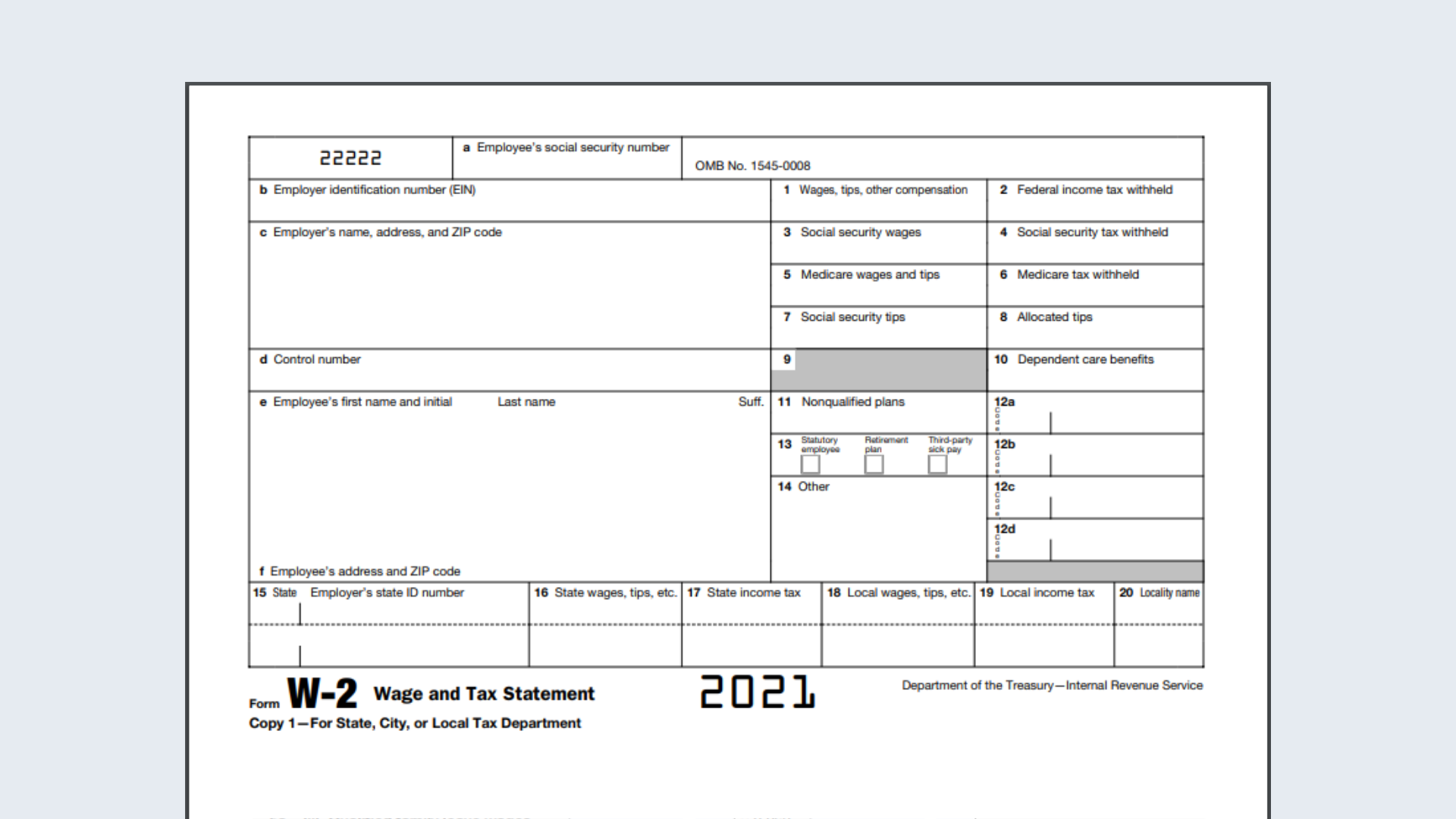

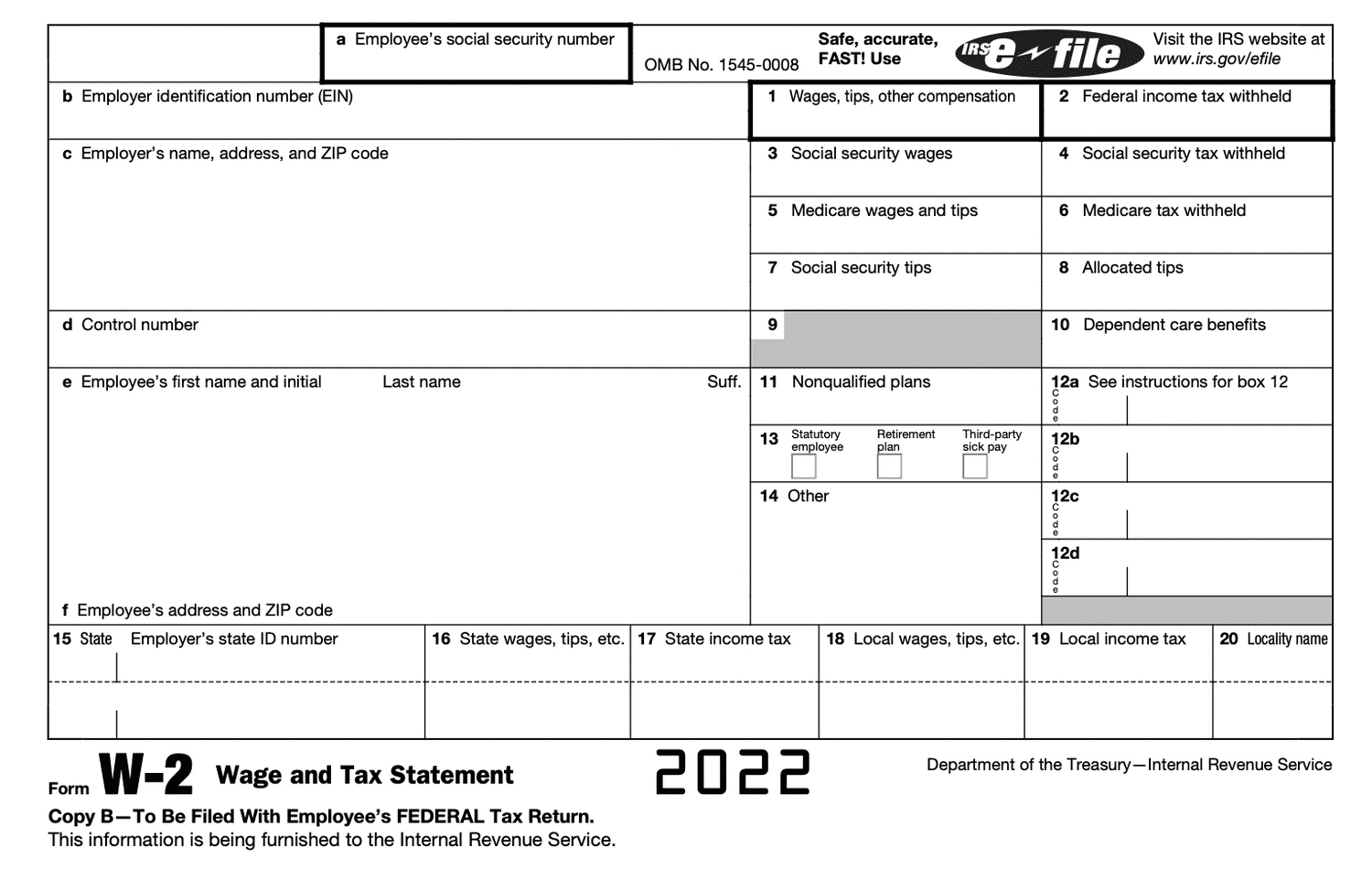

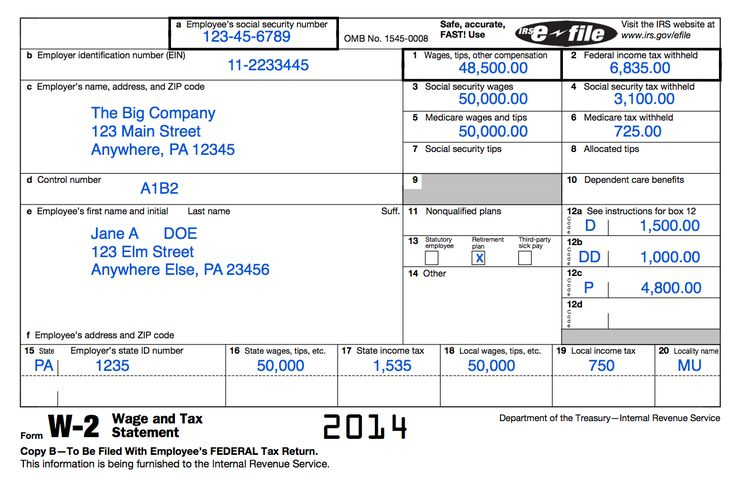

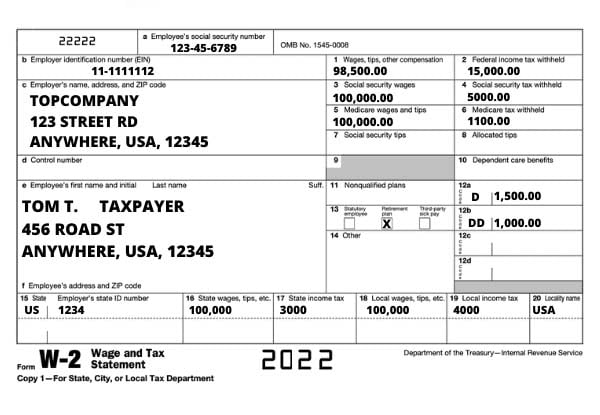

W2 Form Dependents – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

How to Brighten Your Tax Return: Claiming Your Cheerful Dependents!

Claiming dependents on your W2 form can bring a smile to your face and your tax return! Not only can you receive valuable tax benefits by claiming your cheerful dependents, but you can also enjoy the satisfaction of providing for your loved ones. So, let’s spread some joy and learn how to bring some sunshine to your W2 form by claiming your happy dependents!

When it comes to claiming dependents on your W2 form, it’s essential to ensure that you meet the IRS criteria for who qualifies as a dependent. Generally, dependents can include children, relatives, or even non-relatives who live with you and rely on you for financial support. By claiming these cheerful dependents on your W2 form, you may be eligible for tax deductions, credits, and other benefits that can help brighten your tax return.

To claim your happy dependents on your W2 form, make sure to gather all the necessary information, such as their names, Social Security numbers, and relationship to you. Remember to double-check your