W2 Form Ucsd – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the W2 Magic: Your Guide to UCSD’s Tax Forms

Tax season can often feel like diving into a world of paperwork and confusion, but fear not! At UCSD, the process is made easier with the enchanting world of tax forms. From the W2 Wonder to the 1042-S Spectacle, navigating your tax documents doesn’t have to be a daunting task. Let’s dive into the magic of UCSD’s tax forms and unravel the mysteries together!

The Enchanting World of UCSD’s Tax Forms

As you receive your W2 forms from UCSD, it’s like opening a treasure chest filled with valuable information about your earnings and tax deductions. The W2 form is a key document that provides you with a summary of your taxable income, federal and state tax withholdings, and contributions to retirement accounts. It’s your golden ticket to filing your taxes accurately and efficiently. So, grab your wand (or pen) and let’s demystify the W2 Wonder together!

When it comes to understanding your W2 form, each box holds a piece of the puzzle. Box 1 displays your total taxable wages for the year, while Box 2 shows the federal income tax withheld from your paychecks. Boxes 3 and 5 include your wages subject to Social Security and Medicare taxes, respectively. And if you made contributions to a retirement plan, Box 12 will have those details. By decoding each box with care and attention, you’ll be well on your way to mastering the art of tax form sorcery!

Demystifying the W2 Wonder: Your Comprehensive Guide

To ensure a smooth and successful tax filing experience, it’s important to review your W2 form for accuracy. Double-check that your name, Social Security number, and address are all correct. Verify that the amounts in each box align with your records, and don’t hesitate to reach out to UCSD’s payroll department if you spot any discrepancies. Armed with this knowledge, you’ll be able to confidently navigate the tax landscape and cast away any fears of uncertainty.

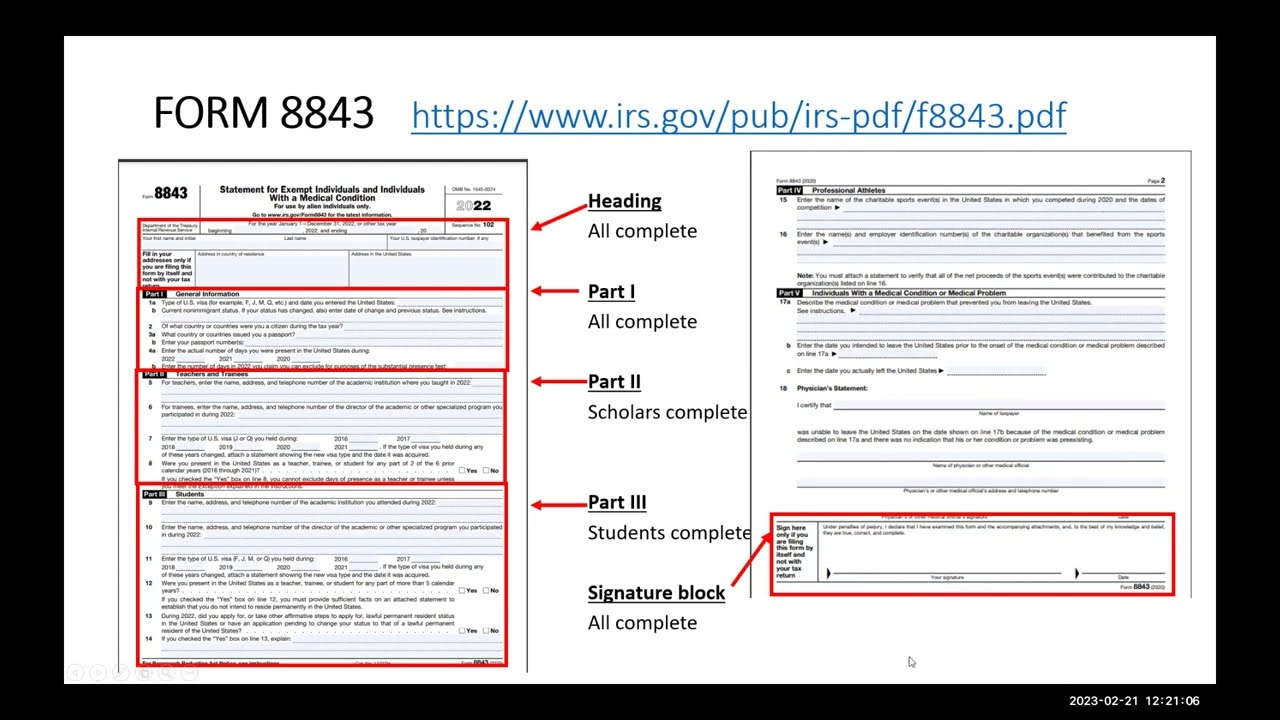

In the magical realm of UCSD’s tax forms, the W2 Wonder is just the beginning. If you received scholarships or grants, you may receive a 1098-T form detailing your educational expenses and tax credits. For international students and scholars, the 1042-S form provides information on tax treaty benefits and income earned in the U.S. So, whether you’re a wizard in training or a seasoned tax sorcerer, UCSD’s tax forms offer a wealth of resources to guide you through the enchanting world of taxes. Embrace the magic, and may your tax season be filled with prosperity and financial wizardry!

In conclusion, navigating UCSD’s tax forms doesn’t have to be a daunting task. By unraveling the mysteries of the W2 Wonder and exploring the enchanting world of tax documents, you can confidently navigate the tax landscape with ease. With a bit of magical know-how and a sprinkle of guidance, you’ll be well on your way to mastering the art of tax form sorcery. So, grab your wand (or pen) and embark on your tax-filing adventure with UCSD’s tax forms as your trusty companions!

Below are some images related to W2 Form Ucsd

how to update my w2 form, que es el w2 form, w2 form ucsd, what is another name for a w2 form, , W2 Form Ucsd.

how to update my w2 form, que es el w2 form, w2 form ucsd, what is another name for a w2 form, , W2 Form Ucsd.