What Is W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Mysteries of the W2 Form

Ah, the infamous W2 form – the document that sparks fear and confusion in the hearts of many employees come tax season. But fear not, for we are here to unravel the mysteries of this enigmatic piece of paper. Join us as we delve into the secrets of the W2 form and discover what lies beneath its seemingly complex facade.

Decoding the Enigma: The W2 Form Unveiled

The W2 form is not just a random piece of paper that your employer hands you at the end of the year – it is a crucial document that provides detailed information about your earnings and taxes withheld. This form is essential for filing your taxes accurately and ensuring that you receive any refunds or credits that you may be entitled to. So, what exactly does all that information on the W2 form mean? Let’s break it down.

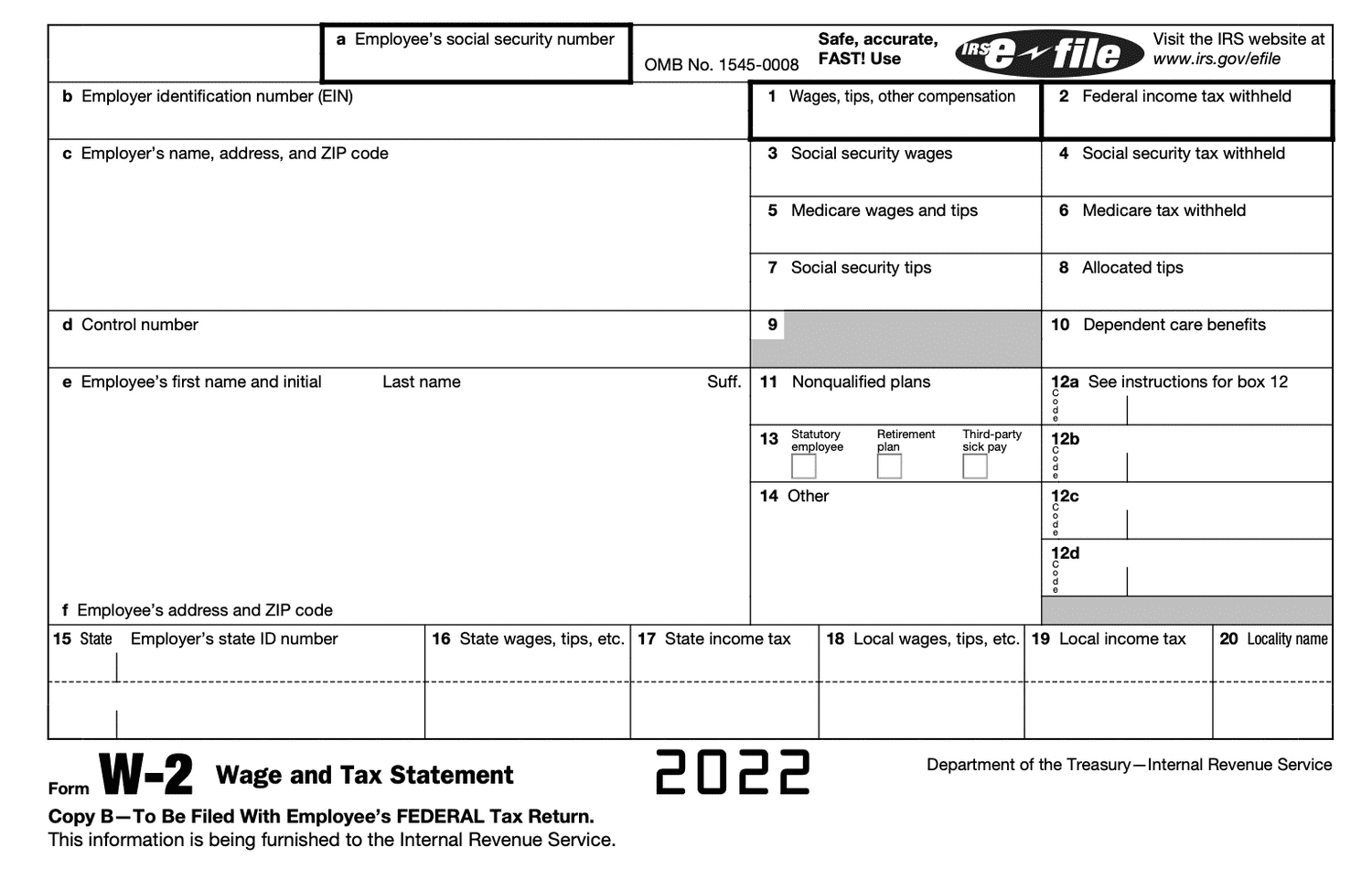

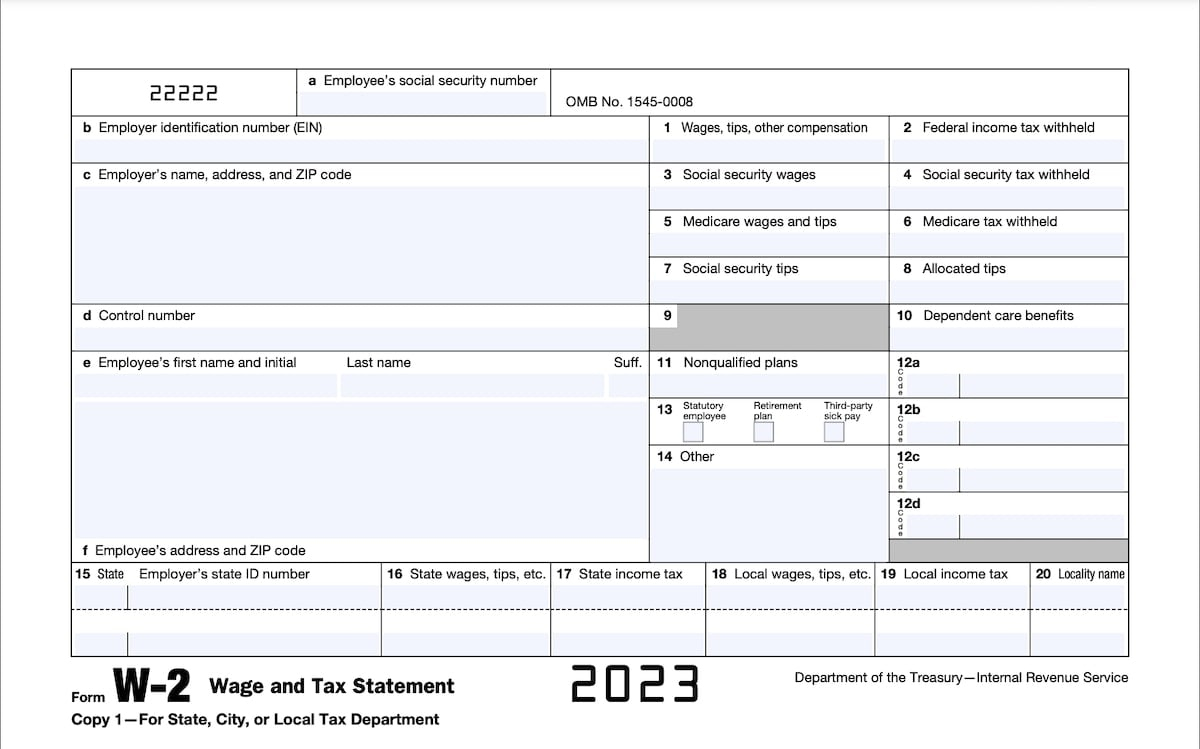

The first section of the W2 form includes your personal information, such as your name, address, and social security number. This is followed by boxes that detail your wages, tips, and other compensation, as well as any federal income tax that has been withheld from your paychecks throughout the year. Additionally, the W2 form includes information about any retirement plan contributions, health insurance premiums, and other deductions that may affect your taxable income. Understanding these numbers is key to ensuring that you file your taxes correctly and avoid any potential discrepancies with the IRS.

Delving into the Secrets of the W2 Form

One of the most important numbers on the W2 form is your total earnings, which are typically listed in box 1. This figure represents the total amount of money you earned from your employer during the tax year, including wages, bonuses, commissions, and other forms of compensation. This number is used to calculate your taxable income and determine how much you owe in federal and state taxes. It’s important to review this number carefully to ensure that it accurately reflects your earnings for the year.

Another key piece of information on the W2 form is your federal income tax withholding, which is listed in box 2. This number represents the total amount of federal income tax that has been withheld from your paychecks throughout the year. This amount is based on the information you provided on your W4 form when you first started working for your employer. If you had too much tax withheld, you may be entitled to a refund. On the other hand, if you had too little tax withheld, you may owe money when you file your taxes. Understanding how this number is calculated can help you plan for any potential tax liabilities or refunds.