entries to avoid any errors that could delay your tax refund. By claiming your cheerful dependents on your W2 form, you can not only lower your taxable income but also enjoy the peace of mind that comes with taking care of those who bring joy to your life. So, let’s brighten our tax returns and spread some cheer by claiming our happy dependents!

Bring Smiles to Your W2 Form: Claiming Your Happy Dependents!

Claiming your happy dependents on your W2 form is a rewarding way to show your love and support for those who bring happiness to your life. Whether it’s your children, siblings, or other relatives, including them as dependents on your tax return can help you save money and receive valuable tax benefits. So, let’s brighten our W2 forms and bring smiles to our loved ones by claiming our happy dependents!

When you claim your cheerful dependents on your W2 form, you not only qualify for tax deductions but also may be eligible for tax credits, such as the Child Tax Credit or the Dependent Care Credit. These credits can help reduce your tax liability and increase your tax refund. By including your happy dependents on your W2 form, you can enjoy the financial benefits of providing for those who rely on you for support.

As you prepare to file your taxes and claim your cheerful dependents on your W2 form, remember the importance of accurate and timely reporting. Keep all relevant documents and receipts organized to support your claims, and seek professional advice if you have any questions or concerns. By taking the necessary steps to claim your happy dependents on your W2 form, you can not only brighten your tax return but also show your loved ones how much you care. So, let’s bring some smiles to our W2 forms and share the joy with our cheerful dependents!

In conclusion, claiming your cheerful dependents on your W2 form is a wonderful way to brighten your tax return and show your love and support for those who bring happiness to your life. By following the IRS guidelines and ensuring accurate reporting, you can enjoy valuable tax benefits and financial savings. So, let’s spread some cheer and bring smiles to our W2 forms by claiming our happy dependents! Let’s make tax season a little brighter for ourselves and our loved ones!

Below are some images related to W2 Form Dependents

form w-2 dependent care benefits, how to fill out w2 dependents, w2 form 2023 dependents, w2 form allowances, w2 form change dependents, , W2 Form Dependents.

form w-2 dependent care benefits, how to fill out w2 dependents, w2 form 2023 dependents, w2 form allowances, w2 form change dependents, , W2 Form Dependents.