W2 Tax Form 2016 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the W2 Magic: Your Guide to Tax Form 2016

Tax season can be a daunting time for many, but fear not! The mystical world of W2 forms holds the key to unlocking the secrets of your taxes. As you delve into the enchanted realm of tax form 2016, you will discover the power of knowledge and understanding when it comes to filing your taxes. So grab your wand (or pen) and let’s embark on this magical journey together!

The Enchanting World of W2 Forms

Ah, the W2 form – a magical document that holds the key to your financial past. This mystical form provides a snapshot of your earnings, taxes withheld, and other important financial information from the previous year. It’s like a map that guides you through the labyrinth of tax filing, helping you navigate through deductions, credits, and potential refunds. Embrace the magic of the W2 form and let it be your guide to a stress-free tax season.

Unwrapping your W2 form may seem like opening a Pandora’s box of numbers and codes, but fear not! Each section of the form has its own special meaning and purpose. From Box 1 (Wages, tips, other compensation) to Box 12 (Codes for various benefits and reimbursements), each box holds a piece of the puzzle that is your tax return. With a little patience and a sprinkle of fairy dust (or coffee), you can decode the secrets hidden within your W2 form and emerge victorious in the battle against taxes.

As you traverse through the enchanted forest of tax form 2016, remember that knowledge is power. Understanding the information contained in your W2 form is the first step towards a successful tax filing experience. So don your wizard hat (or accountant’s visor) and arm yourself with the wisdom of tax codes and regulations. With a little magic and a lot of determination, you can conquer your taxes with ease and confidence.

Unveiling the Secrets of Tax Form 2016

The secrets of tax form 2016 are waiting to be unveiled, and it all begins with your W2 form. This enchanted document holds the key to your financial kingdom, providing you with the information you need to conquer your taxes. Take the time to study your W2 form and familiarize yourself with its contents. By doing so, you will be better equipped to navigate the twists and turns of tax filing and ensure that you don’t leave any money on the table.

One of the most important secrets hidden within your W2 form is the amount of taxes withheld from your paycheck throughout the year. This information is crucial in determining whether you will receive a refund or owe additional taxes come filing season. By scrutinizing your W2 form and understanding the implications of each box and code, you can take control of your financial destiny and make informed decisions when it comes to filing your taxes.

In the world of tax form 2016, knowledge truly is power. By arming yourself with the understanding of your W2 form and its contents, you can navigate the treacherous waters of tax season with confidence and ease. So embrace the magic of tax form 2016, and let your W2 form be your guide to financial success. Remember, with a little bit of pixie dust (or calculators), you can conquer your taxes and emerge victorious in the quest for financial security.

In conclusion, the world of tax form 2016 may seem daunting at first, but with a little magic and a dash of determination, you can unravel its secrets and emerge victorious in the battle against taxes. Let your W2 form be your guide through this enchanted realm, and may the knowledge and understanding you gain lead you to financial success. So grab your cloak of confidence and your wand of wisdom, and may your tax season be filled with prosperity and joy!

