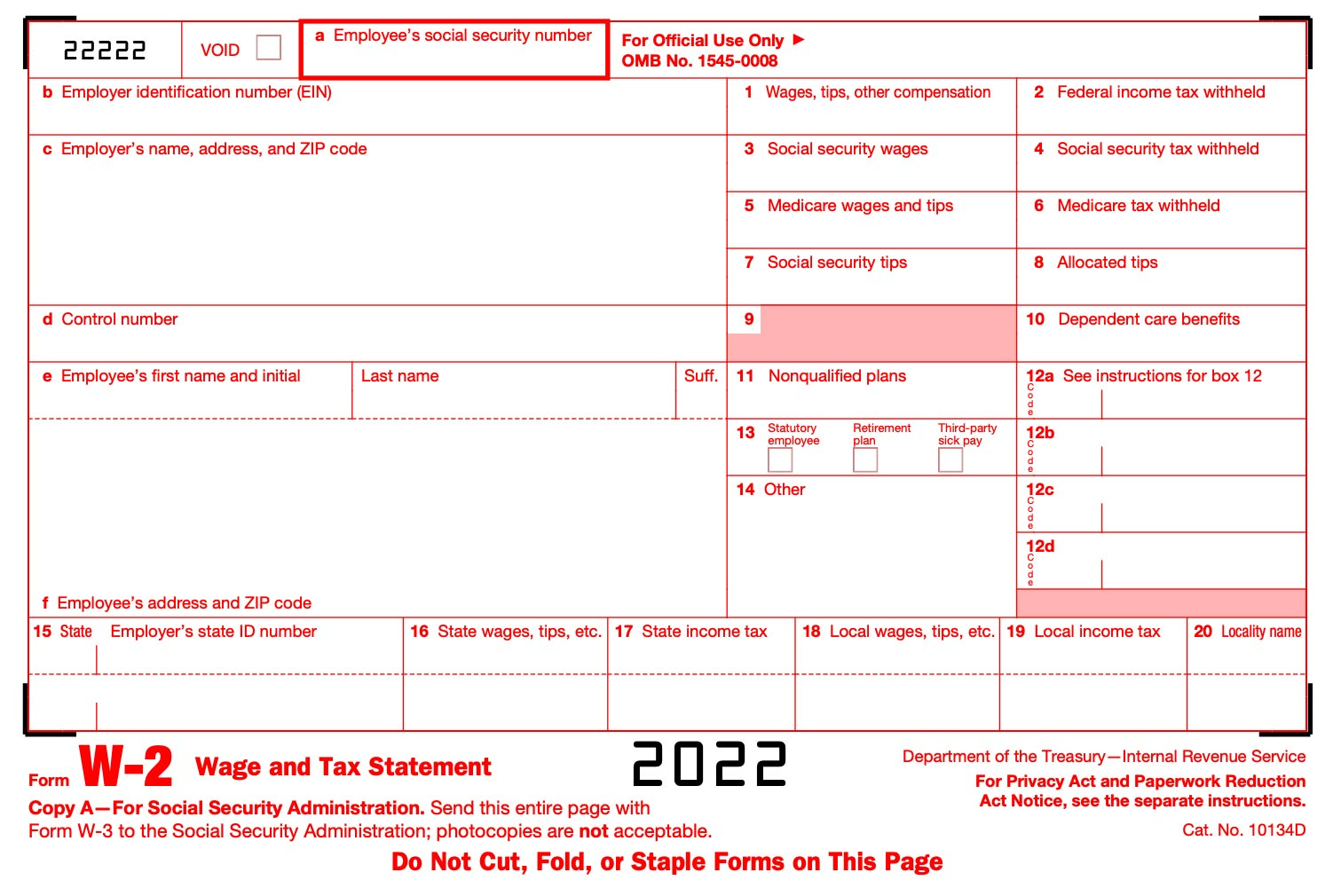

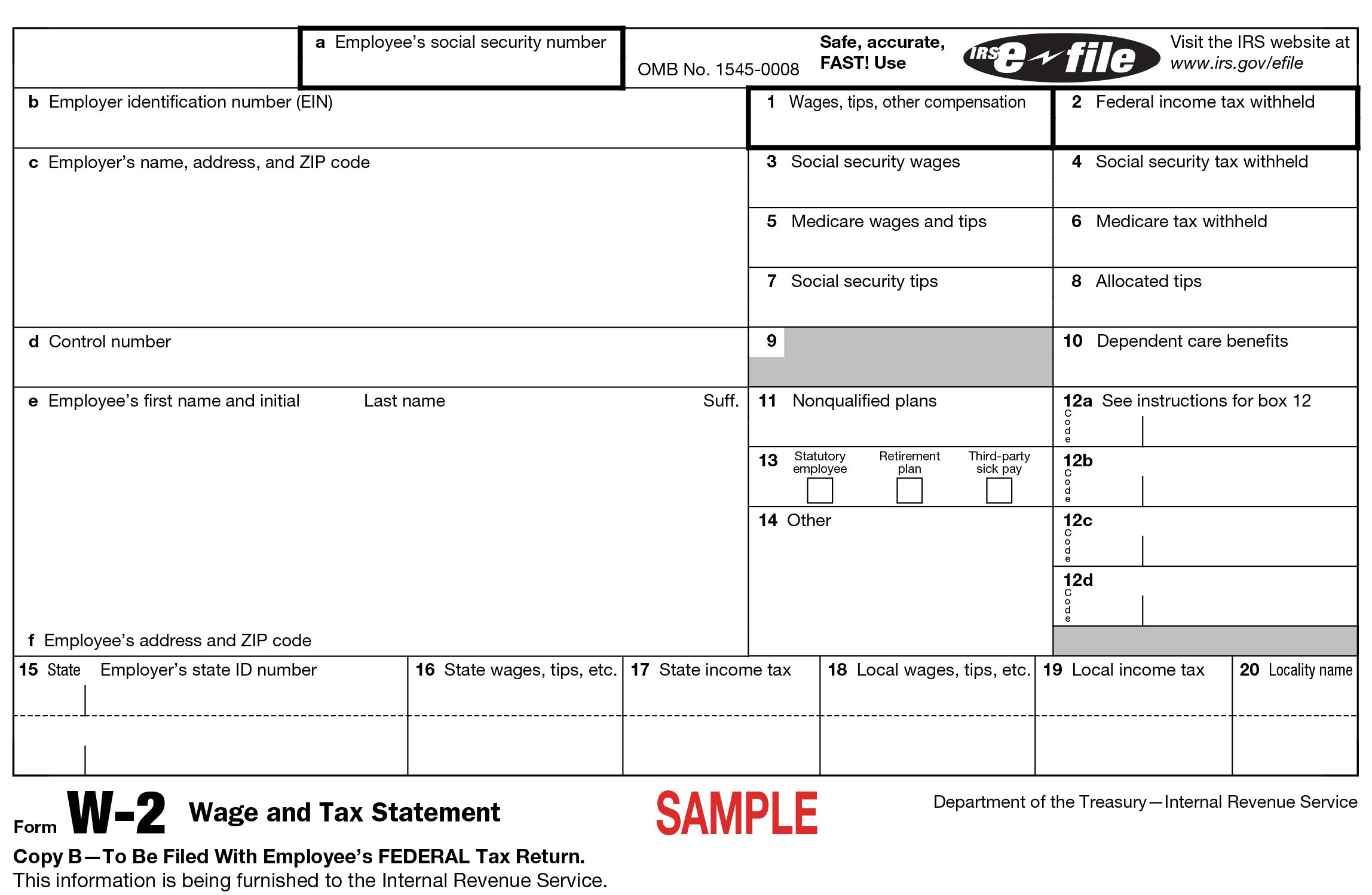

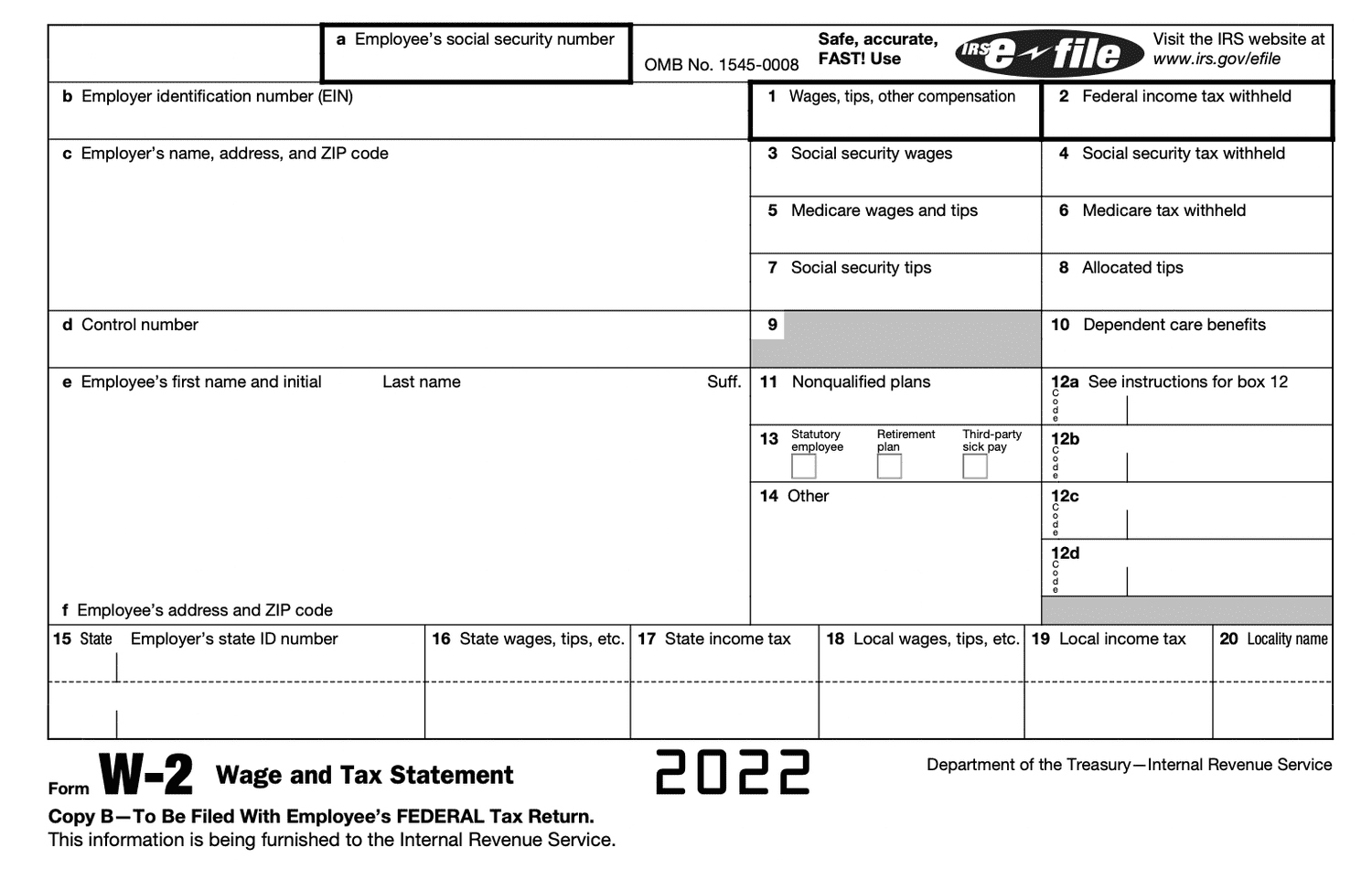

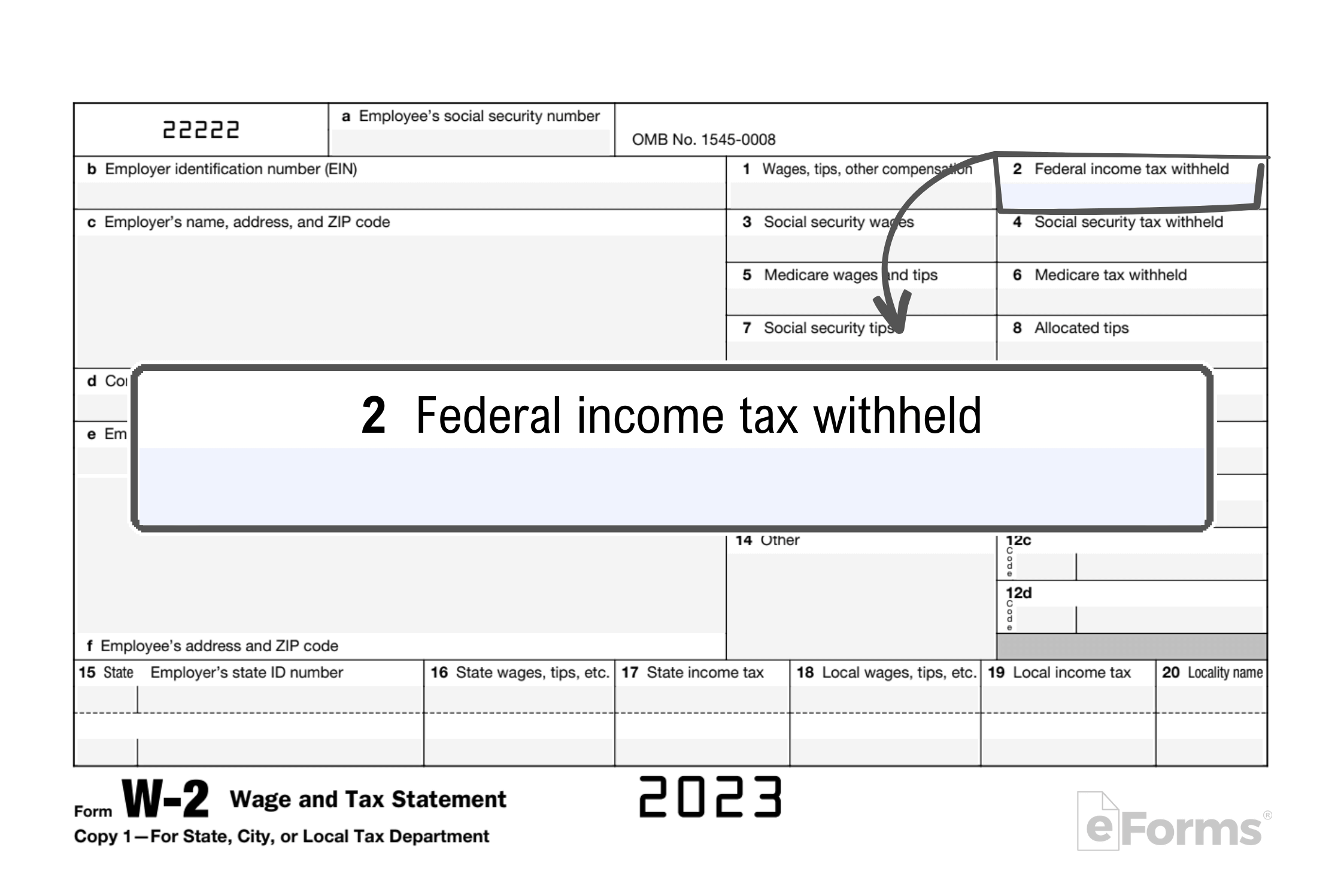

W2 Form Federal Income Tax Withheld – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery of Your W2 Form

Ah, tax season – a time of year that can strike fear into the hearts of many. But fear not, for your trusty W2 form is here to save the day! Your W2 form is like a treasure map that guides you through the maze of taxes and deductions, helping you navigate the murky waters of tax season with ease. This little document holds the key to unlocking important information about your income, taxes withheld, and more. So, grab a cup of coffee, put on your favorite tax-time playlist, and let’s dive into the wonderful world of W2 forms!

When you first lay eyes on your W2 form, it may seem like a jumble of numbers and letters. But fear not – with a little guidance, you’ll soon be able to decipher its secrets. Your W2 form includes vital information such as your total