, when are w2 and 1099 forms due, when should 1099 forms be received, , When Are W2 And 1099 Forms Due.