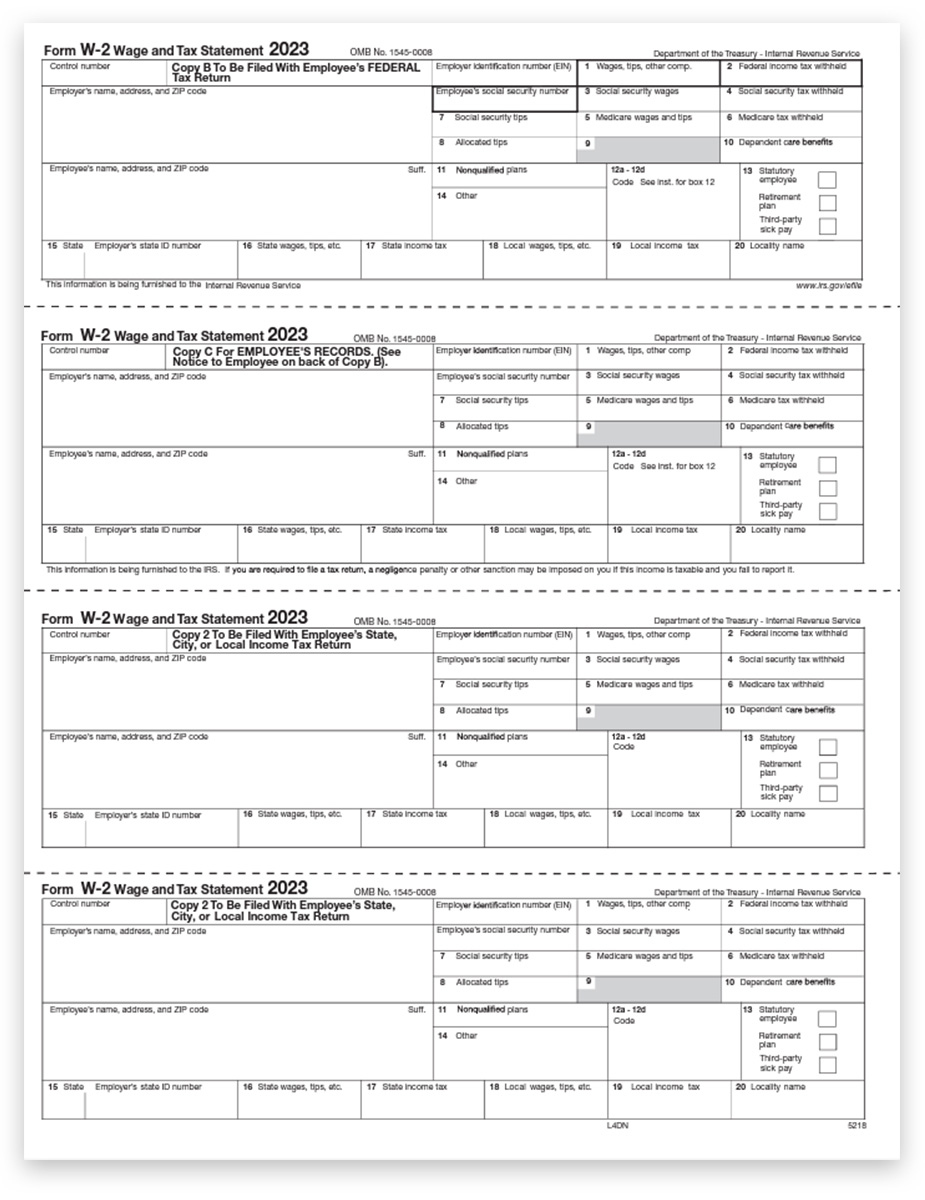

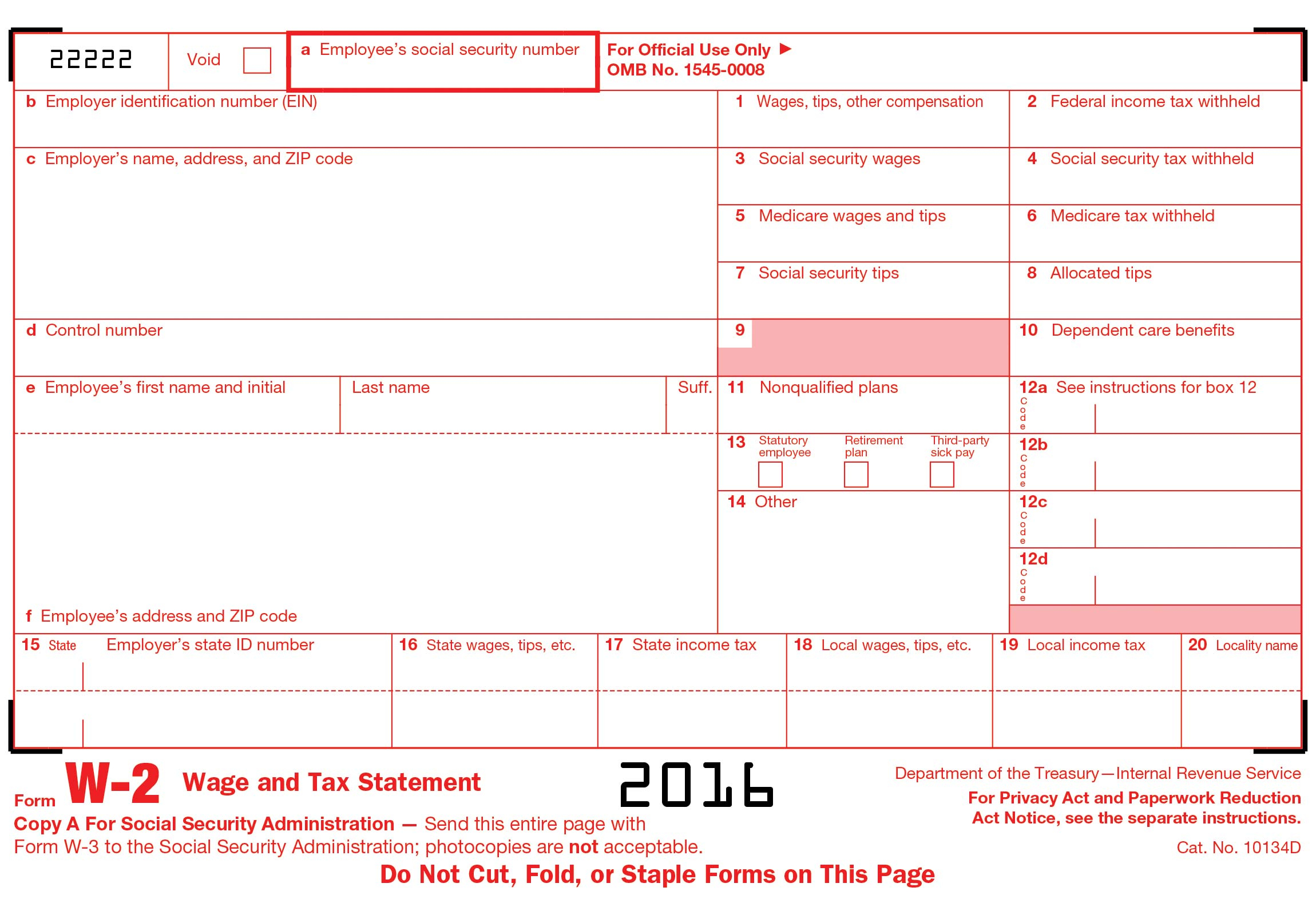

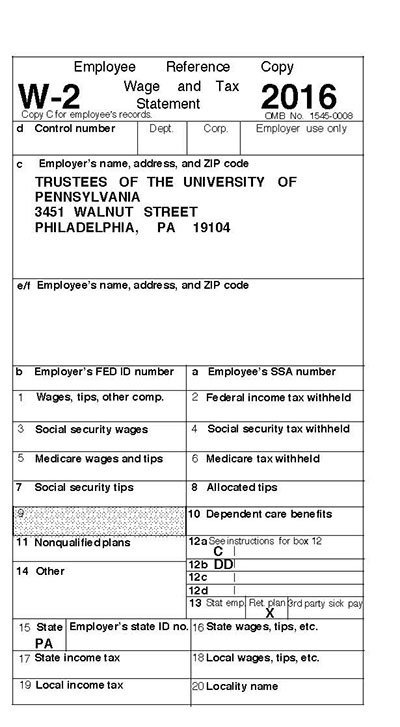