wages, tips, and other compensation, as well as the taxes withheld by your employer throughout the year. This information is crucial for accurately filing your taxes and ensuring that you receive any refunds or credits you may be entitled to. So, take a deep breath and let’s unravel the mystery of your W2 form together!

As you delve deeper into the world of your W2 form, you’ll uncover even more valuable information. For example, your W2 form also includes details about any retirement plan contributions you’ve made, as well as any other deductions that may impact your tax liability. By understanding all the ins and outs of your W2 form, you’ll be better equipped to take full advantage of tax breaks and credits that could save you money in the long run. So, don your detective hat and get ready to explore the wonderful world of tax deductions and credits – your wallet will thank you!

Embrace Tax Season with a Smile – It’s W2 Time!

Tax season doesn’t have to be a dreaded time of year – in fact, it can be an opportunity to take control of your financial future and get a clearer picture of your overall financial health. Your W2 form is like a roadmap that guides you through the twists and turns of tax season, helping you make informed decisions about your finances and plan for the future. So, instead of viewing tax season as a chore, why not embrace it with a smile and see it as a chance to learn more about your money and how you can make it work harder for you?

As you sit down to review your W2 form, take a moment to reflect on all the hard work you put in throughout the year. Your W2 form is a tangible reminder of your dedication and commitment to your job, and it can be a source of pride as you see all your earnings laid out before you. So, pour yourself a glass of bubbly (or a cup of tea, if that’s more your style) and toast to a job well done. Tax season may be stressful at times, but it’s also a time to celebrate your accomplishments and all the effort you’ve put in over the past year.

So, as you gather up your receipts, statements, and other tax documents, remember that your W2 form is your trusty sidekick in the world of taxes. It’s there to guide you, support you, and help you make sense of the sometimes confusing world of tax deductions and credits. So, take a deep breath, put on your thinking cap, and dive into the wonderful world of your W2 form. With a little patience, a sense of humor, and a positive attitude, you’ll be well on your way to conquering tax season like a pro!

Below are some images related to W2 Form Federal Income Tax Withheld

federal income tax withheld from forms) w2 and 1099, review the w-2 form. what is the amount of federal income tax withheld, w2 form federal income tax withheld, w2 form federal income tax withheld blank, w2 form no federal income tax withheld, , W2 Form Federal Income Tax Withheld.

federal income tax withheld from forms) w2 and 1099, review the w-2 form. what is the amount of federal income tax withheld, w2 form federal income tax withheld, w2 form federal income tax withheld blank, w2 form no federal income tax withheld, , W2 Form Federal Income Tax Withheld.