What If I Lost My W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Don’t Fret! Your W2s are Missing?

Have you found yourself in a panic because you have lost your W2s? Don’t worry, you are not alone! It’s a common mistake that can happen to anyone. Your W2 forms are important documents that you will need to file your taxes accurately and on time. But don’t let the stress get to you – there are easy ways to retrieve your lost W2s and get back on track!

Here’s How to Easily Retrieve Them!

The first step you should take is to reach out to your employer. They are required to provide you with a copy of your W2 if you request it. Most companies keep records of their employees’ W2 forms for several years, so it shouldn’t be too difficult for them to provide you with a new copy. If for some reason you are unable to get in touch with your employer or they are unable to provide you with a copy, you can contact the IRS directly. They will assist you in obtaining the necessary information to file your taxes properly.

Another option you have is to use an online service to retrieve your W2 forms. There are many websites and services available that specialize in helping individuals retrieve their lost tax documents. These services are quick, easy, and usually free of charge. Simply provide them with the necessary information and they will do the work for you. This option is especially helpful if you are running out of time before the tax deadline and need your W2 forms quickly.

If all else fails, you can always file for an extension with the IRS. This will give you more time to locate your W2 forms and file your taxes without facing penalties. However, it is important to note that you will still need to estimate your income and taxes owed when filing for an extension. Remember, losing your W2 forms is not the end of the world. Stay calm, follow these steps, and you will be back on track in no time!

In conclusion, losing your W2 forms is a common mistake that can happen to anyone. But there is no need to panic! By reaching out to your employer, contacting the IRS, using online services, or filing for an extension, you can easily retrieve your lost W2 forms and file your taxes accurately and on time. So take a deep breath, follow these steps, and get ready to conquer tax season with confidence!

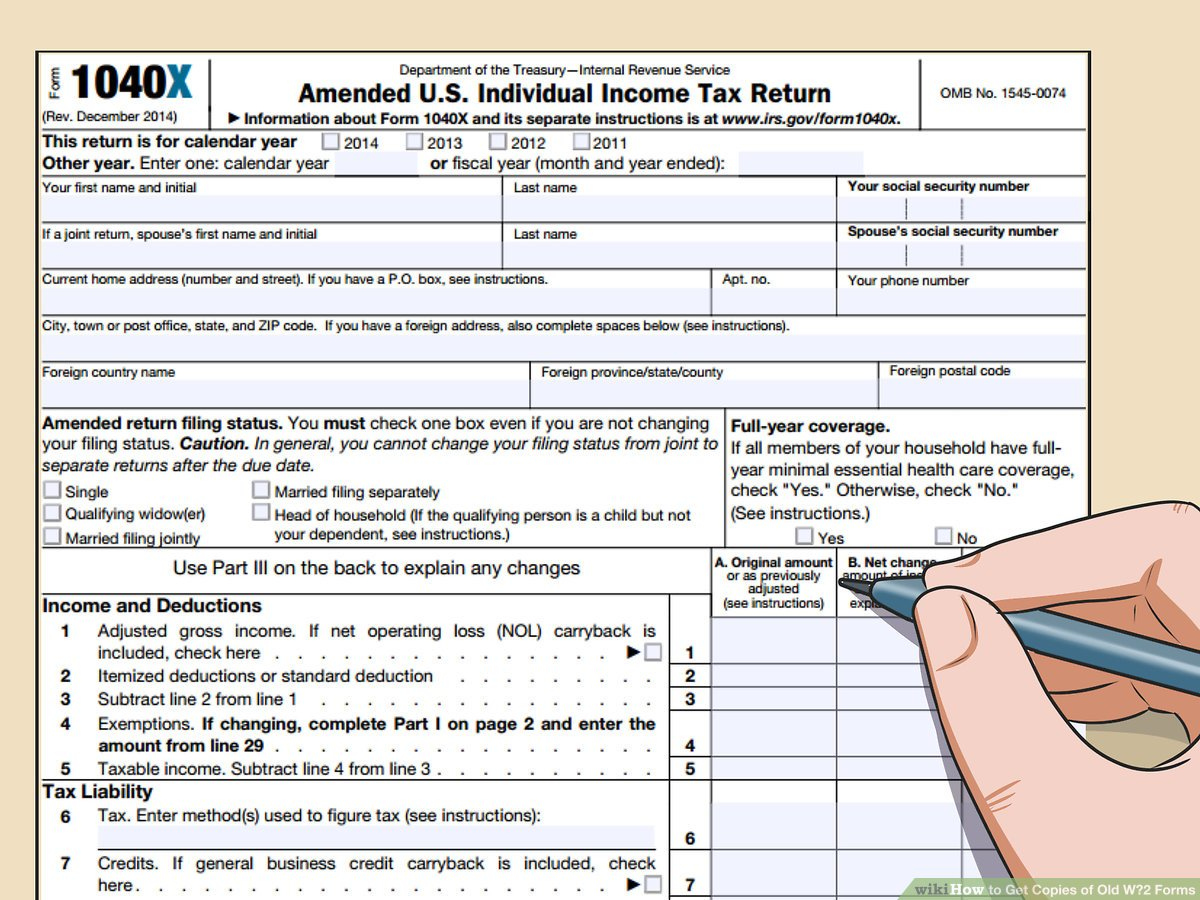

Below are some images related to What If I Lost My W2 Forms

what happens if i lost my w2, what happens if i lost my w2 form, what if i forgot to file one of my w2 forms, what if i lose my w-2 form, what if i lost my w2 form, , What If I Lost My W2 Forms.

what happens if i lost my w2, what happens if i lost my w2 form, what if i forgot to file one of my w2 forms, what if i lose my w-2 form, what if i lost my w2 form, , What If I Lost My W2 Forms.