In conclusion, the W2 form may seem like a daunting document at first glance, but with a little bit of knowledge and guidance, you can easily unravel its mysteries and use it to your advantage come tax season. By understanding the information contained in your W2 form and how it affects your tax liability, you can ensure that you file your taxes accurately and maximize any potential refunds or credits. So, fear not the W2 form – embrace it as a tool to help you navigate the murky waters of tax season with confidence and ease.

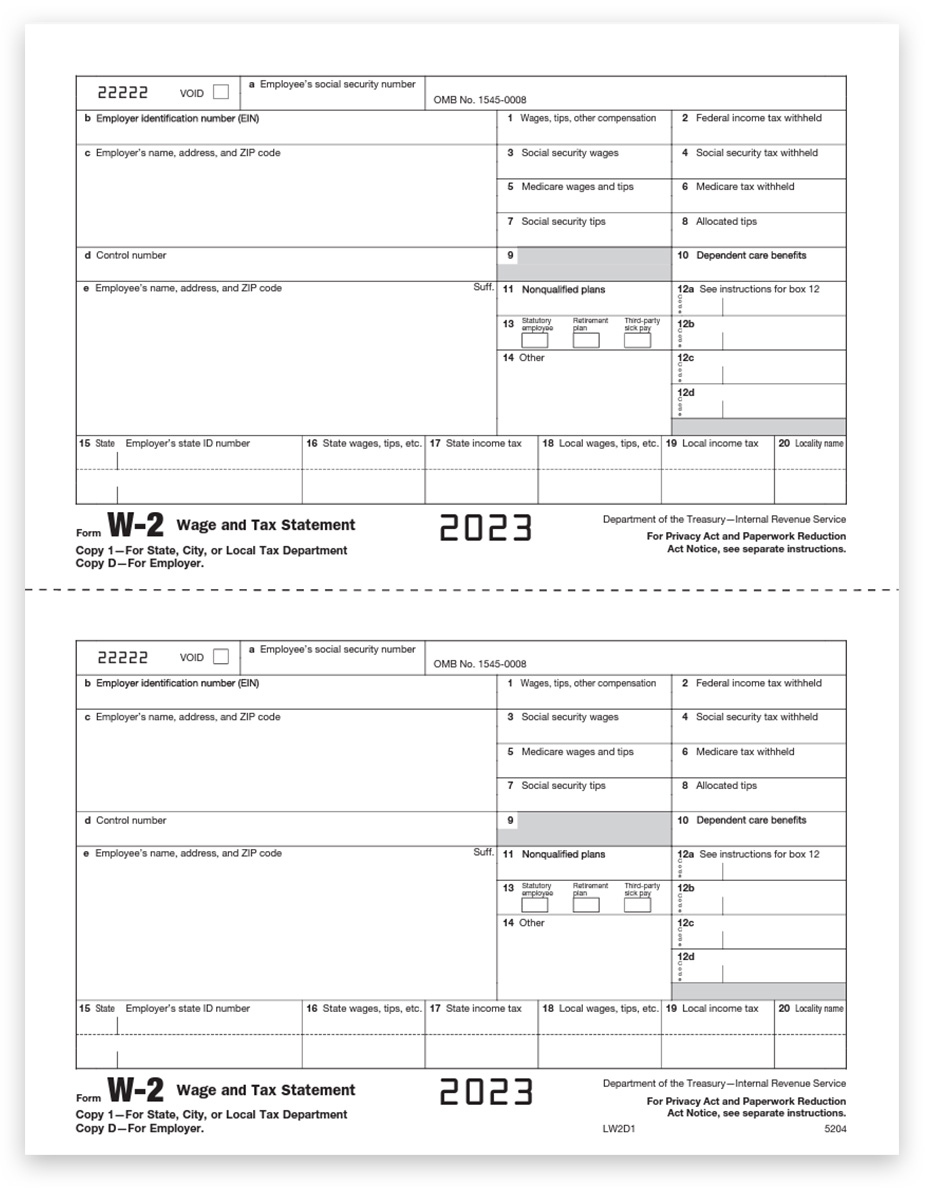

Below are some images related to What Is W2 Form

what does a w2 form tell you, what is the purpose of the w2 form, what is w2 form, what is w2 form 2023, what is w2 form called, , What Is W2 Form.

what does a w2 form tell you, what is the purpose of the w2 form, what is w2 form, what is w2 form 2023, what is w2 form called, , What Is W2 Form.