What To Do If I Lost My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Don’t Panic, We’ve Got You Covered!

Losing your W2 form can be a stressful experience, but don’t worry – we’re here to help! Whether you misplaced it or never received it in the first place, there are steps you can take to get a copy of your W2 form and ensure you can file your taxes on time. So take a deep breath and relax, because we’ve got all the information you need to navigate this situation with ease.

Losing Your W2 Form Isn’t the End of the World!

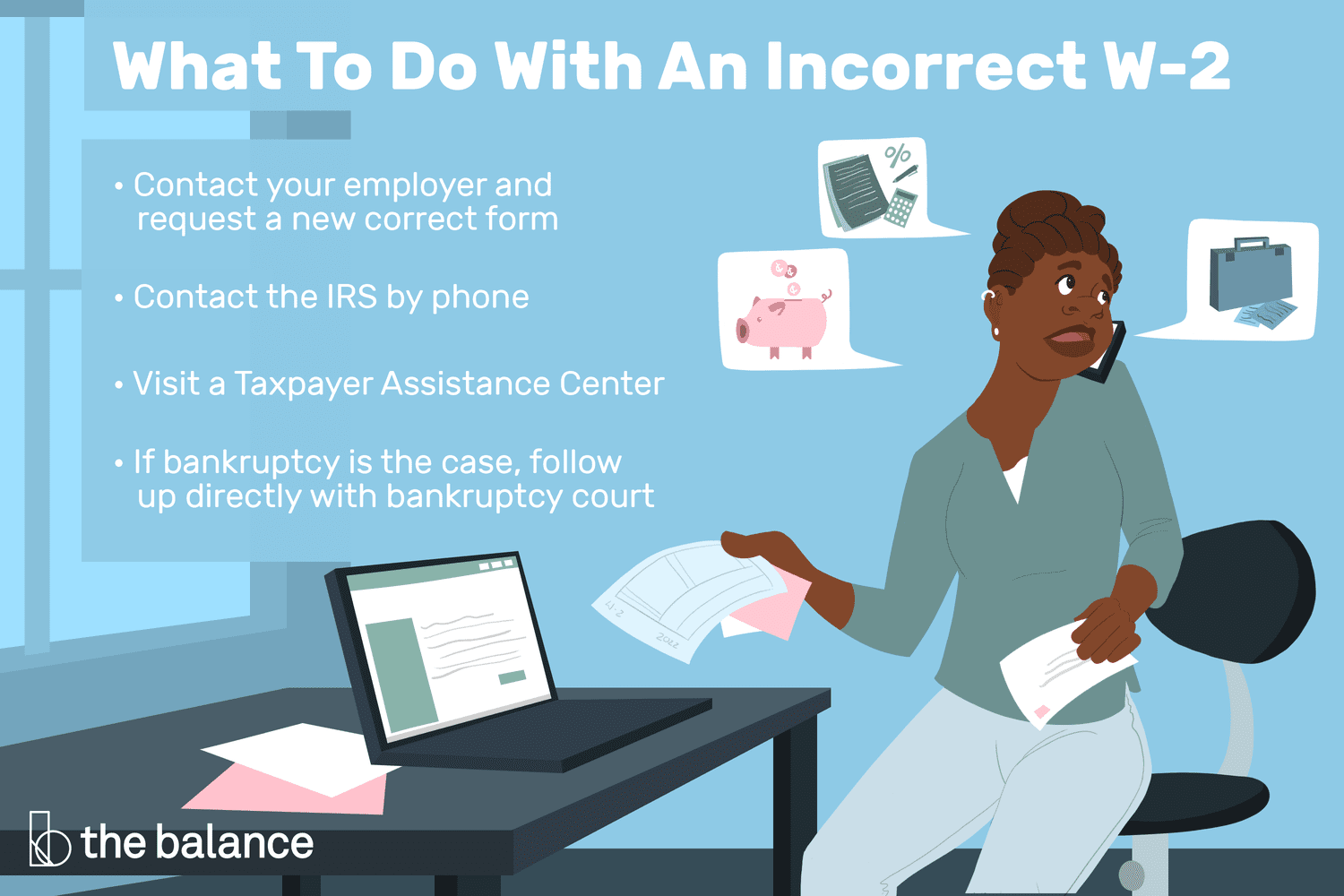

So you’ve realized that your W2 form is nowhere to be found – but fear not, all hope is not lost! The first thing you should do is reach out to your employer. They are required by law to provide you with a copy of your W2 form, so don’t hesitate to ask for their assistance. If you still can’t get ahold of your W2 form, you can contact the IRS for help. They can provide you with a copy of your W2 form or give you guidance on how to proceed with filing your taxes without it.

