What Is 1099 Form Vs W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding Tax Docs: The 1099 Form Vs W2

Are you ready to embark on a thrilling adventure into the world of tax forms? Today, we’re going to unravel the mystery behind two common tax documents: the 1099 and the W2. Buckle up, because we’re about to dive deep into the battle of the tax documents!

Unraveling the Mystery: Understanding Tax Forms

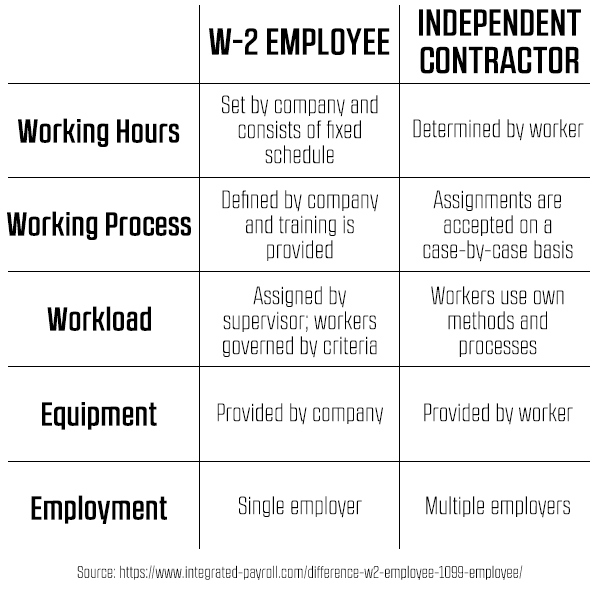

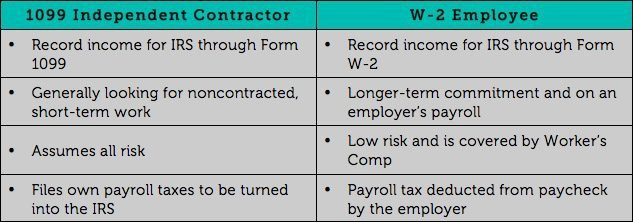

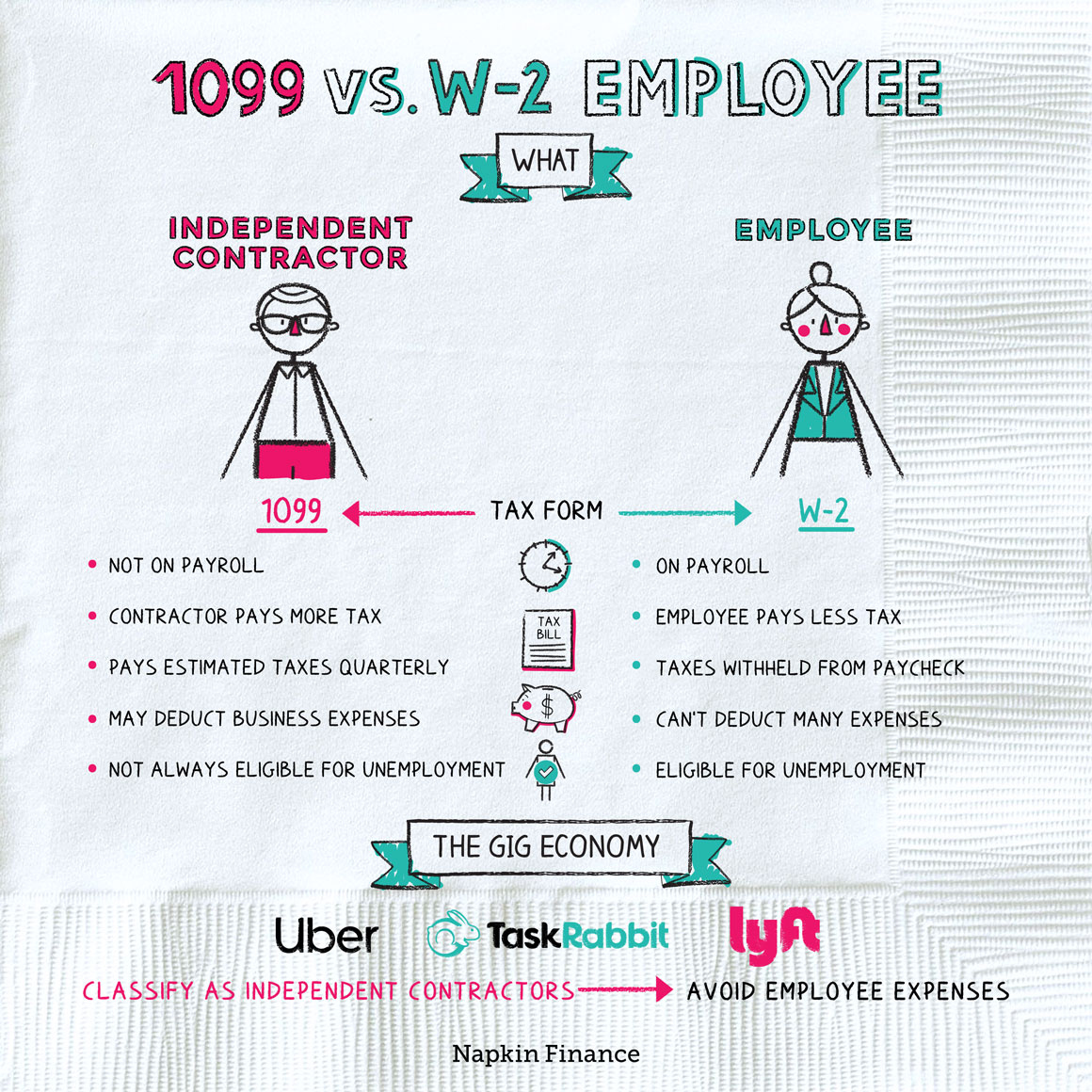

Tax season can be daunting, but understanding the different tax forms can make the process a whole lot easier. Let’s start with the W2 form. This form is typically provided by your employer and outlines your earnings, taxes withheld, and other important information related to your employment. It’s like a snapshot of your income and taxes for the year.

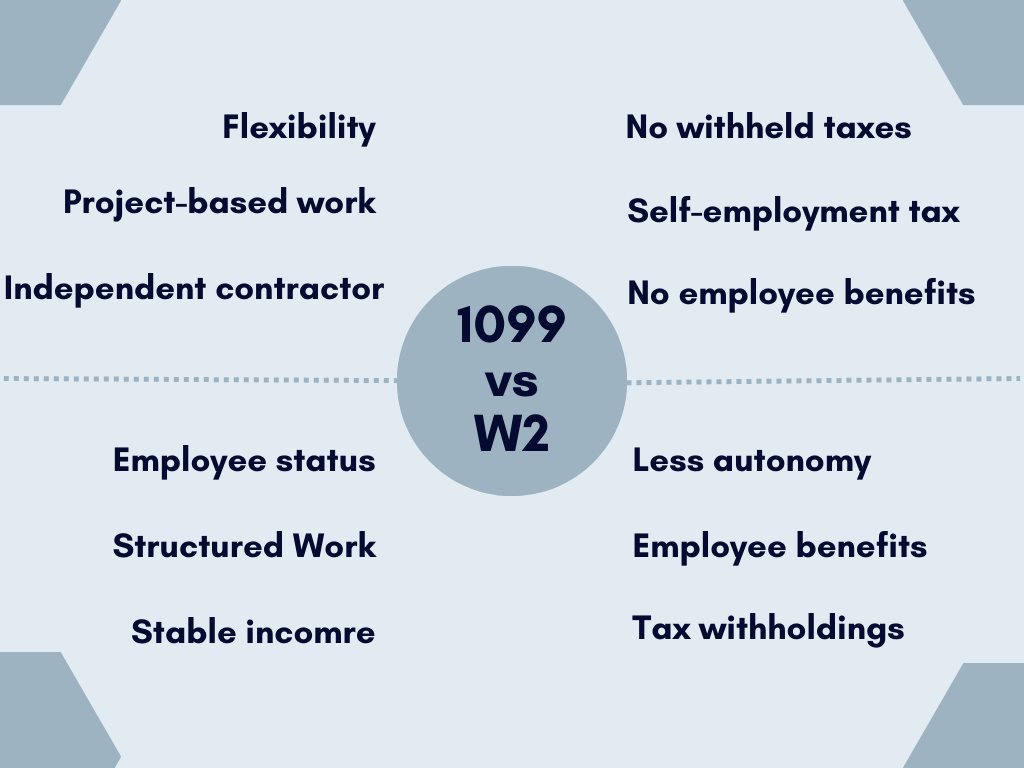

On the other hand, the 1099 form is used for individuals who are not employees, such as freelancers or independent contractors. This form reports income earned from sources other than traditional employment, like freelance work or investments. Unlike the W2, taxes are not withheld from 1099 income, so freelancers are responsible for paying their own taxes throughout the year.