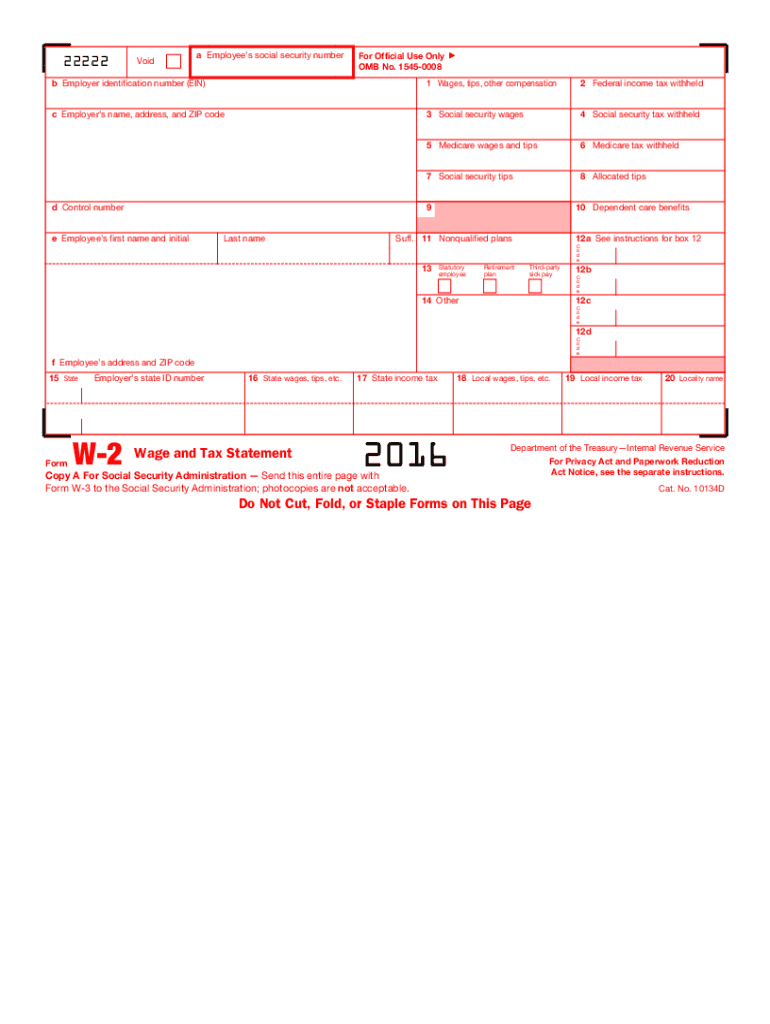

Below are some images related to W2 Tax Form 2016

, W2 Tax Form 2016.

, W2 Tax Form 2016.