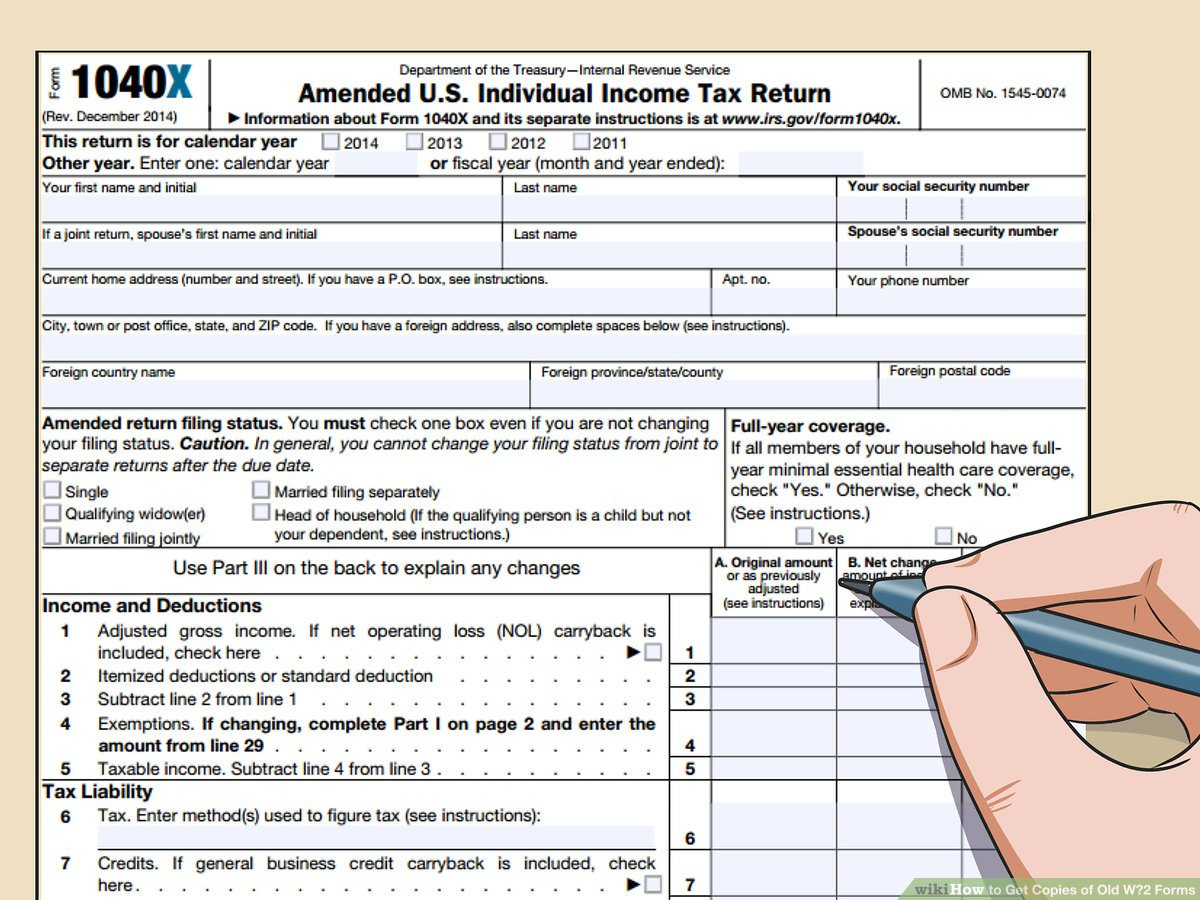

If all else fails, you can request a transcript of your W2 form from the IRS. This document will contain all the necessary information you need to file your taxes accurately, even if you don’t have the physical form in hand. Just visit the IRS website and follow the instructions for requesting a transcript. Remember, it’s important to stay calm and proactive in this situation. With a little patience and perseverance, you’ll have everything you need to complete your taxes successfully, even without your original W2 form.

In conclusion, while losing your W2 form may seem like a daunting setback, it’s definitely not the end of the world. By staying organized, reaching out to the appropriate parties for help, and exploring alternative options, you can easily overcome this obstacle and meet your tax filing obligations. So don’t let a missing W2 form dampen your spirits – with the right approach, you’ll be back on track in no time. Remember, we’re here to support you every step of the way. You’ve got this!

Below are some images related to What To Do If I Lost My W2 Form

what happens if i lost my w2 form, what if i lost my w-2 form, what should i do if i lost my w2 form, what should you do if you lost your w2, what to do if i lost my w2, , What To Do If I Lost My W2 Form.

what happens if i lost my w2 form, what if i lost my w-2 form, what should i do if i lost my w2 form, what should you do if you lost your w2, what to do if i lost my w2, , What To Do If I Lost My W2 Form.