When it comes to tax deductions and benefits, the W2 form typically offers more opportunities for deductions, such as healthcare premiums and retirement contributions. However, 1099 earners can still take advantage of deductions related to their self-employment income, such as business expenses or home office deductions. Understanding these nuances can help you maximize your tax benefits and ensure you’re not leaving any money on the table come tax time.

The Battle of the Tax Documents: 1099 vs W2

In the epic battle of the tax documents, both the 1099 and the W2 have their strengths and weaknesses. The W2 provides a clear snapshot of your earnings and taxes withheld, making it easier to file your taxes. However, for freelancers and independent contractors, the 1099 offers more flexibility and the opportunity to take advantage of unique tax benefits.

Ultimately, whether you receive a 1099 or a W2, the key is to understand the information presented on these forms and how it impacts your tax situation. By decoding these tax documents, you can navigate tax season with confidence and ensure you’re maximizing your tax benefits. So, grab your sword and shield (or calculator and pen) and conquer tax season like a true tax warrior!

Below are some images related to What Is 1099 Form Vs W2

is 1099 better than w2, what is 1099 form vs w2, what the difference between 1099 and w2, when to use 1099 vs w2, , What Is 1099 Form Vs W2.

is 1099 better than w2, what is 1099 form vs w2, what the difference between 1099 and w2, when to use 1099 vs w2, , What Is 1099 Form Vs W2.